Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”)

is pleased to announce its maiden Mineral Resource estimate on the

Beskauga copper-gold project completed by CSA Global Consultants

Canada Ltd (“CSA Global”). Highlights of the Mineral Resource

report include:

- An open

pit-constrained Indicated Mineral Resource of 207 million tonnes

grading 0.35 g/t gold, 0.23% copper and 1.09 g/t silver for 2.33

million ounces of gold, 476.1 thousand tonnes of copper, & 7.25

million ounces of silver.

- An open

pit-constrained Inferred Mineral Resource of 147 million tonnes

grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56

million ounces of gold, 220.5 thousand tonnes of copper, & 4.82

million ounces of silver.

- The constraining pit was

optimised and calculated using a NSR cut-off based on a price of:

$1,500/oz for gold, $2.80/lb for copper, $17.25/oz for silver, and

with an average recovery of 81.7% for copper and 51.8% for both

gold and silver.

Beskauga Resource: The Beskauga

resource was estimated from 118 diamond drill holes, totalling

45,605.8 meters drilled between 2007 and 2017 by the private Swiss

company, Copperbelt AG. Holes were drilled from surface using an HQ

or NQ sized core diameter and varied in depth between 150m to 815m.

The estimated Mineral Resource is shown in the table below.

Table 1. Pit-constrained Mineral Resource

estimate for the Beskauga copper-gold project

|

Category |

Tonnage (Mt) |

Cu % |

Au g/t |

Ag g/t |

Au (Moz) |

Cu (Kt) |

Ag (Moz) |

|

Indicated |

207 |

0.23 |

0.35 |

1.09 |

2.33 |

476.1 |

7.25 |

|

Inferred |

147 |

0.15 |

0.33 |

1.02 |

1.56 |

220.5 |

4.82 |

Notes:

- An NSR $/t cut-off of $5.70/t was

used, and the NSR formula is: NSR $/t = (38.137+11.612 x Cu%) x Cu%

+ (19.18 + 12.322 x Au g/t) x Au g/t + (0.07 + 0.0517 x Ag g/t) x

Ag g/t

- The NSR formula incorporates

variable recovery formulae. Average copper recovery was 81.7%

copper and 51.8% for both gold and silver.

- Metal prices considered were

$2.80/lb copper, $1,500/oz gold and $17.25/oz silver.

- The Resource is stated within a pit

shell that considers a 1.25 factor above the metal prices.

- Mineral Resources are estimated and

reported in accordance with the CIM Definition Standards for

Mineral Resources and Mineral Reserves adopted 10 May 2014.

- The Mineral Resource is not

believed to be materially affected by any known environmental,

permitting, legal, title, taxation, socio-economic, marketing,

political or other relevant factors

- These Mineral Resources are not

Mineral Reserves as they do not have demonstrated economic

viability.

- The quantity and grade of reported

Inferred Resources in this MRE are uncertain in nature and there

has been insufficient exploration to define these Inferred

Resources as Indicated or Measured; however, it is reasonably

expected that the majority of Inferred Mineral Resources could be

upgraded to Indicated Mineral Resources with continued

exploration.

In order to address the potential for eventual

economic extraction in an open pit context, the reported Mineral

Resources fall within an optimized Lerch-Grossman pit shell that

uses a gold price of US$1,500/oz, a copper price of US$2.80, and a

silver price of US$17.25 with an average recovery of copper at

81.7% and gold and silver of 51.8%.

Pit walls are set at 42 degrees in the

overburden and 45 degrees in the hard rock. Mining costs were

assumed to be US$1.00 in overburden and US$1.50/tonne in the hard

rock and processing costs were assumed to be US$5.70/tonne. To

determine the $/t value of the rock the following calculation was

made:

NSR $/t = (38.137+11.612 x Cu%) x Cu% + (19.18 +

12.322 x Au g/t) x Au g/t + (0.07 + 0.0517 x Ag g/t) x Ag p/t

Mineral resources were estimated by Ordinary

Kriging using Micromine modeling software in multiple passes using

20 meter X 20 meter X 20 meter blocks as the SMU size. Blocks have

been classified as Indicated or Inferred Mineral Resources.

The Mineral Resource was estimated by Serik

Urbisinov, a Principal Resource Geologist for CSA Global, who is an

independent Qualified Persons as defined by National Instrument

43-101. The full Technical Report will be filed onto the SEDAR

website within the next 45 days.

Mineralization and geology: The

Beskauga deposit is interpreted to be a copper-gold porphyry.

