Consolidated Uranium Inc. (“CUR”, the “Company” or

“Consolidated Uranium”) (TSXV: CUR) (OTCQX: CURUF) is

pleased to announce the creation and planned spin-out (the

“

Spin-Out”) of Premier American Uranium Inc.

(“

PUR”), currently a majority-controlled

subsidiary of CUR focused on the acquisition, exploration, and

development of uranium projects in Wyoming and Colorado. (Figure

1).

On May 24, 2023, the Company entered into an

arrangement agreement with PUR (the “Arrangement

Agreement”), pursuant to which among other things the

Company has agreed to transfer ownership of certain indirect

wholly-owned subsidiaries which hold eight U.S. Department of

Energy (“DOE”) leases and certain patented claims

located in Colorado (the “CUR Assets”) to PUR in

exchange for 7,753,752 Class A common shares of PUR (“PUR

Shares”), a portion of which will be distributed to the

Company’s shareholders on a pro rata basis (the

“Arrangement”). PUR intends to apply to list the

PUR Shares (the “TSXV Listing”) on the TSX Venture

Exchange (the “TSXV”). The TSXV Listing will be

subject to PUR fulfilling all of the requirements of the TSXV.

In addition, CUR and PUR have entered into a

purchase agreement (the “Premier Agreement”) with,

among others, Premier Uranium Inc. (“Premier”), a

privately held U.S. uranium focused project acquisition vehicle

which owns a 100% interest in the Cyclone project in the Great

Divide Basin of Wyoming (the “Cyclone Project”)

and various mining claims in the Uravan Mineral Belt of Colorado

(collectively, the “Premier Assets”), pursuant to

which PUR has agreed to acquire all of the outstanding shares of

Premier.

Separately, PUR has also staked 368 unpatented

mining claims, covering approximately 6,940 acres in key areas of

the Uravan Mineral Belt.

To view a summary of today’s news delivered by

Philip Williams, Chairman and CEO of CUR, and Tim Rotolo, Chief

Executive Officer of Premier and planned Chief Executive Officer of

PUR, click here.

Transaction Highlights:

- Stable,

Long-term Shareholder Base Ahead of Public Market Listing

– Backed by Sachem Cove Partners, CUR and with additional

institutional investor support, PUR is working toward a public

listing on the TSXV.

-

Extensive Land Holdings in Two Prominent Uranium-Producing

Regions in the U.S. – PUR plans to explore and develop its

large land position in the Great Divide Base of Wyoming and the

Uravan Mineral Belt of Colorado.

- Rich

History of Past Production and Historic Uranium Mineral Resources

with Strong Discovery Potential –

- The Cyclone

Project, in Wyoming is an In Situ Recovery (“ISR”)

project comprised of ~25,500 acres with past work supporting an

exploration target with a range of 6.5 million short tons averaging

0.06% U3O8 (7.9 million lbs. U3O8) to 10.5 million short tons

averaging 0.06% U3O8 (12.6 million lbs. U3O8).1 See below for

additional details.

- The Colorado

projects include multiple past producing mines with historic

uranium mineral resources and exploration potential.

-

Well-Timed Opportunity with Strong Market Fundamentals and

Need for U.S. Domestic Supply – Uranium fundamentals are

the strongest in a decade with a large supply deficit as forecasted

by industry and financial analysts. Security of supply following

the Russian invasion of Ukraine is driving long-term contracting, a

key feature leading up to the previous uranium price rally in 2005

to 2007. PUR presents an attractive opportunity to participate in

the anticipated resurgence and advancement of the U.S. uranium

industry.

-

Unparalleled Experience in the U.S. Uranium Sector across

the Team, Led by Disciplined Capital Allocators

– PUR will be led by Tim Rotolo, co-founder of

Sachem Cove Partners and Founder of Lloyd Harbor Capital

Management, LLC, an SEC Registered Investment Advisor. Together,

the PUR board of directors, management and technical team will have

deep technical, operational, and permitting expertise in the U.S.

with a track record of financing and advancing uranium companies

and significant institutional investment experience in the uranium

sector.

