Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”

or the “Company”) is pleased to announce the timing and additional

details regarding the previously announced distribution (the

“Distribution”) to Silver Bull shareholders of shares of Arras

Minerals Corp. (“Arras”).

Pursuant to the Distribution, shareholders of

Silver Bull common stock as of September 10,

2021 (the “Record Date”) will be entitled to receive one

common share of Arras for each share of Silver Bull common stock

held as of that date. The Distribution is scheduled to occur on

September 24, 2021 (the “Distribution

Date”).

Immediately following completion of the

Distribution, Silver Bull’s shareholders will be issued shares in

Arras so that, collectively, they will own approximately 84% of

Arras, on a non-diluted basis, and Silver Bull will own

approximately 4% of Arras, on a non-diluted basis. The remaining

approximately 12% of Arras will be held by those who participated

in Arras’ private placement in April 2021.

In connection with the approval of the

Distribution by the board of directors of Silver Bull, Silver Bull

and Arras entered into a separation and distribution agreement,

dated August 31, 2021, setting forth the principal actions to

be taken in connection with the Distribution and providing a

framework for the relationship between the parties after the

Distribution.

The Toronto Stock Exchange (the “TSX”) has

decided to implement “due bill” trading in connection with the

Distribution. Each “due bill” will represent an entitlement to an

Arras share to be distributed pursuant to the Distribution and will

attach to each Silver Bull share between the opening of trading on

September 9, 2021 and the closing of trading on

September 24, 2021, allowing Silver Bull shares to carry the

value of the entitlement to the Arras share until the Distribution

is made. As such, Silver Bull shareholders who sell Silver Bull

shares up to the end of trading on the Distribution Date (i.e.,

when Silver Bull shares trade with an attached “due bill”

representing an entitlement to Arras shares to be distributed

pursuant to the Distribution) will be selling their right to

receive Arras common shares in the Distribution. “Ex-distribution”

trading (i.e., where Silver Bull shares trade without an

entitlement to Arras shares to be distributed pursuant to the

Distribution) will commence at the opening of trading on September

27, 2021. The due bill redemption date (i.e., the date when holders

of due bill entitlements are expected to settle their entitlements)

will be September 28, 2021. It is expected that the OTCQB

marketplace will also implement “due bills” trading.

Most Silver Bull shareholders hold their Silver

Bull shares through a bank or brokerage firm. In such cases, the

bank or brokerage firm would be said to hold the shares in “street

name,” and ownership would be recorded on the bank’s or brokerage

firm’s books. If a Silver Bull shareholder holds Silver Bull shares

through a bank or brokerage firm, the bank or brokerage firm will

credit the shareholder’s account for the Arras common shares that

the shareholder is entitled to receive in the Distribution. If

Silver Bull shareholders have any questions concerning the

mechanics of having shares held in “street name,” they should

contact their bank or brokerage firm.

In connection with the Distribution, all

registered Silver Bull shareholders holding physical share

certificates or shares in book-entry form with the Company’s

transfer agent (Olympia Trust Company) will be issued Arras shares

in book-entry form only, which means that no physical share

certificates will be issued. For questions relating to the transfer

or mechanics of the Distribution, please contact Olympia Trust

Company by telephone at 1-833-684-1546 (toll free in North America)

or by online inquiry at cssinquiries@olympiatrust.com.

Upon the consummation of the Distribution, Arras

will not be listed on a public stock exchange but will report under

the U.S. Securities Exchange Act of 1934, as amended (the “Exchange

Act”), as a non-U.S. company with foreign private issuer status.