Pyrite, chalcopyrite and tennantite are the dominant sulphide

minerals at Beskauga, with smaller amounts of bornite, chalcocite,

enargite, and molybdenite, with magnetite and hematite, also

described. Sulphides occur as fine-grained disseminations as well

as in stockwork veins and veinlets, associated with an elongated

granodiorite porphyry intrusion. The grade of the copper and gold

are highly correlated.

At surface, the deposit is covered by a 30 to 40

meter thick layer of recent sediments and remains open in all

directions including at depth, with many of the drill holes

terminating in mineralization. The chemistry and mineralogy of the

mineralization defined thus far suggests the present resource is

still in the upper part of the mineralizing system. The deposit has

not benefited from detailed geological study and modelling which

presents an opportunity to optimize extension targeting and

definition of additional resources.

Figure 1. Surface projection of the

Beskauga deposit showing the gold and the copper cut-offs. Also

shown is the outline of the Lerch-Grossman conceptual pit

is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f0c04427-8517-4050-8211-3eb6972d350a

Infrastructure: The Beskauga

deposit has excellent infrastructure. All operations are based out

of the nearby mining town of Ekibastuz, which services the largest

coal mine in Kazakhstan and provides a highly trained workforce for

Silver Bull to draw upon. Paved road access, 1100 KVA power lines

and heavy rail all lie within a 25 kilometer radius of the project.

The capital city of Nur-Sultan, located approximately 300

kilometers along a double lane highway from the project, has a

major international airport allowing for easy access and

administration of the Beskauga project.

Figure 2. Map showing the location of

infrastructure near the Beskauga deposit. The project is based out

of the nearby mining town of Ekibastuz is available

at

https://www.globenewswire.com/NewsRoom/AttachmentNg/65497a18-e567-487c-bc67-98558badd426

Tim Barry, President, CEO and director of Silver

Bull states, “We are extremely pleased with this first NI 43-101

resource estimate at Beskauga. We believe the Beskauga project

represents one of the best exploration opportunities in the world

and we see significant opportunity to expand the current resource.

We also believe there is considerable exploration potential in the

wider region for both copper and gold and expect to have a pipeline

of projects and associated news coming in from both the Beskauga

Project and the wider area during 2021.

This year is shaping up to be an exciting one

for Silver Bull. Presently, we are compiling the significant

Soviet-era historical information in the region as well as building

a team in-country. We expect to commence our on the ground

exploration program at the beginning of the second quarter of this

year.”

About Kazakhstan

Size: Kazakhstan is the ninth

largest country in the world, covering 2,717,300 square kilometers,

and has a population of 18.2 million people.

Capital City: The capital city

is Nur-Sultan which is located 300 kilometers from the project.

Nur-Sultan has a major international airport allowing for easy

access and administration of the Beskauga Project.

Mining Law: Kazakhstan adopted

a new mining code titled “Code on Surface and Subsoil Use” (the

"SSU Code") on December 27, 2017, and became effective on June 29,

2018. The SSU Code is based on the Western Australian model where

Kazakhstan moved from a contractual regime to a licensing regime

for solid minerals (except for uranium). Coincident with the

updated SSU law, the Kazakhstan government also reduced a

considerable amount of the administrative burdens for subsoil

users.

Tax: A summary of pertinent

taxes related to exploration in Kazakhstan is as follows:

- 20% corporate tax

- 12% value-added tax (VAT) is refundable for exploration

companies

- 4.7% royalty for copper

- 5% royalty for gold and silver

Geological Prospectivity:

Kazakhstan is one of the most prospective countries in the world

for a number of metals. According to the United States Geological

Survey (USGS) Kazakhstan is:

- 1st in the world for uranium production (41% of world

output)

- 2nd in the world for chromite production (18% of world

output)

- 4th in the world for titanium production (6% of world

output)

- 10th in the world for copper production

In addition, Kazakhstan has significant proven

reserves (as yet unmined) of gold, silver, lead, zinc, tin, iron

ore, nickel, cobalt, and bauxite.

The Fraser Institute Annual Survey of Mining

Companies in 2017, ranked Kazakhstan the 24th best mining

jurisdiction in the world.

About Silver Bull: Silver Bull

is a mineral exploration company whose shares are listed on the

Toronto Stock Exchange and trade on the OTCQB in the United States,

and is based out of Vancouver, Canada. In addition to the Beskauga

deposit, Silver Bull also owns the Sierra Mojada Project in

Northern Mexico which is currently under a joint Venture with

South32 Ltd.

