TSX VENTURE COMPANIES:

ADMIRAL BAY RESOURCES INC. ("ADB")

BULLETIN TYPE: Consolidation, Correction

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated November 19, 2010, the

Bulletin should have noted that the Company consolidated its Capital on a

20 old for 1 new basis not 10 old for 1 new basis as previously stated.

The rest of the bulletin remains the same.

ADMIRAL BAY RESOURCES INC. ("ADB")

BULLETIN TYPE: Halt

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 9:42 a.m. PST, November 22, 2010, trading in the shares of the

Company was halted pending an announcement; this regulatory halt is imposed

by Investment Industry Regulatory Organization of Canada, the Market

Regulator of the Exchange pursuant to the provisions of Section 10.9(1) of

the Universal Market Integrity Rules.

---------------------------------------------------------------------------

ADMIRAL BAY RESOURCES INC. ("ADB")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 11:45 a.m. PST, November 22, 2010, shares of the Company

resumed trading, an announcement having been made over StockWatch.

---------------------------------------------------------------------------

ANDOVER VENTURES INC. ("AOX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 14, 2010:

Number of Shares: 4,145,125 shares

Purchase Price: $0.32 per share

Warrants: 2,072,562 share purchase warrants to purchase

2,072,562 shares

Warrant Exercise Price: $0.40 for a two year period

Number of Placees: 10 placee

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Gordon Blankstein Y 132,000

Finders' Fees: Fortuna Capital Partners S.L. (Bernard

Schmidt) will receive a finder's fee of

$28,000.00.

Euroscandic International Group (Scott

Eldridge/Daniel Schiber) will receive a fee of

$25,186.00.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

BARD VENTURES LTD. ("CBS")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation in connection

with a Purchase and Sale Agreement dated November 12, 2010 between Brian

Fowler and Patrick Kelly (the "Optionors") and the Company whereby the

Company has been granted an option to acquire a 100% undivided right, title

and interest in the Little Bear Lake Property located in the Thunder Bay

Mining Division, Ontario. The aggregate consideration is $100,000, 600,000

common shares (300,000 shares to each Optionor) and $400,000 in exploration

expenditures over a five year period.

The Company granted a 2% Net Smelter Return to the Optionors and will

assume a 1% Net Smelter Return granted to the Ontario Exploration

Corporation with an option to buy-back 3/4% of that percentage.

---------------------------------------------------------------------------

BARKERVILLE GOLD MINES LTD. ("BGM")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced November 15, 2010:

Number of Shares: 3,846,154 shares

Purchase Price: $1.30 per share

Number of Placees: 4 placees

Agents' Fees: D&D Securities Inc. will receive a fee of

192,308 common shares and 192,308 share

purchase warrants that are exercisable into

common shares at $1.30 per share for a one

year period.

MGI Securities (USA) Inc. will receive a

finder's fee of $33,182.37.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

BROWNSTONE VENTURES INC. ("BWN")

BULLETIN TYPE: Halt

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 6:02 a.m. PST, November 22, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

BROWNSTONE VENTURES INC. ("BWN")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 7:30 a.m. PST, November 22, 2010, shares of the Company

resumed trading, an announcement having been made over StockWatch.

---------------------------------------------------------------------------

CANOEL INTERNATIONAL ENERGY LTD. ("CIL")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 2,556,667 shares and 1,283,333 warrants to settle outstanding debt

for $308,000.

Number of Creditors: 1 Creditor

No Insider / Pro Group Participation

The Company shall issue a news release when the shares are issued and the

debt extinguished.

---------------------------------------------------------------------------

CARDIOCOMM SOLUTIONS INC. ("EKG")

BULLETIN TYPE: Miscellaneous

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the following agreements:

1. An amended Software Development Agreement dated April 1, 2010 between

the Company and MD Primer Inc. ("MDP") pursuant to which the Company shall

pay a fee of $500,000 plus GST for the development of add-on modules of the

GEM Suite.

2. A Loan and General Security Agreement between the Company and MDP

pursuant to which MDP has agreed to extend a $200,000 line of credit which

bears simple interest at 6% per annum and is repayable on or before July

28, 2012.