-

Initiating Work Programs to Advance Portfolio in 2023

–

- Cyclone Project

Exploration – Airborne radiometric survey completed in Q4 2022 in

preparation for exploration and permitting activities planned for

the remainder of 2023 and subsequent drilling expected in

2024.

- Uravan Mineral

Belt Exploration –

- Monogram Mesa –

Full data review for “on trend” exploration targets with subsequent

drilling.

- Atkinson Mesa –

Historical data review in preparation for planned drilling program

to delineate the extent of mineralization in the central and

northern parts of the properties.

- Additionally,

PUR intends to look to further increase its land position both in

Wyoming and the Uravan Mineral Belt of Colorado.

______________________1 The potential quantity

and grade of this exploration target is conceptual in nature and

based on the geologic interpretation that mineralization is

Sandstone Type mineralization, aerial radiometric anomalies, and

indications of the presence of oxidation reduction interfaces with

mineralization from available drill data. There has been

insufficient exploration to define a mineral resource and it is

uncertain if a mineral resource will be delineated.

Philip Williams, Chairman and Chief Executive

Officer of CUR, commented “We are very excited to announce the

spin-off of PUR, in partnership with Sachem Cove. At CUR, our focus

in the U.S. has been squarely on readying our past-producing Tony

M, Daneros and Rim mines in Utah for production once market

conditions warrant. This inherently meant our Colorado DOE leases,

with a history of production and strong exploration potential, have

received little attention. At the same time, in Premier, Tim and

Sachem Cove have assembled a portfolio of projects in Colorado,

which complement ours, as well as a compelling land package in the

Great Divide Basin in Wyoming with large-scale ISR potential. CUR’s

strategy has been to realize value in our portfolio, either

directly by advancing projects to production, or through

spinouts/divestures where a compelling strategic rationale could be

identified, similar to our Labrador Uranium transaction last year.

In PUR, we are convinced that this is a case where one plus one

could equal much more than two and we believe CUR shareholders will

be the ultimate beneficiaries when we complete the planned TSXV

listing and direct distribution of PUR Shares in the coming

months.”

Tim Rotolo, Chief Executive Officer of Premier

and planned Chief Executive Officer of PUR commented, “The U.S. was

once the global leader in uranium production at over 40 million

pounds per year, enough uranium to supply nearly its entire nuclear

fleet - the largest in the world and provider of 20% of U.S.

electricity. Today, the U.S. produces almost none of its own

domestically consumed uranium as U.S. utilities have turned to

buying nearly half of their uranium needs from former Soviet states

Russia, Kazakhstan, and Uzbekistan. We believe we are on the

precipice of a resurgence in domestic production. For the first

time in decades, a large supply deficit, which may push uranium

prices higher, has converged with a global nuclear renaissance and

newfound bi-partisan political support to safeguard our domestic

nuclear fleet from geopolitical risk of a former Soviet-bloc

dominated nuclear fuel cycle. In respect of this, we started

Premier to capitalize on the U.S. uranium resurgence, accumulating

projects and waiting for the right time to bring them to market.

That time is now, and our partnership with CUR whose projects are

complementary, sets up an exciting and well-timed launch for

PUR.”

The Arrangement Agreement

Pursuant to the Arrangement Agreement, among

other things, CUR has agreed to transfer certain indirect

wholly-owned subsidiaries which hold the CUR Assets to PUR in

exchange for 7,753,752 PUR Shares. Under the terms of the

Arrangement, CUR intends to distribute 50% of the PUR Shares it

receives to its shareholders on a pro-rata basis based on the

number of CUR Shares held at the effective date of the Arrangement.

There will be no change in CUR shareholders’ proportionate

ownership in CUR as a result of the Arrangement. In addition,

holders of options and warrants of CUR as of the effective date of

the Arrangement will have such securities adjusted in accordance

with their terms as a result of the Arrangement.

The Arrangement will be effected by way of a

court-approved plan of arrangement under the Business Corporations

Act (Ontario). The Arrangement will be subject to regulatory

approval, including the approval of the TSXV for the Arrangement

and the TSXV Listing, court approval, as well as approval by not

less than two-thirds of the votes cast at the annual general and

special meeting (the “Meeting”) of the CUR

shareholders, anticipated to be held in the third quarter of 2023.

