- Consolidated copper equivalent production increased 28% and

13% when compared to Q4 2022 and Q1 2022, respectively, as a result

of operational optimization and overall improvements in operating

performance at Sierra’s core assets.

- Bolivar’s path toward improved operating performance

continues with an 11% and 59% increase in throughput over Q4 2022

and Q1 2022, respectively. Copper equivalent production increased

18% over Q4 2022 and 192% when compared to Q1 2022.

- Following the implementation of new technology and safety

measures to safeguard against similar occurrences to last year’s

mudslide incident, Yauricocha operations have recovered, and

production is on track, with a 44% increase in throughput and a 65%

increase in copper equivalent production over the previous

quarter.

Consolidated Q1 2023 financial results will be released

pre-market on Monday, May 15, 2023 with management hosting a

Conference Call and Webcast on the same day at 11:00 AM

EDT.

Sierra Metals Inc. (TSX: SMT) (“Sierra Metals” or the

“Company”) is pleased to announce first quarter 2023 production

results from its three underground mines in Latin America: the

Yauricocha polymetallic mine in Peru, the copper-producing Bolivar

mine and the silver-producing Cusi mine in Mexico. All metals

prices are reported in U.S. dollars.

Ernesto Balarezo, Interim CEO of Sierra Metals, commented,

“Production during the first quarter of the year indicates that we

are beginning to realize the benefits of our plan to optimize all

aspects of our operations. On a consolidated basis, we achieved a

28% increase in copper equivalent production over the last quarter

and a 13% increase over the first quarter of 2022.

“As anticipated, copper equivalent production at Yauricocha has

decreased year-over-year due to mining activity being restricted to

permitted areas only. We expect Yauricocha will continue to operate

below full capacity of 3,600 tonnes per day until the permit to

mine below the 1120 level is obtained. The permit will ultimately

lead to higher throughput rates, allowing access to higher-grade

ore bodies.

“At Bolivar, we are pleased with the continued operational

recovery. The infrastructure upgrades in pumping and ventilation

have stabilized production, which should allow for a steady ramp-up

in production over the course of the year. Our vision is for these

improvements to create a domino effect, whereby stabilized

production from areas of the mine with higher grades will support

higher throughput and lower unit costs. This should, in turn,

generate positive free cash flow, eventually allowing the Company

to re-invest in the mine. These investments are key to further

development to extract Bolivar’s full value potential over time.

Additional strategic initiatives during the quarter included

organization restructuring at the mine, bringing various processes

together to create a unified approach within the mining unit. The

result: improved staffing coordination and operating cost

management, optimization of labour and material handling resources,

and improved mine development activities. We continue to take the

necessary steps to create efficiencies and ensure continued growth

at our key operating mines.”

Mr. Balarezo concluded, “As we complete the first quarter of a

new chapter at Sierra Metals, I remain optimistic about the

Company’s future. We have made both managerial and operational

changes that promote a culture of safety and integrity at all

levels while we continue to pursue stable, reliable, safe, and

efficient operations with full transparency to our stakeholders and

shareholders. We remain dedicated to continuing these efforts.”

First Quarter 2023 Consolidated

Production Results

Consolidated Production

Three months ended

March 31, 2023

December 31, 2022

% Var.

March 31, 2022

% Var.

Tonnes processed

577,284

494,980

17

%

590,730

-2

%

Daily throughput

6,598

5,657

17

%

6,751

-2

%

Silver production (000 oz)

622

570

9

%

734

-15

%

Copper production (000 lb)

8,285

6,170

34

%

6,324

31

%

Zinc production (000 lb)

10,579

6,367

66

%

10,492

1

%

Lead production (000 lb)

3,060

2,071

48

%

4,216

-27

%

Gold Production (oz)

3,910

3,411

15

%

1,923

103

%

Copper equivalent pounds (000's)(1)

18,009

14,073

28

%

15,896

13

%

(1) Copper equivalent pounds were calculated using the

following realized prices: Q1

2023 - $22.57/oz Ag, $4.06/lb Cu, $1.42/lb Zn, $0.97/lb Pb,

$1,891/oz Au. Q4 2022 -

$21.21/oz Ag, $3.63/lb Cu, $1.37/lb Zn, $0.95/lb Pb, $1,730/oz

Au. Q1 2022 - $23.95/oz Ag,

$4.53/lb Cu, $1.69/lb Zn, $1.06/lb Pb, $1,875/oz Au.

