UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

[X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 31, 2012

[] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

GEOPULSE EXPLORATION, INC

(Name of small business in its charter)

|

|

|

|

|

|

|

Nevada

|

000-54141

|

20-2815911

|

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

|

|

6565 Americas Parkway NE

Suite 200

Albuquerque, NM 87110

|

|

(Address of principal executive offices)

|

|

|

Registrant’s telephone number, including area code:

(505

) 563-5787

|

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

[ ] Yes [ X ] No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ] (Do not check if a smaller reporting company)

|

Smaller reporting company [ X ]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of the last business day of the registrant’s most recently completed second fiscal quarter. $0.00

As of April 16, 2012, the Company had 136,180,000 shares issued and outstanding.

PART I

ITEM 1. BUSINESS

Background

Geopulse Exploration, Inc. (hereinafter “we”, “our”, or the “Company”) was incorporated on August 13, 2004 under the laws of the state of Nevada. We were formed for the purpose of engaging in the acquisition and exploration of mineral properties with a view to exploiting any mineral deposits that we discover which demonstrate economic feasibility.

We previously owned one mineral claim known as the CATH 1 Claim, located in British Columbia, Canada. Our plan of operations had been to pursue exploration activities on the CATH 1 Claim with a view to exploiting any mineral deposits that we discovered which demonstrated economic feasibility. However, we have never received any revenue from operations and had been dependent upon obtaining financing to pursue exploration activities. We were unable to obtain the necessary financing, and as of October 17, 2008, the CATH 1 Claim expired.

Current Operations

On February 22, 2011, the Director of the State of Utah School and Institutional Trust Lands Administration officially approved our applications for two metalliferous mineral leases. Lease Application 1 covers a 640 acre parcel of land located in Section 16, Township T30S, Range25E, SLB Meridian located in San Juan County, Utah. Lease Application 2 covers a 340 acre parcel of land located in Section 16, Township 29 South, Range 26, East, SLB Meridian located in San Juan County, Utah. We acquired the properties to expand our asset base and further future possible exploration work.

Metalliferous mineral properties are leased for a 10-year term by competitive filing with the State of Utah, School and Institutional Trust Lands Administration. Minimum annual rental, regardless of acreage is $500.00 or $1.00 per acre, whichever is larger. The metalliferous mineral leases carry a royalty rate of eight (8%) for fissionable metalliferous minerals and four (4%) for non-fissionable metalliferous minerals.

On August 8, 2011, the School and Institutional Trust Lands Administration of the State of Utah granted us a potash lease on a 234 acre parcel of land located in San Juan County, Utah. The lease was granted to us through a competitive bidding process in which sealed bids were submitted. The lease agreement is for a 10-year term with minimum annual rentals of $4.00 per acre for the first five years. Commencing with the 6th year, the minimum annual rental rate increases by $1.00 per acre per year. The lease also provides for an initial royalty rate of 5% of the gross value of potash produced during its term. The acquisition price we paid was $2,380, which will be applied to the minimum annual rent for the first year of the lease.

On January 31, 2012, we paid $670 to acquire an additional metalliferous mineral lease in the State of Utah. The lease covers a 640 acre parcel of land located in Section 32, Township T30S, Range24E, SLB Meridian located in San Juan County, Utah. We acquired the properties to expand our asset base and further future possible exploration work. The new lease has the same general terms as the metalliferous leases previously acquired by the Company, including 10-year term and minimum annual rental, regardless of acreage of $500.00 or $1.00 per acre, whichever is larger. The new lease carries a royalty rate of eight (8%) for fissionable metalliferous minerals and four (4%) for non-fissionable metalliferous minerals

We have not commenced the exploration stage of our business and can provide no assurance that we will discover economic mineralization on our properties, or if such minerals are discovered, that we will enter into

2

commercial production.

Plan of Operations

For the fiscal year ending January 31, 2013, our plan of operation is to seek to commence phase one of an exploration program on one or both of our mineral properties. Phase one of an exploration program is expected to consist of mapping, prospecting and geochemical sampling of the properties by a consulting geologist. Following completion of the phase one exploration program we will review the results and any recommendations provided by the consulting geologist and make a determination as to whether to proceed with a second phase of exploration. If it is determined that the results from the first phase of exploration justify a second phase, it will also be necessary to make a decision regarding the nature and extent of phase two of the exploration program and to establish a budget for the second phase.

For the fiscal year ending January 31, 2013, our plan of operation is also to seek to commence phase one of an exploration program on our potash lease. Phase one of an exploration program is expected to consist of mapping, prospecting and sampling of the property by a consulting geologist. Following completion of a phase one exploration program, we will review the results and any recommendations provided by the consulting geologist and make a determination as to whether to proceed with a second phase of exploration.

Before proceeding with commencement of a proposed phase one exploration program on one or both of our mineral leases, or on our potash lease, we intend to obtain an estimate for the cost of completion of such an exploration program. As of January 31, 2012, we had $7,004 of cash on hand. However, we believe these funds will be needed to pay basic operating costs and costs associated with preparation and filing of required periodic reports. Therefore, before proceeding with commencement of the proposed phase one exploration program, we anticipate that we will also need to obtain sufficient additional financing to cover the associated costs.

Liquidity and Capital Resources

As of January 31, 2012, the Company is in the pre-exploration stage. Our balance sheet reflects total assets of $7,004, all in the form of cash, and total current liabilities of $44,004. We currently have a deficit accumulated in the pre-exploration stage of $(167,872).

On February 22, 2011, the Company entered into an unsecured Line of Credit Agreement (the “Line of Credit”) with Rampoldi, Inc. (the “Rampoldi”) for a Line of Credit totaling $250,000. Pursuant to the terms of the Line of Credit, Rampolidi will provide the Company with cash advances as requested by the Company, in an aggregate amount up to $250,000. The cash advances will bear interest at a rate of 10% per annum beginning on the date the proceeds of each cash advance are delivered to the Registrant. The Line of Credit does not have a set maturity date, but Rampoldi has the right to request repayment of the cash advances at anytime. In the event Rampoldi requests the repayment of a cash advance, the Company has four months in which to repay the outstanding principal and interest due under such cash advance. In the event the Company is unable to fulfill any repayment request within the specified four month period, Rampoldi then has the right to elect to convert every $0.07 of outstanding debt due under the cash advance into one share of the Company’s common stock. The proceeds from the cash advances are intended to be used for operating capital of the Company. As of January 31, 2012, total amounts outstanding under the Line of Credit were $40,433, which includes a principal amount of $38,000 and accrued interest of $2,433.