---------------------------------------------------------------------------

CENTRAL RESOURCES CORP. ("CBC")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 22, 2010 and November

16, 2010:

Number of Shares: 2,200,000 shares

Purchase Price: $0.15 per share

Warrants: 2,200,000 share purchase warrants to purchase

2,200,000 shares

Warrant Exercise Price: $0.25 for a one year period

Number of Placees: 16 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Desiree Kranedijk P 50,000

Doug McDonald P 50,000

Ken Carter Y 100,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

CUE RESOURCES LTD. ("CUE")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced August 4, 2010 and November 5,

2010:

Number of Shares: 39,418,143 shares

Purchase Price: $0.07 per share

Warrants: 39,418,143 share purchase warrants to purchase

39,418,143 shares

Warrant Exercise Price: $0.12 for a two year period

Number of Placees: 77 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Nick Segounis P 200,000

Murray McInnes P 150,000

Pinetree Resource Partnership Y 4,000,000

Mike Mansfield P 200,000

Vito Ruzzuto P 200,000

Michael Gesualdi P 200,000

Donato Sferra P 200,000

John Icke Y 1,000,000

Red Rock Resources PLC

(Regency Mines PLC and Andrew Bell) Y 5,900,000

Meng Gan Y 250,000

Resinco Capital Partners Inc. Y 4,285,715

Finders' Fees: $25,173.60 cash and 359,623 options payable to

Canaccord Genuity Corp.

$9,800 cash and 140,000 options payable to

Haywood Securities Inc.

$92,400 cash and 1,320,000 options payable to

PowerOne Capital Markets Limited

$4,004 cash and 57,200 options payable to PI

Financial Corp.

$2,800 cash and 40,000 options payable to

Wolverton Securities Ltd.

$1,120 cash and 16,000 options payable to

Global Securities Corp.

$560 cash and 8,000 options payable to Union

Securities Ltd.

$3,640 cash payable to Fab Carella

$3,332 cash and 47,600 options payable to

Capital Street Group (David and Rie Taylor)

- Finder's fee options are exercisable at

$0.07 per units and units are under the same

terms as those to be issued pursuant to the

private placement.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

CVC CAYMAN VENTURES CORP. ("CKV")

(formerly CVC Cayman Ventures Corp. ("CKV.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Property-Asset

or Share Purchase Agreement, Private Placement-Non-Brokered, Resume Trading

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange Inc. (the "Exchange") has accepted for filing CVC

Cayman Ventures Corp.'s (the "Company" or "CVC") Qualifying Transaction

described in its filing statement (the "Filing Statement") dated November

1, 2010. As a result, effective at the opening Tuesday, November 23, 2010,

the trading symbol for the Company will change from CKV.P to CKV and the

Company will no longer be considered a Capital Pool Company. The Qualifying

Transaction includes the following matters, all of which have been accepted

by the Exchange.

Acquisition of 51% interest in the Gillis Property:

The Exchange has accepted for filing an Option Agreement between the

Company and Rimfire Minerals Corporation ("Rimfire") dated August 30, 2010.

Under the terms of the Option Agreement, the Company has an option to

acquire a 51% interest in the Gillis Property which is located 30

kilometers southwest of Merritt, British Columbia.

Under the terms of the Option Agreement, Rimfire has granted to the Company

the sole and exclusive right and option, to acquire up to an undivided 51%

interest in and to the Gillis Property free and clear of all charges,

encumbrances and claims, by incurring a total of $2,000,000 in Expenditures

on the Property and by paying cash of $155,000 and issuing 225,000 shares

as follows:

Expenditures

1. $200,000 on or before August 30, 2011;

2. an additional $200,000 on or before August 30, 2012;

3. an additional $500,000 on or before August 30, 2013; and

4. an additional $1,100,000 on or before August 30, 2014.

Cash Payments

1. $30,000 on execution of the Option Agreement; (PAID)

2. $25,000 on or before the first anniversary (August 30, 2011); and

3. $100,000 on or before the second anniversary (August 30, 2012).

Share issuances

1. 25,000 on signing of the Option Agreement (August 30, 2010); (ISSUED)

2. 50,000 on or before 1st anniversary (August 30, 2011);

3. 50,000 on or before 2nd anniversary (August 30, 2012);

4. 50,000 on or before 3rd anniversary (August 30, 2013); and

5. 75,000 on or before 4th anniversary (August 30, 2014).

