Annual Report (foreign Private Issuer) (40-f)

April 26 2019 - 3:22PM

Edgar (US Regulatory)

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

¨

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended:

December 31, 2018

Commission File Number:

001-31819

GOLD RESERVE INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

|

Alberta, Canada

(Province or other jurisdiction of incorporation or organization)

|

1040

(Primary Standard Industrial Classification Code Number)

|

N/A

(I.R.S. Employer Identification Number)

|

999 West Riverside Avenue, Suite 401, Spokane, Washington 99201 (509) 623-1500

(Address and telephone number of Registrant’s principal executive offices)

Rockne J. Timm,

999 West Riverside Avenue, Suite 401, Spokane, Washington, 99201 (509) 623-1500

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

None

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Class A common shares, no par value per share

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

x

Annual Information Form

x

Audited Annual Financial Statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Class A common shares, no par value per share: 99,395,048

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

x

Yes

¨

No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

x

Yes

¨

No

Indicate

by check mark whether the registrant is an emerging growth company as defined

in Rule 12b-2 of the Exchange Act.

¨

Emerging Growth Company.

If an

emerging growth company that prepares its financial statements in accordance

with U.S. GAAP, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Explanatory note

Gold

Reserve Inc. ("Gold Reserve", the "Company", "we",

"us" or "our") is a Canadian issuer eligible to file its

annual report pursuant to Section 13 of the U.S. Securities Exchange Act of

1934, as amended (the "Exchange Act"), on Form 40-F. We are a "foreign

private issuer" as defined in Rule 3b-4 under the Exchange Act and in Rule

405 under the U.S. Securities Act of 1933, as amended (the "Securities Act").

Our equity securities are accordingly exempt from Sections 14(a), 14(b), 14(c),

14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3.

CAUTIONARY NOTE REGARDI

NG differences in united states and

canadian reporting practices

We are

permitted, under a multi-jurisdictional disclosure system adopted by the United

States and Canada, to prepare this Annual Report in accordance with Canadian

disclosure requirements, which are different from those of the United States.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

AND INFORMATION

The

information presented or incorporated

by reference in this report contains both historical information and

"forward-looking statements" (within the meaning of Section 27A of

the Securities Act and Section 21E of the Exchange Act) or

"forward-looking information" (within the meaning of applicable Canadian

securities laws) (collectively referred to herein as "forward-looking

statements") that may state our intentions, hopes, beliefs, expectations

or predictions for the future. Such

forward-looking statements include, without limitation, statements with respect

to the collection of future payments under the Settlement Agreement and/or collection

of the Award via the courts, including the impact of applicable U.S. and

Canadian Sanctions, development plans for the Siembra Minera Project and our

intention to complete the Return of Capital Transaction (collectively, as

defined herein).

Forward-looking statements are necessarily based upon a

number of estimates and assumptions that, while considered reasonable by us at

this time, are inherently subject to significant business, economic and

competitive uncertainties and contingencies that may cause our actual financial

results, performance or achievements to be materially different from those

expressed or implied herein and many of which are outside our control.

Forward-looking statements involve risks and uncertainties,

as well as assumptions, including those set out herein, that may never

materialize, prove incorrect or materialize other than as currently

contemplated which could cause our results to differ materially from those expressed

or implied by such forward-looking statements. The words "believe,"

"anticipate," "expect," "intend,"

"estimate," "plan," "may," "could" and

other similar expressions that are predictions of or indicate future events and

future trends, which do not relate to historical matters, identify

forward-looking statements. Any such forward-looking statements are not

intended to provide any assurances as to future results.

Numerous factors could

cause actual results to differ materially from those described in the

forward-looking statements, including, without limitation:

·

continued delay or failure by the

Bolivarian Republic of Venezuela ("Venezuela") to make payments or

otherwise honor its commitments under the settlement agreement

whereby

Venezuela agreed to pay us damages pursuant to an International Centre for the

Settlement of Investment Disputes ("ICSID") judgment totaling $713

million in damages, plus pre-award interest and legal costs and expenses (the

"Award") and purchase our mining data, previously compiled in

association with our development of the Brisas Project (the "Mining

Data") for $792 million and $240 million, respectively, for a total of

approximately $1.032 billion

(as amended, the "Settlement

Agreement");

·

risk that the Company may be unable to

access

current or future amounts

deposited into a trust account for the benefit

of the Company at Banco de Desarrollo Económico y Social de Venezuela

("Bandes Bank") (the "Trust Account") which have been

blocked as a result of the US Treasury Department’s Office of Foreign Assets

Control (“OFAC”) designation of Bandes Bank as a Specially Designated National

(“SDN”) pursuant to an Executive Order (“EO”)

.