The Arras shares distributed to Silver Bull shareholders, though

freely transferable in the United States, may be illiquid until

such time as the shares are listed or a trading market develops, if

at all. The Distribution of Arras shares by Silver Bull will

constitute a distribution of securities that is exempt from the

prospectus requirements of Canadian securities legislation. As

such, the first trade in Arras shares in Canada will be a

distribution for the purposes of Canadian securities laws and

subject to prospectus requirements unless certain conditions are

satisfied. Until such conditions are satisfied, Arras shares may

only be resold in Canada pursuant to an exemption from prospectus

requirements. Silver Bull warrants and options will also be

adjusted pursuant to the Distribution. For further details

regarding the Canadian resale restrictions on the Arras shares

distributed by Silver Bull and the adjustments being made to Silver

Bull warrants and options in connection with the Distribution,

please refer to the Registration Statement on Form 20-F of

Arras filed on September 1, 2021 with the U.S. Securities and

Exchange Commission (the “SEC”) on EDGAR at www.sec.gov/edgar (the

“20-F”).

Tax Implications

The following discussion is qualified in its

entirety by the discussion of tax matters set forth in the 20-F.

Silver Bull shareholders entitled to receive the Distribution of

Arras shares should make reference to that discussion for further

details regarding the tax consequences of the Distribution.

For U.S. federal income tax purposes, the

receipt of Arras common shares by Silver Bull shareholders should

be treated as a distribution of property in an amount equal to the

fair market value of the common shares received. The Distribution

of Arras common shares should be treated as dividend income to the

extent considered paid out of Silver Bull’s current and accumulated

earnings and profits. Distributions in excess of Silver Bull’s

current and accumulated earnings and profits will be treated as a

non-taxable return of capital to the extent of the holder’s basis

in its Silver Bull shares and thereafter as capital gain. Silver

Bull will not be able to determine the amount of the Distribution

that will be treated as a dividend until after the close of the

taxable year of the Distribution because its current year earnings

and profits will be calculated based on its income for the entire

taxable year in which the Distribution occurs. However, based on

current projections, it is reasonably expected that a portion of

the Distribution of Arras common shares should be treated as a

return of capital rather than a dividend.

For Canadian tax purposes, the Distribution of

Arras shares will be considered a dividend in kind on the Silver

Bull shares to shareholders resident in Canada. Such shareholders

will be required to include in computing their income for a

taxation year the amount of such dividend (equal to the fair market

value of the Arras shares received). A dividend in kind of the

Arras shares paid in respect of the Silver Bull shares to a

shareholder who is not a resident of Canada will not be subject to

Canadian withholding tax or other income tax under the Income

Tax Act (Canada).

The portion of the Distribution treated as a

dividend for U.S. federal income tax purposes that is made to

non-U.S. holders will generally be subject to U.S. federal

gross-basis income tax at a rate of 30%, or a lower rate specified

in an applicable income tax treaty. This tax is generally collected

by way of withholding. Because the amount constituting a dividend

will not be known at the time of the Distribution, Silver Bull or

the applicable withholding agent is generally required to withhold

on entire amount of the Distribution. Silver Bull or the applicable

withholding agent may obtain the funds necessary to remit any such

withholding tax by asking the non-U.S. holder to provide the funds,

by using funds in such holder’s account with the applicable

withholding agent or by selling (on such holder’s behalf) the

portion of Arras common shares otherwise distributable to such

non-U.S. holder needed to pay that tax, together with associated

expenses.

EACH REGISTERED HOLDER OF SILVER BULL COMMON

STOCK THAT IS A NON-U.S. HOLDER WILL HAVE THE OPTION TO PROVIDE THE

FUNDS NECESSARY TO REMIT ANY APPLICABLE WITHHOLDING TAX TO THE IRS.

IF SUCH FUNDS, TOGETHER WITH ANY OTHER REQUIRED DOCUMENTATION TO BE

PROVIDED FROM SUCH HOLDER, ARE NOT RECEIVED BY

SEPTEMBER 17, 2021, THEN, IF APPLICABLE, A

PORTION OF THE ARRAS COMMON SHARES OTHERWISE DISTRIBUTABLE TO SUCH

HOLDER WILL BE WITHHELD AND SOLD (ON SUCH HOLDER’S BEHALF) IN ORDER

TO PAY ANY APPLICABLE WITHHOLDING TAX.