CVC can earn an additional 9% interest in the Gillis Property, for a total

of a 60% interest, by incurring an additional $1,000,000 in exploration

expenditures before August 30, 2015 on the Gillis Property.

The full particulars of the Company's Qualifying Transaction are set forth

in the Filing Statement, which has been accepted for filing by the Exchange

and which is available under the Company's profile on SEDAR.

Non-Brokered Private Placement:

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 26, 2010:

Number of Shares: 1,820,666 flow-through shares

Purchase Price: $0.135 per flow-through share

Warrants: 910,333 share purchase warrants to purchase

910,333 non-flow-through shares

Warrant Exercise Price: $0.20 for a 12 month period

Number of Placees: 19 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Patrick Lee P 100,000

Gordon Medland P 100,000

Dundee Securities Corp

ITF Bernhard Hensel P 100,000

Gordon Steblin Y 50,000

Mackie Research ITF

Brian Butterworth P 50,000

Finders' Fees: Nil

The Company is classified as a 'Mineral Exploration and Development'

company.

Capitalization: Unlimited shares with no par value of which

6,345,666 shares are issued and outstanding

Escrow: 2,000,000 common shares are subject to a

36-month staged release escrow under the CPC

Escrow Agreement

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: CKV (new)

CUSIP Number: 12661B 10 0 (UNCHANGED)

Resume Trading:

Effective at the opening Tuesday, November 23, 2010, trading in the shares

of the Company will resume.

---------------------------------------------------------------------------

CYTERRA CAPITAL CORP. ("CYC.P")

BULLETIN TYPE: Halt

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 6:03 a.m. PST, November 22, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

DIVERSIFIED INDUSTRIES LTD. ("DVS")

BULLETIN TYPE: Halt

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 11:115 a.m. PST, November 22, 2010, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

---------------------------------------------------------------------------

ENABLENCE TECHNOLOGIES INC. ("ENA")

BULLETIN TYPE: Halt

BULLETIN DATE: November 22, 2010

TSX Venture Tier 1 Company

Effective at 12:26 p.m. PST, November 22, 2010, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

---------------------------------------------------------------------------

FIRST BAUXITE CORPORATION ("FBX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced September 17, 2010, October 6,

2010 and October 18, 2010:

Number of Shares: 4,864,458 shares

Purchase Price: $0.83 per share

Warrants: 2,432,229 share purchase warrants to purchase

2,432,229 shares

Warrant Exercise Price: $1.075 for a two year period

Number of Placees: 6 placees

Finders' Fees: $52,500 cash payable to Pacific Road Capital

Management Pty Limited

$52,500 cash payable to RCF Management L.L.C.

$49,000 cash and (i)60,000 warrants payable to

Surge Capital Corp. (Jay Friesen & Nathan

Friesen)

$10,000 cash and (ii)18,072 warrants payable

to Bengal Capital Corp. (Marcel Rada)

$7,500 cash and (ii)18,072 warrants payable to

Michael G. Thomson

90,361 warrants and 36,145 units payable to

Rory S. Godinho Law Corporation

(i)Each finder's fee warrant is exercisable at

$1.075 per share for two years.

(ii)Each finder's fee warrant is exercisable

at $0.83 per share for two years.

- Finder's fee units are under the same terms

as those to be issued pursuant to the private

placement.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

FIRST LITHIUM RESOURCES INC. ("MCI")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing an Option Agreement dated

November 19, 2010 between First Lithium Resources Inc. (the "Company") and

Newcastle Minerals Ltd. ("Newcastle"), whereby the Company has an option to

acquire up to 75% interest in 3 mineral claims comprising 37 units,

totalling approximately 1480 acres located in Benneweis Township, Porcupine

Mining Division mid-way between Sudbury and Timmins, Ontario (the

"Property"). In consideration, the Company will pay $15,000 in cash upon

the Exchange Approval, issue a total of 1,750,000 shares (1,000,000 shares

in the first year) over two years and incur exploration expenditures in the

amount of $1,000,000 ($250,000 in the first year) over three years. Larry

Salo ("LS") holds a 3% NSR of which Newcastle may, in its sole discretion,

purchase one third of the 3% NSR from LS in consideration of $1,000,000.

