Fountain Asset Corp. Announces Its Financial Results for the Quarter Ended June 30, 2023

August 24 2023 - 6:47AM

Fountain Asset Corp. (TSXV:FA) (“Fountain” or the

“Company”) would like to announce its financial results for the

three months ended June 30, 2023 (“

Q2/23”).

Highlights from three months ended June

30, 2023:

-

Net asset value (“NAV”) of $11.00 million ($0.18

per share) at June 30, 2023 compared to $11.68 million ($0.19 per

share) at March 31, 2023, representing a decrease of 5.3% quarter

over quarter on a per share basis. NAV is calculated as the value

of total assets less the value of total liabilities;

-

Net comprehensive loss of $0.70 million for the three months ended

June 30, 2023, compared to net comprehensive loss of $5.02 million

for three months ended June 30, 2022

(“Q2/22”);

-

Total loss from investment activity was $0.53 million compared to

total loss of $4.70 million for Q2/22;

-

Net realized losses on the sale of portfolio investments of $1.56

million compared to net realized losses of $1.24 million for

Q2/22;

-

Net unrealized gains on portfolio investments of $1.03 million

compared to net unrealized losses of $3.47 million for Q2/22;

-

Total expenses of $0.17 million, which included $0.02 million of

stock-based compensation, compared to $0.32 million for Q2/22 which

included $0.02 of stock-based compensation; and

-

Operating expenses of $0.19 million compared to $0.19 million for

Q2/22.

Highlights from six months ended June

30, 2023:

-

NAV of $11.00 million ($0.18 per share) at June 30, 2023 compared

to $11.84 million ($0.19 per share) at December 31, 2022,

representing a 5.3% decrease year to date on a per share basis. NAV

is calculated as the value of total assets less the value of total

liabilities;

-

Net comprehensive loss of $0.88 million for the six months ended

June 30, 2023, compared to net comprehensive loss of $7.06 million

for the six months ended June 30, 2022;

-

Total loss from investment activity was $0.50 million compared to

total loss of $6.50 million for the six months ended June 30,

2022;

-

Net realized losses on the sale of portfolio investments of $1.47

million compared to net realized losses of $2.05 million for the

six months ended June 30, 2022;

-

Net unrealized gains on portfolio investments of $0.97 million

compared to net unrealized losses of $4.47 million for the six

months ended June 30, 2022;

-

Total expenses of $0.39 million, which included $0.05 million of

stock-based compensation, compared to $0.56 million for the six

months ended Juen 30, 2022 which included $0.05 of stock-based

compensation; and

-

Operating expenses of $0.38 million compared to $0.37 million for

the six months ended June 30, 2022.

During Q2/23, the company saw a decrease in its

portfolio of publicly traded companies, as a result of continued

volatility and uncertainty surrounding global markets. The Company

also strategically disposed of non-core investment holdings that

continued to struggle during these challenging times. The decreases

recorded by the Company were slightly offset by increases in the

stock prices of Alchemist Mining Inc. and SRG Mining Inc.

The Company continued to maintain low operating

expenses in Q2/23, which helped reduce the net comprehensive loss

of the Company. As at June 30, 2023, the Company’s net assets were

valued at $11.00 million or $0.18 per share compared to $11.84

million or $0.19 per share at December 31, 2022.

“In Q2/23, Fountain strategically disposed of

non-core portfolio investments and utilized the proceeds received

to continue to strengthen its position in the battery metals,

mining, and energy sectors. Although this resulted in the Company

realizing losses on the sale of some of its investments, we believe

that the new opportunities that Fountain has invested in will lead

to future long term economic benefits for the Company,” said Andrew

Parks, CEO of Fountain.

A full set of the Q2/23 unaudited financial

statements and the management’s discussion & analysis are

available on SEDAR.

About Fountain Asset Corp.

Fountain Asset Corp. is a merchant bank which

provides equity financing, bridge loan services (asset

back/collateralized financing) and strategic financial consulting

services to companies across many industries such as marijuana, oil

& gas, mining, real estate, manufacturing, retail, financial

services, and biotechnology.

Forward-Looking Statements

Certain information contained in this press

release constitutes forward-looking information, which is

information relating to possible events, conditions or results of

operations of the Company, which are based on assumptions and

courses of action and which are inherently uncertain. All

information other than statements of historical fact may be

forward-looking information. Forward-looking information in this

press release includes, but is not limited to, growing Fountain’s

capital base and a strong pipeline going forward. These

forward-looking statements reflect the current expectations or

beliefs of the Company based on information currently available to

the Company. Forward-looking statements are subject to a number of

risks and uncertainties that may cause the actual results of the

Company to differ materially from those discussed in the

forward-looking statements, and even if such actual results are

realized or substantially realized, there can be no assurance that

they will have the expected consequences to, or effects on, the

Company. Factors that could cause actual results or events to

differ materially from current expectations include, among other

things: the level of bridge loans and equity investments completed,

the nature and credit quality of the collateral security and the

nature and quality of equity investments, and the other risks

disclosed under the heading "Risk Factors" and elsewhere in the

Company's annual information form dated August 17,

2022 filed on SEDAR at www.sedarplus.ca. Any forward-looking

statement speaks only as of the date on which it is made and,

except as may be required by applicable securities laws, the

Company disclaims any intent or obligation to update any

forward-looking statement, whether as a result of new information,

future events or results or otherwise. Although the Company

believes that the assumptions inherent in the forward-looking

statements are reasonable, forward-looking statements are not

guarantees of future performance and accordingly undue reliance

should not be put on such statements due to the inherent

uncertainty therein.

Neither TSX Venture Exchange Inc. nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information: please contact Andrew

Parks at (416) 456-7019 or visit Fountain Asset Corp.’s website at

www.fountainassetcorp.com.

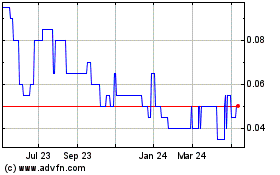

Fountain Asset (TSXV:FA)

Historical Stock Chart

From Jan 2025 to Feb 2025

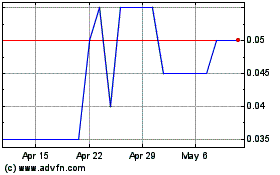

Fountain Asset (TSXV:FA)

Historical Stock Chart

From Feb 2024 to Feb 2025