Full details of the Arrangement will be included in the management

information circular to be sent to CUR shareholders in connection

with the Meeting.

It is anticipated that the Arrangement and the

TSXV Listing will be completed in the third quarter of 2023.

The Premier Agreement

On May 24, 2023, the Company and Premier entered

into the Premier Agreement with PUR, among others, pursuant to

which PUR has agreed to acquire all the outstanding shares of

Premier in exchange for 12,000 Class B common shares of PUR

(“Compressed Shares”). Each Compressed Share

carries the right to 1,000 votes per share and is convertible into

1,000 PUR Shares, with each PUR Share carrying the right to one

vote per share. Completion of the Premier Transaction is subject to

certain closing conditions including, among other things,

completion of the Arrangement and the conditional approval of the

TSXV for the TSXV Listing.

About PUR

Proposed Management and Board of

Directors

- Tim Rotolo,

Chief Executive Officer

- 15+ years as an

investment professional with background in fund management.

- Co-founder of

Sachem Cove Partners and Founder of Lloyd Harbor Capital

Management, LLC, an SEC Registered Investment Advisor.

- Founder of North

Shore Indices, Inc., which launched URNM, a uranium mining ETF in

2019 and raised over $1 Billion before selling to NYSE listed,

Sprott Asset Management.

- Greg Duras,

Chief Financial Officer

- 25+ years in the

resource sector in corporate development, financial management and

cost control.

- Marty Tunney,

Chairman

- Mining engineer

with significant technical and capital markets experience.

- Current

President and Chief Operating Officer of CUR.

- Michael

Harrison, Director

- 25+ years of

executive, financial and technical experience in the mining

industry.

- Current Managing

Partner at Sprott Inc.

- Daniel Nauth,

Director

- Lawyer with a

specialty in U.S.-Canada cross-border capital markets, M&A and

corporate and securities transactions and regulatory

compliance.

Technical Advisors

- Ted Wilton

- 50+ years as a

Senior Geologist in the mining industry, including 25+ in the

uranium sector.

- Involved in

discovering 8 deposits containing more than 10 million ounces gold

in the U.S. and Australia.

- Mike Neumann

- 40+ years in

environmental and regulatory affairs, specialized in uranium mine

permitting in the U.S. and Kazakhstan.

- Gained

regulatory approval for expansion of Daneros, compliance for Tony

M, and Rim Mines in Utah.

- Tyler Johnson

- 14+ years

formerly with Denison and Energy Fuels Inc.

- Geologist

specializing in exploration, mine development, and resource

estimation on uranium and vanadium projects.

The Projects

Figure 1: PUR Project Portfolio located

in the States of Wyoming and Colorado

Wyoming – Great Divide Basin

Wyoming is one of the leading jurisdictions for

U.S. uranium production and produced approximately 230 million lbs

of U3O8 since the first discovery in the 1950s.1 The State ranked

11th of 84 jurisdictions in the Public Policy Perception Index of

the Fraser Institute Annual Survey of Mining Companies 2021.2

The Great Divide Basin is also one of the least

exploited of the Wyoming Basins known to contain significant

deposits of uranium, including the Crooks Gap mining district,

Sweetwater deposit, Lost Creek ISR mine. Nearby property owners

include Uranium Energy Corp. and UR-Energy Inc.1

_____________________1 Source: Wyoming State

Geological Survey; Critical Minerals in Wyoming;

https;//www.wsgs.wyo.gov/minerals/critical-minerals.aspx

2 Source:

www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2021.pdf

Cyclone Project

The Cyclone Project is located approximately 45 miles northwest

of Rawlins, Wyoming and 15 miles from the Sweetwater Uranium Mill.

The project covers 25,500 acres comprising: 1,061 claims totaling

21,220 acres and 7 state leases covering 4,280 acres.

The uranium deposits in the basin are hosted in

flat-lying sandstones of the Battle Spring Formation, with a

widespread alteration of host sandstones and numerous roll-front

uranium deposits associated with altered rocks. Exploration

potential remains high on the project with drilling required to

follow up on historic work and delineate mineralized zones.