Consolidated quarterly throughput during Q1 2023 was 577,284

tonnes, a 17% increase over Q4 2022 due to overall improved

performance at Yauricocha and Bolivar, and a 2% decrease, when

compared to Q1 2022, mainly due to a 30% decrease in throughput at

Yauricocha.

A 59% increase in throughput as well as higher grades in all

metals at Bolivar, offset the 30% decrease in throughput at

Yauricocha, resulting in consolidated copper equivalent production

of 18 million pounds, a 13% increase over Q1 2022. When compared to

Q4 2022, consolidated copper equivalent production increased 28%,

driven by the 44% and 11% higher throughputs at Yauricocha and

Bolivar, respectively.

Yauricocha Mine, Peru

Throughput from the Yauricocha Mine during Q1 2023 was 219,145

tonnes, a 44% sequential increase over Q4 2022, and as anticipated,

a 30% decrease compared to Q1 2022, after the implementation of

measures to safeguard against similar occurrences to last year’s

mudslide incident.

Mining activity at Yauricocha continues to focus on smaller ore

bodies located within the permitted mineable areas above the 1120

level. These smaller ore bodies provided improved head grades in

all metals during Q1 2023 when compared to the previous quarter,

whereas, in Q1 2022, there was a greater contribution to production

from larger ore bodies with lower grades. There was also a notable

improvement in the recovery of silver, copper and gold by 18%, 4%

and 8%, respectively, when compared to the previous quarter, while

zinc and lead recoveries remained in-line with Q4 2022.

Head grades in silver, lead and zinc, when compared to Q1 2022,

improved by 18%, 6%, and 39%, respectively. Copper grades were

in-line with Q1 2022 and gold grades decreased by 12%. Production

of all metals, except for zinc, declined, and copper equivalent

production at the mine decreased by 17% when compared to Q1 2022,

as the improved head grades and stronger recoveries during the

quarter could not compensate for the reduced throughput at

Yauricocha when compared to Q1 2022.

A summary of production from the Yauricocha Mine is provided

below:

Yauricocha Production

Three months ended

March 31, 2023

December 31, 2022

% Var.

March 31, 2022

% Var.

Tonnes processed

219,145

152,586

44

%

315,250

-30

%

Daily throughput

2,505

1,744

44

%

3,603

-30

%

Silver grade (g/t)

46.45

42.25

10

%

39.40

18

%

Copper grade

0.79

%

0.66

%

20

%

0.79

%

0

%

Lead grade

0.70

%

0.63

%

11

%

0.66

%

6

%

Zinc grade

2.54

%

2.21

%

15

%

1.83

%

39

%

Gold Grade (g/t)

0.46

0.41

12

%

0.52

-12

%

Silver recovery

76.16

%

64.35

%

18

%

63.99

%

19

%

Copper recovery

75.70

%

72.57

%

4

%

77.22

%

-2

%

Lead recovery

81.66

%

82.18

%

-1

%

82.50

%

-1

%

Zinc recovery

86.18

%

85.69

%

1

%

82.09

%

5

%

Gold Recovery

23.39

%

21.63

%

8

%

20.06

%

17

%

Silver production (000 oz)

249

134

86

%

256

-3

%

Copper production (000 lb)

2,895

1,621

79

%

4,279

-32

%

Zinc production (000 lb)

10,579

6,367

66

%

10,492

1

%

Lead production (000 lb)

2,778

1,749

59

%

3,828

-27

%

Gold Production (oz)

754

439

72

%

1,057

-29

%

Copper equivalent pounds (000's)(1)