As

a result of the Bandes Bank designation, the Company recorded an impairment

loss on the current balance of the trust of approximately $21.5 million;

·

delay or failure by Venezuela to honor

its commitments associated with the formation and operation of

Empresa

Mixta Ecosocialista Siembra Minera, S.A. ("Siembra Minera") which holds

certain gold, copper, silver and other strategic mineral rights within Venezuela's

Bolivar State which includes the historical Brisas and Cristinas areas

(referred to as the "Siembra Minera Project") including

risks associated with the ability of the Company and

Venezuela to (i) successfully overcome legal or regulatory obstacles to operate

Siembra Minera

for the purpose of developing

the Siembra Minera Project, (ii) complete any additional definitive documentation

and finalize any remaining governmental approvals and (iii) obtain financing to

fund the capital costs of the

Siembra Minera

Project;

·

risks associated with the current or

future sanctions by the U.S., Canada or other jurisdictions which generally

prohibit the Company and its management or its employees from dealing with

certain Venezuelan individuals and entities or entering into certain financial

transactions (the "Sanctions") and which may negatively impact our

ability to freely receive funds from Venezuela, either from the Trust Account

or the remaining funds owed by Venezuela or our ability to do business in

Venezuela;

·

risks that U.S. and Canadian government

agencies that enforce Sanctions may not issue licenses that the Company may

need to engage in certain Venezuela-related transactions;

·

risks that any future Venezuelan

administration will void or otherwise fail to respect the agreements of the

prior administration;

·

risks associated with the collection of

the Award and concentration of our operations and assets in Venezuela which are

and will be subject to risks specific to Venezuela, including the effects of

political, economic and social developments, instability and unrest;

international response to Venezuelan domestic and international policies; Sanctions

by U.S., Canadian or other jurisdictions and potential invalidation,

confiscation, expropriation or rescission of governmental orders, permits,

agreements or property rights either by the existing or future regimes;

·

risks associated with our ability to

resume our efforts to enforce and collect the Award, including the associated

costs of such enforcement and collection effort and the timing and success of

that effort, if Venezuela fails to make payments under the Settlement Agreement,

it is terminated and further efforts related to the Settlement Agreement are

abandoned;

·

the risk that the conclusions of

management and its qualified consultants contained in the Preliminary Economic

Assessment of the Siembra Minera Gold Copper Project in accordance with Canadian

National Instrument 43-101-

Standards of Disclosure for Mineral Projects

("NI

43-101") may not be realized in the future;

·

risks associated with the distribution

of approximately $75 million in the aggregate to holders of Class A shares as a

return of capital (the “Return of Capital Transaction”) that has been approved

by our board of directors (the "Board") including risks related to

our ability to receive required approvals from our shareholders, the Court and

the TSXV and the risk that our Board may determine not to move forward with the

Return of Capital Transaction if it determines it is no longer in the best

interests of the Company and its shareholders;

·

risks associated with exploration,

delineation of adequate reserves, regulatory and permitting obstacles and other

risks associated with the development of the Siembra Minera Project;

·

risks associated with our continued

ability to service outstanding obligations as they come due and access future

additional funding, when required, for ongoing liquidity and capital resources,

pending the receipt of payments under the Settlement Agreement or collection of

the Award in the courts;

·

risks associated with our prospects in

general for the identification, exploration and development of mining projects

and other risks normally incident to the exploration, development and operation

of mining properties, including our ability to achieve revenue producing

operations in the future;

·

shareholder dilution resulting from the

future sale of additional equity, if required;

·

value realized from the disposition of

the remaining assets related to our previous mining project in Venezuela known

as the “Brisas Project”, if any;

·

abilities of and continued

participation by certain employees; and

·

impact of current or future U.S.,

Canadian and/or other jurisdiction's tax laws to which we are or may be

subject.

This list is not exhaustive of the factors that may affect

any of our forward-looking statements. See "Risk Factors" in

Management's Discussion and Analysis for the fiscal year ended December 31, 2018

included herein as Exhibit 99.3.

