Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”

or the “Company”), a mineral exploration company with assets in

Kazakhstan and Mexico, is pleased to announce the completion of a

C$2,517,500 private placement (the “Private Placement”) into its

newly incorporated British Columbia subsidiary, Arras Minerals

Corp. (“Arras Minerals”).

Pursuant to the Private Placement, investors

purchased 5.035 million shares of Arras Minerals at a price of

C$0.50 each for gross proceeds of C$2,517,500, with management and

directors (and their affiliates) taking approximately C$200,000 of

the offering. No placement agent or finder’s fees were paid in

connection with the Private Placement.

Silver Bull’s assets in Kazakhstan, including

the Beskauga Option Agreement and the Ekidos and Stepnoe mineral

licences, have been transferred to Arras Minerals. In return,

Silver Bull has received 36 million shares of Arras Minerals and

owns approximately 88% of the company, with the remaining 12% owned

by the individuals who participated in the Private Placement.

The net proceeds from the Private Placement will

be used to fund exploration activities, technical studies and

permitting on the Company’s projects in Kazakhstan and for general

and working capital purposes in managing the Kazakhstan

projects.

Beskauga Deposit, Kazakhstan:

The Beskauga deposit is an open pittable gold-copper-silver deposit

with a NI 43-101 compliant “Indicated Mineral Resource” of 207

million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t

silver for 2.33 million contained ounces of gold, 476.1 thousand

contained tonnes of copper and 7.25 million contained ounces of

silver and an “Inferred Mineral Resource” of 147 million tonnes

grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56

million contained ounces of gold, 220.5 thousand contained tonnes

of copper and 4.82 million contained ounces of silver.

The constraining pit was optimised and

calculated using a net smelter return (“NSR”) cut-off based on

prices of: $1,500/oz for gold, $2.80/lb for copper, $17.25/oz for

silver, and with an average recovery of 81.7% for copper and 51.8%

for both gold and silver. Mineralization remains open in all

directions as well as at depth.

Table 1. Pit-constrained Mineral Resource estimate for the

Beskauga copper-gold project

|

CATEGORY |

TONNAGE (MT) |

CU % |

AU G/T |

AG G/T |

AU (MOZ) |

CU (KT) |

AG (MOZ) |

|

Inferred |

207 |

0.23 |

0.35 |

1.09 |

2.33 |

476.1 |

7.25 |

|

Indicated |

147 |

0.15 |

0.33 |

1.02 |

1.56 |

220.5 |

4.82 |

Notes:

- An NSR $/t cut-off of $5.70/t was

used, and the NSR formula is: NSR $/t = (38.137+11.612 x Cu%) x Cu%

+ (19.18 + 12.322 x Au g/t) x Au g/t + (0.07 + 0.0517 x Ag g/t) x

Ag g/t

- The NSR formula incorporates

variable recovery formulae. Average copper recovery was 81.7%

copper and 51.8% for both gold and silver.

- Metal prices considered were

$2.80/lb copper, $1,500/oz gold and $17.25/oz silver.

- The Resource is stated within a pit

shell that considers a 1.25 factor above the metal prices.

- Mineral Resources are estimated and

reported in accordance with the CIM Definition Standards for

Mineral Resources and Mineral Reserves adopted 10 May 2014.

- The Mineral Resource is not

believed to be materially affected by any known environmental,

permitting, legal, title, taxation, socio-economic, marketing,

political or other relevant factors

- These Mineral Resources are not

Mineral Reserves as they do not have demonstrated economic

viability.

- The quantity and grade of reported

Inferred Resources in this mineral resource estimate (MRE) are

uncertain in nature and there has been insufficient exploration to

define these Inferred Resources as Indicated or Measured; however,

it is reasonably expected that the majority of Inferred Mineral

Resources could be upgraded to Indicated Mineral Resources with

continued exploration.

For additional details, please refer to the

Beskauga Copper-Gold Project NI 43-101 Technical Report prepared by

CSA Global Mining Industry Consultants dated February 8, 2021,

which is available on SEDAR at www.sedar.com.

The technical information of this news release

has been reviewed and approved by Tim Barry, a Chartered

Professional Geologist (CPAusIMM), and a qualified person for the

purposes of National Instrument 43-101.