On August 11, 2011, we entered into a Financing Agreement with Haycliffe, Inc., of Zurich, Switzerland. The Financing Agreement was for a term of 90 days. Under its terms, Haycliffe agreed to use its best efforts to seek to arrange a financing for us for a maximum amount of US$25 million and was entitled to a fee equal to 5% of the gross amount of the financing. The Financing Agreement provided us with a right of first

3

refusal regarding the source of the financing which gave us the right to accept or reject any proposed financing based on its source or its terms. We did not receive financing under the terms of the Haycliffe Financing Agreement, and it expired in accordance with its terms, on November 9, 2011.

Off Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements.

Reports to security holders

(1) The Company is not required to deliver an annual report to security holders and at this time does not anticipate the distribution of such a report.

(2) The Company will file reports with the SEC. The Company will be a reporting company and will comply with the requirements of the Exchange Act.

(3) The public may read and copy any materials the Company files with the SEC at the SEC's Public Reference Section, Room 1580, 100 F Street N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at

http://www.sec.gov.

ITEM 2.

PROPERTIES.

Our executive offices are located at 6565 Americas Avenue, Suite 200, Albuquerque, New Mexico.

These offices are suitable for our current needs, and we will use these offices for the foreseeable future.

On February 22, 2011, the Company acquired metalliferouse mineral lease rights to two parcels of land in Utah. One lease covers a 640 acre parcel of land located in Section 16, Township T30S, Range25E, SLB Meridian located in San Juan County, Utah, and the other lease covers a 340 acre parcel of land located in Section 16, Township 29 South, Range 26, East, SLB Meridian located in San Juan County, Utah. Each of the leases is for a 10-year term. Minimum annual rental, regardless of acreage is $500.00 or $1.00 per acre, whichever is larger. The metalliferous mineral leases carry a royalty rate of eight (8%) for fissionable metalliferous minerals and four (4%) for non-fissionable metalliferous minerals.

On August 8, 2011, we acquired a potash lease on a 234 acre parcel of land located in San Juan County, Utah. The lease was granted to us through a competitive bidding process in which sealed bids were submitted. The lease agreement is for a 10-year term with minimum annual rentals of $4.00 per acre for the first five years. Commencing with the 6th year, the minimum annual rental rate increases by $1.00 per acre per year. The lease also provides for an initial royalty rate of 5% of the gross value of potash produced during its term. The acquisition price of $2,380 was applied to the minimum annual rent for the first year of the lease.

On January 31, 2012, we paid $670 to acquire an additional metalliferouse mineral lease to an additional 640 acre parcel of land located in Section 32, Township T30S, Range24E, SLB Meridian in San Juan County, Utah. The lease is for a 10-year term. Minimum annual rental is $500.00 or $1.00 per acre, whichever is larger, and the lease carries a royalty rate of eight (8%) for fissionable metalliferous minerals and four (4%) for non-fissionable metalliferous minerals.

4

ITEM 3.

LEGAL PROCEEDINGS.

The Company is not a party to any pending legal proceedings, and no such proceedings are known to be contemplated. No director, officer or affiliate of the Company, and no owner of record or beneficial owner of more than 5.0% of the securities of the Company, or any associate of any such director, officer or security holder is a party adverse to the Company or has a material interest adverse to the Company in reference to pending litigation.

ITEM 4.

(REMOVED AND RESERVED)

PART II

ITEM 5.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS AND SMALL BUSINESS ISSUERS PURCHASES OF EQUITY SECURITIES.

Our shares are approved for trading on the OTC Bulletin Board under the symbol, GPLS.OB. Priced quotations for our stock were not entered until December 31, 2007. The following table sets forth the range of high and low bid quotations for each fiscal quarter for the last two fiscal years ended January 31, 2012. These quotations reflect inter-dealer prices without retail mark-up, markdown, or commissions and may not necessarily represent actual transactions

.

|

|

|

|

|

Bid Prices ($)

|

|

|

High

|

Low

|

|

2012 Fiscal Year

January 31, 2012

October 31, 2011

July 31, 2011

April 30, 2011

2011 Fiscal Year:

|

$0.10

$0.37

$0.10

$0.19

|

$0.02

$0.06

$0.05

$0.05

|

|

January 31, 2011

October 31, 2010

July 31, 2010

|

$0.105

$0.10

$0.0909

|

$$0.10

$0.10

$0.0909

|

|

April 30, 2010

|

$0.0318

|

$0.0318

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

On January 31, 2012, the closing bid price for our stock was $0.06.

There are currently no outstanding options or warrants to purchase, or security convertible into, our common shares. We are not publicly offering and not proposing to publicly offer any common shares.

Our outstanding common shares are held by 2 shareholders of record, one of which is CEDE & Co, which is

5

the holder of record of shares held in street name.

We have not paid cash dividends in the past, nor do we expect to pay cash dividends for the foreseeable future. We anticipate that earnings, if any, will be retained for the development of our business.

ITEM 6.

SELECTED FINANCIAL DATA.

Not applicable.