Investors are cautioned not to put undue reliance on

forward-looking statements,

and

investors should not infer that there has been no change in our affairs since

the date of this report that would warrant any modification of any

forward-looking statement made in this document

,

other documents periodically filed with the U.S. Securities and Exchange

Commission (the "SEC") or other securities regulators or presented on

the Company

’s

website. Forward-looking statements speak only as of the

date made. All subsequent written and oral forward-looking statements

attributable to us or persons acting on our behalf are expressly qualified in their entirety by this

notice. We disclaim any intent or obligation to update publicly or otherwise

revise any forward-looking statements or the foregoing list of assumptions or

factors, whether as a result of new information, future events or otherwise,

subject to our disclosure obligations under applicable U.S. and Canadian

securities regulations. Investors are urged to read the Company

’s

filings with U.S. and Canadian securities regulatory

agencies, which can be viewed online at www.sec.gov and

www.sedar.com

, respectively.

The terms "mineral resource," "measured

mineral resource," "indicated mineral resource" and

"inferred mineral resource" are defined in and required to be

disclosed by NI 43-101. However, these terms are not defined terms under SEC

Industry Guide 7 and normally are not permitted to be used in reports and

registration statements filed with the SEC. Investors are cautioned not to

assume that any part or all of the mineral deposits in these categories will

ever be converted into reserves. “Inferred mineral resources” have a great

amount of uncertainty as to their existence, and great uncertainty as to their

economic and legal feasibility. It cannot be assumed that all or any part of an

inferred mineral resource will ever be upgraded to a higher category. Under

Canadian rules, estimates of inferred mineral resources may not form the basis

of feasibility or pre-feasibility studies, except in rare cases, and such

estimates are not part of the SEC industry Guide 7.

CURRENCY

Unless

otherwise indicated, all references to "$", “U.S. $” or "U.S.

dollars" in this Annual Report refer to U.S. dollars and references to "Cdn$"

or "Canadian dollars" refer to Canadian dollars. The 12 month average

rate of exchange for one Canadian dollar, expressed in U.S. dollars, for each

of the last two calendar years equaled 0.7716 and 0.7705, respectively, and the

exchange rate at the end of each such period equaled 0.7329 and 0.7989, respectively

.

PrincipAl Canadian Documents

Annual

Information Form.

Our Annual

Information Form for the fiscal year ended December 31, 2018, is included

herein as Exhibit 99.1.

Audited Annual Financial Statements.

Our audited consolidated financial statements as at

December 31, 2018 and 2017, and for the fiscal years ended December 31, 2018 and

2017, including Management’s Annual Report on Internal Control over Financial

Reporting and the report of our independent registered public accounting firm

with respect thereto, are included herein as part of Exhibit 99.2.

Management’s

Discussion and Analysis.

Management’s

discussion and analysis for the fiscal year ended December 31, 2018, is

included herein as Exhibit 99.3.

DISCLOSURE CONTROLS AND PROCEDURES

An

evaluation was performed under the supervision and with the participation of our

management, including the chief executive officer and chief financial officer,

of the effectiveness of the design and operation of our disclosure controls and

procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act) as

of the end of the period covered by this Annual Report. Based on that

evaluation, management, including the chief executive officer and chief

financial officer, concluded that our disclosure controls and procedures were

effective as of December 31, 2018 to provide reasonable assurance that

information required to be disclosed by us in the reports that we file or

submit under the Exchange Act is recorded, processed, summarized and reported

within the time period specified in the SEC rules and forms.

MANAGEMENT’S ANNUAL REPORT ON INTERNAL CONTROL OVER

FINANCIAL REPORTING

Management's

Annual Report on Internal Control over Financial Reporting for the fiscal year

ended December 31, 2018, is included herein as part of Exhibit 99.2.

Attestation Report of The Registered Public Accounting Firm

The

effectiveness of our internal control over financial reporting as of December

31, 2018, has been audited by PricewaterhouseCoopers LLP, independent

registered public accounting firm

(“PwC”), as stated in their report included herein as part

of Exhibit 99.2.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

In

connection with the preparation of the Company’s unaudited interim consolidated

financial statements for the three and nine months ended September 30, 2018, an

error was identified in the income tax calculation for the three month period

ended June 30, 2018, which impacted the Company’s previously filed unaudited

interim financial statements for the three and six month periods ended June 30,

2018. Management did not recognize that income should have been allocated to a

different taxing jurisdiction which resulted in a material error in the

calculation of tax expense for the period ended June 30, 2018. In conjunction

with this matter, the Company’s management determined it had a material

weakness in the Company’s Internal Control over Financial Reporting

("ICFR") and Disclosure Controls and Procedures ("DC&P"),

and as such, its internal control over financial reporting as of September 30,

2018 was not effective. Management remediated this control deficiency by the

implementation of additional review and oversight procedures with respect to

the preparation and review of the tax amounts included in the financial

statements. As stated in Management's Annual Report on Internal Controls over

Financial Reporting, management assessed the effectiveness of the Company’s

internal control over financial reporting as of December 31, 2018. Based on

this assessment, management concluded that the Company's ICFR and DC&P were

effective as of December 31, 2018.

