Jamieson Wellness Inc. (“Jamieson Wellness” or the “Company”)

(TSX:JWEL) announced today that it has closed its previously

announced agreement to partner with DCP Capital (“DCP”) pursuant to

which DCP has contributed $47.4 million ($35 million in USD) in

capital in exchange for a 33% interest in the Company’s Chinese

operations. In conjunction with this investment, DCP has also

completed its previously announced subscription for approximately

$101.6 million ($75 million in USD) of preferred shares of the

Company and warrants to purchase 2,527,121 common shares of the

Company at an exercise price of $40.19. This represents a 10%

premium to the 20-day volume weighted average common share price as

of the signing of the subscription agreement on February 23, 2023.

This partnership with DCP is another significant

step forward in the Company’s growth plans in its fastest growing

market. Earlier this month, the Company announced its acquisition

of the operating assets of its previous distribution partner in

China, providing it full control of the value chain and the ability

to directly connect with Chinese consumers. DCP will support this

new owned operations model by leveraging its deep experience and

knowledge of the Chinese market to expedite growth.

“DCP has decades of experience building

international brands in China,” said Mike Pilato, President and CEO

of Jamieson Wellness. “We have already established the Jamieson

brand at an impressive base position in this market and believe

that with DCP’s partnership, it is perfectly positioned for

accelerated growth. DCP’s partnership will support our expanding

infrastructure and marketing plans for the Chinese market, as well

as the overall growth aspirations of Jamieson Wellness,

globally.

We could not ask for a better partner to join us

on this journey. We look forward to leveraging the expertise that

DCP brings to the table and are excited to work together to realize

our opportunities in the world’s second largest VMS market.”

“We know that the Jamieson brand fits the key

purchase attributes of the Chinese consumer, making it a natural

candidate for growth,” said Hwan Chung, Managing Director of DCP.

“We have a long track record of building successful international

brands in China, and strong operational expertise in this complex

market. We believe our skill set perfectly complements Jamieson’s

capabilities and will be instrumental in helping the Company reach

the Chinese consumer under the new operating model.”

China is the second largest vitamin market

worldwide at approximately $30 billion USD with significant annual

growth1. The Company expects to see revenues of $47-$50 million in

the country in fiscal year 2023, representing an annual growth rate

of 65-75%, which includes the impact of the Company’s direct to

customer sales under its new owned-distribution model.

1Euromonitor International, 2022. Figure in

USD.

Advisors

Nomura Securities International, Inc. served as

financial advisor and McCarthy Tétrault LLP and Morrison &

Foerster LLP served as legal advisors to the Company.

CG/Sawaya Partners (operating under Canaccord

Genuity) and Solomon Partners served as financial advisors and

Cleary Gottlieb Steen & Hamilton LLP and Stikeman Elliott LLP

served as legal advisors to DCP.

About Jamieson Wellness

Inc.

Jamieson Wellness is dedicated to improving the

world's health and wellness with its portfolio of innovative

natural health brands. Established in 1922, Jamieson is the

Company's heritage brand and Canada's #1 consumer health brand.

Jamieson Wellness also offers a variety of VMS products under its

youtheory, Progressive, Smart Solutions, Iron Vegan and Precision

brands. The Company is a participant of the United Nations Global

Compact and adheres to its principles-based approach to responsible

business. For more information please

visit www.jamiesonwellness.com.

About DCP Capital

DCP Capital is a leading international private

equity firm founded by experienced private equity investors in

Greater China. The DCP team previously led KKR and Morgan Stanley’s

private equity businesses in Asia, with an outstanding long-term

track record across multiple economic cycles. DCP is supported by a

diverse group of world-class long-term institutional investors,

including leading sovereign wealth funds, pension funds,

endowments, family offices and funds of funds around the globe.

Over the past three decades, the DCP team has led a number of

successful transactions and nurtured numerous industry leaders in

China such as Ping An Insurance, Mengniu Dairy, Haier Appliances,

China International Capital Corp, Oriental Yuhong Building

Material, Dongbao Pharmaceutical, Venus Medtech, 51 jobs, AAC

Dairy, Simple Love Yogurt, Nanfu Battery, COFCO Joycome, Sunner

Poultry, Far East Horizon, Hengan Intl., Belle, Modern Dairy, and

United Envirotech. Combining its global investment experience and

extensive local network, the DCP team has accumulated deep industry

knowledge and strong operational capabilities. As a disciplined and

operationally focused investor, DCP is committed to building

long-term, win-win partnerships with portfolio companies and

supporting value creation initiatives.

Forward-Looking Information

This press release may contain forward-looking

information within the meaning of applicable securities

legislation. Such information includes, but is not limited to,

statements related to the Company’s plans to expedite growth and

expand in China and the Company’s expected revenue growth.

Words such as “expected”, “anticipate”,

“intend”, “may”, “will”, “believe”, “estimate” and variations of

such words and similar expressions are intended to identify such

forward-looking information. This information reflects the

Company’s current expectations regarding future events.

Forward-looking information is based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond the Company’s control that could cause actual results

and events to differ materially from those that are disclosed in or

implied by such forward-looking information. Such risks and

uncertainties include, but are not limited to, the factors

discussed under “Risk Factors” in the Company’s Annual Information

Form dated March 30, 2023 and under the “Risk Factors” section in

the management’s discussion and analysis of financial condition and

results of operations of the Company filed May 4, 2023 (the

“MD&A”). This information is based on the Company’s reasonable

assumptions and beliefs in light of the information currently

available to it and the statements are made as of the date of this

press release. The Company does not undertake any obligation to

update such forward-looking information, whether as a result of new

information, future events or otherwise, except as expressly

required by applicable law or regulatory authority.

The Company cautions that the list of risk

factors and uncertainties is not exhaustive and other factors could

also adversely affect the Company’s results. Readers are urged to

consider the risks, uncertainties and assumptions associated with

these statements carefully in evaluating the forward-looking

information and are cautioned not to place undue reliance on such

information. See “Forward-looking Information” and “Risk Factors”

within the MD&A for a discussion of the uncertainties, risks

and assumptions associated with these statements.

Investor and Media Contact:

Ruth Winker Jamieson

Wellness416-705-5437rwinker@jamiesonlabs.com

Source: Jamieson Wellness Inc.

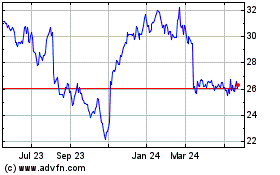

Jamieson Wellness (TSX:JWEL)

Historical Stock Chart

From Feb 2025 to Mar 2025

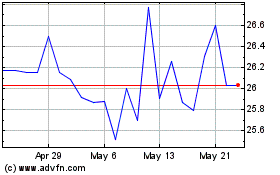

Jamieson Wellness (TSX:JWEL)

Historical Stock Chart

From Mar 2024 to Mar 2025