---------------------------------------------------------------------------

GLEN EAGLE RESOURCES INC. ("GER")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating to

a Property Acquisition Agreement dated November 2nd, 2010, whereby the

Company may acquire a 100% interest in 19 claims located in the Township of

LaMotte, in the province of Quebec.

In order to obtain the 100% interest, the Company is required to issue

132,000 common shares within the first year upon signing.

The Vendor will retain a 2% Net Smelter Royalty on the revenues generated

by these claims, 50% of which (1%) may be repurchased for a sum of

$200,000.

For further information, please refer to the Company's press release dated

November 2nd, 2010.

GLEN EAGLE RESOURCES INC. ("GER")

TYPE DE BULLETIN: Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN: Le 22 novembre 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents relativement a une

convention d'achat de propriete datee du 2 novembre 2010, selon laquelle la

societe peut acquerir un interet de 100 % dans les 19 claims situes dans le

canton de " LaMotte ", dans la province du Quebec.

Afin d'acquerir 100 % de l'interet, la societe doit emettre 132 000 actions

pendant la premiere annee suite a la signature.

Le vendeur conservera une royaute "NSR" de 2,0 % sur les revenus generes

par ces claims, duquel la moitie, soit (1 %), peut etre rachete pour une

somme de 200 000 $.

Pour plus d'information, veuillez vous referer au communique de presse emis

par la societe le 2 novembre 2010.

---------------------------------------------------------------------------

LIONS BAY CAPITAL INC. ("LBI.P")

BULLETIN TYPE: New Listing-CPC-Shares

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

This Capital Pool Company's ('CPC') Prospectus dated August 26, 2010 has

been filed with and accepted by TSX Venture Exchange and the Alberta,

British Columbia and Ontario Securities Commissions and the Saskatchewan

Financial Services Commission effective August 26, 2010, pursuant to the

provisions of the Alberta, British Columbia, Ontario and Saskatchewan

Securities Acts. The Common Shares of the Company will be listed on TSX

Venture Exchange on the effective date stated below.

The Company has completed its initial distribution of securities to the

public. The gross proceeds received by the Company for the Offering were

$200,000 (1,000,000 common shares at $0.20 per share).

Commence Date: At the opening Tuesday, November 23, 2010, the

Common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: Unlimited common shares with no par value of

which 1,575,500 common shares are issued

and outstanding

Escrowed Shares: 500,000 common shares

Transfer Agent: Olympia Trust Company

Trading Symbol: LBI.P

CUSIP Number: 536263106

Sponsoring Member: Haywood Securities Inc.

Agent's Securities: 100,000 non-transferable stock options. One

option to purchase one share at $0.20 per

share up to 24 months from the date of

the listing.

50,000 common shares in satisfaction of

one-half of the Agent's commission.

25,000 common shares of the Company in

satisfaction of one-half of the Agent's

corporate finance fee.

For further information, please refer to the Company's Prospectus dated

August 26, 2010.

Company Contact: Mr. Rick Wilson, CEO, CFO and Secretary

Company Address: Unit 101, 4705 Wayburne Drive,

Burnaby, BC V5G 3L1

Company Phone Number: (604) 669-7775

Company Fax Number: (604) 687-3581

Company Email Address: rickwilson@shaw.ca

-- Seeking QT primarily in these sectors: Mineral exploration and

development.

---------------------------------------------------------------------------

MAINSTREAM MINERALS CORPORATION ("MJO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 14, 2010:

Number of Shares: 5,000,000 shares

Purchase Price: $0.09 per share

Warrants: 2,500,000 share purchase warrants to purchase

2,500,000 shares

Warrant Exercise Price: $0.12 for a one year period

Number of Placees: 30 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Peter Brown P 500,000

Stav Adler P 140,000

Linda English P 60,000

Rick Cohen P 450,000

Finder's Fee: An aggregate of $16,416 in cash payable to PI

Financial Corp., Canaccord Genuity Corp. and

Union Securities Ltd.

Note that in certain circumstances the Exchange may later extend the expiry

date of the warrants, if they are less than the maximum permitted term.

For further details, please refer to the Company's news releases dated

November 4, 2010 and November 12, 2010.

---------------------------------------------------------------------------

MAINSTREAM MINERALS CORPORATION ("MJO")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to an

Option Agreement (the "Agreement") dated September 23, 2010, between

Mainstream Minerals Corporation (the "Company") and Glen Coyne (the

"Optionor"). Pursuant to the Agreement, the Company shall have the option

to acquire a 100% interest in the 28 mining claims (the "Property") located

at the Bobjo Mine Project, Earngey Township, Red Lake Mining District.

