Columbus Gold Corp. (CGT: TSX) (CGTFF: OTCQX)

(“Columbus”) is pleased to announce that it has entered

into an agreement with IAMGOLD Corporation (IMG: TSX) to acquire up

to a 70% interest in the Maripa gold project, located in French

Guiana, France.

“With mine permitting well underway at the

Montagne d’Or gold deposit, the timing was right for this deal on

Maripa,” said Robert Giustra, Chairman of Columbus

Gold. “This low-cost, high-potential acquisition

solidifies Columbus Gold’s position as the leading gold exploration

and development company in French Guiana.”

Maripa is located in eastern French Guiana, 50

kilometres south of the capital city of Cayenne, and is comprised

of up to five contiguous exploration permits (PER) that cover an

area of approximately 120 square kilometres. Gold has been mined in

the area for over a century; the past producing Changement mine,

located within the Maripa project area, recorded gold production of

some 40,000 ounces of gold from 1985 to 1996. Past drilling by

previous operators between 2002 and 2006 returned the following

near-surface drill intercepts:

- 36 metres of 4.3 g/t gold

- 10.5 metres of 12.4 g/t gold

- 34.5 metres of 1.8 g/t gold

- 25.5 meters of 2.5 g/t gold

- 21.5 meters of 2.2 g/t gold

Additional drill results can be found in the

table below.

Maripa has the potential to host a significant

gold deposit, and unlike many other gold projects in the Guiana

Shield, it is located in an area of excellent access with national

highway RN2 running through most of the project.

A Maripa project Location Map

can be found at the following link:

www.columbusgold.com/i/nr/2018-08-14-map-location.pdf

A Maripa project Claim Map can

be found at the following link:

www.columbusgold.com/i/nr/2018-08-14-map-claim.pdf

THE MARIPA PROJECT*

Maripa is situated along the southern border of

a regional deformation zone known as the Northern Guiana Trough

(NTG), which can be traced across northern French Guiana into

neighboring Suriname. The NTG is recognized as a highly favorable

geological setting for gold mineralization; IAMGOLD’s Rosebel mine

(13.1 Moz gold) in Suriname is located on the NTG. The geological

setting of Maripa is similar to Rosebel, highlighted by a faulted

contact between volcanic assemblages of the Paramaca Formation and

younger pull-apart basin sediments of the Upper Detrital Unit (UDU,

or the Orapu Formation). The presence of thick sections of UDU

sediments in the Maripa area attest to an extensional structural

regime favorable to hydrothermal activity and associated gold

mineralization.

Past Exploration Work at

Maripa

Maripa has been subject to several phases of

exploration, beginning with the Bureau Minier Guyanais (BMG), from

1958-59, and ending with IAMGOLD, from 2000 to 2006. Exploration

consisted of ground and airborne geophysical surveying, soil and

auger grid sampling, geological mapping and rock sampling,

trenching, and core drilling. To date, a total of 134 shallow core

holes have been drilled (average core length 67 metres), totaling

9,000 metres. Past exploration was successful in delineating

several wide zones/shears of gold mineralization along the

Paramaca-UDU contact, in the Paramaca volcanics to south of the

contact, and within granitic stocks that intrude the Paramaca

volcanics. Gold mineralization is associated with quartz and

quartz-pyrite veining.

Most of the drilling was conducted by IAMGOLD

(106 of the 134 holes) and was focused on five large gold

geochemical anomalies, the Changement, Filon Dron, Maripa Sud‑Est,

Rhyodacite and Filon Scieur targets. Although first pass drilling

of these targets was limited to shallow depths within the oxidized

saprolite layer, all five targets returned drill intersections of

economic interest with demonstrated potential for expansion and

mineral resource delineation. Additionally, several large gold

geochemical anomalies remain untested.

Past exploration work conducted at Maripa

provides Columbus with an excellent base of geological, geochemical

and geophysical data to advance Maripa to the drill definition

stage in 2019.

Table: Maripa Exploration

Highlights

|

PER |

Area(km2) |

Exploration Highlights |

|

CHANGEMENT |

20.6 |

Changement mine

• 40,000 oz gold produced (1985-96)

• 63 ddh (4,478 m) • 2

shear zones traced up to 1.5-km strike and up to 10-12 m wide with

average grade of 3.9 g/t Au |

|

ORAPU |

6.7 |

• Up to 0.89 ppm gold in soil at the

NW border of the PER • No drilling |

|

MARIPA |

24.5 |

Filon Dron target

Trench results 4.7 g/t Au over

6 m • 10 ddh (878 m)

• Best drilling results

2.5 g/t Au over 25.5 m 4.3

g/t Au over 36 m • 2 km west

of Filon Dron quartz boulders over granite intrusive returned with

values of 1.0 to 10.6 g/t Au |

|

CRIQUE VÉOUX(Pending PER) |

47.5 |

• 41 ddh (2,457 m) on Filon Scieur and

Rhyodacite targetsFilon Scieur

target • Best drilling

results 1.4 g/t Au over 10.5 m

1.8 g/t Au over 34.5 m Ryodacite

target • Best drilling

results 3.6 g/t Au over 6 m

4.7 g/t Au over 4.5 m |

|

MARIPA SUD-EST(Pending PER) |

19.8 |

Maripa Sud-Est target

• 1.5 km long gold-soil anomaly

• Best trench results 2.6 g/t Au

over 14 m 1.2 g/t Au over 26

m • 20 ddh

(1,200m) • Best drilling

results 1.5 g/t Au over 16.5

m 0.9 g/t Au over 25.5

m 12.4 g/t Au over 10.5

m 2.1 g/t Au over 12.6

m 2.2 g/t Au over 21.5

m 1.3 g/t Au over 8.2 m |

SUMMARY OF PRINCIPAL AGREEMENT

TERMS

Two-stage option to earn up to a 70% interest in

the Maripa Project:

|

|

• |

Initial

option (the “First Option”) to acquire a 50%

interest by incurring US$5M in expenditures within 5 years of the

effective date of the Agreement, with Columbus acting as

Operator: |

|

|

|

- Firm spending commitment of US$200,000 by December 31,

2018;

