AB Foods Launches GBP500 Million Share Buyback, Fiscal Year 2022 Pretax Profit Rose -- Update

November 08 2022 - 2:53AM

Dow Jones News

By Michael Susin

Associated British Foods PLC said Tuesday that it is launching a

buyback program and raised its dividend payout after reporting a

rise in pretax profit increase for fiscal 2022, driven by increased

pricing.

The British conglomerate, which owns the Primark fashion

retailer, said it will launch a 500 million-pound ($575.7 million)

share buyback program to be completed in fiscal 2023. It also

increased its final dividend to 29.9 pence a share, bringing the

total dividend to 43.7 pence a share and compared with a total

payout of 40.5 pence a share a year prior.

The company said it made a pretax profit for the year ended

Sept. 17 of GBP1.08 billion, up from GBP725 million in fiscal

2021.

Adjusted operating profit--the company's preferred metric, which

strips out exceptional and other one-off items--rose 42% to GBP1.43

billion.

Total group revenue increased to GBP17 billion from GBP13.88

billion. This compares with a forecast of GBP16.75 billion taken

from FactSet based on 18 analysts' estimations.

The company said it expects operating profit to be lower than in

fiscal 2022, but it sees significant growth in sales from pricing

in its food business, as well as from some pricing and space

expansion at Primark.

"Our businesses will continue to seek to recover these higher

costs in the most appropriate way," Chief Executive George Weston

said.

Primark reported sales in line with its previous guidance of

GBP7.7 billion, while operating profit margin improved to 9.8%

compared with expectations of 9.6%. This was mainly driven by a

significant increase in customer footfall and sales densities as

markets recovered from pandemic, the company added.

"Primark has faced significant input cost inflation and sharply

moving currency exchange rates. We have decided to hold prices for

the new financial year at the levels already implemented and

planned and to stand by our customers, rather than set pricing

against these highly volatile input costs and exchange rates," the

company said.

Shares at 0822 GMT were up 62.5 pence, or 4.4%, at 1,491.5

pence.

Write to Michael Susin at michael.susin@wsj.com

(END) Dow Jones Newswires

November 08, 2022 03:38 ET (08:38 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

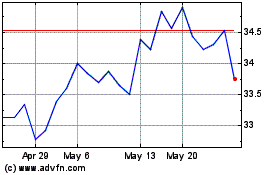

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Dec 2024 to Jan 2025

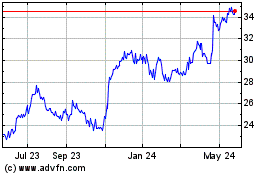

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Jan 2024 to Jan 2025