As consideration, the Company must pay the Optionor $10,000 and issue

100,000 common shares. The Optionor will retain a 2% net smelter return

(the "NSR") in the Property, of which the Company has the option of buying

back 50% of the NSR with a further cash payment of $1,000,000.

For further information, please refer to the Company's press release dated

September 27, 2010.

---------------------------------------------------------------------------

MAINSTREAM MINERALS CORPORATION ("MJO")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to an

Option Agreement (the "Agreement") dated September 15, 2010, between

Mainstream Minerals Corporation (the "Company"), and an arm's-length party

(the "Vendor"), whereby the Company can acquire a 100% interest in certain

unpatented mineral claims (the "Slate Lake Property"), located

approximately 80 km east of Red Lake, Ontario.

Under the terms of the Agreement, the Company can earn a 100% interest in

the Property by making aggregate cash payments of CDN$80,000 over a four

year period, and by issuing 200,000 common shares over a one year period.

For further details, please refer to the Company's news release dated

October 20, 2010.

---------------------------------------------------------------------------

NORTHERN LION GOLD CORP. ("NL")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 29, 2010:

Number of Shares: 7,700,000 shares

Purchase Price: $0.20 per share

Warrants: 3,850,000 share purchase warrants to purchase

3,850,000 shares

Warrant Exercise Price: $0.30 for an eighteen month period

Number of Placees: 37 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Pinetree Resource Partnership

(Pinetree Capital Ltd., a TSX

listed company & Sheldon Inwentash) Y 1,000,000

Anthony P. Fierro P 100,000

James Oleynick P 150,000

Bill Whitehead P 100,000

Finders' Fees: $12,225 cash, 183,375 finder's units (comprised of one

share and one half one warrant with each full warrant exercisable at $0.30

for eighteen months), and 326,000 finder's warrants exercisable at $0.25

for eighteen months payable to Axemen Resource Capital Ltd.

199,500 finder's units (same terms as above), and 266,000 finder's

warrants (same terms as above) payable to Canaccord Genuity Corp.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

PUMA EXPLORATION INC. ("PUM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with respect

to a Non-Brokered Private Placement announced on September 29, 2010:

Number of Shares: 11,150,000 flow-through common shares

Purchase Price: $0.05 per flow-through common share

Warrants: 11,150,000 warrants to purchase 11,150,000

common shares

Warrants Exercise Price: $0.10 per share for the 24 months following

the closing of the Private Placement

Number of Placees: 25 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / Number of Shares

Andre De Guise Y 100,000

Clement Duchesne Y 200,000

Marcel Robillard Y 100,000

Anne Slivitzky Y 100,000

Denis Amoroso P 200,000

The Company has confirmed the closing of the above-mentioned Private

Placement.

EXPLORATION PUMA INC. ("PUM")

TYPE DE BULLETIN: Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN: Le 22 novembre 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 29

septembre 2010:

Nombre d'actions: 11 150 000 actions ordinaires accreditives

Prix: 0,05 $ par action ordinaire accreditive

Bons de souscription: 11 150 000 bons de souscription permettant de

souscrire a 11 150 000 actions ordinaires

Prix d'exercice des bons: 0,10 $ l'action pendant les 24 mois suivant

la cloture du placement prive

Nombre de souscripteurs: 25 souscripteurs

Participation des inities / Groupe Pro:

Initie=Y /

Nom GroupePro=P / Nombre d'actions

Andre De Guise Y 100 000

Clement Duchesne Y 200 000

Marcel Robillard Y 100 000

Anne Slivitzky Y 100 000

Denis Amoroso P 200 000

La societe a confirme la cloture du placement prive.

---------------------------------------------------------------------------

PURE INDUSTRIAL REAL ESTATE TRUST ("AAR.UN")

BULLETIN TYPE: Notice of Distribution

BULLETIN DATE: November 22, 2010

TSX Venture Tier 1 Company

The Issuer has declared the following distribution:

Distribution per Trust Unit: $0.025

Payable Date: December 15, 2010

Record Date: November 30, 2010

Ex-Distribution Date: November 26, 2010

---------------------------------------------------------------------------

QUETZAL ENERGY LTD. ("QEI")

BULLETIN TYPE: Halt

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 6:02 a.m. PST, November 22, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

QUETZAL ENERGY LTD. ("QEI")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 8:30 a.m. PST, November 22, 2010, shares of the Company

resumed trading, an announcement having been made over StockWatch.