ITEM 7.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

SPECIAL NOTE OF CAUTION REGARDING FORWARD-LOOKING STATEMENTS

CERTAIN STATEMENTS IN THIS REPORT, INCLUDING STATEMENTS IN THE FOLLOWING DISCUSSION ARE WHAT ARE KNOWN AS “FORWARD-LOOKING STATEMENTS,” WHICH ARE BASICALLY STATEMENTS ABOUT THE FUTURE. FOR THAT REASON, THESE STATEMENTS INVOLVE RISK AND UNCERTAINTY SINCE NO ONE CAN ACCURATELY PREDICT THE FUTURE. WORDS SUCH AS “PLANS,” “INTENDS,” “WILL,” “HOPES,” “SEEKS,” “ANTICIPATES,” “EXPECTS,” AND THE LIKE, OFTEN IDENTIFY SUCH FORWARD-LOOKING STATEMENTS, BUT ARE NOT THE ONLY INDICATION THAT A STATEMENT IS A FORWARD-LOOKING STATEMENT. SUCH FORWARD-LOOKING STATEMENTS INCLUDE STATEMENTS CONCERNING OUR PLANS AND OBJECTIVES WITH RESPECT TO THE PRESENT AND FUTURE OPERATIONS OF THE COMPANY, AND STATEMENTS WHICH EXPRESS OR IMPLY THAT SUCH PRESENT AND FUTURE OPERATIONS WILL OR MAY PRODUCE REVENUES, INCOME OR PROFITS. NUMEROUS FACTORS AND FUTURE EVENTS COULD CAUSE THE COMPANY TO CHANGE SUCH PLANS AND OBJECTIVES, OR FAIL TO SUCCESSFULLY IMPLEMENT SUCH PLANS OR ACHIEVE SUCH OBJECTIVES, OR CAUSE SUCH PRESENT AND FUTURE OPERATIONS TO FAIL TO PRODUCE REVENUES, INCOME OR PROFITS. THEREFORE, THE READER IS ADVISED THAT THE FOLLOWING DISCUSSION SHOULD BE CONSIDERED IN LIGHT OF THE DISCUSSION OF RISKS AND OTHER FACTORS CONTAINED IN THIS REPORT ON FORM 10-K AND IN THE COMPANY’S OTHER FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. NO STATEMENTS CONTAINED IN THE FOLLOWING DISCUSSION SHOULD BE CONSTRUED AS A GUARANTEE OR ASSURANCE OF FUTURE PERFORMANCE OR FUTURE RESULTS.

Plan of Operation

Geopulse Exploration, Inc. (the “Company” or “We”) was incorporated on August 13, 2004 under the laws of the state of Nevada. We are a pre-exploration stage company and are currently seeking business opportunities.

We previously owned one mineral claim known as the CATH 1 Claim, located in British Columbia, Canada. Our plan of operations had been to pursue exploration activities on the CATH 1 Claim with a view to exploiting any mineral deposits that we discover which demonstrate economic feasibility.

From the date of our incorporation to the present, we have not received any revenues from operations and we have been dependent upon obtaining financing to pursue exploration activities. We have been unable to obtain the necessary financing. As of October 17, 2008, the CATH 1 Claim expired and because of

6

insufficient funds, we elected not to renew it.

Liquidity and Capital Resources

As of January 31, 2012, the Company is in the pre-exploration stage. As of January 31, 2012, the Company’s balance sheet reflects total assets of $7,004, all in the form of cash, and total current liabilities of $44,004. As of January 31, 2012, we have a deficit accumulated in the pre-exploration stage of $(167,872).

Our cash reserves are not sufficient to meet our financial obligations for the next twelve-month period. As a result, we will need to seek additional funding in the near future. We anticipate that additional funding will either be in the form of equity financing from the sale of our common stock or advances from our directors or shareholders, although no such arrangement has been made. At this time, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or through advances from our directors to meet our obligations over the next twelve months. We do not have any arrangements in place for any future equity financing.

Off Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements.

ITEM 7A.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not Applicable.

ITEM 8.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The following financial statements of the Company provide the information required by Article 8 of Regulation S-X.

7

|

|

GEOPULSE EXPLORATION, INC.

Financial Statements

For The Years Ended January 31, 2012 and 2011

(With Report of Independent Registered Public Accounting Firm Thereon)

|

8

GEOPULSE EXPLORATION, INC.

INDEX TO FINANCIAL STATEMENTS

|

|

|

|

|

|

Page

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

|

10

|

|

|

|

|

|

Balance Sheets

|

|

11

|

|

|

|

|

|

Statements of Operations

|

|

12

|

|

|

|

|

|

Statements of Stockholders’ Equity

|

|

13

|

|

|

|

|

|

Statements of Cash Flows

|

|

14

|

|

|

|

|

|

Notes to Financial Statements

|

|

15 - 18

|

9

To the Board of Directors and

Stockholders of Geopulse Exploration Inc.

(A Pre-Exploration Stage Company)

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have audited the accompanying balance sheets of Geopulse Exploration Inc. (a Pre-Exploration Stage Company) (The Company) as of January 31, 2012 and 2011, and the related statements of operations, stockholders’ equity, and cash flows for each of the years in the two-year period ended January 31, 2012, and for the period August 13, 2004 (date of inception) to January 31, 2012. The Company’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purposes of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Geopulse Exploration Inc. (a Pre-Exploration Stage Company) as of January 31, 2012 and 2011, and the results of its operations and its cash flows for each of the years in the two-year period ended January 31, 2012, and the period August 13 2004 (date of inception) to January 31, 2012, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company will need additional working capital to service its debt and for its planned activity, which raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are described in the notes to the financial statements. These financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/Madsen & Associates, CPA’s Inc.

Murray, Utah

April 19, 2012

10

|

|

|

|

|

|

GEOPULSE EXPLORATION INC.

|

|

(Pre-Exploration Stage Company)

|

|

BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

January 31, 2012

|

|

January 31, 2011

|

|

ASSETS

|

|

|

|

Current Assets:

|

|

|

|

|

|

Cash

|

$

|

7,004

|

$

|

4,472

|

|

|

|

|

|

|

|

Total Current Assets

|

|

7,004

|

|

4,472

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

$

|

7,004

|

$

|

4,472

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

Advances - related party

|

$

|

1,026

|

$

|

1,026

|

|

Accounts payable

|

|

2,545

|

|

3,733

|

|

Accrued interest payable

|

|

2,433

|

|

-

|

|

Note payable

|

|

38,000

|

|

-

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES

|

|

44,004

|

|

4,759

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

-

|

|

-

|

|

|

|

|

|

|

|

Stockholders’ Equity:

|

|

|

|

|

|

Common stock, $0.001 par value, 1,000,000,000 shares authorized, 136,180,000 shares issued and outstanding at January 31, 2012 and 2011, respectively

|

|

136,180

|

|

136,180

|

|

Additional paid in capital

|

|

(5,308)

|

|

(5,308)

|

|

Deficit accumulated during the Pre-Exploration Stage

|

|

(167,872)

|

|

(131,159)

|

|

TOTAL STOCKHOLDERS’ EQUITY

|

|

(37,000)

|

|

(287)

