Silver Bull Announces Closing of Second Tranche of Private Placement for Cumulative Gross Proceeds of US$1.85 Million

November 10 2020 - 6:00AM

Silver Bull Resources, Inc. (TSX: SVB; OTCQB: SVBL)

(“

Silver Bull” or the “

Company”)

is pleased to announce that it has completed the second and final

tranche of its previously announced private placement (the

“

Private Placement”). Under the

second tranche, the Company issued 319,000 units (the

“

Units”) at a price of US$0.47 per Unit for

aggregate gross proceeds of US$149,930. Each Unit consists of one

share of common stock in the Company (a “

Common

Share”) and one half of one transferable Common Share

purchase warrant (each whole warrant, a

“

Warrant”). Each Warrant entitles the holder to

acquire one Common Share at a price of US$0.59 per Common Share

until the fifth anniversary of closing of the second tranche of the

Private Placement.

Under the initial tranche of the Private

Placement, which closed on October 27, 2020, Silver Bull issued a

total of 3,623,580 Units for aggregate gross proceeds of

USD$1,703,083.

Directors and management (and their affiliates)

of the Company purchased 1,159,000 Units (approximately US$545,000)

in the Private Placement.

The net proceeds of the Private Placement will

be used by Silver Bull for general working capital purposes.

All securities issued pursuant to the Private

Placement are subject to a hold period under applicable Canadian

securities laws, which will expire four months plus one day from

the date of closing of the Private Placement, and will be

restricted securities for purposes of U.S. securities laws.

The securities issued under the Private

Placement have not been registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities

Act”), or any state securities laws, and accordingly, may

not be offered or sold within the United States except in

compliance with the registration requirements of the U.S.

Securities Act and applicable state securities requirements or

pursuant to exemptions therefrom. The Company plans to file a

registration statement pursuant to the U.S. Securities Act which,

when effective, will permit the resale of the Common Shares issued

in connection with the Private Placement as well as the Common

Shares issuable upon exercise of the Warrants. This news release

does not constitute an offer to sell or a solicitation of an offer

to buy any of Silver Bull’s securities in the United States.

About Silver Bull: Silver Bull

is a Vancouver-based mineral exploration company whose shares are

listed on the TSX and trade on the OTCQB in the United States.

Silver Bull recently signed an Option Agreement to acquire the

Beskauga Copper-Gold Project, located in North Eastern Kazakhstan.

This agreement is subject to on the ground due diligence, which

will occur once safe travel to the region is allowed due to current

COVID-19 related restrictions. In addition, Silver Bull owns the

Sierra Mojada Project which is located 150 kilometers north of the

city of Torreon in Coahuila, Mexico, and is highly prospective for

silver and zinc. Sierra Mojada is currently under a joint venture

option with South32 International Investment Holdings Pty Ltd.

On behalf of the Board of Directors “Tim

Barry”

Tim Barry, CPAusIMM Chief

Executive Officer, President and Director

INVESTOR RELATIONS: +1 604 687

5800 info@silverbullresources.com

Cautionary note regarding forward

looking statements: Certain statements in this news

release are “forward-looking” within the meaning of applicable

securities legislation. Forward-looking statements can generally be

identified by the use of forward-looking terminology such as “may”,

“will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”,

“continue”, “plans” or similar terminology. Forward-looking

statements include, but are not limited to, statements relating to

the expected use of proceeds from the Private Placement.

Forward-looking statements are necessarily based upon the current

belief, opinions and expectations of management that, while

considered reasonable by the Company, are inherently subject to

significant business, economic, competitive, political and social

uncertainties and other contingencies. Many factors could cause the

Company’s actual results to differ materially from those expressed

or implied in the forward-looking statements. These factors

include, among others, market prices, metal prices, availability of

capital and financing, general economic, market or business

conditions, as well as other risk factors set out under the heading

“Risk Factors” in the Annual Report on Form 10-K for the year

ended October 31, 2019, which is available on SEDAR at

www.sedar.com. Investors are cautioned not to put undue reliance on

forward-looking statements due to the inherent uncertainty

therein.

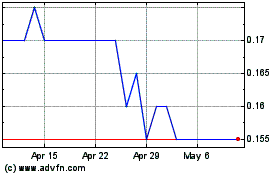

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Feb 2024 to Feb 2025