---------------------------------------------------------------------------

RAVENSTAR VENTURES INC. ("RVE.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated November 19, 2010, effective

at 8:456 a.m. PST, November 22, 2010 trading in the shares of the Company

will remain halted pending receipt and review of acceptable documentation

regarding the Qualifying Transaction pursuant to Listings Policy 2.4.

---------------------------------------------------------------------------

RIDGEMONT IRON ORE CORP. ("RDG")

(formerly Ridgemont Capital Corp. ("RDG.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Property-Asset

or Share Purchase Agreement, Private Placement-Non-Brokered, Name Change,

Resume Trading

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange Inc. (the "Exchange") has accepted for filing

Ridgemont Capital Corp.'s (the "Company") Qualifying Transaction described

in its filing statement (the "Filing Statement") dated November 10, 2010.

As a result, effective at the opening Tuesday, November 23, 2010, the

trading symbol for the Company will change from RDG.P to RDG and the

Company will no longer be considered a Capital Pool Company. The Qualifying

Transaction includes the following matters, all of which have been accepted

by the Exchange.

Acquisition of up to a 75% interest in the Redford Property:

The Exchange has accepted for filing an Option Agreement between the

Company and Logan Resources Ltd., a mineral exploration company listed on

the Exchange (TSXV: LGR) ("Logan") dated July 27, 2010. Under the terms of

the Option Agreement, the Company has agreed to acquire from Logan up to

75% of Logan's right, title and interest in and to the Redford Property

which is located 22 kilometres northeast of Ucluelet, in the Alberni Mining

Division, Vancouver Island, British Columbia, and is comprised of 26 claims

covering 10,821 hectares.

In order to earn an initial 50% interest (the "First Option") in and to the

Redford Property, the Company is required to:

(a) pay to Logan total cash payments of $225,000, comprised of: (i)

$25,000, which amount has been paid; (ii) $50,000 on the Closing Date; and

(iii) $50,000 on or before each of the next three anniversaries of the

closing date;

(b) incur no less than $3,000,000 in work costs, as follows: (i) $750,000

on or before the first anniversary of the closing date; (ii) $1,000,000 on

or before the second anniversary of the closing date; and (iii) $1,250,000

on or before the third anniversary of the closing date; and

(c) issue an aggregate of 300,000 common shares to Logan as to 100,000 on

or prior to each of the first, second, and third anniversaries of the

closing date.

Upon exercising the First Option, the Company may exercise a second option,

thereby earning an additional 25% interest in and to the Property, by:

(a) completing a bankable feasibility report and paying all costs and

expenses to complete all exploration, study, permitting, and other work

related to such, including obtaining all necessary permits to operate a

mine and to make a production decision, the cost of which shall be borne

100% by the Company; and

(b) subsequent to a production decision, by the Company arranging the

production financing, with 25% of such production financing to be repaid by

Logan to the Company exclusively from Logan's share of the proceeds of the

production from the Redford Property.

When the Company has exercised the First Option, Logan will provide the

Company with written notice confirming that the First Option has been

exercised. The Company will then have 120 days from the date of receipt of

such notice to provide Logan written notice of its intention to exercise

the Second Option, failing which the Second Option shall terminate.

Upon the Company having exercised the First Option, Logan and the Company

shall enter into a joint venture agreement for the purpose of further

exploration and development work on the Redford Property and, if warranted,

the operation of one or more mines on the Redford Property. The Company

shall serve as the initial operator under the joint venture agreement. In

the event that the Company does not provide Logan with notice of its

intention to exercise the Second Option in accordance with the terms of the

Option Agreement, then Logan shall be the operator under the joint venture

agreement.

The Company will pay a finder's fee of shares of the Company to Axemen

Resource Capital Ltd. ("Axemen") through the issuance of 738,750 Shares in

conjunction with the completion of the Qualifying Transaction. Axemen is at

arm's length to the Company.