9,003

5,471

65

%

10,876

-17

%

(1) Copper equivalent pounds were calculated using the

following realized prices: Q1

2023 - $22.57/oz Ag, $4.06/lb Cu, $1.42/lb Zn, $0.97/lb Pb,

$1,891/oz Au. Q4 2022 -

$21.21/oz Ag, $3.63/lb Cu, $1.37/lb Zn, $0.95/lb Pb, $1,730/oz

Au. Q1 2022 - $23.95/oz Ag,

$4.53/lb Cu, $1.69/lb Zn, $1.06/lb Pb, $1,875/oz Au.

Bolivar Mine, Mexico

The Bolivar Mine processed 299,017 tonnes during Q1 2023, an 11%

increase over Q4 2022 and a 59% increase compared to Q1 2022, due

to improvements in ventilation and advancement in the mine’s

development and preparation which allowed for increased mining

activity during the quarter. As a result, the Bolivar mine saw

improved productivity and higher grades in copper and silver by 6%

and 31%, respectively, with a decrease of 10% in gold grades when

compared to Q4 2022. When comparing the quarter to Q1 2022, there

were significantly higher grades in copper, silver, and gold by

50%, 59% and 181%, respectively, as well as an 11% and 9%

improvement in copper and gold recovery rates.

Bolivar generated 7.6 million pounds in copper equivalent

production during Q1 2023, an 18% increase over the previous

quarter and a 192% increase when compared to Q1 2022.

A summary of production for the Bolivar Mine is provided

below:

Bolivar Production

Three months ended

March 31, 2023

December 31, 2022

% Var.

March 31, 2022

% Var.

Tonnes processed (t)

299,017

270,313

11

%

187,556

59

%

Daily throughput

3,417

3,089

11

%

2,144

59

%

Copper grade

0.87

%

0.82

%

6

%

0.58

%

50

%

Silver grade (g/t)

17.39

13.25

31

%

10.97

59

%

Gold grade (g/t)

0.45

0.50

-10

%

0.16

181

%

Copper recovery

94.25

%

92.70

%

2

%

85.22

%

11

%

Silver recovery

83.99

%

81.43

%

3

%

88.44

%

-5

%

Gold recovery

69.47

%

64.52

%

8

%

63.53

%

9

%

Copper production (000 lb)

5,390

4,549

18

%

2,045

164

%

Silver production (000 oz)

140

93

51

%

58

141

%

Gold production (oz)

3,037

2,801

8

%

592

413

%

Copper equivalent pounds (000's)(1)

7,588

6,432

18

%

2,597

192

%

(1) Copper equivalent pounds were calculated using the

following realized prices: Q1

2023 - $22.57/oz Ag, $4.06/lb Cu, $1.42/lb Zn, $0.97/lb Pb,

$1,891/oz Au. Q4 2022 -

$21.21/oz Ag, $3.63/lb Cu, $1.37/lb Zn, $0.95/lb Pb, $1,730/oz

Au. Q1 2022 - $23.95/oz Ag,

$4.53/lb Cu, $1.69/lb Zn, $1.06/lb Pb, $1,875/oz Au.

Cusi Mine, Mexico

The Cusi Mine was classified as non-core in the Company’s Q4

2022 results. The mine processed 59,122 tonnes of ore during Q1

2023, an 18% decrease when compared to Q4 2022 and a 33% decrease

from Q1 2022. The decrease in throughput, combined with lower

grades in silver, gold and lead by 17%, 24%, and 4%, respectively,

resulted in a 31% decrease in silver equivalent production when

compared to Q4 2022. When compared to Q1 2022, decreases in grades

for the same metals of 18%, 32%, and 8% respectively, resulted in a

44% decrease in silver equivalent production.

The decrease in throughput during Q1 2023, was attributed to a

general decline in mining activity, and a greater focus on recovery

of production sites from several issues that arose during the

quarter, including flooding at depth, contractor performance, and

the lack of availability of mining equipment. Head grades were also

impacted by the reduction in active mining sites during the

quarter.

