Glacier Media Inc. (TSX: GVC) (“Glacier” or the “Company”) reported

revenue and earnings for the period ended March 31, 2022.

SUMMARY RESULTS

| (thousands of dollars) |

|

Three months ended March 31, |

|

except share and per share amounts |

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

| Revenue |

|

$ |

42,232 |

|

|

$ |

39,497 |

|

| EBITDA (1) |

|

$ |

2,240 |

|

|

$ |

4,403 |

|

| EBITDA (1) margin |

|

|

5.3 |

% |

|

|

11.1 |

% |

| EBITDA (1) per share |

|

$ |

0.02 |

|

|

$ |

0.04 |

|

| Capital expenditures |

|

$ |

1,092 |

|

|

$ |

1,113 |

|

| Net (loss) income attributable

to common shareholder |

|

$ |

(666 |

) |

|

$ |

1,731 |

|

| Net (loss) income attributable

to common shareholder per share |

|

$ |

(0.01 |

) |

|

$ |

0.01 |

|

| |

|

|

|

|

| Weighted average shares

outstanding, net |

|

|

132,755,559 |

|

|

|

125,213,346 |

|

| |

|

|

|

|

| Results including joint

ventures and associates: |

|

|

|

|

| Revenue (2) |

|

$ |

49,796 |

|

|

$ |

46,890 |

|

| EBITDA (2) |

|

$ |

3,050 |

|

|

$ |

5,585 |

|

| EBITDA margin (2) |

|

|

6.1 |

% |

|

|

11.9 |

% |

| EBITDA

per share (2) |

|

$ |

0.02 |

|

|

$ |

0.04 |

|

| |

|

|

|

|

(1) EBITDA is considered a non-GAAP

measure. Refer to “EBITDA Reconciliation” below for a

reconciliation of the Company’s net (loss) income attributable to

common shareholders as reported under IFRS to EBITDA.

(2) Certain results are presented to

include the Company’s proportionate share of its joint venture and

associate operations, as this is the basis on which management

bases its operating decisions and performance. The Company’s joint

ventures and associates include Great West Media Limited

Partnership, the Victoria Times-Colonist, Rhode Island Suburban

Newspapers, Inc., and Village Media Inc. Borden Bridge Development

Corporation was included up to August 31, 2021 at which point the

Company acquired the remaining 50% and started to consolidate the

results. Results including joint ventures and associates is a

non-GAAP measure. Refer to “Results Including Joint Ventures and

Associates Reconciliation” below.

Q1 2022 OPERATING PERFORMANCE AND

OUTLOOK

Operating Performance

Consolidated revenue for the quarter ended March

31, 2022, was $42.2 million, up $2.7 million or 6.9% from the same

period in the prior year. The increase was primarily the result of

growth in a number of the Company’s businesses due to stronger

operating performance, healthy industry conditions in a number of

the Company’s sectors, and the benefits from relaxation of many

COVID related restrictions. This has been partially offset by the

ongoing maturation of print media industry, supply chain

constraints, and the effects of industry consolidation affecting

GFM, as well as other adverse impacts on business activity.

Consolidated EBITDA for the quarter was $2.2

million, down $2.2 million from $4.4 million for the prior year.

These results include wage subsidies, regular and special Aid to

Publishers (“ATP”) at varying levels and other grants and subsidies

in both years. The Company recognized wage subsidies from the CEWS

program of $2.2 million in the first quarter of 2021. The CEWS

program ended in October 2021.

Excluding CEWS, consolidated EBITDA increased

$0.1 million or 3.6%. Continued investments are being made in key

strategic development areas, including the REW digital real estate

marketplace, new weather and agricultural markets

subscription-based products, and digital community media products.

These investments have resulted in EBITDA being less than it

otherwise would have been. Other factors affecting EBITDA relate to

the industry consolidation affecting GFM.

Outlook

The Company has been working to strengthen its

financial position and operating profitability throughout the

pandemic. Revenues were significantly affected early on, although

they have continued to improve during the latter part of 2020 and

throughout 2021. It remains unclear if COVID-19 related impacts

will continue to unfold and affect conditions for the market in

general and the Company’s businesses in particular.