Previous exploration on the project includes ~80

holes drilled during 2007-2008, with mineralization showing typical

grades and thicknesses to uranium deposits found elsewhere in the

Great Divide Basin. Intersections from exploration on the Rim

Target include hole UT-8 which intersected 8.0 ft. averaging 0.092%

eU308 (0.02% cut-off) or 5.5 ft. @ 0.121% eU308 at 200 feet from

the surface and hole UT-44 which intersected 7.5 ft. averaging

0.081% eU3O8 (0.02% cut-off grade) or 5.5 ft. averaging 0.104%

eU308 at a 0.05% cut-off grade.

Sufficient historical exploration data is

available for the North and East claim blocks to define an

exploration target, which shows a range of 6.5 million short tons

averaging 0.06% U3O8 (7.9 million lbs. U3O8) to 10.5 million short

tons averaging 0.06% U3O8 (12.6 million lbs. U3O8). The potential

quantity and grade of this exploration target is conceptual in

nature and based on the geologic interpretation that mineralization

is roll-front sandstone – type mineralization, and that

mineralization is present as indicated by airborne radiometric

anomalies, indications of the presence of oxidation reduction

interfaces with associated uranium mineralization as depicted in

available historic drill data. There has been insufficient

exploration to define a mineral resource and it is uncertain if a

mineral resource will be delineated. For the definition of the

exploration target, the following criteria based on direct

knowledge and experience in the area and similar sandstone hosted

uranium deposits in the Great Divide Basin and other areas of

Wyoming was used: (i) a minimum cut-off grade of 0.02% U3O8 and a

grade thickness product (GT) of 0.10, (ii) a radiometric

disequilibrium factor of 1, and (iii) a bulk density of 16 cubic

feet per ton.

A detailed review of the historical drill data

is planned with permitting underway in preparation for drilling in

2024.

Colorado – Uravan Mineral

Belt

The Uravan Mineral Belt of Colorado has a rich

history of uranium exploration and production and produced nearly

80 million lbs of U3O8 and more than 400 million lbs of V2O5 since

1945.3 Colorado ranked 5th of 62 jurisdictions in the Investment

Attractiveness Index of the Fraser Institute Annual Survey of

Mining Companies 2022.4 PUR’s projects in Colorado are in the heart

of the Uravan Mineral Belt, in proximity to significant

infrastructure. Mineralization is hosted in the Salt Wash Member of

the Morrison Formation.

_______________________3 Source: Chenoweth,

William L., 1981, "The Uranium-Vanadium Deposits of the Uravan

Mineral Belt and Adjacent Areas, Colorado and Utah. In New Mexico

Geological Society Guidebook 32, Western Slope, Colorado" and

Goodnight, Craig S., William L. Chenoweth, Richard D. Davyault and

Edward T. Cotter, 2005: "Geologic Road Log for Uravan Mineral Belt

Field Trip, West-Central, Colorado" Rocky Mountain Section of the

Geologic Society of America.

4 Source:

www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2022.pdf

Monogram Mesa

The Monogram Mesa project covers approximately

7,431 acres and consists of 361 mining claims.

The property includes multiple historic mines on

the northeast and the West (Bull Canyon) sides of Monogram Mesa.

The historic mines are generally stable and dry, with numerous

mineralized zones exposed. The property is strategically located

within several miles of a paved highway with mine roads and power

lines crossing the property. Historical drilling data indicates

presence of numerous exploration targets.

|

Historic Production1 |

|

|

Tons (short) |

Grade

(%U3O8) |

Pounds

U3O8 |

Grade

(%V2O5) |

Pounds

V2O5 |

|

MonogramMesa Mines |

840,761 |

0.30 |

4,992,179 |

1.19 |

20,001,113 |

- As disclosed in Nelson-Moore, James

L, Donna Bishop Collins, and A. L. Hornbaker, 1978; Radioactive

Mineral Occurrences of Colorado, Colorado Geological Survey

Bulletin 40, 1,054 pages, 18 figures, 3 tables, 12 plates.

An exploration drilling program to confirm and

potentially expand currently known mineralization is planned with

the potential to acquire surrounding properties, further

consolidating the area.

