Remedent, Inc. Completes Private Placement Financing

July 02 2007 - 7:30AM

Business Wire

Remedent, Inc. (OTC BB: REMI) announced today that it has completed

its previously announced private placement financing with

institutional investors. Net proceeds to Remedent from the sale of

the shares of common stock will be approximately $6.2 million after

deducting the fees and expenses of the placement agent. The net

proceeds will be used for working capital and general corporate

purposes and setting up the United States marketing and

distribution activities for its new revolutionary veneer

technology, called GlamSmileTM. The financing consisted of the sale

of 5.6 million shares of its common stock at a per share price of

$1.25. The financing also included the issuance of warrants to

purchase an additional 4.2 million shares of common stock at an

exercise price of $1.55. The lead investor in the private placement

was Special Situations Fund in New York. Other participants

included MicroCapital, LLC., Potomac Capital Management, LLC. and

other institutional investors. The placement agent in this

financing was Roth Capital Partners, LLC. The details of this

private placement have been disclosed in the Company�s Current

Report on Form 8-K filed with the Securities and Exchange

Commission on June 27, 2007. The shares of common stock being sold

have not been registered under the Securities Act of 1933, or any

state securities laws, and will be sold in a private transaction

under Regulation D. Unless the shares are registered, they may not

be offered or sold in the United States except pursuant to an

exemption from the registration requirements of the Securities Act

and applicable state laws. Remedent is obligated to register the

shares being sold for resale on a registration statement to be

filed on or before July 20, 2007. This announcement is made

pursuant to SEC Rule 135 and shall not constitute an offer of any

of the Company�s securities by the Company or any of the

institutional investors participating in the private placement.

About Remedent Remedent, Inc., a publicly listed company trading on

the OTC BB, strives to be a world leader in the research and

development, manufacturing and marketing of oral care and cosmetic

dentistry products. Remedent products are renowned for their

technological superiority and ease-of-use. Based in Deurle,

Belgium, Remedent has successfully researched, developed and

manufactured all of its own products. These products are now

distributed in more than 35 countries worldwide. For additional

information, visit Remedent�s web site at www.remedent.com.

FORWARD-LOOKING STATEMENTS �Safe Harbor� Statement under the

Private Securities Litigation Reform Act of 1995: The statements by

Guy De Vreese, the statements regarding growth of the GlamSmileTM

product line, optimism related to the business, expanding sales and

other statements in this press release are forward-looking

statements within the meaning of the Securities Litigation Reform

Act of 1995. Such statements are based on current expectations,

estimates and projections about the Company�s business. Words such

as expects, anticipates, intends, plans, believes, sees, estimates

and variations of such words and similar expressions are intended

to identify such forward-looking statements. These statements are

not guarantees of future performance and involve certain risks and

uncertainties that are difficult to predict. Actual results could

vary materially from the description contained herein due to many

factors including continued market acceptance of the Company�s

products. In addition, actual results could vary materially based

on changes or slower growth in the oral care and cosmetic dentistry

products market; the potential inability to realize expected

benefits and synergies; domestic and international business and

economic conditions; changes in the dental industry; unexpected

difficulties in penetrating the oral care and cosmetic dentistry

products market; changes in customer demand or ordering patterns;

changes in the competitive environment including pricing pressures

or technological changes; technological advances; shortages of

manufacturing capacity; future production variables impacting

excess inventory and other risk factors listed from time to time in

the Company�s Securities and Exchange Commission filings under

�risk factors� and elsewhere. The forward-looking statements

contained in this press release speak only as of the date on which

they are made, and the Company does not undertake any obligation to

update any forward-looking statement to reflect events or

circumstances after the date of this press release.

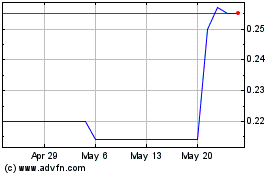

Elysee Development (PK) (USOTC:ASXSF)

Historical Stock Chart

From Jun 2024 to Jul 2024

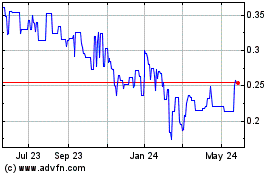

Elysee Development (PK) (USOTC:ASXSF)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Elysee Development Corp (PK) (OTCMarkets): 0 recent articles

More Remedent, Inc. News Articles