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

$

|

7,004

|

$

|

4,472

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GEOPULSE EXPLORATION INC.

|

|

(Pre-Exploration Stage Company)

|

|

STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended

|

|

For the Year Ended

|

|

From Inception (August 13, 2004) to

|

|

|

|

January 31, 2012

|

|

January 31, 2011

|

|

January 31, 2012

|

|

|

|

|

|

|

|

|

|

Revenues

|

$

|

-

|

$

|

-

|

$

|

-

|

|

|

|

|

|

|

|

|

|

Impairment loss on mineral claims

|

|

4,256

|

|

-

|

|

4,256

|

|

General and administrative

|

|

30,031

|

|

21,434

|

|

161,190

|

|

Total operating expenses

|

|

(34,287)

|

|

(21,434)

|

|

(165,446)

|

|

|

|

|

|

|

|

|

|

Other Income (Expense)

|

|

|

|

|

|

|

|

Interest Income

|

|

7

|

|

-

|

|

7

|

|

Interest Expense

|

|

(2,433)

|

|

-

|

|

(2,433)

|

|

Net loss

|

|

(36,713)

|

|

(21,434)

|

|

(167,872)

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding - basic and diluted

|

|

108,680,000

|

|

108,680,000

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted

|

$

|

(0.00)

|

$

|

(0.00)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GEOPULSE EXPLORATION INC.

|

|

(Pre-Exploration Stage Company)

|

|

STATEMENT OF STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

1,000,000,000 shares authorized

|

|

Additional Paid-In Capital

|

|

Deficit accumulated during Development Stage

|

|

|

|

|

|

Shares Issued

|

|

Par Value $.001 per share

|

|

|

|

Total

|

|

BALANCE, August 13, 2004 (inception)

|

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

|

Net loss for period ended January 31, 2005

|

|

|

|

|

|

|

|

(4,415)

|

|

(4,415)

|

|

Issuance of common stock for cash - November 2005

|

|

20,900,000

|

|

20,900

|

|

(1,900)

|

|

|

|

19,000

|

|

Issuance of common stock for cash - January 2006

|

|

5,280,000

|

|

5,280

|

|

18,720

|

|

|

|

24,000

|

|

Net loss for the year ended January 31, 2006

|

|

|

|

|

|

|

|

(3,264)

|

|

(3,264)

|

|

Net loss for the year ended January 31, 2007

|

|

|

|

|

|

|

|

(10,976)

|

|

(10,976)

|

|

Net loss for the year ended January 31, 2008

|

|

-

|

|

-

|

|

-

|

|

(45,905)

|

|

(45,905)

|

|

BALANCE, January 31, 2008

|

|

26,180,000

|

|

26,180

|

|

16,820

|

|

(64,560)

|

|

(21,560)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year ended January 31, 2009

|

|

|

|

|

|

|

|

(29,464)

|

|

(29,464)

|

|

BALANCE, January 31, 2009

|

|

26,180,000

|

|

26,180

|

|

16,820

|

|

(94,024)

|

|

(51,024)

|

|

Payment of debt by related parties - contribution to capital

|

|

|

|

|

|

67,899

|

|

|

|

67,899

|

|

Net loss for the year ended January 31, 2010

|

|

-

|

|

-

|

|

-

|

|

(15,701)

|

|

(15,701)

|

|

BALANCE, January 31, 2010

|

|

26,180,000

|

|

26,180

|

|

84,719

|

|

(109,725)

|

|

1,174

|

|

Issuance of common stock for cash; May 2010

|

|

110,000,000

|

|

110,000

|

|

(90,027)

|

|

|

|

19,973

|

|

Net loss for the year ended January 31, 2011

|

|

-

|

|

-

|

|

-

|

|

(21,434)

|

|

(21,434)

|

|

BALANCE, January 31, 2011

|

|

136,180,000

|

$

|

136,180

|

$

|

(5,308)

|

$

|

(131,159)

|

$

|

(287)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year ended January 31, 2012

|

|

-

|

|

-

|

|

-

|

|

(36,713)

|

|

(36,713)

|

|

BALANCE, January 31, 2012

|

|

136,180,000

|

$

|

136,180

|

$

|

(5,308)

|

$

|

(167,872)

|

$

|

(37,000)

|

|

|

|

|

|

|

|

|

GEOPULSE EXPLORATION INC.

|

|

(Pre-Exploration Stage Company)

|

|

STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended

|

|

For the Year Ended

|

|

From Inception (August 13, 2004) to

|

|

|

|

January 31, 2012

|

|

January 31, 2011

|

|

January 31, 2012

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

Net loss

|

$

|

(36,713)

|

$

|

(21,434)

|

$

|

(167,872)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

Impairment loss on mineral claims

|

|

4,256

|

|

|

|

4,256

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

Net change in accounts payable and accrued interest payable

|

|

1,245

|

|

3,733

|

|

4,978

|

|

Net cash (used in) provided by operating activities

|

|

(31,212)

|

|

(17,701)

|

|

(158,638)

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

Payments to acquire mineral claims

|

|

(4,256)

|

|

|

|

(4,256)

|

|

Net cash (used in) provided by operating activities

|

|

(4,256)

|

|

|

|

(4,256)

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

Proceeds from the issuance of common stock

|

|

-

|

|

19,973

|

|

62,973

|

|

Proceeds from the issuance of a note payable

|

|

38,000

|

|

-

|

|

38,000

|

|

Advances from related parties

|

|

-

|

|

1,026

|

|

68,925

|

|

Net cash provided by financing activities

|

|

38,000

|

|

20,999

|

|

169,898

|

|

|

|

|

|

|

|

-

|

|

CHANGE IN CASH

|

|

2,532

|

|

3,298

|

|

7,004

|

|

|

|

|

|

|

|

|

|

CASH AT BEGINNING OF PERIOD

|

|

4,472

|

|

1,174

|

|

-

|

|

|

|

|

|

|

|

-

|

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD

|

$

|

7,004

|

$

|

4,472

|

$

|

7,004

|

|

|

|

|

|

|

|

-

|

|

Supplemental disclosures of cash flow information:

|

|

|

|

|

|

-

|

|

Cash paid for income taxes

|

$

|

-

|

$

|

-

|

$

|

-

|

|

Cash paid for interest expense

|

$

|

-

|

$

|

-

|

$

|

-

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of non cash financing activities:

|

|

|

|

|

|

|

|

Payment of Company debt by officers and directors

|

$

|

-

|

$

|

-

|

$

|

67,899

|

|

|

|

|

|

|

|

|

GEOPULSE EXPLORATION INC.