AUDIT COMMITTEE

The Board

has a separately-designated standing Audit Committee for the purpose of

overseeing our accounting and financial reporting processes and audits of our

annual financial statements.

As at the date of the Annual Report, the following

individuals comprise the entire membership of our Audit Committee, which has

been established in accordance with Section 3(a)(58)(A) of the Exchange Act:

Jean Charles Potvin (Chair)

James P. Geyer Michael Johnston

Mr. Potvin holds a Hon. Bachelor of Science in geology as

well as an MBA and has been a director of the Company for almost 25 years and

is also a director of Murchison Minerals Ltd. (formerly Flemish Gold Corp.) and

a director and chairman of the audit committee of Azimut Exploration Ltd. a

publicly listed mineral exploration company. Mr. Potvin also has nearly 14

years' experience as a top-ranked mining investment analyst at Burns Fry Ltd.

(now BMO Nesbitt Burns Inc.).

Mr. Potvin has been a member of the Audit

Committee since August 2003.

Mr. Geyer has

a Bachelor of Science in Mining Engineering from the Colorado School of Mines,

has 41 years of experience in underground and open pit mining and has held

engineering and operations positions with a number of companies including AMAX

and ASARCO.

Mr. Geyer was the Senior Vice President

of the Company responsible for the development of the Brisas Project and also

led the analysis of the Brisas Cristinas Project on behalf of the Company.

Mr.

Geyer is a former Director of Thompson Creek Metals Inc. where he was

previously a member of the audit committee. Mr. Geyer has been a member of the

Audit Committee since March 2015.

Mr. Johnston

co-founded Steelhead Partners LLC in late 1996 to form and manage the Steelhead

Navigator Fund. Prior thereto, as senior vice president and senior portfolio

manager at Loews Corporation, Mr. Johnston co-managed over $5 billion in

corporate bonds and also managed an equity portfolio. He began his investment

career at Prudential Insurance as a high yield and investment-grade credit

analyst. Mr. Johnston was promoted to co-portfolio manager of an $11 billion

fixed income portfolio in 1991. He graduated with honors from Texas Christian

University with a degree in finance and completed his MBA at the Johnson

Graduate School of Business at Cornell University. Mr. Johnston has been a

member of the Audit Committee since 2017.

Our Audit Committee’s Charter can be found

on our website at www.goldreserveinc.com in the Investor Relations section

under "Governance."

Independence.

The

Board has made the affirmative determination that all members of the Audit

Committee are "independent" pursuant to the criteria outlined by the

Canadian National Instrument 52-110 - Audit Committees, Rule 10A-3 of the

Exchange Act and the policies of the TSX Venture Exchange.

Audit Committee Financial Expert.

Each member of the Audit Committee is considered to

be financially literate. The Board has determined that Mr. Potvin is an

"audit committee financial expert" as such term is defined under

Item 8(b) of General Instruction B to Form 40-F. The SEC has

indicated that the designation of Mr. Potvin as an audit committee financial

expert does not make Mr. Potvin an "expert" for any purpose, impose

any duties, obligations or liabilities on Mr. Potvin that are greater than

those imposed on other members of the Audit Committee and Board who do not

carry this designation or affect the duties, obligations or liability of any

other member of the Audit Committee and Board.

CODE OF ETHICS

We have

adopted a Code of Conduct and Ethics (the "Code") that is applicable

to all our directors, officers and employees. The Code contains general

guidelines for conducting our business. The Code was amended and approved by

the Board effective March 24, 2006. No waivers to the provisions of the Code

have been granted since its inception. We intend to disclose future amendments

to, or waivers from, certain provisions of the Code on our website within five

business days following the date of such amendment or waiver. A copy of the

Code can be found on our website at www.goldreserveinc.com in the Investor

Relations section under "Governance." We believe that the Code

constitutes a "code of ethics" as such term is defined by Item 9(b)

of General Instruction B to Form 40-F.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Audit Fees.