The combination of improved revenues, cost

management and stronger business conditions in a number of the

markets in which the Company operates has resulted in improved

levels of operating profitability excluding wage subsidies. This

has been partially offset by continued operating investments being

made in key strategic development areas. Certain the Company’s

areas of business remain affected by the pandemic, in particular

the low level of activity in events and tourism.

The Company has no debt net of cash and is in a

strong financial position with which to 1) operate at the lower

levels of revenue and profitability currently being experienced in

certain markets, 2) have the financial capacity to handle

restructuring costs required and other cash obligations, and 3)

withstand further economic uncertainty, additional waves of the

pandemic and any related impact on revenues and cash flow.

While the pandemic and related measures are

still affecting the Company’s businesses to varying degrees, the

Company’s digital media, data, and information businesses have

performed relatively well. The underlying fundamentals and

resilience of these products have demonstrated their value in the

face of the challenging market conditions.

It is encouraging that the efforts and

investment made in the core areas of focus for the Company prior to

the pandemic have allowed demand for these products and services to

be resilient throughout the pandemic. The respective brands, market

positions and value to customers have remained strong.

While print advertising revenues have recovered

from declines caused by the restrictions of the pandemic, they are

expected to decline over time. Government assistance received from

the expanded ATP program will help with the continued transition of

the local media operations.

The Company is working to reach the point where

increases in the revenue, profit and cash flow from its data,

analytics and intelligence products and digital media products

exceeds the decline of its print advertising related profit and

cash flow. The Company has made progress in this regard and can

operate at lower levels of revenue from its digital media, data and

information operations in the future and operate profitably.

Financial Position. As at March

31, 2022, the Company was in a net cash positive position, with a

cash balance of $23.1 million and $8.0 million of non-recourse

mortgages and loans (the majority of which relates to farm show

land in Saskatchewan and Ontario).

The Company has net $7.4 million of deferred

purchase price obligations to be paid over the next three years.

This amount is net of contributions from minority partners. The

Company has a $5.0 million vendor-take back receivable to be paid

over the next two years resulting from the sale of the Company’s

interest in Fundata and an estimated $1.2 million potential

earn-out proceeds receivable over the next three years from the

sale of the energy business.

For further information please contact Mr. Orest

Smysnuik, Chief Financial Officer, at 604-708-3264.

ABOUT THE COMPANY

Glacier Media Inc. is an information &

marketing solutions company pursuing growth in sectors where the

provision of essential information and related services provides

high customer utility and value. The Company’s products and

services are focused in two areas: 1) data, analytics and

intelligence; and 2) content & marketing solutions.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

statements that relate to, among other things, the Company’s

objectives, goals, strategies, intentions, plans, beliefs,

expectations and estimates. These forward-looking statements

include, among other things, statements relating to our belief that

the Company is in a strong financial position with which to 1)

operate at lower levels of revenue and profitability currently

being experienced in certain markets, 2) have the financial

capacity to handle restructuring costs required and other cash

obligations, and 3) withstand further economic uncertainty,

additional waves of the pandemic and any related impact on revenues

and cash flow; and our expectation that the Company can generate

future profits operating at lower levels of revenue from its

digital media, data and information operations. These

forward-looking statements are based on certain assumptions,

including continued economic growth and recovery and the

realization of cost savings in a timely manner and in the expected

amounts, which are subject to risks, uncertainties and other

factors which may cause results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements, and undue reliance should not be placed

on such statements.

Important factors that could cause actual

results to differ materially from these expectations include

failure to implement or achieve the intended results from our

strategic initiatives, the failure to reduce debt and the other

risk factors listed in our Annual Information Form under the

heading “Risk Factors” and in our MD&A under the heading

“Business Environment and Risks”, many of which are out of our

control. These other risk factors include, but are not limited to,

the continued impact of the COVID-19 pandemic, that future cash

flow from operations and the availability under existing banking

arrangements are believed to be adequate to support financial

liabilities and that the Company expects to be successful in its

objection with CRA, the ability of the Company to sell advertising

and subscriptions related to its publications, foreign exchange

rate fluctuations, the seasonal and cyclical nature of the

agricultural and energy sectors, discontinuation of government

grants, general market conditions in both Canada and the United

States, changes in the prices of purchased supplies including

newsprint, the effects of competition in the Company’s markets,

dependence on key personnel, integration of newly acquired

businesses, technological changes, tax risk, financing risk, debt

service risk and cybersecurity risk.

