American Manganese Inc.: Artillery Peak Manganese Project Review and Future Plans

January 15 2013 - 5:00AM

Marketwired Canada

Larry W. Reaugh, Chief Executive Officer of American Manganese Inc. ("American

Manganese" or the "Company") (TSX VENTURE:AMY)(PINKSHEETS:AMYZF)(FRANKFURT:2AM),

reports on American Manganese's 2011 and 2012 programs and managements plans

relating to future development of the Artillery Peak Project.

Future Plan

Since the pre-feasibility study management has been studying ways to maximize

their resources at Artillery Peak as follows:

a. Address the opportunities to reduce capital expenses (capex) and

operating expenses (opex) which include production of electrolytic

manganese dioxide (EMD) or chemical manganese dioxide (CMD). Only 60% of

manganese metal is used to produce an equivalent amount of EMD or CMD to

EMM (100%) significantly reducing the footprint and positively affect

the capex and opex. Production of CMD eliminates the requirement for

electrolytic cells.

b. The Company has identified areas to explore where the potential to

increase the manganese grades exists such as:

-- Wildcat drill hole AP-11-133 was drilled in the upper Shannon located 4

km west of manganese mesa and returned 7.62 meters grading 7.39% Mn.

-- Wildcat diamond drill hole #ADH-25 was drilled 1.6 km south and east of

Loves Mine and returned 24.39 meters of 4.34% Mn.

The Company will evaluate these targets which have the potential to host

higher grades thereby possibly further reducing the overall foot print

of the mill site and mining operations. Other areas on the property like

the Maggie Canyon also host the potential for higher grades of

manganese.

-- Focus on the criticality of manganese to the U.S. Government and various

potential end users.

-- Continue the dialogue with potential off-takers that have shown an

interest in the manganese metal and dioxide market.

-- The elimination of the electrolytic cells by focussing on research and

development of CMD could reduce the electrical requirements by up to 75-

80%.

-- Reducing the amount of production (25 - 40,000 Ts/year) of manganese

dioxide product potentially reducing capex for mining and processing.

-- American Manganese's cost of production is one of the lowest in the

world.

Review

1. 10,607 meters (34,800 ft) of reverse circulation drilling in 84 holes

(2011 program) was completed in the North Chapin, Lakes/MacGregor area

resulting in the following Ni43-101 resource at a 1.0% Mn cut-off:

------------------------------------------------------

Average Contained

Resource (T) Grade Mn% Mn Metal (T)

------------------------------------------------------------------------

Indicated 62,201,000 2.3% 1,445,000

------------------------------------------------------------------------

Inferred 20,033,000 2.5% 506,000

------------------------------------------------------------------------

Previous drilling and Ni-43-101 resource studies identified additional reported

resources on the Maggie Mine/Shannon Mine/Loves/Hurley/Planche/South

Chapin/Burro/Price and Priceless zones at a 0.9% Mn cut-off as follows:

------------------------------------------------------

Average Contained

Resource (T) Grade Mn% Mn Metal (T)

------------------------------------------------------------------------

Indicated 145,575,196 2.98% 4,279,000

------------------------------------------------------------------------

Inferred 54,700,239 2.83% 1,547,000

------------------------------------------------------------------------

The Company has drilled 18,160 meters (59,565 ft) in 154 holes since 2008.

2. On September 27, 2011 Kemetco completed the successful pilot plant

operation on Artillery Peak materials. Initial results of the leach and

solid/liquid separation pilot tests were excellent; for instance rates

of extraction of 92.7% manganese recovered was achieved from coarse feed

material (minus 6.35mm) in 2 hours. Initial expectation of the pilot

plant was to process 3 to 5 kg of resource material per hour. In the

continuous pilot plant run, the average processing rate was 20.8 kg per

hour, which greatly exceeded expectation. Success of the pilot plant

operation has removed a significant amount of technical risk from the

flow sheet.

3. On May 24, 2011, the Tucson, Arizona office of Tetra Tech was awarded

the contract to provide environmental and consulting services to the

Company on their Artillery Peak Project.

4. On December 6, 2011, the Company received a detailed positive manganese

market forecast study from CPM Group. Executive summary may be found on

the website.

5. March 14, 2012, the Company announced the publication of their advanced

process patent application. The Company is addressing minor deficiencies

received from the U.S. Patent Office and expects approval in the first

quarter 2013.

6. On August 27, 2012, the Company filed an Amended Pre-feasibility Study

at the request of the British Columbia Securities Commission in which

the base case was amended to the 3 years trailing average. The project

was deemed to be uneconomic as a producer of electrolytic manganese

metal (EMM). The production of electrolytic manganese dioxide (EMD) or

chemical manganese dioxide (CMD) introduces a different set of dynamics

to the project. All of the pilot plant testing, environmental studies

and pre-feasibility may be incorporated into new studies for CMD or EMD.

7. October 12, 2012, the Company's contractor, Kemetco Research Inc.

successfully produced rechargeable lithium ion batteries from CMD

produced from the Company's Artillery Peak pilot plant test. This is a

major breakthrough. Future testing by Kemetco will focus on a high

purity product for the battery industry.

About American Manganese Inc.

American Manganese Inc. is a diversified specialty and critical metal Company

focusing on potentially becoming a producer of high purity EMD and CMD for the

battery industry.

This release has been reviewed by John W. Fisher, PEng, a qualified person

pursuant to National Instrument 43-101.

On behalf of Management

AMERICAN MANGANESE INC.

Larry W. Reaugh, President and Chief Executive Officer

This news release may contain certain "Forward-Looking Statements" within the

meaning of Section 21E of the United States Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical fact, included

herein are forward-looking statements that involve various risks and

uncertainties. There can be no assurance that such statements will prove to be

accurate, and actual results and future events could differ materially from

those anticipated in such statements. Important factors that could cause actual

results to differ materially from the Company's expectations are disclosed in

the Company's documents filed from time to time with the TSX-Venture Exchange,

the British Columbia Securities Commission and the US Securities and Exchange

Commission.

FOR FURTHER INFORMATION PLEASE CONTACT:

American Manganese Inc.

Larry W. Reaugh

President and Chief Executive Officer

604-531-9639

American Manganese Inc.

Connie Fischer

Investor Relations

604-531-9639 ext. 110

connieir@amymn.com or info@amymn.com

www.americanmanganeseinc.com

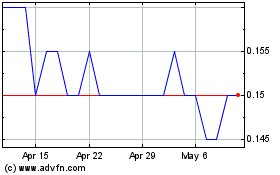

Recylico Battery Materials (TSXV:AMY)

Historical Stock Chart

From Apr 2024 to May 2024

Recylico Battery Materials (TSXV:AMY)

Historical Stock Chart

From May 2023 to May 2024