The full particulars of the Company's Qualifying Transaction are set forth

in the Filing Statement, which has been accepted for filing by the Exchange

and which is available under the Company's profile on SEDAR.

Non-Brokered Private Placement:

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced June 1, 2010:

Number of Shares: 16,000,000 shares

Purchase Price: $0.10 per share

Warrants: 16,000,000 share purchase warrants to purchase

16,000,000 shares

Warrant Exercise Price: $0.25 for a 24 month period

Number of Placees: 61 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Bryan Henry P 25,000

Connor Cruise P 25,000

Greg Nelson P 110,000

Leona Nielson P 30,000

Marion Nelson P 110,000

Carrie Clark P 100,000

Anthony Fierro P 100,000

Gary Winters P 25,000

Steve Wright P 25,000

Sonya Atwal Y 60,000

Sheila Paine Y 25,000

Finders' Fees: PI Financial Corp. will receive 62,500 common

shares and 62,500 warrants entitling the

holder to acquire an additional common share

for $0.25 for a period of 24 months.

Axemen Research Capital Ltd. will receive

282,500 common shares and 282,500 warrants

entitling the holder to acquire an additional

common share for $0.25 for a period of 24

months.

Name Change:

Pursuant to a resolution passed by directors on November 19, 2010, the

Company has changed its name to Ridgemont Iron Ore Corp.

Effective at the opening on Tuesday, November 23, 2010, the common shares

of Ridgemont Iron Ore Corp. will commence trading on TSX Venture Exchange

and the common shares of Ridgemont Capital Corp. will be delisted. The

Company is classified as a 'Mineral Exploration and Development' company.

Capitalization: Unlimited shares with no par value of which

29,183,750 shares are issued and outstanding

Escrow: 10,000,000 common shares are subject to a

36-month staged release escrow under the CPC

Escrow Agreement

Transfer Agent: Computershare Trust Company

Trading Symbol: RDG (new)

CUSIP Number: 76609P 10 9 (new)

Resume Trading:

Effective at the opening Tuesday, November 23, 2010, trading in the shares

of the Company will resume.

---------------------------------------------------------------------------

RPT RESOURCES LTD. ("RPT")

BULLETIN TYPE: Halt

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 6:03 a.m. PST, November 22, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

SOLID GOLD RESOURCES CORP. ("SLD")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced November 18, 2010:

Number of Shares: (i) 300,000 non flow-through shares

(ii) 633,333 flow-through shares

Purchase Price: (i) $0.25 per non flow-through share

(ii) $0.30 per flow-through share

Warrants: (i) 300,000 share purchase warrants to

purchase 300,000 shares

(ii) 633,333 share purchase warrants to

purchase 633,333 shares

Warrant Exercise Price: (i) $0.35 for a two year period

(ii) $0.40 for a two year period

Number of Placees: 2 placees

Finder's Fee: An aggregate of $26,499.99 and 93,333 broker's

warrants payable to Kingsdale Capital Markets

Inc. and First Canadian Capital Markets Inc.

Each broker warrant is exercisable into one

common share and one warrant at a price of

$0.25 per broker warrant for a two year

period. Each warrant is further exercisable

into one common share at a price of $0.35 per

share for a two year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). Note that in certain

circumstances the Exchange may later extend the expiry date of the

warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

STORAGEVAULT CANADA INC. ("SVI")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to the

Acquisition Agreement of Purchase and Sale (the "Agreement") between the

Company and Younghusband Holdings Ltd. (the "Vendor") whereby the Company

will acquire the business operated by the Vendor known as Parksville Mini

Storage located in Parksville, BC. Under the terms of the Agreement, the

Company will pay an aggregate of $2,800,000, including a $1,400,000 take-

back mortgage.

No Insider / Pro Group Participation.