As this Distribution, as described

above, is reasonably expected to result in a taxable dividend, the

Company or an applicable withholding agent generally will be

required to withhold with respect to the Distribution being made to

certain non-U.S. holders. The Company implores shareholders who

have not yet provided proof of their tax residency to do so by

filing the appropriate forms with their bank, brokerage firm or for

those who hold physical share certificates or in book entry form

with the Company’s transfer agent, Olympia Trust Company, prior to

the Record Date.

Benefits of the Transaction

The Distribution is expected to:

- provide investors with the

potential for greater value than a single company, by unlocking a

premium value for the Beskauga and Sierra Mojada projects

separately;

- create two separate companies that

have clear commodity and regional demarcation, allowing for

targeted branding and marketing;

- allow each company flexibility in

allocating resources and deploying capital in a manner consistent

with the separate business strategies;

- broaden the appeal of the potential

investor base for both companies, with Kazakhstan appealing to

European and Middle Eastern investors and Mexico potentially

appealing to North American investors; and

- facilitate the ability of the

companies to separately finance the Beskauga and Sierra Mojada

projects based on the unique characteristics of each project and

jurisdiction.

Tim Barry, President, CEO and director of Silver

Bull states, “We continue to believe greater value will be created

with two independent companies compared to the value that would be

achieved by keeping the two sets of assets in a single company.

Both the Beskauga and Sierra Mojada projects have NI 43-101

compliant resources as well as exploration upside and we believe

the split will allow each company to execute its own unique

business strategy and achieve a premium for any success in resource

development and exploration. With continued strong metal prices and

demand for commodities, we are confident that now is the right time

to separate the projects in different companies.”

Beskauga Deposit, Kazakhstan:

The Beskauga deposit is an open pittable gold-copper-silver deposit

with a NI 43-101 compliant “Indicated” Mineral Resource of 207

million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t

silver for 2.33 million ounces of contained gold, 476.1 thousand

tonnes of contained copper, and 7.25 million ounces of contained

silver and an “Inferred” Mineral Resource of 147 million tonnes

grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56

million ounces of contained gold, 220.5 thousand tonnes of

contained copper, and 4.82 million ounces of contained silver.

The constraining pit was optimised and

calculated using a NSR cut-off based on a price of: $1,500/oz for

gold, $2.80/lb for copper, $17.25/oz for silver, and with an

average recovery of 81.7% for copper and 51.8% for both gold and

silver. Mineralization remains open in all directions as well as at

depth.

Table 1. Pit-constrained Mineral Resource

estimate for the Beskauga copper-gold project

|

CATEGORY |

TONNAGE (MT) |

CU % |

AU G/T |

AG G/T |

AU (MOZ) |

CU (KT) |

AG (MOZ) |

|

Indicated |

207 |

0.23 |

0.35 |

1.09 |

2.33 |

476.1 |

7.25 |

|

Inferred |

147 |

0.15 |

0.33 |

1.02 |

1.56 |

220.5 |

4.82 |

For a full summary of the Beskauga resource

please refer to the Company’s press release dated January 28,

2021 and filed on the Company’s profile at www.SEDAR.com, or by

visiting the following link:

https://www.silverbullresources.com/news/silver-bull-announces-maiden-ni-43-101-resource-of-2.33-million-ounces-of-gold-476-thousand-tonnes-of-copper-in-the-indicated/

Sierra Mojada deposit, Mexico:

Sierra Mojada is an open pittable oxide deposit with a NI 43-101

compliant Measured and Indicated “global” Mineral Resource of 70.4

million tonnes grading 3.4% zinc and 38.6 g/t silver for 5.35

billion pounds of contained zinc and 87.4 million ounces of

contained silver. Included within the “global” Mineral Resource is

a Measured and Indicated “high grade zinc zone” of 13.5 million

tonnes with an average grade of 11.2% zinc at a 6% cutoff, for

3.336 billion pounds of contained zinc, and a Measured and

Indicated “high grade silver zone” of 15.2 million tonnes with an

average grade of 114.9 g/t silver at a 50 g/t cutoff for 56.3

million contained ounces of silver. Mineralization remains open in

the east, west, and northerly directions.