- US$1.5M firm cumulative spending commitment by 2nd anniversary

of the Effective Date;

- US$2.75M cumulative spending by 3rd anniversary of the

Effective Date;

- US$4M cumulative spending by 4th anniversary of the Effective

Date;

- US$5M cumulative spending and the completion of an internal

scoping study by the 5th anniversary of the Effective Date.

|

|

|

• |

Election to

acquire an additional 20% interest: |

|

|

|

- Following exercise of the First Option, the parties may form a

50/50 joint-venture (JV), or if IAMGOLD elects not to participate

in the 50/50 JV, then Columbus may provide notice to IAMGOLD that

it will aim to earn an additional 20% interest by completing a

Preliminary Feasibility Study (PFS) in an additional 3 years;

- A 70:30 JV will be formed upon completion of a PFS by

Columbus.

|

|

|

• |

If any

party’s interest in a JV falls below 10% it will convert to a 2%

NSR, of which 1% can be purchased by the other party for

US$3M. |

| * The

source of the Maripa technical information was obtained from

IAMGOLD’s filing documents. |

Qualified PersonRock Lefrançois, President

& Chief Operating Officer for Columbus Gold and Qualified

Person under National Instrument 43-101, has reviewed the technical

content of this news release.

About Columbus GoldColumbus is a leading gold

exploration and development company operating in French Guiana,

France. Columbus holds a major interest in the world-class Montagne

d'Or gold deposit in French Guiana. A Feasibility Study for

Montagne d'Or was completed in May 2017, and the permitting process

is currently underway.

ON BEHALF OF THE BOARD,

Robert F. Giustra Chairman

For more information contact:Investor

Relations(604) 634-0970

or1-888-818-1364info@columbusgold.com

Certain statements and information contained in

this press release constitute "forward-looking statements" within

the meaning of applicable U.S. securities laws and “forward-looking

information” within the meaning of applicable Canadian securities

laws, which are referred to collectively as "forward-looking

statements". The United States Private Securities Litigation Reform

Act of 1995 provides a “safe harbor” for certain forward-looking

statements. Forward-looking statements are statements and

information regarding possible events, conditions or results of

operations that are based upon assumptions about future economic

conditions and courses of action. All statements and information

other than statements of historical fact may be forward-looking

statements. In some cases, forward-looking statements can be

identified by the use of words such as “seek”, “expect”,

“anticipate”, “budget”, “plan”, “estimate”, “continue”, “forecast”,

“intend”, “believe”, “predict”, “potential”, “target”, “may”,

“could”, “would”, “might”, “will” and similar words or phrases

(including negative variations) suggesting future outcomes or

statements regarding an outlook. Forward-looking statements in this

and other press releases include but are not limited to statements

and information regarding: the potential for Maripa to host a

significant gold deposit; advancing Maripa to the drill definition

stage in 2019 or at all; the exercise of the First Option or the

entering into a joint venture with IAMGOLD; the election for

Columbus to earn an additional 20% interest in Maripa; the

construction and development plans for the Montagne d’Or gold mine,

including anticipated costs and timing thereof; the satisfaction of

additional requirements to the construction of the Montagne d’Or

gold mine, including but not limited to, the completion of a public

consultation process; and the submission and processing of mine

permit applications. Such forward-looking statements are based on a

number of material factors and assumptions and involve known and

unknown risks, uncertainties and other factors which may cause

actual results, performance or achievements, or industry results,

to differ materially from those anticipated in such forward-looking

information. You are cautioned not to place undue reliance on

forward-looking statements contained in this press release. Some of

the known risks and other factors which could cause actual results

to differ materially from those expressed in the forward-looking

statements are described in the sections entitled “Risk Factors” in

the Annual Information Form of Columbus Gold Corp., available on

SEDAR under Columbus’ profile at www.sedar.com. Actual results and

future events could differ materially from those anticipated in

such statements. Columbus undertakes no obligation to update or

revise any forward-looking statements included in this press

release if these beliefs, estimates and opinions or other

circumstances should change, except as otherwise required by

applicable law.

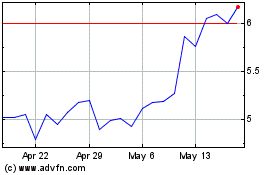

IAMGOLD (TSX:IMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

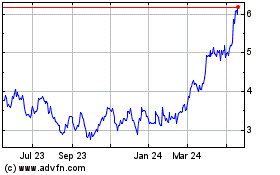

IAMGOLD (TSX:IMG)

Historical Stock Chart

From Dec 2023 to Dec 2024