Silver Bull Resources, Inc. (OTCQB: SVBL, TSX: SVB) (“Silver Bull”)

and Arras Minerals Corp. (“Arras”) are pleased to announce the

appointment of Darren Klinck to both companies as President,

effective October 1, 2021. Mr. Klinck will also be joining the

Board of Directors of Arras.

Mr. Klinck is an accomplished mining executive

with considerable management experience throughout Australasia

& The Americas. He was most recently President & CEO of

Bluestone Resources, following the acquisition of the Cerro Blanco

gold project in Guatemala in 2017, where he led the team that

financed and advanced the project through resource expansion,

feasibility and engineering phases of project development. He also

spent more than ten years with OceanaGold as a member of the

Executive Committee that achieved significant growth and business

expansion to become a multi-mine, international gold mining

company, growing from a market capitalization of less than C$100M

to one greater than C$3B.

Over the past 20 years, Darren has been

instrumental in negotiating both equity and debt financing packages

totaling more than $800m and has significant experience leading

teams in emerging markets with a strong focus on Corporate Social

Responsibility (CSR) and community engagement programs, as well as

extensive government relations activities.

Mr. Klinck has a Bachelor of Commerce degree

from the Haskayne School of Business at The University of Calgary.

He is a Director of ValOre Metals Corp and Gold Basin Resources

Corp.

Mr. Klinck commented, “I look forward to working

closely with Tim and the team as we advance from a solid base

already in place in Mexico at Silver Bull but also as we begin to

emerge with Arras in Kazakhstan. The team has done a terrific job

through this challenging global pandemic to evaluate opportunities

focusing on high-quality geological potential in jurisdictions that

welcome mineral development. The significant opportunity

established in Kazakhstan by Arras over the past year has

positioned the company to be an early mover in one of the few

copper-gold belts remaining globally that has not benefitted from

significant modern exploration and focus. Pleasingly, Beskauga is

already a significant deposit in its own right and provides a solid

base from which to build on in the future within a country that is

the most advanced economy in Central Asia; has recently modernized

their mining regulations based on Western Australian code; and is

now seeing new entrants comprising of the largest players in our

industry.”

Brian Edgar, Chairman of Silver Bull stated

“This is an important step forward for Silver Bull and Arras.

Darren’s appointment significantly strengthens and diversifies our

existing management team. He has a track record of creating

shareholder value and a broad range of experience in management,

corporate finance and investor relations. Silver Bull and Arras

have two exceptional projects which provide exposure to silver and

zinc, and gold and copper, respectively, and Darren’s capital

markets expertise, coupled with management’s technical expertise,

positions the Companies for significant success.”

Silver Bull and Arras Moving

Forward: On September 24, 2021, Silver Bull completed the

distribution of shares of Arras to its shareholders. Silver Bull

continues to own approximately 4% of Arras, on a non-diluted

basis.

Silver Bull will continue to focus on the Sierra

Mojada project and surrounding area in Mexico and managing the

joint venture option with South32. It will continue to trade under

the symbol “SVB” on the TSX, and “SVBL” on the OTCQB.

Arras as a standalone entity will focus on the

Beskauga deposit in Northeastern Kazakhstan.

The exploration activities of both companies

will continue to be managed by current management and will be

headquartered in Vancouver.

A summary of Arras’s Beskauga project in

Kazakhstan, and the Sierra Mojada Project in Mexico is provided

below.

Beskauga Deposit, Kazakhstan:

The Beskauga deposit is an open pittable gold-copper-silver deposit

with a NI 43-101 compliant “Indicated” Mineral Resource of 207

million tonnes grading 0.35 g/t gold, 0.23% copper and 1.09 g/t

silver for 2.33 million ounces of contained gold, 476.1 thousand

tonnes of contained copper, and 7.25 million ounces of contained

silver and an “Inferred” Mineral Resource of 147 million tonnes

grading 0.33 g/t gold, 0.15% copper and 1.02 g/t silver for 1.56

million ounces of contained gold, 220.5 thousand tonnes of

contained copper, and 4.82 million ounces of contained silver.

