Venezuela Uses Bonds to Pay Settlement With Mining Company -- Update

August 16 2018 - 10:33AM

Dow Jones News

By Julie Wernau and Andrew Scurria

Venezuela has made a payment to a mining company using

government bonds instead of cash, potentially the first time it has

done so since U.S. sanctions last year barred similar

transactions.

The payment on Tuesday was made as creditors scramble to move in

on the remaining assets of a country that is already in widespread

default and enmeshed in an economic crisis. Last week a U.S. court

ruled that a creditor could seize Venezuela's biggest U.S. asset,

Citgo Petroleum Corp., causing alarm among bondholders who fear

collection efforts could disadvantage them.

Gold Reserve Inc., a mining company incorporated in Canada and

headquartered in Spokane, Wash., said in a statement that it had

received Venezuelan government bonds with an estimated market value

of around $88.5 million. The payment was made as part of a

settlement agreement that calls for the Venezuelan government to

pay it around $1 billion related to a mining project in the

country. Venezuela's government debt is currently trading at

between 20 and 30 cents on the dollar.

Short on dollars and facing the sanctions imposed by the U.S.

last August, Venezuela has been constrained in efforts to raise

cash or pay down debt.

They were put in place after the asset-management arm of Goldman

Sachs Group Inc. purchased at a steep discount $2.8 billion in

Venezuelan bonds that had been held by the country's central bank.

The purchase drew criticism from opposition politicians in

Venezuela and some investors for supplying cash to President

Nicolás Maduro.

"This money belongs to the Venezuelan people," President Donald

Trump said in a statement after ratcheting up sanctions he said

would prevent Venezuela from conducting "fire sales" that liquidate

Venezuelan assets.

Venezuela's National Assembly has similarly barred such

transactions, but Mr. Maduro effectively dissolved Congress last

year and replaced it with his own government. Investors say it is

unclear whether a reinstated Congress under another government

would honor bonds Mr. Maduro's regime has put into the market to

pay down debts.

The sanctions appeared to keep an estimated $3.5 billion in

bonds still owned by Venezuela from making their way to the market

-- until the payment of bonds to Gold Reserve.

"This is the first transaction in which the Venezuelan

government paid somebody with bonds since the sanctions," said

Francisco Rodriguez, chief economist at Torino Capital, a New

York-based investment bank.

The U.S. Treasury Department clarified last month that its

sanctions aim to block U.S. entities from participating in "corrupt

and shortsighted financing schemes" involving Venezuela selling off

government assets, including bonds, for less than they are

worth.

In the company's statement, President A. Doug Belanger said Gold

Reserve was "very pleased with the receipt of bonds" and that it

looks forward to working with Venezuela on a large, undeveloped

gold-copper project.

Despite the U.S. sanctions, companies can apply for and receive

an exemption to a sanction, but such licenses aren't made

public.

"The Treasury Department will issue specific licenses allowing

collections of past debts that would otherwise be prohibited by

sanctions as long as the debt was incurred before that sanction,"

said Peter Harrell, a consultant on economic sanctions who oversaw

Iran sanctions under the Obama administration.

The bonds transferred to Gold Reserve are on a list of bonds the

U.S. government has licensed to trade, according to a person

familiar with the matter.

Officials at Global Affairs Canada said they don't comment on

specific cases. A U.S. Treasury spokesman wouldn't address the Gold

Reserve transaction but said the question of whether a creditor can

accept Venezuela bonds as payment depends on "the particular facts

and circumstances at issue."

Gold Reserve is one of several creditors that have won large

arbitration judgments against Venezuela. Defunct Canadian gold

mining company Crystallex International Corp. won a U.S. court

ruling last week authorizing its seizure of Citgo, the U.S. oil

refiner owned by Venezuela's state oil company, to satisfy a $1.4

billion award.

Venezuela had reached a settlement with Crystallex last year to

end its pursuit of Citgo, according to Canadian court documents.

Crystallex was paid at least $25 million in cash before Venezuela

lapsed on additional required payments, scuttling the agreement.

Citgo's owner, Petróleos de Venezuela SA, has said it would

challenge the potential seizure in a U.S. appeals court.

Already hobbled Venezuelan bonds fell to a two-year low

following the Citgo ruling. Investors holding defaulted Venezuela

bonds have expressed alarm that such rulings or bond payments by

Venezuela could disadvantage the country's other creditors.

Venezuela and its various state-controlled entities together

have $62 billion of unsecured bonds outstanding, with approximately

$5 billion so far in unpaid interest and principal. Analysts

estimate that the government has approximately $150 billion total

in debt outstanding to creditors around the world.

Write to Julie Wernau at Julie.Wernau@wsj.com and Andrew Scurria

at Andrew.Scurria@wsj.com

(END) Dow Jones Newswires

August 16, 2018 11:18 ET (15:18 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

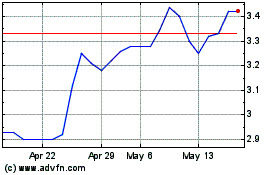

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Feb 2024 to Feb 2025