The aggregate fees billed for each of

the last two fiscal years for professional services rendered by our independent

registered public accounting firm, PwC, for the integrated audit of our annual

financial statements, quarterly reports and services provided in respect of

other regulatory-required auditor attest functions associated with government

audit reports, registration statements, prospectuses, periodic reports and

other documents filed with securities regulatory authorities or other documents

issued in connection with securities offerings for 2018 and 2017 were $162,756

and $134,745, respectively.

Tax Fees.

The aggregate fees billed in each of the

last two fiscal years for professional services rendered by PwC for tax

compliance, consulting and return preparation services for 2018 and 2017 were $74,307

and $111,340, respectively.

Audit Related Fees.

The aggregate fees billed in

each of the last two fiscal years for professional services rendered by PwC for

audit related services for 2018 and 2017 were $41,084 and $66,038,

respectively.

All Other Fees.

The aggregate fees billed in

each of the last two fiscal years for all other professional services rendered

by PwC for 2018 and 2017 were nil and $3,455, respectively.

Audit Committee Services Pre-Approval

Policy

The Audit

Committee is responsible for the oversight of our independent registered public

accounting firm’s work and pre-approves all services provided by PwC. Audit

Services and Audit-Related Services rendered in connection with the annual

financial statements and quarterly reports are presented to and approved by the

Audit Committee typically at the beginning of each year. Audit-Related Services

other than those rendered in connection with the quarterly reports and Tax

services provided by PwC are typically approved individually during the Committee’s

periodic meetings or on an as-needed basis. The Audit Committee’s Chair is

authorized to approve such services in advance on behalf of the Committee with

such approval reported to the full Audit Committee at its next meeting. The

Audit Committee sets forth its pre-approval and/or confirmation of services

authorized by the Audit Committee Chair in the minutes of its meetings.

OFF-BALANCE SHEET ARRANGEMENTS

We are not

a party to any off-balance sheet arrangements that have, or are reasonably

likely to have, a current or future material effect on our financial performance,

financial condition, revenues and expenses, results of operations, liquidity,

capital expenditures or capital resources.

CONTRACTUAL

OBLIGATIONS

We had no

material contractual obligation payments as of December 31, 2018.

UNDERTAKING AND

CONSENT TO SERVICE OF PROCESS

We

undertake to make available, in person or by telephone, representatives to

respond to inquiries made by the SEC staff, and to furnish promptly, when

requested to do so by the SEC staff, information relating to: the securities

registered pursuant to Form 40-F; the securities in relation to which the

obligation to file an annual report on Form 40-F arises; or transactions in

said securities.

We previously filed an Appointment of Agent for Service of

Process and Undertaking on Form F-X signed by us and our agent for service of

process on May 7, 2007 with respect to the class of securities in relation to

which the obligation to file this Annual Report on Form 40-F arises.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the

Registrant certifies that it meets all of the requirements for filing on Form

40-F and has duly caused this annual report to be signed on its behalf by the undersigned,

thereto duly authorized.

GOLD RESERVE INC.

By:

/s/ Robert A.

McGuinness

Robert A. McGuinness,

its Vice President of Finance,

Chief Financial

Officer and its Principal Financial and Accounting Officer

April 26, 2019

EXHIBIT INDEX

Exhibit

Number Exhibit

99.1 Annual Information Form for the fiscal year ended

December 31, 2018

99.2 Audited Consolidated Financial Statements as at

December 31, 2018 and 2017 and for the fiscal years ended December 31, 2018 and

2017

99.3 Management’s Discussion and Analysis for the fiscal

year ended December 31, 2018

99.4 Certification of Gold

Reserve Inc. Chief Executive Officer pursuant to Section 302 of the

Sarbanes-Oxley Act of 2002

99.5 Certification of Gold

Reserve Inc. Chief Financial Officer pursuant to Section 302 of the

Sarbanes-Oxley Act of 2002

99.6 Certification of Gold

Reserve Inc. Chief Executive Officer pursuant to Section 906 of the

Sarbanes-Oxley Act of 2002

99.7 Certification of Gold

Reserve Inc. Chief Financial Officer pursuant to Section 906 of the

Sarbanes-Oxley Act of 2002

99.8 Consent of PricewaterhouseCoopers LLP, Independent Registered

Public Accounting firm

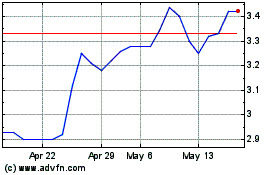

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gold Reserve (QX) (USOTC:GDRZF)

Historical Stock Chart

From Feb 2024 to Feb 2025