The forward-looking statements made in this news

release relate only to events or information as of the date on

which the statements are made. Except as required by law, the

Company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

FINANCIAL MEASURES

To supplement the consolidated financial

statements presented in accordance with International Financial

Reporting Standards, Glacier uses certain non-IFRS measures that

may be different from the performance measures used by other

companies. These non-IFRS measures include earnings before

interest, taxes, depreciation and amortization (EBITDA) and all

measures including joint ventures and associates which are not

alternatives to IFRS financial measures. These non-IFRS measures do

not have any standardized meanings prescribed by IFRS and

accordingly they are unlikely to be comparable to similar measures

presented by other issuers. Management utilizes these financial

performance measures to assess profitability and return on equity

in its decision making. In addition, the Company, its lenders and

its investors use EBITDA and resulting including joint ventures and

associates to measure performance and value for various

purposes.

EBITDA RECONCILIATION

| (thousands of dollars) |

|

Three months ended March 31, |

|

|

except share and per share amounts |

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

| Net (loss) income attributable

to common shareholders |

|

$ |

(666 |

) |

|

$ |

1,731 |

|

|

Add (deduct): |

|

|

|

|

|

Non-controlling interests |

|

$ |

877 |

|

|

$ |

1,589 |

|

|

Net interest expense, debt and lease liability |

|

$ |

411 |

|

|

$ |

363 |

|

|

Depreciation and amortization |

|

$ |

3,045 |

|

|

$ |

2,996 |

|

|

Net gain on sale |

|

$ |

- |

|

|

$ |

(2,207 |

) |

|

Restructuring and other (income) expenses (net) |

|

$ |

(488 |

) |

|

$ |

(448 |

) |

|

Share of earnings from joint ventures and associates |

|

$ |

(369 |

) |

|

$ |

(617 |

) |

|

Income tax (recovery) expense |

|

$ |

(570 |

) |

|

$ |

996 |

|

|

EBITDA (1) |

|

$ |

2,240 |

|

|

$ |

4,403 |

|

|

Notes: |

|

|

|

|

| (1) Refer to

"Non-IFRS Measures" section of MD&A for discussion of non-IFRS

measures used in this table. |

| |

|

|

|

|

RESULTS INCLUDING JOINT VENTURES AND ASSOCIATES

RECONCILIATION

| |

|

Revenue |

|

EBITDA |

| |

|

Three months ended March 31, |

|

(thousands of dollars) |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

|

|

| Environmental and

Property Information |

12,104 |

|

|

9,182 |

|

|

862 |

|

|

389 |

|

| Commodity Information |

|

10,685 |

|

|

12,260 |

|

|

1,266 |

|

|

2,814 |

|

| Community Media |

|

27,007 |

|

|

25,448 |

|

|

2,417 |

|

|

3,943 |

|

| Centralized and Corporate

Costs |

|

- |

|

|

- |

|

|

(1,495 |

) |

|

(1,561 |

) |

|

|

|

|

|

|

|

|

|

|

| Total Including

Joint Ventures and Associates (1) |

49,796 |

|

|

46,890 |

|

|

3,050 |

|

|

5,585 |

|

| Joint Ventures and

Associates |

|

(7,564 |

) |

|

(7,393 |

) |

|

(810 |

) |

|

(1,182 |

) |

|

|

|

|

|

|

|

|

|

|

| Total

IFRS |

|

42,232 |

|

|

39,497 |

|

|

2,240 |

|

|

4,403 |

|

| |

|

|

|

|

|

|

|

|

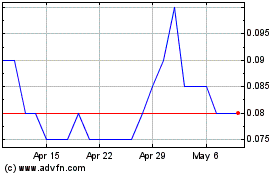

Glacier Media (TSX:GVC)

Historical Stock Chart

From Feb 2025 to Mar 2025

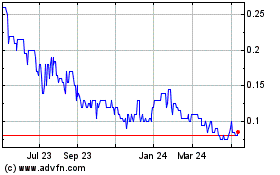

Glacier Media (TSX:GVC)

Historical Stock Chart

From Mar 2024 to Mar 2025