Omni-Lite Industries Canada Inc. (the "Company" or “Omni-Lite”;

TSXV: OML) today reported results for the fiscal year ending

December 31, 2021. Full financial results are available at

sedar.com.

Fourth Quarter Fiscal 2021

Results

Revenue for the fourth quarter of fiscal 2021

was approximately US$1.7 million, an increase of 29% as compared to

the fourth quarter of fiscal 2020. The increase in revenue was due

to higher volume contributions from aerospace fasteners and track

spikes. Adjusted EBITDA(1) was approximately US$(450,000) as

compared to approximately US$(616,000) in the fourth quarter of

fiscal 2020. The improved Adjusted EBITDA was the result of the

increased revenue offset by unutilized manufacturing costs

associated with inventory reductions. Adjusted Free Cash Flow(1)

was approximately breakeven in the fiscal quarter, as compared to

US$221,000 in the fourth quarter of fiscal 2020. Bookings in the

fourth quarter of 2021 were approximately US$1.3 million, up 39% as

compared to the fourth quarter of fiscal 2020 and backlog at

December 31, 2021 was approximately US$2.3 million.

Fiscal Year 2021 Results

Revenue for the fiscal year ending December 31,

2021 was approximately US$5.8 million, as compared to US$6.7

million in the prior year, a decrease of 14%. Increases in

microwave defense electronics and automotive sales were more than

offset by decreases in military and aerospace fastener volume as a

result of the continuing effects from the COVID-19 pandemic.

Adjusted EBITDA(1) was approximately US$(908,000) as compared to

approximately US$(833,000) in the prior year. Despite an

approximately US$0.9 million reduction in revenue, Fiscal 2021

Adjusted EBITDA declined only slightly as compared to Fiscal 2020.

Adjusted Free Cash Flow(1) was US$(461,000) as compared to

US$(19,000) in fiscal 2020. Adjusted Free Cash Flow(1) for fiscal

2021 was negatively impacted by lower shipments and reduced

manufacturing absorption, offset partially by realized cost savings

during the fiscal year. Excluded items from Fiscal 2021 Adjusted

Free Cash Flow(1) included approximately US$404,000 in transaction

costs associated with the acquisition of DP Cast and approximately

US$293,000 of capitalized rent expense resulting from the

sale/leaseback of the Company’s California facility. Capital

expenditures for the year were approximately US$37,000.

Omni-Lite reported a Fiscal Year 2021 net loss

of US$0.5 million, or US$(0.04) per diluted share, as compared to a

net loss of US$0.6 million or US$(0.05) per diluted share in Fiscal

Year 2020. The net loss for 2021 was primarily due to the effects

of the COVID-19 pandemic on revenue offset by a gain on sale of the

Company’s California facility of approximately US$1.8 million and

Paycheck Protection Program 2 loan forgiveness of approximately

US$0.4 million.

First Quarter Fiscal 2022 Preliminary

Revenue

The Company is expected to deliver revenue in

the First Quarter of Fiscal 2022 of approximately US$2.4 million

(unaudited), representing a 86% increase over the US$1.3 million

First Quarter Fiscal 2021 revenue. The increase is attributable to

a combination of organic growth in the Company’s fastener and

defense electronics businesses and the contribution of DP Cast’s

first full quarter since the acquisition closed in late December

2021.

Chief Financial Officer Transition

Today, the Company announced that Amy

Vetrano-Palmer has joined the Company and will assume the role of

Chief Financial Officer on May 5, 2022. The Board of Directors

succession planning for Carl Lueders‘ retirement, after 3 years as

CFO of Omni-Lite, ensures continuity and support for an effective

transition. To that end, Mr. Lueders has agreed to remain with

the Company in a consultative capacity for the next month, after

which time will be available on an as-needed basis through the end

of the third quarter of fiscal 2022.

Ms. Vetrano-Palmer was most recently Corporate

Controller at Resonetics, a portfolio company controlled by GTCR

and Carlyle. Amy spent 4 years at Resonetics and developed and led

the operational finance and reporting functions, was a member of

the leadership team and was deeply involved in Resonetics

enterprise transformation through the completion and integration of

eight add-on acquisitions which expanded its capabilities to serve

its interventional medical device customer base.

“We are excited to have Amy join Omni-Lite as Chief Financial

Officer. Her ability to apply finance to business operations

coupled with her acquisition experience make her a valuable

addition the the senior leadership of Omni-Lite,“ commented David

Robbins, CEO.