About the Sierra Mojada

deposit: Sierra Mojada is an open-pittable oxide deposit

with a NI 43-101 compliant Measured and Indicated "global" Mineral

Resource of 70.4 million tonnes grading 3.4% zinc and 38.6 g/t

silver at a $13.50 NSR cutoff giving 5.35 billion pounds of zinc

and 87.4 million ounces of silver. Included within the "global"

Mineral Resource is a Measured and Indicated "high grade zinc zone"

of 13.5 million tonnes with an average grade of 11.2% zinc at a 6%

cutoff, giving 3.336 billion pounds of zinc, and a Measured and

Indicated "high grade silver zone" of 15.2 million tonnes with an

average grade of 114.9 g/t silver at a 50 g/t cutoff giving 56.3

million ounces of silver. Mineralization remains open in the east,

west, and northerly directions. Approximately 60% of the current

3.2 kilometer mineralized body is at or near surface before dipping

at around 6 degrees to the east.

The technical information of this news release

has been reviewed and approved by Tim Barry, a Chartered

Professional Geologist (CPAusIMM), and a qualified person for the

purposes of National Instrument 43-101.

On behalf of the Board of Directors "Tim Barry"

Tim Barry, CPAusIMM Chief Executive Officer,

President and Director

INVESTOR RELATIONS: +1 604 687

5800info@silverbullresources.com

Cautionary Note to U.S. Investors

concerning estimates of Measured, Indicated, and Inferred

Resources: This press release uses the terms "measured

resources", "indicated resources", and "inferred resources" which

are defined in, and required to be disclosed by, NI 43-101. We

advise U.S. investors that these terms are not recognized by the

United States Securities and Exchange Commission (the "SEC"). The

estimation of measured, indicated and inferred resources involves

greater uncertainty as to their existence and economic feasibility

than the estimation of proven and probable reserves. U.S. investors

are cautioned not to assume that measured and indicated mineral

resources will be converted into reserves. The estimation of

inferred resources involves far greater uncertainty as to their

existence and economic viability than the estimation of other

categories of resources. U.S. investors are cautioned not to assume

that estimates of inferred mineral resources exist, are

economically minable, or will be upgraded into measured or

indicated mineral resources. Under Canadian securities laws,

estimates of inferred mineral resources may not form the basis of

feasibility or other economic studies.

Disclosure of "contained ounces" in a resource

is permitted disclosure under Canadian regulations, however the SEC

normally only permits issuers to report mineralization that does

not constitute "reserves" by SEC standards as in place tonnage and

grade without reference to unit measures. Accordingly, the

information contained in this press release may not be comparable

to similar information made public by U.S. companies that are not

subject NI 43-101.

Cautionary note regarding forward

looking statements: This news release contains

forward-looking statements regarding future events and Silver

Bull's future results that are subject to the safe harbors created

under the U.S. Private Securities Litigation Reform Act of 1995,

the Securities Act of 1933, as amended, the Securities Exchange Act

of 1934, as amended, and applicable Canadian securities laws.

Forward-looking statements include, among others, statements

regarding that Beskauga is a mineralized system that has

considerable upside that has yet to be explored, and geological

prospectivity of Kazakhstan. These statements are based on current

expectations, estimates, forecasts, and projections about Silver

Bull's exploration projects, the industry in which Silver Bull

operates and the beliefs and assumptions of Silver Bull's

management. Words such as "expects," "anticipates," "targets,"

"goals," "projects," "intends," "plans," "believes," "seeks,"

"estimates," "continues," "may," variations of such words, and

similar expressions and references to future periods, are intended

to identify such forward-looking statements. Forward-looking

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond our control, including such

factors as the results of exploration activities and whether the

results continue to support continued exploration activities,

unexpected variations in ore grade, types and metallurgy,

volatility and level of commodity prices, the availability of

sufficient future financing, and other matters discussed under the

caption "Risk Factors" in our Annual Report on Form 10-K for the

fiscal year ended October 31, 2019 and our Quarterly Reports on

Form 10-Q for the interim periods ended January 31, 2020, April 30,

2020, as amended, and July 31, 2020 and our other periodic and

current reports filed with the SEC and available on www.sec.gov and

with the Canadian securities commissions available on

www.sedar.com. Readers are cautioned that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those expressed

or implied in the forward-looking statements. Any forward-looking

statement made by us in this release is based only on information

currently available to us and speaks only as of the date on which

it is made. We undertake no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

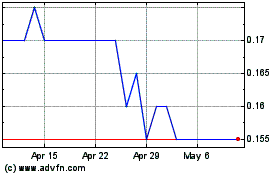

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Jan 2024 to Jan 2025