The constraining pit was optimised and

calculated using a NSR cut-off based on a silver price of US$15/oz,

and a zinc price of US$1.20/lb and assumed a recovery for silver of

75% and a recovery for zinc of 41%. Approximately 60% of the

current 3.2 kilometer mineralized body is at or near surface before

dipping at around 6 degrees to the east.

|

CATEGORY |

TONNES (MT) |

AG (G/T) |

CU (%) |

PB (%) |

ZN (%) |

AG (MOZS) |

CU (MLBS) |

PB (MLBS) |

ZN (MLBS) |

|

MEASURED |

52.0 |

39.2 |

0.04 |

% |

0.3 |

% |

4.0 |

% |

65.5 |

45.9 |

379.1 |

4,589.3 |

|

INDICATED |

18.4 |

37.0 |

0.03 |

% |

0.2 |

% |

1. 9 |

% |

21.9 |

10.8 |

87.0 |

764.6 |

|

TOTAL M&I |

70.4 |

38.6 |

0.04 |

% |

0.3 |

% |

3.4 |

% |

87.4 |

56.8 |

466.1 |

5,353.9 |

|

INFERRED |

0.1 |

8.8 |

0.02 |

% |

0.2 |

% |

6.4 |

% |

0.02 |

0.04 |

0.4 |

10.7 |

For a full summary of the Sierra Mojada

resource, please refer to the Company’s press release dated October

31, 2018 and filed on the Company’s profile at www.SEDAR.com, or by

visiting the following link:

https://www.silverbullresources.com/news/silver-bull-resources-announces-5.35-billion-pounds-zinc-87.4-million-ounces-silver-in-updated-sierra-mojada-measured-and/

Sierra Mojada is currently under an illegal

blockade from a group called Sociedad Cooperativa de Exploración

Minera Mineros Norteños, S.C.L. (“Mineros Norteños”).

In 2014, Mineros Norteños filed a lawsuit

against Silver Bull’s Mexican subsidiary “Minera Metalin”. In the

lawsuit, Mineros Norteños sought payment of a capped 2% production

royalty, including interest at a rate of 6% per annum since

August 30, 2004, even though no revenue has been produced from

the applicable mining concessions. Mineros Norteños also sought

payment of wages to the Mineros Norteños members since

August 30, 2004 under this agreement, even though a mineral

processing plant was never built and none of the individuals were

hired or performed work for Silver Bull under this agreement and

Silver Bull did not commit to hiring them.

To date, Mineros Norteños has lost three

separate rulings on its lawsuit. In an attempt to force Silver Bull

into making a settlement, Mineros Norteños has undertaken to

illegally block access to the project since September 2019. To

ensure the safety of all involved, Silver Bull has elected to halt

all operations on the project until a resolution can be found.

Post-Distribution of Arras

Shares

Following the Distribution, Silver Bull will

focus on the Sierra Mojada asset and surrounding area in Mexico and

continue to manage the joint venture option with South32. It will

continue to trade under the symbol “SVB” on the TSX, and “SVBL” on

the OTCQB. The current management and board are expected to remain

in place to continue to run the Company.

Arras will focus on the Beskauga deposit and the

exploration licenses held in the surrounding area. In addition,

current Silver Bull management and board have been appointed as

management and board of Arras, along with G. Wesley Carson as an

additional independent board member.

Both companies will remain headquartered in

Vancouver.