(Pre-Exploration Stage Company)

NOTES TO FINANCIAL STATEMENTS

January 31, 2012

1.

ORGANIZATION

The Company was incorporated under the laws of the state of Nevada on August 13, 2004.

The Company was organized for the purpose of acquiring and developing mineral claims. During fiscal year 2011, the Company’s previous mining claims lapsed, and the Company shifted its business model to look for merger possibilities, and thus entered the Development Stage. Subsequent to January 31, 2011, the Company acquired two mining claims, and is now considered to be a pre-exploration stage company.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Accounting Methods

The Company recognizes income and expenses based on the accrual method of accounting.

Dividend Policy

The Company has not yet adopted a policy regarding payment of dividends.

Financial Instruments

The carrying amounts of financial instruments are considered by management to be their estimated fair values due to their short term maturities.

Income Taxes

The Company utilizes the liability method of accounting for income taxes. Under the liability method deferred tax assets and liabilities are determined based on the differences between financial reporting and the tax bases of the assets and liabilities and are measured using the enacted tax rates and laws that will be in effect, when the differences are expected to reverse. An allowance against deferred tax assets is recorded, when it is more likely than not, that such tax benefits will not be realized.

On January 31, 2012, the Company had a net operating loss carryforward of $167,872. The income tax benefit of approximately $ 57,000 has been fully offset by a valuation reserve because the use of the future tax benefit is doubtful. The net operating loss will begin to expire in 2026.

Foreign Currency Translations

Part of the transactions of the Company were completed in Canadian dollars and have been translated to US dollars as incurred, at the exchange rate in effect at the time, and therefore, no gain or loss from the translation is recognized. The reporting and functional currency is US dollars.

Mineral Property Acquisition and Exploration Costs

Mineral property acquisition costs are initially capitalized when incurred. These costs are then assessed for impairment when factors are present to indicate the carrying costs may not be recoverable. Mineral exploration costs are expensed when incurred.

Revenue Recognition

Revenue is recognized on the sale and delivery of a product or the completion of a service provided.

Advertising and Market Development

The company expenses advertising and market development costs as incurred.

Financial and Concentrations Risk

The Company does not have any concentration or related financial credit risk.

Estimates and Assumptions

Management uses estimates and assumptions in preparing financial statements in accordance with accounting principles generally accepted in the United States of America. Those estimates and assumptions affect the reported amounts of the assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were assumed in preparing these financial statements.

Basic and Diluted Net Income (Loss) Per Share

Basic net income (loss) per share amounts are computed based on the weighted average number of shares actually outstanding. Diluted net income (loss) per share amounts are computed using the weighted average number of common shares and common equivalent shares outstanding as if shares had been issued on the exercise of any common share rights. The Company has no outstanding options, warrants or other convertible instruments that could affect the calculated number of shares.

Recent Accounting Pronouncements

The Company does not expect that the adoption of any recent accounting pronouncements will have a material impact on its financial statements.

3. MINERAL CLAIMS

On February 22, 2011, the Company acquired metalliferouse mineral lease rights to two parcels of land in Utah (980 acres in total) for $1,206. The minimum annual rental, regardless of acreage, is $500 or $1 per acre, whichever is larger. The metalliferous mineral leases carry a royalty rate of eight (8%) for fissionable metalliferous minerals and four (4%) for non-fissionable metalliferous minerals.

On August 8, 2011, we acquired a potash lease on a 234 acre parcel of land located in San Juan County, Utah. The lease agreement is for a 10-year term with minimum annual rentals of $4.00 per acre for the first five years. Commencing with the 6th year, the minimum annual rental rate increases by $1.00 per acre per year. The lease also provides for an initial royalty rate of 5% of the gross value of potash produced during its term. The acquisition price of $2,380 was applied to the minimum annual rent for the first year of the lease.

On January 31, 2012, we paid $670 to acquire an additional metalliferouse mineral lease to an additional 640 acre parcel of land located in Section 32, Township T30S, Range24E, SLB Meridian in San Juan County, Utah. The lease is for a 10-year term. The minimum annual rental is $500 or $1 per acre, whichever is larger, and the lease carries a royalty rate of eight (8%) for fissionable metalliferous minerals and four (4%) for non-fissionable metalliferous minerals.

As of January 31, 2012, the Company had indicators that the carrying amounts of these mineral claims may not be recoverable. Accordingly, based on a cash flows analysis, the Company determined the mineral claims were impaired and recorded a related impairment loss of $4,256 in its statement of operations.

4. NOTE PAYABLE

On February 22, 2011, the Company entered into an unsecured Line of Credit Agreement (the “Line of Credit”) with Rampoldi, Inc. (the “Rampoldi”) for a Line of Credit totaling $250,000. Pursuant to the terms of the Line of Credit, Rampolidi will provide the Company with cash advances as requested by the Company, in an aggregate amount up to $250,000. The cash advances will bear interest at a rate of 10% per annum beginning on the date the proceeds of each cash advance are delivered to the Registrant. The Line of Credit does not have a set maturity date, but Rampoldi has the right to request repayment of the cash advances at any time. In the event Rampoldi requests the repayment of a cash advance, the Company has four months in which to repay the outstanding principal and interest due under such cash advance. In the event the Company is unable to fulfill any repayment request within the specified four month period, Rampoldi then has the right to elect to convert every $0.07 of outstanding debt due under the cash advance into one share of the Company’s common stock. The proceeds of the cash advances are intended to be used for operating capital of the Company. As of January 31, 2012, total amounts outstanding under the Line of Credit were $40,433, which includes a principal amount of $38,000 and accrued interest of $2,433.