"Over the past 3

years, Carl has been a highly valued member of the Omni-Lite's

leadership team and trusted partner of mine, playing a critical

role in creating a high-performance finance, operational and IT

organization and instrumental in driving our evolution as a middle

market-sized aerospace, defense and industrial company,"

said David Robbins. "On behalf of our Board of Directors and

the entire company, we thank Carl for his countless contributions

and wish him well in his retirement."

"It has been an honor

to serve as Omni-Lite’s CFO as the Company has evolved and

responded to the opportunities and challenges in the marketplace,

particularly, it’s efforts surrounding the effects from COVID-19

pandemic, and to collaborate with so many talented colleagues

during my tenure. I want to thank our Board, Dave, the operating

team, and all of our employees for their partnership over the past

3 years. I look forward to the Company's continued success," said

Carl Lueders.

Management Comments

David Robbins, Omni-Lite’s CEO, stated

"Omni-Lite Industries finished stronger in a challenging Fiscal

2021, with a 29% year-over-year fourth quarter revenue increase.

While revenue for the fiscal year declined 14% year over year, our

focus on capital allocation, business development, and operational

and cash flow management initiatives positions the Company to

benefit from the continuing recovery in the commercial aerospace

market and current stability in government defense spending

levels.”

“Late in Fourth Quarter Fiscal 2021 we closed on

the sale/leaseback of our California facility’s land and building,

generating approximately $6.6 million in cash proceeds before taxes

and transaction expenses. With these proceeds, we repaid our

outstanding revolving credit facility and used a portion of these

funds to purchase DP Cast, a leading aerospace and industrial

investment casting company. DP Cast fits strategically

in the Omni-Lite sphere of hard to manufacture, high value parts

and components supporting tier one and related defense, aerospace

and industrial customers. This transaction is consistent with our

stated strategy to grow both organically and through M&A.”

Mr. Robbins continued, “Leading indicators for

air travel continue to show steady improvement. As a result,

coupled with strong defense electronics bookings and DP Cast sales,

we expect solid revenue growth in Fiscal 2022.Our liquidity

position remains strong as a result of our strict and disciplined

approach to management of our costs and spending. We ended the

Fiscal Year 2021 with approximately US$2.4 million in cash and no

debt outstanding. Subsequent to the Company’s fiscal 2021 year end,

Omni-Lite completed the private placement offering with the Company

issuing 1,000,000 common shares of the Company at a price of C$1.25

per common share to Candeco Realty Limited for aggregate gross

proceeds of C$1,250,000.”

Financial SummaryAll figures in

(US$000) unless noted.

|

For the Three Months Ended December 31, |

|

|

|

2021 |

|

|

2020 |

|

% Increase/(Decrease) |

|

Revenue |

$ |

1,661 |

|

$ |

1,285 |

|

29% |

|

Adjusted EBITDA(1) |

|

(450 |

) |

|

(615 |

) |

30% |

|

Adjusted Free Cash Flow(1) |

|

(4 |

) |

|

221 |

|

N/A |

|

Acquisition Costs |

|

(404 |

) |

|

- |

|

N/A |

|

Capitalized Rent |

|

(293 |

) |

|

- |

|

N/A |

|

Free Cash Flow(1) |

|

(701 |

) |

|

221 |

|

N/A |

|

Net Income/(Loss) |

|

523 |

|

|

143 |

|

N/A |

|

Diluted EPS |

$ |

0.05 |

|

$ |

0.02 |

|

150% |

|

For the Twelve Months Ended December 31, |

|

|

|

2021 |

|

|

2020 |

|

% Increase/(Decrease) |

|

Revenue |

$ |

5,763 |

|

$ |

6,684 |

|

(14%) |

|

Adjusted EBITDA(1) |

|

(908 |

) |

|

(833 |

) |

(9%) |

|

Adjusted Free Cash Flow(1) |

|

(461 |

) |

|

(19 |

) |

N/A |

|

Acquisition Costs |

|

(404 |

) |

|

- |

|

N/A |

|

Capitalized Rent |

|

(293 |

) |

|

- |

|

N/A |

|

Free Cash Flow(1) |

|

(1,158 |

) |

|

(19 |

) |

N/A |

|

Net Loss |

|

(483 |

) |

|

(618 |

) |

22% |

|

Diluted EPS |

($ |

0.04 |

) |

($ |

0.05 |

) |

20% |

Investor Conference Call

Omni-Lite will host a conference call for

investors on May 3, 2022, beginning at 12:00 P.M. (EDT) to discuss

the Fiscal 2021 results and review of its business and operations.