The technical information of this news release

has been reviewed and approved by Tim Barry, a Chartered

Professional Geologist (CPAusIMM), and a qualified person for the

purposes of National Instrument 43-101.

On behalf of the Board of Directors “Tim

Barry”

Tim Barry, CPAusIMM Chief

Executive Officer, President and Director

INVESTOR RELATIONS: +1 604 687

5800 info@silverbullresources.com

Cautionary Note to U.S. Investors

concerning estimates of Measured, Indicated, and Inferred

Resources: This press release uses the terms “measured

resources”, “indicated resources”, and “inferred resources” which

are defined in, and required to be disclosed by, NI 43-101. We

advise U.S. investors that these terms are not recognized by the

SEC. The estimation of measured, indicated and inferred resources

involves greater uncertainty as to their existence and economic

feasibility than the estimation of proven and probable reserves.

U.S. investors are cautioned not to assume that measured and

indicated mineral resources will be converted into reserves. The

estimation of inferred resources involves far greater uncertainty

as to their existence and economic viability than the estimation of

other categories of resources. U.S. investors are cautioned not to

assume that estimates of inferred mineral resources exist, are

economically minable, or will be upgraded into measured or

indicated mineral resources. Under Canadian securities laws,

estimates of inferred mineral resources may not form the basis of

feasibility or other economic studies.

Disclosure of “contained ounces” in a resource

is permitted disclosure under Canadian regulations, however the SEC

normally only permits issuers to report mineralization that does

not constitute “reserves” by SEC standards as in place tonnage and

grade without reference to unit measures. Accordingly, the

information contained in this press release may not be comparable

to similar information made public by U.S. companies that are not

subject NI 43-101.

Cautionary note regarding forward

looking statements: This news release contains

forward-looking statements regarding future events and Silver

Bull’s future results that are subject to the safe harbors created

under the U.S. Private Securities Litigation Reform Act of 1995,

the Securities Act of 1933, as amended, and the Exchange Act, and

applicable Canadian securities laws. Forward-looking statements

include, among others, statements regarding the expected timing,

mechanics, income tax consequences, benefits and other aspects of

the proposed Distribution, expected post-Distribution management

focus, and the Mineral Resource estimates for the Beskauga and

Sierra Mojada projects. These statements are based on current

expectations, estimates, forecasts, and projections about Silver

Bull’s exploration projects, the industry in which Silver Bull

operates and the beliefs and assumptions of Silver Bull’s

management. Words such as “expects,” “anticipates,” “targets,”

“goals,” “projects,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “continues,” “may,” variations of such words, and

similar expressions and references to future periods, are intended

to identify such forward-looking statements. Forward-looking

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond our control, including such

factors as whether the Distribution is ultimately achieved, in the

manner and on the timeline currently contemplated, or at all,

whether some or all of the expected benefits of the Distribution

will be achieved, the impact of the Distribution on Silver Bull

shareholders, whether management’s focus will be as described in

this news release following the Distribution, the results of

exploration activities and whether the results continue to support

continued exploration activities, unexpected variations in ore

grade, types and metallurgy, volatility and level of commodity

prices, the availability of sufficient future financing, and other

matters discussed under the caption “Risk Factors” in our Annual

Report on Form 10-K for the fiscal year ended October 31, 2020

and our Quarterly Report on Form 10-Q for the interim periods ended

January 31, 2021, April 30, 2021, and our other periodic

and current reports filed with the SEC and available on www.sec.gov

and with the Canadian securities commissions available on

www.sedar.com. Readers are cautioned that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those expressed

or implied in the forward-looking statements. Any forward-looking

statement made by us in this release is based only on information

currently available to us and speaks only as of the date on which

it is made. We undertake no obligation to publicly update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

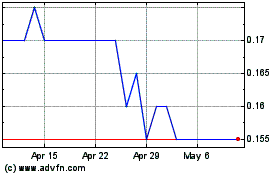

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Jan 2024 to Jan 2025