Additional details of this transaction can be found in the Company's press

releases dated September 9 and November 2, 2010

---------------------------------------------------------------------------

SULTAN MINERALS INC. ("SUL")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 28, 2010:

Number of Shares: 4,662,500 shares

Purchase Price: $0.08 per share

Warrants: 4,662,500 share purchase warrants to purchase

4,662,500 shares

Warrant Exercise Price: $0.15 for a two year period

Number of Placees: 6 placees

Finder's Fee: $1,600 payable to Brad Docherty

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

TRADE WINDS VENTURES INC. ("TWD")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced October 25, 2010:

Number of Shares: 9,298,000 shares

Purchase Price: $0.31 per share

Number of Placees: 11 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Ian Lambert Y 100,000

Bruce Winfield Y 80,000

Verlee Webb Y 15,000

Craig Anderson Y 28,000

Christos Doulis P 30,000

Agent's Fee: 6% cash ($166,935) and 6% compensation options

(538,500 broker warrants) payable to

Desjardins Securities Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

TRANSAMERICAN ENERGY INC. ("TAE")

BULLETIN TYPE: Halt

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 6:03 a.m. PST, November 22, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

TRANSAMERICAN ENERGY INC. ("TAE")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 11:15 a.m. PST, November 22, 2010, shares of the Company

resumed trading, an announcement having been made over StockWatch.

---------------------------------------------------------------------------

VALGOLD RESOURCES LTD. ("VAL")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first tranche of a Non-Brokered Private Placement announced November 9,

2010:

Number of Shares: 1,110,000 flow-through shares

Purchase Price: $0.30 per flow-through share

Warrants: 1,110,000 share purchase warrants to purchase

1,110,000 shares

Warrant Exercise Price: $0.50 for a two year period

Number of Placees: 6 placees

Finder's Fee: $15,000 and 50,000 finder's warrants payable

to Secutor Capital Management Corporation

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

VEGA RESOURCES INC. ("VGR")

BULLETIN TYPE: Halt

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

Effective at 6:02 a.m. PST, November 22, 2010, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

WILDCAT EXPLORATION LTD. ("WEL")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 26, 2010:

Number of Shares: 8,571,428 flow-through shares

18,333,334 non-flow-through shares

Purchase Price: $0.07 per flow-through share

$0.06 per non-flow-through share

Warrants: 22,619,047 share purchase warrants to purchase

22,619,047 shares

Warrant Exercise Price: $0.10 for a two year period

Number of Placees: 25 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Mackie Research ITF Rein Lee P 400,000

Denis Fillion Y 150,000

John Knowles Y 75,000

Finders' Fees: $87,000.18 and 1,378,574 finder's warrants

payable to MacDougall MacDougall MacTier

$4,932 and 78,600 finder's warrants payable to

Mackie Research Capital Inc.

$1,440 and 24,000 finder's warrants payable to

Joseph Falvo

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

WINDSTORM RESOURCES INC. ("WSR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 22, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 18, 2010:

Number of Shares: 8,052,000 shares

Purchase Price: $0.30 per share

Warrants: 4,026,000 share purchase warrants to purchase

4,026,000 shares

Warrant Exercise Price: $0.35 for an eighteen month period

Number of Placees: 78 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Gerald Carlson Y 75,000

Alex Heath P 50,000

Bernhard Hensel P 80,000

Sean Hurd Y 120,000

KGE Management (G. Carlson) Y 350,000

Desiree Kranendijk P 47,000

Patrick Lee P 100,000

Douglas McDonald P 23,000

Jock Ross P 100,000

Jonathan Switzer P 20,000

Judy Wong P 30,000

Nick Zucarro P 150,000

Finders' Fees: $14,910 and 49,700 compensation warrants

payable to Canaccord Genuity Corp.

$15,330 and 51,100 compensation warrants

payable to Raymond James Ltd.

$25,893 and 86,310 compensation warrants

payable to Long Wave Strategies Inc.

$6,510 and 21,700 compensation warrants

payable to Raven Waschilowski

$7,665 and 25,550 compensation warrants

payable to Macquarie Private Wealth Inc.

$13,860 and 46,200 compensation warrants

payable to Mackie Research Capital Corporation

$357 and 1,190 compensation warrants payable

to PI Financial Corp.

$7,350 and 24,500 compensation warrants

payable to Malcolm Finlay

$1,785 and 5,950 compensation warrants payable

to Denise Dodds

$9,534 and 31,780 compensation warrants

payable to Don McClauchlin

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

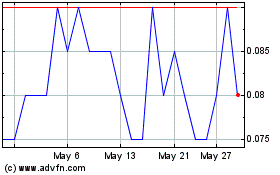

Minnova (TSXV:MCI)

Historical Stock Chart

From Apr 2024 to May 2024

Minnova (TSXV:MCI)

Historical Stock Chart

From May 2023 to May 2024