On behalf of the Board of Directors "Tim Barry"

Tim Barry, CPAusIMM Chief Executive Officer,

President and Director

INVESTOR RELATIONS: +1 604 687 5800

info@silverbullresources.com

Cautionary Note to U.S. Investors

concerning estimates of Measured, Indicated, and Inferred

Resources: This news release uses the terms "measured

resources", "indicated resources", and "inferred resources" which

are defined in, and required to be disclosed by, NI 43-101. We

advise U.S. investors that these terms are not recognized by the

United States Securities and Exchange Commission (the "SEC") under

SEC Industry Guide 7. The SEC has adopted amendments to its

disclosure rules in subpart 1300 of Regulation S-K to modernize the

mineral property disclosure requirements for issuers whose

securities are registered with the SEC under the United States

Securities Exchange Act of 1934, as amended (the “New Mining

Disclosure Rules”). Under the New Mining Disclosure Rules, the SEC

will permit issuers to disclose estimates of mineral resources if

certain conditions are met. The estimates prepared in this news

release were prepared in accordance with NI 43-101 and not in

accordance with the New Mining Disclosure Rules. The estimation of

measured, indicated and inferred resources involves greater

uncertainty as to their existence and economic feasibility than the

estimation of proven and probable reserves. U.S. investors are

cautioned not to assume that measured and indicated mineral

resources will be converted into reserves. The estimation of

inferred resources involves far greater uncertainty as to their

existence and economic viability than the estimation of other

categories of resources. U.S. investors are cautioned not to assume

that estimates of inferred mineral resources exist, are

economically minable, or will be upgraded into measured or

indicated mineral resources. Under Canadian securities laws,

estimates of inferred mineral resources may not form the basis of

feasibility or other economic studies.

Disclosure of "contained ounces" in a resource

is permitted disclosure under Canadian regulations, however under

SEC Industry Guide 7 the SEC normally only permits issuers to

report mineralization that does not constitute "reserves" by SEC

standards as in place tonnage and grade without reference to unit

measures. Accordingly, the information contained in this news

release may not be comparable to similar information made public by

U.S. companies that are not subject NI 43-101.

Cautionary note regarding forward

looking statements: This news release contains

forward-looking statements regarding future events and Silver

Bull's future results that are subject to the safe harbors created

under the U.S. Private Securities Litigation Reform Act of 1995,

the Securities Act of 1933, as amended (the "Securities Act"), and

the Securities Exchange Act of 1934, as amended (the "Exchange

Act"), and applicable Canadian securities laws. Forward-looking

statements include, among others, statements relating to the

expected use of proceeds from the Private Placement. These

statements are based on current expectations, estimates, forecasts,

and projections about Silver Bull's exploration projects, the

industry in which Silver Bull operates and the beliefs and

assumptions of Silver Bull's management. Words such as "expects,"

"anticipates," "targets," "goals," "projects," "intends," "plans,"

"believes," "seeks," "estimates," "continues," "may," variations of

such words, and similar expressions and references to future

periods, are intended to identify such forward-looking statements.

Forward-looking statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond our control,

including such factors as the results of exploration activities and

whether the results continue to support continued exploration

activities, unexpected variations in ore grade, types and

metallurgy, volatility and level of commodity prices, the

availability of sufficient future financing, and other matters

discussed under the caption "Risk Factors" in our Annual Report on

Form 10-K for the fiscal year ended October 31, 2020 and our

Quarterly Report on Form 10-Q for the interim period ended January

31, 2021 and our other periodic and current reports filed with the

SEC and available on www.sec.gov and with the Canadian securities

commissions available on www.sedar.com. Readers are cautioned that

forward-looking statements are not guarantees of future performance

and that actual results or developments may differ materially from

those expressed or implied in the forward-looking statements. Any

forward-looking statement made by us in this news release is based

only on information currently available to us and speaks only as of

the date on which it is made. We undertake no obligation to

publicly update any forward-looking statement, whether written or

oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

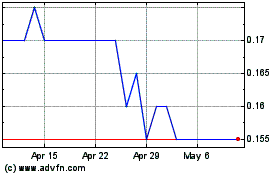

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Jan 2024 to Jan 2025