Athabasca Minerals announces Third Quarter Financial Results

November 27 2017 - 6:01AM

Athabasca Minerals Inc. (“Athabasca” or the “Corporation”)

(TSX-V:ABM) is pleased to announce its financial results for the

three months ended September 30, 2017. The Corporation’s unaudited

interim financial statements and management’s discussion and

analysis (“MD&A”) for the three months ended September 30, 2017

are available on SEDAR at www.sedar.com and on the Athabasca

Minerals website at www.athabascaminerals.com.

Q3 Highlights

- Revenue for the three months ended September 30, 2017 decreased

7% to $3,479,022 versus $3,745,532 in the comparable three-month

period ending September 30, 2016;

- Corporate pits sales decreased 9% for the three months ended

September 30, 2017 to $2,026,736;

- Working capital of $4.7 million; current debt of $0.4 million;

non-current debt $0.2 million;

- During the nine months ended September 30, 2017, 83,277 tonnes

of aggregate was produced at the KM248 corporate pit and 23,449

tonnes of aggregate was produced at the Logan corporate

pit;

- Recent meetings and discussions with frac-sand supply chain and

logistics companies, equipment suppliers, and interested parties

for potential staging locations have taken place to consider the

feasibility of a pilot project for the Firebag Frac Sand Project;

- Susan Lake Gravel Pit closure activities are underway in

relation to 30-November-2017 contract completion date. Closure Plan

has been submitted and a Request for Extension to 30-September-2018

is pending approval by Alberta Environment & Parks;

- Revised Corporation’s organizational structure and management

team to optimize costs as well as strengthen development,

reclamation and project management capabilities;

Financial

Highlights

| |

|

|

| ($ CDN,

except metric tonnes sold) |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Aggregate management

fees |

$2,481,158 |

|

$2,867,463 |

|

$4,349,512 |

|

$4,289,646 |

|

| Susan Lake royalty

expense |

$1,028,872 |

|

$1,347,065 |

|

$1,846,710 |

|

$1,986,437 |

|

| Corporate pits sales

revenue |

$2,026,736 |

|

$2,225,134 |

|

$2,730,200 |

|

$3,486,936 |

|

| Total revenue |

$3,479,022 |

|

$3,745,532 |

|

$5,233,002 |

|

$5,790,145 |

|

| Gross profit

(loss) |

$801,942 |

|

$1,072,747 |

|

$566,890 |

|

$1,007,414 |

|

| Total comprehensive

(loss) |

($431,203 |

) |

($411,859 |

) |

($1,958,309 |

) |

($1,304,782 |

) |

| |

|

|

|

|

| Tonnes Sold (metric

tonnes) |

|

|

|

|

| Corporate pits |

|

66,262 |

|

|

63,795 |

|

|

92,455 |

|

|

112,212 |

|

| Susan Lake

Operations |

|

1,165,150 |

|

|

1,370,804 |

|

|

2,042,761 |

|

|

2,060,500 |

|

| Total aggregate tonnes

sold |

|

1,231,412 |

|

|

1,434,599 |

|

|

2,135,216 |

|

|

2,172,712 |

|

| Loss per share, basic

and fully diluted ($ per share) |

($0.013 |

) |

($0.012 |

) |

($0.059 |

) |

($0.039 |

) |

| |

|

|

|

|

|

|

|

|

Outlook

Athabasca is actively addressing and working on various

strategic and operational initiatives related to the following

activities.

