Osisko Metals Incorporated (the "

Company" or

"

Osisko Metals") (TSX-V: OM; OTCQX: OMZNF;

FRANKFURT: 0B51) is pleased to announce the terms of a proposed

"best efforts" private placement offering of up to 7,500,000 common

shares of the Company (each, a "

FT Share") that

will qualify as "flow-through shares" within the meaning of the

Income Tax Act (Canada) (the "

Tax Act") and the

Taxation Act (Québec) at a price of $0.40 per FT Share (the

"

Offering Price") for gross proceeds to the

Company of up to $3,000,000 (exclusive of the Agents' Option (as

defined herein)) (the "

Offering").

The Offering will be completed pursuant to the

terms of an agency agreement to be entered into among the Company

and Velocity Trade Capital Ltd., as lead agent and sole bookrunner

(the "Lead Agent"), for and on behalf of a

syndicate of agents (together with the Lead Agent, the

"Agents"). In connection with the Offering, the

Agents will have an option, exercisable in full or in part, up to

48 hours prior to the closing of the Offering, to raise additional

gross proceeds of up to $500,000 from the offer and sale of up to

an additional 1,250,000 FT Shares at the Offering Price per FT

Share (the "Agents' Option").

In consideration for the services to be rendered

by the Agents in connection with the Offering, the Company has

agreed to: (i) pay the Agents a cash commission equal to 7.0% of

the gross proceeds of the Offering; and (ii) issue to the Agents

such number of non-transferable broker warrants (each, a

"Broker Warrant") as is equal to 7.0% of the

number of FT Shares offered and sold under the Offering. Each

Broker Warrant will entitle the holder thereof to purchase one

common share of the Company at a price of $0.25 per common share

for a period of 18 months from the closing date of the

Offering.

The gross proceeds from the sale of FT Shares

will be used to incur "Canadian exploration expenses" as defined in

subsection 66.1(6) of the Tax Act that (i) qualify as "flow-through

critical mineral mining expenditures" as defined in subsection

127(9) of the Tax Act, and (ii) will be eligible for the two 10%

enhancements under section 726.4.9 and section 726.4.17.1 of the

Taxation Act (Québec) (the "Qualifying

Expenditures"). Such Qualifying Expenditures will be

renounced to the subscribers of the FT Shares with an effective

date not later than December 31, 2023, in the aggregate amount of

not less than the total amount of gross proceeds raised from the

issue of FT Shares. The Company intends to use the gross proceeds

of the Offering to fund exploration activities at the Gaspé

property, which includes the site of the past-producing Gaspé

copper mine (the "Gaspé Copper Property"), located

near Murdochville, Québec.

The Offering is expected to close on or about

July 12, 2023, or such other date or date(s) as the Company and the

Lead Agent may agree, and remains subject to the receipt of all

necessary approvals, including, but not limited to, the conditional

approval of the TSX Venture Exchange (the

"Exchange").

Subject to compliance with applicable regulatory

requirements and in accordance with National Instrument 45-106 –

Prospectus Exemptions ("NI 45-106"), the FT Shares

will be offered for sale to purchasers in each of the Provinces and

Territories of Canada in reliance on the "listed issuer financing

exemption" in accordance with the requirements of Part 5A of NI

45-106 (the "LIFE Exemption"). The FT Shares

issued under the Offering in reliance on the LIFE Exemption will

not be subject to resale restrictions pursuant to applicable

Canadian securities laws.

There is an offering document related to the

Offering that can be accessed on SEDAR (www.sedar.com) under the

Company's issuer profile and on the Company's website

(www.osiskometals.com). Prospective investors should read this

offering document before making an investment decision.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This news

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any State in which such offer, solicitation or sale would be

unlawful.

Qualified Person

The scientific and technical information

included in this news release has been reviewed and approved by Mr.

Robert Wares, the Chairman and CEO of the Company, and a "qualified

person" within the meaning of NI 43-101 (as defined herein).

