MedMira Reports FY2020 Fourth Quarter and Year End Financial Results

November 30 2020 - 6:00PM

MedMira Inc. (MedMira) (TSXV: MIR), reported today on its financial

results for the financial year ended July 31, 2019.

Profit and Loss Highlights

- Revenue: The

Company recorded revenues in FY2020 of $919,072 compared to

$527,445 in FY2019. The increase in revenue was due to the

Company’s additional revenues generated with the REVEALCOVID-19TM

Total Antibody Test.

- Gross Profit:

The Company recorded a gross profit in FY2020 of $572,280 compared

to $423,351 for the same period last year.

- Operating

expenses: In this financial year, the Company recorded operating

expenses of $1,872,437 compared to $1,719,384 in FY2019. The

increase of 9% in operating expenses were due to additional labour

costs associated with the enhanced production for the Company’s

REVEALCOVID-19TM Total Antibody Test.

- Net loss: The

Company recorded a net loss of $2,045,386 compared to $2,106,448 in

FY2019.

Balance Sheet

Highlights

- Assets: The

Company had an expected increase of its assets by $3,143,557

compared to last financial year which was mainly due to the

adoption of IFRS 16 which accounts for approximately $2.3m. IFRS

16, which was adopted by the Company in August 2019, changes the

accounting requirement of how to recognize, measure, present and

disclose leases. For MedMira, its leases are placed into assets and

liabilities.

- Liabilities: The

Company’s liabilities increased by $5,188,943 or 38% between FY2019

and FY2020. This was mainly due to the adoption of IFRS 16 of

approximately $2.3m. Furthermore, prepayments received from

customers during this period in the amount of approximately $1.2m

are considered deferred revenue and part of the current liabilities

until these have been converted into revenue.

- Loans in default

slightly increased by $13,850 or 1% compared to the previous

financial year. This increase was due to a related party’s loan

being due in FY2020. All long and short terms debts are currently

under negotiation to restructure terms and conditions of

repayment.

- Working Capital

deficit: As a result of the increases noted above, the Company

recorded higher working capital deficit of $1,371,642 or 10%

compared to last financial year which was mainly due to an increase

in deferred revenue (prepayment) of $1,240,890 from the Company’s

distributors. These prepayments will be converted into revenue at

the time of shipment.

“In FY2020, MedMira was able

to highlight the company’s adaptability to new

global changes by developing a high-quality testing

solution within a short time and which through repeated

third-party testing demonstrated accuracy and ease of use. In

addition, the company successfully ramped-up

production to unprecedented levels

without sacrificing stringent quality control measures,”

said Markus Meile, CFO of MedMira Inc. “Whereas this new

opportunity provided MedMira additional revenues and cash flow,

other product sales had suffered during the third and fourth

financial quarters, which was mainly due to the global lock downs

and the market’s focus on COVID-19 testing. However, subsequent to

the financial year end, these sales have steadily increased and

will be reported in the following financial quarters.”

Regulatory StatusMedMira has applied to the US

FDA to obtain FDA Emergency Use Authorization (EUA) for the

REVEALCOVID-19™ Total Antibody Test, and its applications is under

review. However, while awaiting the authorization, REVEALCOVID-19™

Total Antibody Test can be distributed in the U.S. according to

Section IV.D of the Policy for Coronavirus Disease-2019 Test. In

addition, MedMira received on the 21st of May 2020 the right to

sell in all countries accepting CE mark. In Canada, the Company has

re-submitted, based on the new template issued by Health Canada,

its application on the 29th of October 2020. No sales can be made

in Canada prior to receipt of the interim order from Health

Canada.

The Company’s financial statements and

management’s discussion and analysis are available on the Company’s

profile on SEDAR at www.sedar.com. For matters of going concern,

reference is made to the Auditor’s Emphasis of Matter statement in

the fiscal year ended 2020 Auditors Report and note 2b in the

audited financial statements which are also available on SEDAR.

About MedMira

MedMira is the developer and owner of Rapid

Vertical Flow (RVF)® Technology. The Company’s rapid test

applications built on RVF Technology provide hospitals, labs,

clinics and individuals with instant diagnosis for diseases such as

HIV and hepatitis C in just three easy steps. The Company’s tests

are sold under the Reveal®, Multiplo® and Miriad® brands in global

markets. MedMira’s corporate offices and manufacturing facilities

are located in Halifax, Nova Scotia, Canada and the Company has a

sales and customer service office located in the United States. For

more information visit medmira.com. Follow us on Twitter and

LinkedIn.

This news release contains forward-looking

statements, which involve risk and uncertainties and reflect the

Company’s current expectation regarding future events including

statements regarding possible approval and launch of new products,

future growth, and new business opportunities. Actual events could

materially differ from those projected herein and depend on a

number of factors including, but not limited to, changing market

conditions, successful and timely completion of clinical studies,

uncertainties related to the regulatory approval process,

establishment of corporate alliances and other risks detailed from

time to time in the company quarterly filings.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

MedMira

Contacts:

Markus Meile,

CFO Tel:

902-450-1588 Email:

ir@medmira.com

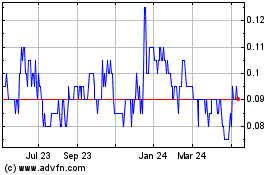

MedMira (TSXV:MIR)

Historical Stock Chart

From Nov 2024 to Dec 2024

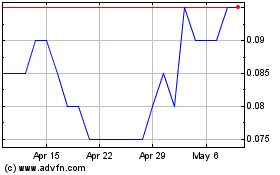

MedMira (TSXV:MIR)

Historical Stock Chart

From Dec 2023 to Dec 2024