3iQ Leads Institutional Investors to Think Beyond Bitcoin and Expand Their Digital Asset Exposure

October 24 2024 - 7:32AM

Business Wire

Pioneering Digital Asset Management Company

Embarks on Path to Democratize Access to Institutional-Quality

Digital Asset Investments

3iQ Digital Asset Management (3iQ), a pioneer in digital asset

management, today announced a strategic rebranding initiative that

unveils a new positioning that underscores its commitment to making

institutional-quality digital assets accessible to all. The firm's

rebranding is centered around an ongoing mission to provide safe,

simple, and secure investment products that meet the needs of

today's institutional investors. The new brand expression follows

3iQ’s recent partnership with Monex Group, one of Japan’s largest

financial institutions, as 3iQ prepares to expand globally with a

suite of new products catered to institutions like family offices,

pension funds, and other institutional investors.

According to Bloomberg, the market capitalization of

cryptocurrencies today stands at around $1.3 trillion out of the

global $400 trillion in economic activity, underscoring significant

growth potential. Even so, currently only about 4% of alternative

asset allocation is part of a traditional asset investor’s

portfolio. 3iQ is on a mission to be the trusted brand responsible

for making digital assets the largest weighting in alternative

investment portfolios.

"Digital assets are not just a niche market anymore; they are

poised to become the largest category of alternative assets," said

Pascal St-Jean, President & CEO at 3iQ. "Our updated mission

focuses on inclusivity and excellence. We believe everyone deserves

access to high-quality investments. By forging new paths in

alternative investing using digital assets, we continue to innovate

and reshape the alternatives investing landscape.”

3iQ has been at the forefront of this emerging market class and

continues a strong track record of innovation offering early access

to BTC and ETH through ETF structures. The recent Monex partnership

combines 3iQ’s established expertise in regulated products and

Monex’s international reach to tap new institutional customer

segments. This collaboration has accelerated the ability of 3iQ to

bring new products to market including the 3iQ Managed Account

Platform (QMAP) hedge fund investment solution, the revolutionary

Ether Staking ETF, and most recently the collaboration with Coin

Desk Indices on the CoinDesk 20 Fund.

3iQ’s brand refresh marks a significant milestone in 3iQ's

journey, laying down a robust foundation for future products and

services aligned with their mission of expanding access to

high-quality digital asset investments. Investors, clients, and

partners are invited to visit the new website and explore the

innovative world that 3iQ continues to pioneer. For more

information about 3iQ and their digital asset investment solutions,

please visit www.3iq.io.

3iQ Corp Announces Participation in Investor Day Hosted by

Reflexivity Research

3iQ is excited to announce its participation in Reflexivity

Research’s inaugural Crypto Investor Day on October 25, 2024, in

New York City. The event will bring together thought leaders,

investors, entrepreneurs and more, with the shared goal of bridging

the power of traditional finance with the innovation of digital

assets. This gathering aligns with 3iQ's strategic partnership with

CoinDesk Indices to globally offer the CoinDesk 20 Index across

multiple fund structures, thereby improving options for

institutional investors.

Organized by Reflexivity Research, a leading crypto research

firm, Crypto Investor Day is set to gather nearly 1,000 influencers

from the cryptocurrency and traditional finance sectors. The event

will spotlight critical discussions led by industry stalwarts,

featuring Pascal St-Jean, CEO of 3iQ, alongside other prominent

figures.

About 3iQ Digital Asset Management

A global leader in digital asset investing, 3iQ democratizes

access to digital assets by offering convenient, familiar

investment products that provide digital asset exposure. 3iQ has

been a pioneer in the digital assets space since 2014, launching

North America’s first major exchange-listed Bitcoin and Ether

funds: the Bitcoin Fund (TSX: QBTC) (TSX: QBTC.U), the 3iQ Bitcoin

ETF (TSX: BTCQ) (TSX: BTCQ.U), the Ether Fund (TSX: QETH.UN) (TSX:

QETH.U), and the 3iQ Ether Staking ETF (TSX: ETHQ) (TSX: ETHQ.U).

The company continues to develop innovative investment products for

institutions, with a focus on expanding access globally through its

partnership with Monex in Japan. To learn more about 3iQ, visit

3iq.io.

This release is for informational purposes only, and the content

contained herein should not be considered investment advice or a

solicitation, offer, or recommendation to sell or buy any asset,

strategy, or product. Investing in digital assets involves a high

degree of risk, including the loss of principal.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024606097/en/

Greg Jawski Allison Worldwide 3iQ@allisonworldwide.com

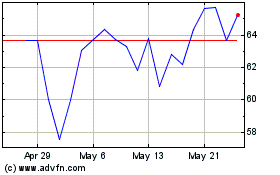

The Bitcoin (TSX:QBTC.U)

Historical Stock Chart

From Jan 2025 to Feb 2025

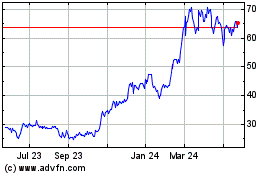

The Bitcoin (TSX:QBTC.U)

Historical Stock Chart

From Feb 2024 to Feb 2025