Timbercreek Financial Corp. announces normal course issuer bid

June 10 2024 - 6:00AM

Timbercreek Financial Corp. (TSX: TF) (the

"

Company") announced today that it has obtained

the approval of the Toronto Stock Exchange (the

"

TSX") to commence a normal course issuer bid (the

“

NCIB”) with respect to its common shares (the

“

Shares”). The NCIB will commence on June 12, 2024

and will terminate on the earlier of June 11, 2025 or the date

on which the Company has purchased the maximum number of Shares

permitted under the NCIB.

Under the NCIB, the Company may, over a 12-month

period commencing on June 12, 2024, purchase in the normal course

through the facilities of the TSX in accordance with its rules or

through alternative Canadian trading platforms up to a regulatory

maximum of 8,216,051 Shares, such amount representing 10% of the

public float of the Shares issued and outstanding as of

May 31, 2024. Furthermore, subject to certain exemptions for

block purchases, the maximum number of Shares that the Company may

acquire on any one trading day is 32,099 Shares, such amount

representing 25% of the average daily trading volume

(“ADTV”) of the Shares for the six calendar months

prior to the start of the NCIB, being 128,397 Shares. As of May 31,

2024, there were 83,009,516 Shares issued and outstanding.

Under the normal course issuer bid which

commenced on May 26, 2023 and terminated on May 25, 2024 (the

“2023 NCIB”), the Company was authorized to

purchase up to 8,305,467 Shares and purchased 765,500 Shares on the

open market at a volume weighted average price of $7.02 per Share.

Purchases made under the 2023 NCIB were made either through the

facilities of the TSX in accordance with its rules or through

alternative Canadian trading platforms. All Shares purchased under

the 2023 NCIB by the Company were cancelled.

The price which the Company will pay for any

Shares under the NCIB will be the market price at the time of

acquisition. During the period of the NCIB, the Company may make

purchases under the NCIB by means of open market transactions or

otherwise as permitted by the TSX. All purchases under the NCIB

will be purchased on the open market through the facilities of the

TSX and alternative Canadian trading platforms at the prevailing

market price at the time of such transaction. Any Shares purchased

by the Company will be cancelled. National Bank Financial will

conduct the bid on behalf of the Company.

The Company believes that the market price of

its Shares may not, from time to time, accurately reflect their

underlying value, making the purchase of Shares an attractive

investment and an advantageous use of the Company’s available

funds. The Company expects that the purchase of Shares will benefit

remaining shareholders by increasing their equity interest in the

Company’s assets.

There can be no assurance as to the precise

number of Shares that will be repurchased under the NCIB or the

aggregate dollar amount of the Shares purchased. The Company may

discontinue purchases at any time, subject to compliance with

applicable regulatory requirements.

For information, please visit

www.timbercreekfinancial.com.

For further information:

Blair TamblynChief Executive Officer

1-844-304-9967btamblyn@timbercreek.com

About the Company

Timbercreek Financial is a leading non-bank,

commercial real estate lender providing shorter-duration,

structured financing solutions to commercial real estate investors.

Our sophisticated, service-oriented approach allows us to meet the

needs of borrowers, including faster execution and more flexible

terms that are not typically provided by Canadian financial

institutions. By employing thorough underwriting, active management

and strong governance, we are able to meet these needs while

targeting strong risk-adjusted returns for investors.

Certain statements contained in this news

release may contain projections and "forward looking statements"

within the meaning of that phrase under Canadian securities laws.

When used in this news release, the words "may", "would", "should",

"could", "will", "intend", "plan", "anticipate", "believe",

"estimate", "expect", "objective" and similar expressions may be

used to identify forward looking statements. By their nature,

forward looking statements reflect the Company's current views,

beliefs, assumptions and intentions are subject to certain risks

and uncertainties, known and unknown, including, without

limitation, those risks disclosed in the Company's public filings.

Many factors could cause actual results, performance or

achievements to be materially different from any future results,

performance or achievements that may be expressed or implied by

these forward looking statements. The Company does not intend to

nor assumes any obligation to update these forward looking

statements whether as a result of new information, plans, events or

otherwise, unless required by law.

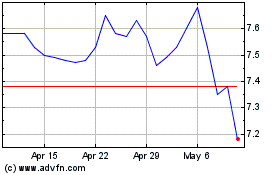

Timbercreek Financial (TSX:TF)

Historical Stock Chart

From Oct 2024 to Nov 2024

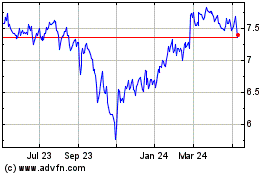

Timbercreek Financial (TSX:TF)

Historical Stock Chart

From Nov 2023 to Nov 2024