Integrated Asset Management Corp. and GPM Investment Management Announce Close of GPM (12) Raising $ 174 Million

May 10 2011 - 2:14PM

Marketwired Canada

Integrated Asset Management Corp. ("IAM") (TSX:IAM) and its real estate arm,

GPM Investment Management ("GPM"), announced today the closing of GPM (12), the

12th fund in its highly successful series of pooled real estate funds, raising

$ 174 million.

Like the previous 11 funds in the series, GPM (12) is a closed-end,

discretionary fund focusing on industrial properties in the GTA, Ottawa,

Edmonton, Calgary, Vancouver, Montreal and Halifax markets.

GPM (12) is the largest fund yet raised by GPM. As has become customary,

investors were predominantly repeat investors, with approximately one quarter of

the investors being new to the GPM series of funds.

The GPM funds have proven very popular with institutional investors making their

first allocation to real estate. They are attracted by the long, successful

track record and the low volatility and stable income generated by GPM. Over the

last 28 years, the composite rate of return on the funds, net of all fees and

expenses, was approximately 12.3 % annually to the end of December 2010.

Brent Chapman, President & CEO of GPM, said, "We are very pleased with the

confidence our clients have expressed in us and look forward to continuing our

well-established tradition of superior performance."

GPM is a wholly-owned subsidiary of IAM. IAM is one of Canada's leading

alternative asset management companies, with approximately $2.4 billion in

assets and committed capital under management in private corporate debt, real

estate, private equity, managed futures, global bonds and retail alternative

investments.

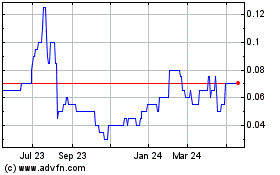

GPM Metals (TSXV:GPM)

Historical Stock Chart

From Dec 2024 to Jan 2025

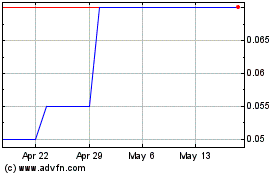

GPM Metals (TSXV:GPM)

Historical Stock Chart

From Jan 2024 to Jan 2025