Atkinson Mesa Project

The Atkinson Mesa project covers 5,863 acres,

including 128 unpatented lode mining claims, 4 DOE leases. The

project also includes approximately 2,702 acres, and 18 patented

(fee simple) mining claims spanning 360 acres. Several past

producing mines are present on the property, including the King

Solomon mine, a large-scale underground mine that was one of the

most significant uranium producers in the entire Uravan Mineral

Belt.5 The property is situated within one of the most substantial

uranium-vanadium production areas within the entire Uravan Mineral

Belt.5

|

Historic Production1 |

|

|

Tons (short) |

Grade

(%U3O8) |

Pounds

U3O8 |

Grade

(%V2O5) |

Pounds

V2O5 |

|

King SolomanComplex |

1,230,000 |

0.21 |

5,160,000 |

1.11 |

26,540,000 |

- Goodnight, Craig S., William L.

Chenoweth, Richard D. Davyaault, and Edward T. Cotter, 2005;

Geologic Road Log for Uravan Mineral Belt Field Trip, West-Central

Colorado; Rocky Mountain Section of Geological Society of America,

2005 Annual Meeting.

_______________________5 Source: Goodnight,

Craig S., William L. Chenoweth, Rochard D. Davyault and Edward T.

Cotter, 2005; Geologic Road Log for Uravan Mineral Belt Field Trip,

West-Central Colorado; Rocky Mountain Section of the Geological

Society of America.

Outlaw Mesa & Slick Rock Projects

The Outlaw Mesa and Slick Rock projects are

located at the northern and southern ends of the Uravan Mineral

Belt, respectively. Outlaw Mesa covers 5,759 acres with 2 DOE

leases and Slick Rock covers 1,226 acres with 2 DOE leases.

Both projects include historic production from

multiple mines, including the well-known Spud Patch mines in the

Slick Rock area and the Calamity Mesa mines in the Outlaw

mesa-Calamity Mesa area. All leases contain uranium and vanadium

mineralization. In January 2020, a new 10-year lease was signed

with the DOE, providing long-term potential for the project.

|

Historic Production1 |

|

|

Tons (short) |

Grade

(%U3O8) |

Pounds

U3O8 |

Grade

(%V2O5) |

Pounds

V2O5 |

|

Slick Rock |

434,300 |

0.34 |

2,953,600 |

1.30 |

11,333,800 |

|

Outlaw andCalamity Mesas |

423,500 |

0.34 |

2,917,200 |

1.29 |

10,994,500 |

- As disclosed in

the above and by Nelson-Moore, James L, Donna Bishop Collins and A.

L. Hornbaker, 1978; Radioactive Mineral Occurrences of Colorado,

Colorado Geological Survey Bulletin 40, 1,054 pages, 18 figures, 3

tables, 12 plates.

Technical Disclosure and Qualified Person

The scientific and technical information

contained in this news release was reviewed and approved by Dean T.

Wilton: PG, CPG, MAIG, a consultant of CUR who is a “Qualified

Person” (as defined in National Instrument 43-101 - Standards of

Disclosure for Mineral Projects).

The data disclosed in this news release is

related to historical drilling results. CUR has not undertaken any

independent investigation of the sampling, nor has it independently

analyzed the results of the historical exploration work in order to

verify the results. CUR considers these historical drill results

relevant as the Company is using this data as a guide to plan

exploration programs. The Company's current and future exploration

work includes verification of the historical data through

drilling.

About Premier American Uranium Inc.

Premier American Uranium Inc., a subsidiary of

Consolidated Uranium Inc. (“TSXV:CUR”), is focused on the

consolidation, exploration, and development of uranium projects in

the United States. One of PUR's key strengths lies in the

agreements it has to acquire extensive land holdings in two

prominent uranium-producing regions in the United States: the Great

Divide Basin of Wyoming and the Uravan Mineral Belt of Colorado.

With a rich history of past production and historic uranium mineral

resources, PUR is initiating work programs to advance its portfolio

in 2023.

Backed by Sachem Cove Partners, CUR, additional

institutional investors, and an unparalleled team with U.S. uranium

experience, PUR's entry into the market comes at a well-timed

opportunity, as uranium fundamentals are currently the strongest

they have been in a decade.

PUR intends to apply to list its shares on the

TSXV, cementing its position as a leading U.S. uranium player.

Listing will be subject to PUR fulfilling all of the requirements

of the TSXV.

