Form 8-K - Current report

November 14 2023 - 1:00PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to The Securities Exchange Act

Date

of Report (Date of earliest event reported) November 13, 2023

YASHENG

GROUP

(Exact

name of registrant as specified in its charter)

| Colorado |

|

000-31899 |

|

33-0788293 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification

No.) |

| Address:

2245 Fortune Dr # C, |

|

|

| San Jose,

CA 95131 |

|

95131 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code

Tel

:(510) 860-4685

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HERB |

|

OTC

Markets |

Section

8 – Other Events

Item

8.01 Other Events

On

November 8, 2023, the Board of Directors (the “Board”) of Yasheng Group (the “Company”) authorized and approved

a share repurchase program for up to $1 million of the currently outstanding shares of the Company’s common stock over a period

of 12 months. Under the stock repurchase program, the Company intends to repurchase shares through open market purchases,

privately-negotiated transactions, block purchases or otherwise in accordance with applicable federal securities laws, including Rule

10b-18 of the Securities Exchange Act of 1934 (the “Exchange Act”). The company is currently authorized to issue corporate

bonds (minimum $1000 face value) payable at 5% interest per annum for a period of 10 years to shareholders that agree to sell their shares

to the Company in exchange therefor at $0.20 per share. Shareholders may email info@yashenggroup.com for further details regarding exchange

of shares for bonds.

The

Board also authorized the Company to enter into written trading plans under Rule 10b5-1 of the Exchange Act. Adopting a trading

plan that satisfies the conditions of Rule 10b5-1 allows a company to repurchase its shares at times when it might otherwise be prevented

from doing so due to self-imposed trading blackout periods or pursuant to insider trading laws. Under any Rule 10b5-1 trading plan, the

Company’s third-party broker, subject to Securities and Exchange Commission regulations regarding certain price, market, volume

and timing constraints, would have authority to purchase the Company’s common stock in accordance with the terms of the plan. The

Company may from time to time enter into Rule 10b5-1 trading plans to facilitate the repurchase of its common stock pursuant to its share

repurchase program.

The

Company cannot predict when or if it will repurchase any shares of common stock as such stock repurchase program will depend on a number

of factors, including constraints specified in any Rule 10b5-1 trading plans, price, general business and market conditions, and alternative

investment opportunities. Information regarding share repurchases will be available in the Company’s periodic reports

filed with the Securities and Exchange Commission as required by the applicable rules of the Exchange Act.

This

report contains forward-looking information, as that term is defined under the Exchange Act, including information regarding purchases

by the Company of its common stock pursuant to any Rule 10b5-1 trading plans. By their nature, forward-looking information and statements

are subject to risks, uncertainties, and contingencies, including changes in price and volume and the volatility of the Company’s

common stock; adverse developments affecting either or both of prices and trading of OTC securities, including securities listed on the

OTC Markets; and unexpected or otherwise unplanned or alternative requirements with respect to the capital investments of the Company.

The Company does not undertake to update any forward looking statements or information, including those contained in this report.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

YaSheng

Group |

| |

|

|

| November 13, 2023 |

By: |

/s/ Hui

Rong Zhang |

| |

|

Hui Rong Zhang |

| |

|

Vice President |

2

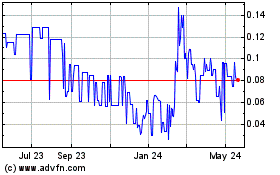

Yasheng (PK) (USOTC:HERB)

Historical Stock Chart

From Dec 2024 to Jan 2025

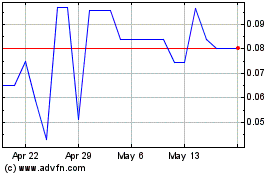

Yasheng (PK) (USOTC:HERB)

Historical Stock Chart

From Jan 2024 to Jan 2025