Strategic Execution and Corporate Simplification Continues – ECN Capital Announces Completion of the Sale of Red Oak Inventory Finance to BharCap Partners

March 21 2024 - 4:58PM

ECN Capital Corp. (TSX: ECN) (“

ECN

Capital” or the “

Company”) today

announced the sale of Red Oak Inventory Finance (“Red Oak”) to

BharCap Partners. The transaction closed on February 21, 2024.

This transaction is another milestone in ECN

Capital’s corporate simplification plan and strategic review

process for the Company’s RV & Marine platform. The net

proceeds from the transaction were initially used to pay down debt

under the Company’s credit facility and are expected to be

available to be redeployed into ECN’s manufactured housing and RV

& Marine origination platforms.

RBC Capital Markets acted as sole financial

advisor to the Company, and Cravath, Swaine & Moore LLP acted

as legal advisor to the Company in connection with the

transaction.

About ECN

Capital Corp.

With managed assets of US$4.8 billion, ECN Capital

Corp. (TSX: ECN) is a leading provider of business services to

North American based banks, credit unions, life insurance

companies, pension funds and institutional investors (collectively

our “Partners”). ECN Capital originates, manages and advises on

credit assets on behalf of its Partners, specifically consumer

(manufactured housing and recreational vehicle and marine) loans

and commercial (inventory finance or floorplan) loans. Our Partners

are seeking high quality assets to match with their deposits, term

insurance or other liabilities. These services are offered through

two operating segments: (i) Manufactured Housing Finance, and (ii)

Recreational Vehicles and Marine Finance. For more information

about ECN Capital, visit www.ecncapitalcorp.com.

About Bharcap Partners

BharCap Partners, LLC is a private investment

firm investing in businesses across the financial services industry

including insurance distribution and insurance services; asset and

wealth management; financial technology and tech-enabled business

services. BharCap is a minority-owned and controlled firm and

manages over $2.2 billion of capital across 11 investments since

inception. For more information, visit www.bharcap.com.

Contact

John Wimsatt

561-389-2334jwimsatt@ecncapitalcorp.com

Forward-Looking

Statements

This release includes forward-looking statements

regarding ECN Capital and its business. Such statements are based

on the current expectations and views of future events of ECN

Capital’s management. In some cases the forward- looking statements

can be identified by words or phrases such as “may”, “will”,

“expect”, “plan”, “anticipate”, “intend”, “potential”, “estimate”,

“believe” or the negative of these terms, or other similar

expressions intended to identify forward-looking statements.

Forward-looking statements in this press release include those

related to the expected impact of the transaction on ECN Capital’s

business and results of operations, the expected use of the

net proceeds from the transaction and opportunities for the

Company to redeploy the net proceeds (or any part thereof) into

ECN’s originations platforms. The forward-looking events and

circumstances discussed in this release may not occur and could

differ materially as a result of known and unknown risk factors and

uncertainties affecting ECN Capital, including risks regarding the

finance industry, economic factors, and many other factors beyond

the control of ECN Capital.

No forward-looking statement can be guaranteed.

Forward-looking statements and information by their nature are

based on assumptions and involve known and unknown risks,

uncertainties and other factors which may cause our actual results,

performance or achievements, or industry results, to be materially

different from any future results, performance or achievements

expressed or implied by such forward- looking statement or

information. Accordingly, readers should not place undue reliance

on any forward-looking statements or information. A discussion of

some of the applicable material risks and assumptions associated

with such forward-looking statements or information can be found in

ECN Capital’s MD&A for the three-month period and financial

year ended December 31, 2023 and the Company’s Annual Information

Form dated March 30, 2023 each of which have been filed on SEDAR

and can be accessed at www.sedar.com. Accordingly, readers should

not place undue reliance on any forward-looking statements or

information. Except as required by applicable securities laws,

forward-looking statements speak only as of the date on which they

are made and ECN Capital does not undertake any obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events, or otherwise.

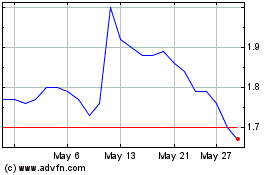

Ecn Capital (TSX:ECN)

Historical Stock Chart

From Oct 2024 to Nov 2024

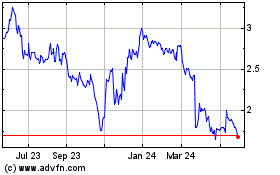

Ecn Capital (TSX:ECN)

Historical Stock Chart

From Nov 2023 to Nov 2024