For more information, please visit www.premierur.com.

About Consolidated Uranium Inc.

Consolidated Uranium Inc. (TSXV: CUR) (OTCQX:

CURUF) was created in early 2020 to capitalize on an anticipated

uranium market resurgence using the proven model of diversified

project consolidation. To date, Consolidated Uranium has acquired

or has the right to acquire uranium projects in Australia, Canada,

Argentina, and the United States each with significant past

expenditures and attractive characteristics for development.

Consolidated Uranium completed a

transformational strategic acquisition and alliance with Energy

Fuels Inc., a leading U.S.-based uranium mining company, and

acquired a portfolio of permitted, past-producing conventional

uranium and vanadium mines in Utah and Colorado. These mines are

currently on stand-by, ready for rapid restart as market conditions

permit, positioning Consolidated Uranium as a near-term uranium

producer.

For More Information, Please Contact:

Philip WilliamsChairman and

CEOpwilliams@consolidateduranium.comToll-Free: 1-833-572-2333

Twitter: @ConsolidatedUr www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information.

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to the timing and outcome of

the Arrangement, the Premier acquisition and the Listing, including

required shareholder, regulatory, court and stock exchange

approvals; the anticipated timing of the Meeting; the anticipated

benefits of the Arrangement; the satisfaction or waiver of the

closing conditions set out in the Arrangement Agreement and the

Premier Agreement; the exploration activities anticipated for the

remainder of 2023 and 2024; the anticipated management team and

board of directors of PUR; the final approval of the Arrangement

and Listing by the TSXV; anticipated strategic and growth

opportunities; expectations regarding the U.S. uranium industry;

any expectations with respect to defining mineral resources or

mineral reserves on any of the projects and any expectation with

respect to any permitting, development or other work that may be

required to bring any of the projects into development or

production and other activities, events or developments that the

Company expects or anticipates will or may occur in the future.

Generally, but not always, forward- looking information and

statements can be identified by the use of words such as “plans”,

“expects”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates”, or “believes” or the

negative connotation thereof or variations of such words and

phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative connotation thereof. Such forward-looking

information and statements are based on numerous assumptions,

completion of the Arrangement, the Listing and the Premier

acquisition, including the ability of the parties to receive, in a

timely manner and on satisfactory terms, the necessary regulatory,

court and shareholder approvals; the ability of the parties to

satisfy, in a timely manner, the other conditions to the completion

of the Arrangement, the Listing and the Premier acquisition; that

the anticipated benefits of the Arrangement will be realized; that

general business and economic conditions will not change in a

material adverse manner, that financing will be available if and

when needed and on reasonable terms, and that third party

contractors, equipment and supplies and governmental and other

approvals required to conduct the Company’s planned exploration

activities will be available on reasonable terms and in a timely

manner. Although the assumptions made by the Company in providing

forward-looking information or making forward-looking statements

are considered reasonable by management at the time, there can be

no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: the failure to obtain

shareholder, regulatory, court or stock exchange approvals in

connection with the Arrangement, the Listing and the Premier

acquisition; failure to realize the anticipated benefits of the

Arrangement or implement the business plan for PUR; the diversion

of management time on transaction-related issues; expectations

regarding negative operating cash flow and dependence on third

party financing, uncertainty of additional financing, no known

mineral reserves or resources, reliance on key management and other

personnel, potential downturns in economic conditions, actual

results of exploration activities being different than anticipated,

changes in exploration programs based upon results, and risks

generally associated with the mineral exploration industry,

environmental risks, changes in laws and regulations, community

relations and delays in obtaining governmental or other approval

and the risk factors with respect to Consolidated Uranium set out

in Consolidated Uranium’s annual information form in respect of the

year ended December 31, 2022 which has been filed with the Canadian

securities regulators and is available under Consolidated Uranium’s

profile on SEDAR at www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

A graphic accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0fd6e6e6-004b-4c8c-9ba2-dbd43db21572

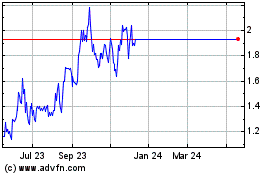

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Dec 2023 to Dec 2024