- Conclude the Susan Lake Management Renewal Contract

(30-November-2017 expiry date) and execute the closure program of

the Susan Lake Gravel Pit, subject to milestones in the Request for

Extension to 30-September-2018 (still pending approval by Alberta

Environment & Parks);

- Optimize Corporate overheads and expenses;

- Preserve the Corporation’s cash position, including the

disposition of non-core or low-priority assets;

- Sell existing stockpiled inventories of sand and gravel;

- Re-commence production from the Corporation’s Logan Pit and

Kearl Pit in the range of 100 kT to 300 kT (production volume and

range is dependent on geological re-assessment of available

aggregates at Kearl);

- Advance the Firebag Frac Sand project venture – initiate site

development activities to retain permits, and pursue potential

partnerships (processing, and logistics) to support a pilot project

with offsite staging area;

- Expand the role and functionality of strategic inventory

staging & distribution hubs (e.g. Conklin, Poplar Creek, and

potentially House River area) to augment corporate pits limited by

winter access roads;

- Selectively pursue conventional aggregate companies for

potential acquisition;

As at September 30, 2017 the Corporation was not in compliance

with certain financial covenants on their credit facility with HSBC

Bank Canada, namely the funded debt to EBITDA ratio and the debt

service coverage ratio. HSBC Bank Canada has granted the

Corporation forbearance for the three and nine months ended

September 30, 2017 on the funded debt to EBITDA ratio and the debt

service coverage ratio covenants.

The Corporation also announces that its Board of Directors has

approved the grant of 200,000 stock options to an officer and

employees of the Corporation subject to regulatory and TSX Venture

Exchange approval. The options have an exercise price of $0.22 per

share and have a five-year term.

About Athabasca Minerals

The Corporation is a resource company involved

in the management, exploration and development of aggregate

projects. These activities include contracts works, aggregate pit

management, aggregate production and sales from corporate-owned

pits, new aggregate development and acquisitions of sand and gravel

operations. The Corporation also has industrial mineral land

holdings for the purpose of locating and developing sources of

industrial minerals and aggregates essential to high growth

economic development.

For further Information on Athabasca, please

contact:

Dean StuartT: 403 617 7609E:

dean@boardmarker.net

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture) accepts responsibility for the

adequacy or accuracy of this release.

This press release contains forward looking statements

concerning anticipated developments and events that may occur in

the future, including (but not limited to) statements regarding the

Corporation’s operational focus for the next 12 months including

striving to increase production with improved margins from

corporate pits, improving the Corporation's cash position,

disposition of non-core &/or low-priority assets, improving

revenue generation and inventory management, production from

corporate pits, sales of inventory produced at corporate pits and

stockpiled at stockpile sites, and sales of inventories from

staging areas. In certain cases, forward looking statements can be

identified by the use of words such as “planning”, “expects”,

“anticipates”, “believes” or “does not expect”, “striving”,

“optimizing”, “improving”, or variations of such words and phrases

or state that certain actions, events or results “may”, “could”,

“would”, “might” or “will be taken”, “occur” or “be achieved”.

Forward looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Corporation to be materially

different from future results, performance or achievements

expressed or implied by forward looking statements including

general economic and business conditions; the Corporation’s

reliance on oil sands industry which impacts the market demand for

the Corporations’ product; extension of the Susan Lake contract;

impact of extreme weather conditions on production; the

Corporation’s products and potential development projects such as

silica sand and salt are commodities, and as such, there is always

pricing risk in a competitive market; the Corporation has the risk

that projects will not develop as anticipated or resources may not

have the quality or quantity that management anticipates;

reclamation obligations estimates could significantly change due to

potential changes in regulatory requirements prior to completing

reclamation work. Although the Corporation has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in forward

looking, there may be other factors that cause actions, events or

results not to be as anticipated, estimated or intended. See “Risks

and Uncertainties” in the MD&A. There can be no assurance that

forward looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking statements. These

forward-looking statements are made as of the date of this document

and, other than as required by applicable securities laws, the

Corporation assumes no obligation to update or revise them to

reflect new events or circumstances or otherwise.

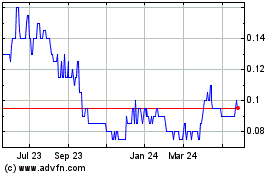

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Jan 2025 to Feb 2025

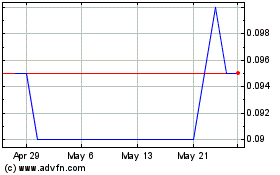

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Feb 2024 to Feb 2025