5. COMMON STOCK

During 2005 and 2006 the Company issued 20,900,000 common shares for $19,000 and 5,280,000 common shares for $24,000.

On May 24, 2010, the Company issued 110,000,000 common shares to its CEO for cash of $19,973.

On June 7, 2010, the Company increased the number of its authorized common shares of stock to 1,000,000,000 shares.

On December 13, 2010, the Company approved an 11 for 1 forward stock split. All share references in these financial statements (unless otherwise noted) have been retroactively adjusted for this stock split.

6. SIGNIFICANT TRANSACTIONS WITH RELATED PARTIES

Previous officers and directors have paid Company debt of $67,899.

During the last quarter of 2009 there was a sale of stock by the former officers-directors to the new officers-directors.

The Chief Executive Officer of the Company has acquired 91% of the Company’s outstanding common stock, and has made advances to the Company of $1,026. These advances are non-interest bearing and payable on demand.

7. GOING CONCERN

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company does not have sufficient working capital for its planned activity, and to service its debt, which raises substantial doubt about its ability to continue as a going concern.

Continuation of the Company as a going concern is dependent upon obtaining additional working capital and the management of the Company has developed a strategy, which it believes will accomplish this objective through advances from an officer-director, and additional equity investment, which will enable the Company to continue operations for the coming year.

15

ITEM 9

.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

Not applicable.

ITEM 9A(T).

CONTROLS AND PROCEDURES.

Disclosure Controls and Procedures

The Securities and Exchange Commission defines the term “disclosure controls and procedures” to mean a company's controls and other procedures of an issuer that are designed to ensure that information required to be disclosed in the reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Securities Exchange Act of 1934 is accumulated and communicated to the issuer’s management, including its chief executive and chief financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. The Company maintains such a system of controls and procedures in an effort to ensure that all information which it is required to disclose in the reports it files under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified under the SEC's rules and forms and that information required to be disclosed is accumulated and communicated to chief executive and chief financial officers to allow timely decisions regarding disclosure.

As of the end of the period covered by this report, our sole officer carried out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures. Based on this evaluation, and the identification of the material weaknesses in internal control over financial reporting described below, our sole officer concluded that, as of January 31, 2012, the Company's disclosure controls and procedures were not effective.

Internal Control Over Financial Reporting

The management of the Company is responsible for the preparation of the financial statements and related financial information appearing in this Annual Report on Form 10-K. The financial statements and notes have been prepared in conformity with accounting principles generally accepted in the United States of America. The management of the Company also is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. A company's internal control over financial reporting is defined as a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the issuer are being made only in accordance with authorizations of management and directors of the Company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements.

Management, including the chief executive officer and chief financial officer, does not expect that the Company's disclosure controls and internal controls will prevent all error and all fraud. Because of its inherent limitations, a system of internal control over financial reporting can provide only reasonable, not absolute, assurance that the objectives of the control system are met and may not prevent or detect misstatements. Further, over time control may become inadequate because of changes in conditions or the degree of compliance with the policies or procedures may deteriorate.

Our sole officer evaluated the effectiveness of the Company's internal control over financial reporting as of January 31, 2012 based upon the framework in Internal Control –Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company's annual or interim financial statements will not be prevented or detected on a timely basis. In connection with management's assessment of our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act of 2002, we identified the following material weaknesses in our internal control over financial reporting as of January 31, 2012:

1.

The Company has not established adequate financial reporting monitoring procedures to mitigate the risk of management override, specifically because there are no employees, and only a single officer and director with management functions. Therefore there is lack of segregation of duties.

2.

There is insufficient oversight of accounting principles implementation.

3.

There are weaknesses in the financial statement closing process as evidenced by the adjustments required to make the financial statements comply with U.S. GAAP.

Because of the material weaknesses noted above, management has concluded that we did not maintain effective internal control over financial reporting as of January 31, 2012, based on Internal Control over Financial Reporting - Guidance for Smaller Public Companies issued by COSO.

REMEDIATION OF MATERIAL WEAKNESSES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

The Company does not currently have the resources to employ staff experienced in SEC disclosure and GAAP compliance. The Company intends to work with its external consultants to properly address changes in accounting principles and SEC disclosure requirements. The Company believes this approach to be the most cost effective solution available for the foreseeable future.

The Company will also increase management's review of key financial documents and records.

The Company does not currently have the resources to fund sufficient staff to ensure a complete segregation of responsibilities within the accounting function. However, Company management will increase the review of financial statements on a periodic basis. These actions, in addition to the improvements identified above, will minimize any risk of a potential material misstatement occurring.

This annual report does not include an attestation report of the Company's registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only management's report in this Transition Report on Form 10-K.

There were no changes in the Company's internal control over financial reporting that occurred during the last fiscal quarter, that has materially affected, or is reasonably likely to materially affect, the Company's internal control over financial reporting.

ITEM 9B. OTHER INFORMATION.

None.

PART III

ITEM 10.

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE.

Each of our directors serves until the next annual meeting of our shareholders or until his or her successor is elected and qualified. Each of our officers is elected by the board of directors and serves for a term of office which is at the discretion of the board of directors. The board of directors has no nominating, audit or compensation committee.

Our executive officers and directors and their respective ages and positions as of the date of filing of this report on Form 10-K are as follows:

|

|

|

|

Name

|

Age

|

Position

|

|

|

|

|

|

Massimiliano Farneti

|

41

|

President, Director, CEO, CFO and Secretary

|

|

|

|

|

|

|

|

|

Biographical Information

Massimiliano Farneti

Mr. Farneti is an Italian businessman with close to twenty years of corporate and engineering experience. He has been involved in both public and private companies throughout Europe and North America. He has a degree in Mechanical Engineering.

Family Relationships

None.

Involvement in Certain Legal Proceedings

None of our officers, directors, promoters or control persons has been involved in the past five (5) years in any of the following:

(1)

Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time;

(2)

Any conviction in a criminal proceedings or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

(3)

Being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, or any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or

(4)

Being found by a court of competent jurisdiction (in a civil action), the SEC or the U.S. Commodity Futures Trading Commission to have violated a federal or state securities laws or commodities law, and the judgment has not been reversed, suspended, or vacated.

