SRG MINING ANNOUNCES USD$1,600,000 UNDER THE SPROTT CONVERTIBLE FINANCING IN SUPPORT OF ITS NAL BID

April 06 2021 - 5:12PM

Montreal, Quebec April 6, 2021 - SRG Mining Inc. (TSXV: SRG)

(“

SRG” or the “

Company”) announced today that further

to its press release dated January 26, 2021 announcing a private

placement in the form of a convertible debt financing for USD$7.5M

(approximately CAD$9.53M) (the “

Financing”) with Sprott

Private Resource Lending II (Collector), LP (“

Sprott”), and

the announcement of March 26, 2021 announcing the closing of the

first tranche of the Financing for USD$800,000 which matured on

April 2, 2021 (the “

First Tranche”), the Company would like

to provide a general update to the market.

Considering the Company’s current working capital needs, market

conditions and SRG’s bid on the assets of North American Lithium

Inc. (“NAL”), Sprott has agreed to refinance the First

Tranche and replace it with a new secured credit agreement for

USD$1.6M (the “USD$1.6M Note”) which was funded on the date

hereof and represents a fresh cash injection of USD$800,000, as the

balance will be used to refinance and replace the previously

announced convertible financing under the First Tranche.

The USD$1.6M Note, includes a refinancing and a replacement of

the previously announced USD$800,000 First Tranche, as well as a

fresh cash injection on the same terms which are for the totality

of the amount; (i) an interest rate of 8% per annum, (ii) a term

expiring on July 31, 2023, (iii) is convertible into common shares

of the Company, at the discretion of Sprott, at a conversion price

equal to C$0.69 per share and (iv) includes the issuance of

warrants as described herein.

Concurrently, the Company has issued transferable common share

purchase warrants to Sprott exercisable for up to 2,913,623 common

shares of the Company at C$0.69 per share until July 31, 2023. The

above noted securities are subject to a four-month hold

period.

As for the Financing announced on January 26, 2021, the parties

continue to finalize the terms and conditions of the Financing,

including the conversion price. The Financing and the USD1.6M Note

(as it concerns the refinancing of the First Tranche and the new

cash injection) remain subject to applicable rules and approvals of

the TSX Venture Exchange (the “TSXV”).

About SRG Mining

SRG Mining is a Canadian-based mining company focused on

developing the Lola graphite deposit located in the Republic of

Guinea, West Africa. SRG is committed to operating in a socially,

environmentally, and ethically responsible manner.

For additional information, please visit SRG’s website at

www.srgmining.com.

Contact :

Benoit La Salle, FCPA FCA

Email: benoit.lasalle@srgmining.com

Neither the TSXV nor its Regulation Services Provider (as that

term is defined in the policies of the TSXV) accepts responsibility

for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains "forward-looking information" within

the meaning of Canadian securities legislation. All information

contained herein that is not clearly historical in nature may

constitute forward-looking information. Generally, such

forward-looking information can be identified by the use of

forward-looking terminology such as “firm”, “anticipated”,

“potential”, “will”, “continue”, “demonstrate”, “deliver”,

“believe”, or variations of such words and phrases or state that

certain actions, events or results "may", "could", "would" or

"might". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: (i) volatile stock price; (ii) the general global

markets and economic conditions; (iii) the possibility of

write-downs and impairments; (iv) the risk associated with

exploration, development and operations of mineral deposits and

mine plans for the Company’s mining operations; (v) the risk

associated with establishing title to mineral properties and assets

including permitting, development, operations and production from

the Company’s operations being consistent with expectations and

projections; (vi) fluctuations in commodity prices, finding offtake

takers and potential clients or enforcing such agreements against

same and other risks and factors described or referred to in the

section entitled "Risk Factors" in the MD&A of the Company and

which is available at www.sedar.com, all of which should be

reviewed in conjunction with the information found in this news

release.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially from those

contained in the forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such forward-looking

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

forward-looking information. Such forward-looking information has

been provided for the purpose of assisting investors in

understanding the Company's business, operations and exploration

plans and may not be appropriate for other purposes. Accordingly,

readers should not place undue reliance on forward-looking

information. Forward-looking information is given as of the date of

this press release, and the Company does not undertake to update

such forward-looking information except in accordance with

applicable securities laws.

Kathleen Jones-Bartels

SRG Mining

16043417474

Kathleen.bartels@srgmining.com

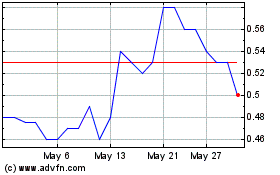

SRG Mining (TSXV:SRG)

Historical Stock Chart

From Nov 2024 to Dec 2024

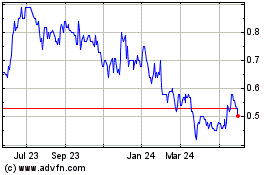

SRG Mining (TSXV:SRG)

Historical Stock Chart

From Dec 2023 to Dec 2024