About Osisko Metals

Osisko Metals Incorporated is a Canadian

exploration and development company creating value in the critical

metals space, specifically copper and zinc. The Company is a joint

venture partner with Appian Canada Pine B.V. for the advancement of

one of Canada's premier past-producing zinc mining camps, the Pine

Point Project, located in the Northwest Territories, for which the

2022 PEA (as defined herein) has indicated an after-tax NPV of $602

million and an IRR of 25%, based on long-term zinc price of

US$1.37/lb and the current mineral resource estimates that are

amenable to open pit and shallow underground mining. The current

mineral resource estimate in the 2022 PEA consists of 15.7Mt

grading 5.55% ZnEq of indicated mineral resources and 47.2Mt

grading 5.94% ZnEq of inferred mineral resources. Please refer to

the technical report entitled "Preliminary Economic Assessment,

Pine Point Project, Hay River, Northwest Territories, Canada" dated

August 26, 2022 (with an effective date of July 30, 2022), which

has been prepared for Osisko Metals and Pine Point Mining Limited

by representatives of BBA Engineering Inc., Hydro-Resources Inc.,

PLR Resources Inc. and WSP Canada Inc. (the "2022 PEA"). Please

refer to the full text of the 2022 PEA, a copy of which is

available on SEDAR (www.sedar.com) under Osisko Metals' issuer

profile, for the assumptions, methodologies, qualifications and

limitations described therein. The Pine Point Project is located on

the south shore of Great Slave Lake in the Northwest Territories,

near infrastructure, paved highway access, and has an electrical

substation as well as 100 kilometres of viable haulage roads

already in place.

The Company also has an agreement to acquire,

from Glencore Canada Corporation, a 100% interest in the

past-producing Gaspé Copper Mine, located near Murdochville in the

Gaspé peninsula of Québec. The Company is currently focused on

resource evaluation of the Mount Copper Expansion Project that

hosts an inferred mineral resource (in accordance with National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

("NI 43-101")) of 456Mt grading 0.31% Cu (see

April 28, 2022 news release of Osisko Metals entitled "Osisko

Metals Announces Maiden Resource at Gaspé Copper – Inferred

Resource of 456Mt Grading 0.31% Copper"). Gaspé Copper hosts the

largest undeveloped copper resource in Eastern North America,

strategically located near existing infrastructure in the

mining-friendly province of Québec.

For further information on this news

release, visit www.osiskometals.com

or contact:

Robert Wares, Chairman & CEO of Osisko Metals

Incorporated(514) 861-4441

Email: info@osiskometals.comwww.osiskometals.com

Cautionary Statement on Forward-Looking

Information

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation based on expectations, estimates and projections as at

the date of this news release. Any statement that involves

predictions, expectations, interpretations, beliefs, plans,

projections, objectives, assumptions, future events or performance

are not statements of historical fact and constitute

forward-looking information. This news release may contain

forward-looking information pertaining to the Pine Point Project,

the Gaspé Copper Mine, and the Offering, including, among other

things, the results of the 2022 PEA and the IRR, NPV and estimated

costs, production, production rate and mine life; the expectation

that the Pine Point Project will be a robust operation and

profitable at a variety of prices and assumptions; the ability to

identify additional resources and reserves (if any) and exploit

such resources and reserves on an economic basis; the expected high

quality of the Pine Point concentrates; the timing and ability for

the Company to complete the Offering (if at all) and on the terms

announced; the use of proceeds of the Offering; the tax treatment

of the FT Shares; the timing of the renouncement of the Qualifying

Expenditures in favour of subscribers; the ability of the Company

to obtain the approval of the Exchange in respect of the Offering;

and the timing and ability (if at all) of the Company to complete

the acquisition of the Gaspé Copper Mine.

Forward-looking information is not a guarantee

of future performance and is based upon a number of estimates and

assumptions of management, in light of management's experience and

perception of trends, current conditions and expected developments,

as well as other factors that management believes to be relevant

and reasonable in the circumstances, including, without limitation,

assumptions about: favourable equity and debt capital markets;

future prices of zinc and lead; the timing and results of

exploration and drilling programs; the accuracy of mineral resource

estimates; production costs; operating conditions being favourable;

political and regulatory stability; the receipt of governmental and

third party approvals; licenses and permits being received on

favourable terms; sustained labour stability; stability in

financial and capital markets; availability of equipment; the

economic viability of the Pine Point Project; and positive

relations with local groups. Forward-looking information involves

risks, uncertainties and other factors that could cause actual

events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. Factors that could cause actual results to differ

materially from such forward-looking information are set out in the

Company's public disclosure record on SEDAR (www.sedar.com) under

Osisko Metals' issuer profile. Although the Company believes that

the assumptions and factors used in preparing the forward-looking

information in this news release are reasonable, undue reliance

should not be placed on such information, which only applies as of

the date of this news release, and no assurance can be given that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated by

such information. The Company disclaims any intention or obligation

to update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, other than

as required by law.

Neither the Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

Exchange) accept responsibility for the adequacy or accuracy of

this news release. No stock exchange, securities commission or

other regulatory authority has approved or disapproved the

information contained herein.

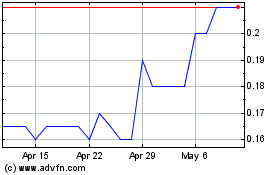

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Nov 2023 to Nov 2024