Directorships

The Company’s sole officer and director, Massimiliano Farneti, also serves as a director of Wild Brush Energy, Inc., whose shares trade publicly under the symbol WBRE.PK. This company is not currently subject to reporting requirements under the Securities Exchange Act of 1934.

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's officers and directors, and persons who own more than ten percent of a registered class of the Company's equity securities, to file reports of ownership of Form 3 and changes in ownership on Form 4 or Form 5 with the Securities and Exchange Commission. Such officers, directors and 10% stockholders are also required by SEC rules to furnish the Company with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms received by it, the Company believes that, as of Janaury 31, 2012, and as of the date of filing of this report on Form 10K, all Section 16(a) filing requirements applicable to its officers, directors and 10% stockholders were satisfied.

Code of Ethics

We have adopted a Code of Ethics and Business Conduct for Officers, Directors and Employees that applies to all of our officers, directors and employees.

16

Audit Committee Expert

The Company does not have an Audit Committee. Because the Company does not have an Audit Committee it does not currently have a financial expert serving on an Audit Committee.

ITEM 11.

EXECUTIVE COMPENSATION

.

Summary Compensation Table

The following table sets forth information with respect to the compensation we paid to our officers and directors during the fiscal years ended January 31, 2012 and 2011:

|

|

|

|

|

|

|

|

|

|

|

|

|

Long Term Compensation

|

|

|

|

|

Annual Compensation

|

Awards

|

Payouts

|

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

(f)

|

(g)

|

(h)

|

(i)

|

|

|

|

|

|

Other

|

|

|

|

|

|

|

|

|

|

Annual

|

Restricted

|

Securities

|

|

|

|

|

|

|

|

Compen-

|

Stock

|

Underlying

|

LTIP

|

All Other

|

|

Name and Principal

|

|

Salary

|

Bonus

|

sation

|

Award(s)

|

Options /

|

Payouts

|

Compen-

|

|

Position [1]

|

Year

|

($)

|

($)

|

($)

|

($)

|

SARs (#)

|

($)

|

sation ($)

|

|

|

|

|

|

|

|

|

|

|

|

Massimiliano Farneti (1)

|

2012

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

|

2011

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

|

|

|

|

|

|

|

|

|

[1]

Mr. Farneti was appointed as an officer and director of the Company on February 1, 2010.

Future compensation of officers will be determined by the Board of Directors based upon the financial condition, financial requirements and performance of the Company, and individual performance of each officer.

Director Compensation

At this time, no compensation has been scheduled for members of the Board of Directors or officers, and no compensation has been paid for the last year. The following table provides summary information concerning compensation awarded to, earned by, or paid to any of our directors for all services rendered to the Company in all capacities for the fiscal year ended January 31, 2012.

|

|

|

|

|

|

|

|

|

Name

|

Salary/Fees Earned or Paid in Cash ($)

|

Stock Awards ($)

|

Option Awards ($)

|

Non-Equity Incentive Plan Compensation ($)

|

Changes in Pension Value and Nonqualified Deferred Compensation Earnings

|

All other Compensation

|

Total Compensation

|

|

Massimiliano Farneti (1)

|

--

|

--

|

--

|

--

|

--

|

--

|

--

|

[1]Mr. Farneti was appointed as a Director on February 1, 2010

Employment Agreements

We do not have any employment agreements with any officers or employees

.

ITEM 12.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDERS MATTERS.

The following table sets forth information regarding the beneficial ownership of our common stock as of January 31, 2012. The information in this table provides the ownership information for each person known by us to be the beneficial owner of more than 5% of our common stock; each of our directors; each of our executive officers; and our executive officers and directors as a group.

Beneficial ownership has been determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect to the shares. Unless otherwise indicated, the persons named in the table below have sole voting and investment power with respect to the number of shares indicated as beneficially owned by them. Common stock beneficially owned and percentage ownership is based on 136,180,000 shares outstanding on January 31, 2012.

|

|

|

|

Name and Address

|

Number of Shares Beneficially Owned

|

Percent of Class

|

|

Massimiliano Farneti

6565 Americas Parkway NE, Suite 200, Albuquerque, NM 87110

|

123,376,000

|

90.60%

|

|

All Officers and Directors as a Group (1 in number)

|

123,376,000

|

90.60%

|

(1) This person is an officer and director of the Company as of the date of filing of this report on Form 10-K.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

Certain Relationships and Related Transactions

On

May 25, 2010, the Company’s Board of Directors authorized the issuance of 10,000,000 shares (pre-forward stock split) of the Company’s common stock to

Massimiliano Farneti

, the sole officer and director. The shares were purchased at a price of $0.002 per share pursuant to the terms of a Common Stock Purchase Agreement.

Aside from the foregoing, there were no material transactions, or series of similar transactions, during our Company’s last fiscal year, or any currently proposed transactions, or series of similar transactions, to which our Company was or is to be a party, in which the amount involved exceeded the lesser of $120,000 or one percent of the average of the small business issuer’s total assets at year-end for the last three completed fiscal years and in which any director, executive officer or any security holder who is known to us to own of record or beneficially more than five percent of any class of our common stock, or any member of the immediate family of any of the foregoing persons, had an interest.

17

Director Independence

The NASDAQ Stock Market has instituted director independence guidelines that have been adopted by the Securities & Exchange Commission. These guidelines provide that a director is deemed “independent” only if the board of directors affirmatively determines that the director has no relationship with the company which, in the board’s opinion, would interfere with the director’s exercise of independent judgment in carrying out his or her responsibilities. Significant stock ownership will not, by itself, preclude a board finding of independence.