To join the conference call, 888-437-3179 in the USA and Canada, or

862-298-0702 for all other countries. Please call five to ten

minutes prior to the scheduled start time. A replay of the

conference call will be available 48 hours after the call and

archived on the Company’s investors page of the Company’s website

at www.omni-lite.com for 12 months.

(1) Adjusted EBITDA is a non-IFRS financial

measure defined as earnings before interest, taxes, depreciation,

amortization, stock-based compensation provision, gains (losses) on

sale of assets, and non-recurring items, if any. Free Cash Flow is

a non-IFRS financial measure defined as cash flow from operations

minus capital expenditures. Adjusted Free Cash Flow is a non-IFRS

financial measure defined as Free Cash Flow excluding special

items, among others, gains (losses) on sale of assets and

non-recurring items, net of tax effects, if any. These are non-IFRS

financial measures, as defined herein, and should be read in

conjunction with IFRS financial measures and they are not intended

to be considered in isolation or as a substitute for, or superior

to, financial information prepared and presented in accordance with

IFRS. The non-IFRS financial measures as used herein may not be

comparable to similarly titled measures reported by other

companies. We believe the use of Adjusted EBITDA, Adjusted Free

Cash Flow and Free Cash Flow along with IFRS financial measures

enhances the understanding of our operating results and may be

useful to investors in comparing our operating performance with

that of other companies and estimating our enterprise value.

Adjusted EBITDA, Adjusted Free Cash Flow and Free Cash Flow are

also useful tools in evaluating the operating results of the

Company given the significant variation that can result from; for

example, the timing of capital expenditures and the amount of

working capital in support of our customer programs and contracts.

We also use Adjusted EBITDA, Adjusted Free Cash Flow and Free Cash

Flow internally to evaluate the operating performance of the

Company, to allocate resources and capital, and to evaluate future

growth opportunities.

Please see 2021 Management Discussion and Analysis for

additional notes and definitions.

About Omni-Lite Industries Canada Inc.

Omni-Lite Industries Canada Inc. is an

innovative company that develops and manufactures mission critical,

precision components utilized by Fortune 100 companies in the

aerospace and defense industries.For further information,

please contact:

Mr. David RobbinsChief Executive OfficerTel. No. (562) 404-8510

or (800) 577-6664Email: d.robbins@omni-lite.comWebsite:

www.omni-lite.com Forward Looking

Statements

Except for statements of historical fact, this

news release contains certain “forward-looking information” within

the meaning of applicable securities law. Forward-looking

information is frequently characterized by words such as “plan”,

“expect”, “project”, “intent”, “believe”, “anticipate”, “estimate”

and other similar words, or statements that certain events or

conditions “may” or “will” occur. Forward-looking information in

this press release includes, but is not limited to, the expect

future performance of the Company. Although we believe that the

expectations reflected in the forward-looking information are

reasonable, there can be no assurance that such expectations will

prove to be correct. We cannot guarantee future results,

performance or achievements. Consequently, there is no

representation that the actual results achieved will be the same,

in whole or in part, as those set out in the forward-looking

information. Forward-looking information is based on the opinions

and estimates of management at the date the statements are made,

and are subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

information. Some of the risks and other factors that could cause

the results to differ materially from those expressed in the

forward-looking information include, but are not limited to:

general economic conditions in Canada, the United States and

globally; industry conditions, governmental regulation, including

environmental consents and approvals, if and when required; stock

market volatility; competition for, among other things, capital,

skilled personnel and supplies; changes in tax laws; and the other

risk factors disclosed under our profile on SEDAR at www.sedar.com.

Readers are cautioned that this list of risk factors should not be

construed as exhaustive.

The forward-looking information contained in

this news release is expressly qualified by this cautionary

statement. We undertake no duty to update any of the

forward-looking information to conform such information to actual

results or to changes in our expectations except as otherwise

required by applicable securities legislation. Readers are

cautioned not to place undue reliance on forward-looking

information.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

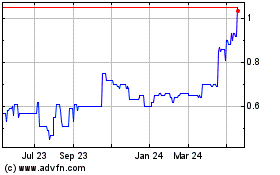

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Dec 2024 to Jan 2025

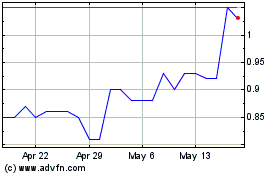

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Jan 2024 to Jan 2025