The constraining pit was optimised and

calculated using a NSR cut-off based on a price of: $1,500/oz for

gold, $2.80/lb for copper, $17.25/oz for silver, and with an

average recovery of 81.7% for copper and 51.8% for both gold and

silver. Mineralization remains open in all directions as well as at

depth.

Table 1. Pit-constrained Mineral Resource

estimate for the Beskauga copper-gold project

|

CATEGORY |

TONNAGE (MT) |

CU % |

AU G/T |

AG G/T |

AU (MOZ) |

CU (KT) |

AG (MOZ) |

|

Indicated |

207 |

0.23 |

0.35 |

1.09 |

2.33 |

476.1 |

7.25 |

|

Inferred |

147 |

0.15 |

0.33 |

1.02 |

1.56 |

220.5 |

4.82 |

For a full summary of the Beskauga resource

please refer to Silver Bull’s press release dated January 28,

2021 and filed on its profile at www.SEDAR.com, or by visiting the

following link:

https://www.silverbullresources.com/news/silver-bull-announces-maiden-ni-43-101-resource-of-2.33-million-ounces-of-gold-476-thousand-tonnes-of-copper-in-the-indicated/

Sierra Mojada deposit, Mexico:

Sierra Mojada is an open pittable oxide deposit with a NI 43-101

compliant Measured and Indicated “global” Mineral Resource of 70.4

million tonnes grading 3.4% zinc and 38.6 g/t silver for 5.35

billion pounds of contained zinc and 87.4 million ounces of

contained silver. Included within the “global” Mineral Resource is

a Measured and Indicated “high grade zinc zone” of 13.5 million

tonnes with an average grade of 11.2% zinc at a 6% cutoff, for

3.336 billion pounds of contained zinc, and a Measured and

Indicated “high grade silver zone” of 15.2 million tonnes with an

average grade of 114.9 g/t silver at a 50 g/t cutoff for 56.3

million contained ounces of silver. Mineralization remains open in

the east, west, and northerly directions.

The constraining pit was optimised and

calculated using a NSR cut-off based on a silver price of US$15/oz,

and a zinc price of US$1.20/lb and assumed a recovery for silver of

75% and a recovery for zinc of 41%. Approximately 60% of the

current 3.2 kilometer mineralized body is at or near surface before

dipping at around 6 degrees to the east.

|

CATEGORY |

TONNES (MT) |

AG (G/T) |

CU (%) |

PB (%) |

ZN (%) |

AG (MOZS) |

CU (MLBS) |

PB (MLBS) |

ZN (MLBS) |

|

MEASURED |

52.0 |

39.2 |

0.04% |

0.3% |

4.0% |

65.5 |

45.9 |

379.1 |

4,589.3 |

|

INDICATED |

18.4 |

37.0 |

0.03% |

0.2% |

1.9% |

21.9 |

10.8 |

87.0 |

764.6 |

|

TOTAL M&I |

70.4 |

38.6 |

0.04% |

0.3% |

3.4% |

87.4 |

56.8 |

466.1 |

5,353.9 |

|

INFERRED |

0.1 |

8.8 |

0.02% |

0.2% |

6.4% |

0.02 |

0.04 |

0.4 |

10.7 |

For a full summary of the Sierra Mojada

resource, please refer to Silver Bull’s press release dated October

31, 2018 and filed on its profile at www.SEDAR.com, or by visiting

the following link:

https://www.silverbullresources.com/news/silver-bull-resources-announces-5.35-billion-pounds-zinc-87.4-million-ounces-silver-in-updated-sierra-mojada-measured-and/

The technical information of this news release

has been reviewed and approved by Tim Barry, a Chartered

Professional Geologist (CPAusIMM), and a qualified person for the

purposes of National Instrument 43-101.

