Current Report Filing (8-k)

March 24 2017 - 12:19PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 24, 2017 (March 24, 2017)

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55127

|

|

98-0550257

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification No.)

|

|

301

McCullough Drive, 4th Floor, Charlotte, North Carolina 28262

|

(Address

of principal executive offices) (Zip Code)

(Registrant’s

telephone number, including area code)

|

(Former

Name or Former Address, if Changed since Last Report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

As

used in this Current Report, all references to the terms “we”, “us”, “our”, “Blue Sphere”

or the “Company” refer to Blue Sphere Corporation and its wholly-owned subsidiaries, unless the context clearly requires

otherwise.

Unless

otherwise indicated in this Current Report, all the Company’s common stock, par value $0.001 per share (“Common Stock”),

share and per share information, including price per share information, in this Current Report gives effect to the Reverse Stock

Split (as defined below).

Item

1.01

Entry

Into a Material Definitive Agreement

As reported by the Company on our Current

Report on Form 8-K filed on December 28, 2015, on December 23, 2015, the Company completed an offering with six investors,

thereby issuing USD $3,000,000 of our two-year 11% Senior Debentures (the “Debentures”) and warrants to purchase up

to 61,544 shares of Common Stock, with 50% of such shares exercisable at a price per share of $6.50 and the other 50% of such

shares exercisable at price per share of $9.75.

On March 24, 2017, the Company

and five of the six holders of the Debentures, representing an aggregate principal balance of $2,000,000, entered into a First

Amendment to Senior Debenture (the “Debenture Amendment”, and all such amended Debentures, the “Convertible

Debentures”), thereby amending the Debentures to provide that some or all of the principal balance, and accrued but unpaid

interest thereon, is convertible into shares of Common Stock at the holders’ election, with such right to convert beginning

on the six-month anniversary of the effective date of the Debenture Amendment, September 24, 2017, and ending ten days

prior to the date the Convertible Debentures mature, December 12, 2017.

The number of shares of Common Stock

issuable upon any conversion of the Convertible Debentures shall equal the number derived by dividing the amount of the

principal amount and accrued but unpaid interest that the holder elects to convert divided by the conversion price.

The conversion price shall be (a) equal to 80% of the average reported closing price of the Common Stock on The

NASDAQ Capital Market, calculated using the five trading days immediately following the up-list to The NASDAQ Capital Market,

or (b) if the up-list has not occurred prior to the date of the conversion notice, equal to 80% of the average

reported closing price of the Common Stock on the OTCQB Venture Marketplace, calculated using the five trading days

immediately preceding the date of the conversion notice. Immediately upon issuance of shares of Common Stock pursuant to a

conversion notice, the principal amount of a holder’s Convertible Debenture shall be automatically amended to subtract

the principal amount converted. If a timely conversion notice is not received by the Company, the Convertible Debenture shall

be subject to repayment of the principal amount in full no later than the maturity date, December 22, 2017.

The foregoing descriptions of the Debentures

and the Debenture Amendment do not purport to be complete and are qualified in their entirety by reference to the full text of

the forms of Debenture and Debenture Amendment filed as Exhibits 10.1 and 10.2 to this Current Report, respectively, and are incorporated

herein by reference.

The Company is providing this report in

accordance with Rule 135c under the Securities Act of 1933, as amended (the “Securities Act”), and the notice contained

herein does not constitute an offer to sell the Company’s securities, and is not a solicitation for an offer to purchase

the Company’s securities. The securities offered have not been registered under the Securities Act, as amended, and may

not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

Item

2.03

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

Reference

is made to the disclosure set forth under Item 1.01 above, which disclosure is incorporated herein by reference.

Item

5.03

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year

As reported by the Company on our Definitive

Schedule 14C Information Statement filed with the SEC on December 9, 2016, our shareholders authorized the Company to

effect a reverse split of our Common Stock at a ratio reasonably necessary to satisfy the minimum requirements for listing on

The NASDAQ Capital Market.

On March 24, 2017 at

12:01 a.m. EST (the “Effective Time”), pursuant to filing with the Secretary of State of the State of Nevada

a Certificate of Amendment to our Articles of Incorporation (the “Amendment”), we effectuated a reverse split of

our Common Stock at a ratio of 130-to-1 (the “Reverse Stock Split”). The Amendment provides that at the Effective

Time, each 130 shares of Common Stock issued and outstanding immediately prior to the Effective Time will automatically

combine into one validly issued, fully paid and non-assessable share of Common Stock without any further action by the

Company or the holder thereof. No fractional shares of Common Stock will be issued as a result of the Reverse Stock Split.

Shareholders who otherwise would be entitled to a fractional share shall receive the next higher number of whole shares. As a

result of the Reverse Stock Split, proportionate adjustments will be made to the per share exercise price of any options,

warrants or other securities convertible or exercisable into Common Stock.

The foregoing description of the Amendment

does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which is filed

as Exhibit 10.3 to this Current Report, and is incorporated herein by reference.

Item

9.01

Financial

Statements and Exhibits.

The

following exhibits are furnished as part of this Current Report on Form 8-K:

(d)

Exhibits.

|

|

10.1

|

Form

of Senior Debenture. (1)

|

*Filed

herewith.

(1)

Incorporated by reference to our Current Report on Form 8-K filed on December 28, 2015.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Blue

Sphere Corporation

|

|

|

|

|

|

Dated: March 24, 2017

|

By:

|

/s/ Shlomi Palas

|

|

|

Name:

|

Shlomi

Palas

|

|

|

Title:

|

President

and Chief Executive Officer

|

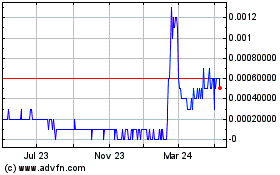

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Jan 2025 to Feb 2025

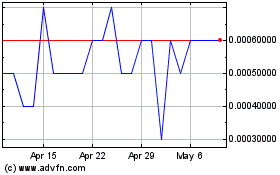

Blue Sphere (CE) (USOTC:BLSP)

Historical Stock Chart

From Feb 2024 to Feb 2025