For NASDAQ Stock Market listed companies, the director independence rules list six types of disqualifying relationships that preclude an independence filing. The Company’s board of directors may not find independent a director who:

1.

is an employee of the company or any parent or subsidiary of the company;

2.

accepts, or who has a family member who accepts, more than $60,000 per year in payments from the company or any parent or subsidiary of the company other than (a) payments from board or committee services; (b) payments arising solely from investments in the company’s securities; (c) compensation paid to a family member who is a non-executive employee of the company’ (d) benefits under a tax qualified retirement plan or non-discretionary compensation; or (e) loans to directors and executive officers permitted under Section 13(k) of the Exchange Act;

3.

is a family member of an individual who is employed as an executive officer by the company or any parent or subsidiary of the company;

4.

is, or has a family member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which the company made, or from which the company received, payments for property or services that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, other than (a) payments arising solely from investments in the company’s securities or (b) payments under non-discretionary charitable contribution matching programs;

5.

is employed, or who has a family member who is employed, as an executive officer of another company whose compensation committee includes any executive officer of the listed company; or

6.

is, or has a family member who is, a current partner of the company’s outside auditor, or was a partner or employee of the company’s outside auditor who worked on the company’s audit.

Based upon the foregoing criteria, Mr. Farneti may not be considered to be an independent director because he is also currently an officer of the Company.

18

ITEM 14.

PRINCIPAL ACCOUNTING

FEES AND SERVICES

Audit Fees

(1)

The aggregate fees billed by Madsen & Associates, CPA’s, Inc., for audit of the Company's financial statements were $9,830 for the fiscal year ended January 31, 2012 and $5,750 for the fiscal year ended January 31, 2011.

Audit Related Fees

(2)

Madsen & Associates, CPA’s, Inc., did not bill the Company any amounts for assurance and related services that were related to its audit or review of the Company’s financial statements during the fiscal years ended January 31, 2012 and 2011.

Tax Fees

(3)

The aggregate fees billed by Madsen & Associates, CPA’s, Inc., for tax compliance, advice and planning were $0.00 for the fiscal year ended January 31, 2012 and $0.00 for the fiscal year ended January 31, 2011.

All Other Fees

(4)

Madsen & Associates, CPA’s, Inc., did not bill the Company for any products and services other than the foregoing during the fiscal years ended January 31, 2012 and 2011.

Audit Committees Pre-approval Policies and Procedures

(5)

Geopulse Exploration, Inc. does not have a separate audit committee. The current board of directors functions as the audit committee.

ITEM 15.

EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

(a)

Audited Financial Statements for fiscal year ended January 31, 2012.

(b)

Exhibits.

|

|

|

|

|

3(i)

|

Articles of Incorporation (incorporated by reference from Registration Statement on SB-2 filed with the Securities and Exchange Commission on September 22, 2006).

|

|

|

|

|

|

|

3(ii)

|

Bylaws (incorporated by reference from Registration Statement on SB-2 filed with the Securities and Exchange Commission on September 22, 2006).

|

|

|

|

|

|

|

10.1

|

Absolute Bill of Sale dated August 13, 2004 (incorporated by reference from Registration Statement on SB-2 filed with the Securities and Exchange Commission on September 22, 2006).

|

|

|

|

|

|

|

10.2

|

Shareholder Loan Agreement dated January 31, 2008, between Geopulse, Tianying Zheng and Zhiquan Cai (incorporated by reference from Current Report on Form 8-K dated January 31, 2008

|

|

|

|

|

|

|

10.3

|

Lease Application 1- Metalliferous Mineral Lease Application (incorporated by reference from Current Report on Form 8-K dated February 22, 2011)

|

|

|

|

|

|

|

10.4

|

Lease Application 2 – Metalliferous Mineral Lease Application (incorporated by reference from Current Report on Form 8-K dated February 22, 2011)

|

|

|

|

|

|

|

10.5

|

Line of Credit Agreement dated February 22, 2011, by and between Geopulse, Inc., and Rampoldi, Inc. (incorporated by reference from Current Report on Form 8-K dated February 22, 2011)

|

|

|

|

|

|

|

10.6

|

Financing Agreement dated August 11, 2011, by and between the Registrant and Haycliffe, Inc. (incorporated by reference from Current Report on Form 8-K dated August 11, 2011).

|

|

|

|

|

|

|

10.7

|

Potash Lease Agreement Number ML 52046, dated September 1, 2011, by and between the Registrant and the School and Institutional Trust Lands Administration of the State of Utah. *

|

|

|

|

|

|

|

10.8

|

Metalliferous Lease Agreement Number ML 52128, dated March 1, 2012, by and between the Registrant and the School and Institutional Trust Lands Administration of the State of Utah. *

|

|

|

|

|

|

|

31.1

|

Certifications pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.*

|

|

|

|

|

|

|

31.2

|

Certifications pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.*

|

|

|

|

|

|

|

32.1

|

Certifications pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.*

|

|

|

|

|

|

|

32.2

|

Certifications pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.*

|

|

|

|

|

|

|

101

|

SCH XBRL Schema Document.*

|

|

|

|

|

|

|

101

|

CAL XBRL Taxonomy Extension Calculation Linkbase Document. *

|

|

|

|

|

|

|

101

|

LAB XBRL Taxonomy Extension Label Linkbase Document. *

|

|

|

|

|

|

|

101

|

PRE XBRL Taxonomy Extension Presentation Linkbase Document. *

|

|

|

|

|

|

|

101

|

DEF XBRL Taxonomy Extension Definition Linkbase Document. *

|

* Filed Herewith

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

GEOPULSE EXPLORATION, INC.

By: /S/ Massimiliano Farneti

Director, Principal Executive Officer, Principal Financial Officer, and Principal Accounting Officer

Date: April 23, 2012

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated:

By: /S/ Massimiliano Farneti

Director, Principal Executive Officer, Principal Financial Officer, and Principal Accounting Officer

Date: April 23, 2012

19

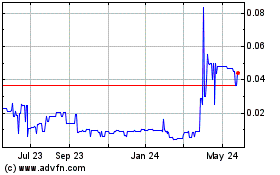

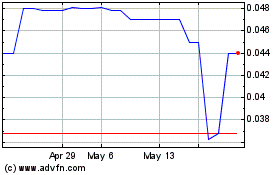

Geopulse Explorations (PK) (USOTC:GPLS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Geopulse Explorations (PK) (USOTC:GPLS)

Historical Stock Chart

From Dec 2023 to Dec 2024