On behalf of the Board of Directors “Tim

Barry”

Tim Barry, CPAusIMM Chief

Executive Officer and Director

INVESTOR RELATIONS: +1 604 687

5800 info@silverbullresources.com

Cautionary Note to U.S. Investors

concerning estimates of Measured, Indicated, and Inferred

Resources: This press release uses the terms “measured

resources”, “indicated resources”, and “inferred resources” which

are defined in, and required to be disclosed by, NI 43-101. We

advise U.S. investors that these terms are not recognized by the

SEC. The estimation of measured, indicated and inferred resources

involves greater uncertainty as to their existence and economic

feasibility than the estimation of proven and probable reserves.

U.S. investors are cautioned not to assume that measured and

indicated mineral resources will be converted into reserves. The

estimation of inferred resources involves far greater uncertainty

as to their existence and economic viability than the estimation of

other categories of resources. U.S. investors are cautioned not to

assume that estimates of inferred mineral resources exist, are

economically minable, or will be upgraded into measured or

indicated mineral resources. Under Canadian securities laws,

estimates of inferred mineral resources may not form the basis of

feasibility or other economic studies.

Disclosure of “contained ounces” in a resource

is permitted disclosure under Canadian regulations, however the SEC

normally only permits issuers to report mineralization that does

not constitute “reserves” by SEC standards as in place tonnage and

grade without reference to unit measures. Accordingly, the

information contained in this press release may not be comparable

to similar information made public by U.S. companies that are not

subject NI 43-101.

Cautionary note regarding forward

looking statements: This news release contains

forward-looking statements regarding future events and Silver

Bull’s and Arras’s future results that are subject to the safe

harbors created under the U.S. Private Securities Litigation Reform

Act of 1995, the Securities Act of 1933, as amended, and the

Exchange Act, and applicable Canadian securities laws.

Forward-looking statements include, among others, statements

regarding the Mineral Resource estimates for the Beskauga and

Sierra Mojada projects and the development of both such projects.

These statements are based on current expectations, estimates,

forecasts, and projections about Silver Bull’s and Arras’s

exploration projects, the industry in which Silver Bull and Arras

operate and the beliefs and assumptions of Silver Bull’s and

Arras’s management. Words such as “expects,” “anticipates,”

“targets,” “goals,” “projects,” “intends,” “plans,” “believes,”

“seeks,” “estimates,” “continues,” “may,” variations of such words,

and similar expressions and references to future periods, are

intended to identify such forward-looking statements.

Forward-looking statements are subject to a number of assumptions,

risks and uncertainties, many of which are beyond our control,

including such factors as whether management’s focus will be as

described in this news release, the results of exploration

activities and whether the results continue to support continued

exploration activities, unexpected variations in ore grade, types

and metallurgy, volatility and level of commodity prices, the

availability of sufficient future financing, and other matters

discussed under the caption “Risk Factors” in Silver Bull’s Annual

Report on Form 10-K for the fiscal year ended October 31, 2020

and our Quarterly Report on Form 10-Q for the interim periods ended

January 31, 2021, April 30, 2021, July 31, 2021, and our

other periodic and current reports filed with the SEC and available

on www.sec.gov and with the Canadian securities commissions

available on www.sedar.com. Readers are cautioned that

forward-looking statements are not guarantees of future performance

and that actual results or developments may differ materially from

those expressed or implied in the forward-looking statements. Any

forward-looking statement made by us in this release is based only

on information currently available to us and speaks only as of the

date on which it is made. We undertake no obligation to publicly

update any forward-looking statement, whether written or oral, that

may be made from time to time, whether as a result of new

information, future developments or otherwise.

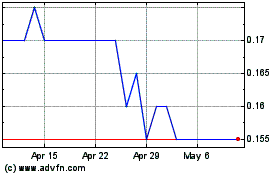

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Silver Bull Resources (TSX:SVB)

Historical Stock Chart

From Jan 2024 to Jan 2025