A summary of production for the Cusi Mine is provided below:

Cusi Production

Three months ended

March 31, 2023

December 31, 2022

% Var.

March 31, 2022

%Var.

Tonnes processed (t)

59,122

72,081

-18

%

87,924

-33

%

Daily throughput(2)

676

824

-18

%

1,005

-33

%

Silver grade (g/t)

141.80

171.34

-17

%

173.96

-18

%

Gold grade (g/t)

0.13

0.17

-24

%

0.19

-32

%

Lead grade

0.24

%

0.25

%

-4

%

0.26

%

-8

%

Silver recovery (flotation)

86.30

%

86.44

%

0

%

85.37

%

1

%

Gold recovery (lixiviation)

46.57

%

44.56

%

5

%

49.94

%

-7

%

Lead recovery

88.67

%

81.51

%

9

%

76.96

%

15

%

Silver production (000 oz)

233

343

-32

%

420

-45

%

Gold production (oz)

119

171

-30

%

274

-57

%

Lead production (000 lb)

282

322

-12

%

388

-27

%

Silver equivalent ounces (000's)(1)

255

372

-31

%

458

-44

%

(1) Silver equivalent ounces were calculated using the

following realized prices: Q1

2023 - $22.57/oz Ag, $4.06/lb Cu, $1.42/lb Zn, $0.97/lb Pb,

$1,891/oz Au. Q4 2022 -

$21.21/oz Ag, $3.63/lb Cu, $1.37/lb Zn, $0.95/lb Pb, $1,730/oz

Au. Q1 2022 - $23.95/oz Ag,

$4.53/lb Cu, $1.69/lb Zn, $1.06/lb Pb, $1,875/oz Au.

Conference Call and

Webcast

Management will host a conference call and webcast to discuss Q1

2023 financial and operating results on Monday, May 15, 2023 at

11:00 AM EDT. Details are as follows:

Webcast:

https://services.choruscall.ca/links/sierrametalsq12023.html

Dial In:

Canada/US Toll Free: 1-800-319-4610

Other: 1-416-915-3239

Participants are asked to dial in 5-10 minutes before the

scheduled start time and ask to join the Sierra Metals First

Quarter 2023 Consolidated Financial Results call.

About Sierra Metals

Sierra Metals is a diversified Canadian mining company with

green metal exposure including copper, zinc and lead production

with precious metals byproduct credits, focused on the production

and development of its Yauricocha Mine in Peru and its Bolivar Mine

in Mexico. The Company is focused on the safety and productivity of

its producing mines. The Company also has large land packages with

several prospective regional targets providing longer-term

exploration upside and mineral resource growth potential.

For further information regarding Sierra Metals, please visit

www.sierrametals.com.

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals

| Facebook: SierraMetalsInc | LinkedIn: Sierra Metals

Inc | Instagram: sierrametals

Forward-Looking Statements

This press release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Sierra and reflect management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action. In

certain cases, statements that contain forward-looking information

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes" or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will be taken", "occur" or

"be achieved" or the negative of these words or comparable

terminology. By its very nature forward-looking information

involves known and unknown risks, uncertainties and other factors

that may cause actual performance of Sierra to be materially

different from any anticipated performance expressed or implied by

such forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 28,

2023 for its fiscal year ended December 31, 2022 and other risks

identified in the Company's filings with Canadian securities

regulators, which are available at www.sedar.com.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230425005526/en/

Investor Relations

Sierra Metals Inc. Tel: +1 (416) 366-7777 Email:

info@sierrametals.com

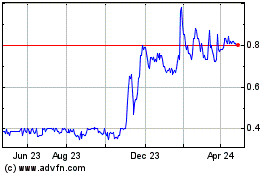

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

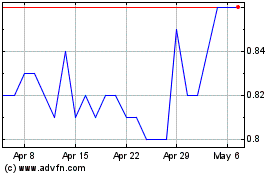

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Dec 2023 to Dec 2024