The FTSE 100 closed up 0.18% on Tuesday, following an initially

weak start. It's been a challenging day for European markets with

concerns over a global economic slowdown apparently driving a move

into bonds and pushing yields lower, and hitting the resources and

energy sector by pressuring oil prices, Michael Hewson, chief

market analyst at CMC Markets U.K. says in a note. "These concerns

are once again being reflected by resilience in the traditional

safe havens of utilities and health care, with Centrica [PLC] and

SSE [PLC] building on their rebounds yesterday, while airlines have

also rebounded led by [International Consolidated Airlines Group

S.A.]," Mr. Hewson says.

Companies News:

United Utilities to Sell Renewable Energy Business for Around

GBP100 Mln

United Utilities Group PLC said Tuesday that it has agreed to

sell its non-appointed renewable energy business to SDCL Energy

Efficiency Income Trust PLC for an enterprise value of around 100

million pounds ($118.9 million).

---

Balfour Beatty to Sell Indiana University Asset for $150 Mln

Balfour Beatty PLC said Tuesday that it is selling its 67%-owned

on-campus student accommodation of the Purdue University in West

Lafayette, Indiana, for a total of $150 million.

---

Plus500 Set to Surpass 2022 Market Views After Strong 1H

Plus500 Ltd. said Tuesday that it expects to post revenue and

earnings before interest, taxes, depreciation and amortization for

2022 as a whole ahead of market expectations after closing a strong

first-half performance.

---

Totally FY 2022 Pretax Profit Rose on Higher Demand; Raises

Dividend

Totally PLC said on Tuesday that performance for fiscal 2022 was

above both the board and market expectations driven by an increased

demand due to the impact of the pandemic on waiting lists.

---

Grafton Backs 2022 View as 1H Revenue Grew 12%

Grafton Group PLC said Tuesday that its full-year expectations

are unchanged as its first-half performance was in line with

plans.

---

Wincanton 1Q Revenue Rose, Supporting FY Market Views

Wincanton PLC said Tuesday that revenue for the first quarter of

fiscal 2023 rose despite a challenging macroeconomic environment

and it is on track to deliver full-year results in line with market

views.

---

Marshalls Posts 1H Revenue Rise, Expects Full Year in Line With

Market Views

Marshalls PLC said Tuesday that revenue for the first half of

the year rose and that it expects its full-year performance to be

in line with market expectations.

---

Dewhurst Group Appoints John Bailey as CEO

Dewhurst Group PLC said Tuesday that it has appointed John

Bailey as chief executive officer, effective Oct. 1.

---

System1 Group to Launch Share Buyback Program for Up to GBP1.5

Mln

System1 Group PLC said Tuesday that it intends to launch a share

buyback program for up to 1.5 million pounds ($1.8 million).

---

Anglo Pacific Group to Buy Royalties Portfolio for $185 Mln

Anglo Pacific Group PLC said Tuesday it has agreed to buy a

royalties portfolio from South32 Royalty Investments Pty. Ltd. for

$185 million.

---

Petropavlovsk to File for Administration, Halt Trading on

LSE

Petropavlovsk PLC said Tuesday that its board has requested to

temporarily suspend its shares from trading on the London Stock

Exchange after filing for administration due to its financial

situation.

---

Foresight Group FY 2022 Pretax Profit Rose, Raises Dividend

Foresight Group Holdings Ltd. said on Tuesday that pretax profit

for its first full year as a public company rose as revenue grew

across all its divisions, and declared an increased dividend

payout.

---

Bens Creek Appoints Murat Erden as CFO

Bens Creek Group PLC said Tuesday that it has appointed Murat

Erden as chief financial officer, effective July 12.

---

Kistos Makes GBP1 Bln Bid for Serica to Form New North Sea

Producer

Kistos PLC on Tuesday outlined a cash-and-equity takeover

proposal for Serica Energy PLC which values the U.K. gas producer

at 1.04 billion pounds ($1.24 billion) and would grant Serica

shareholders a 50% stake in the combined business.

---

System1 Group Reports 1Q Revenue Fall; Lower FY 2022 Pretax

Profit

System1 Group PLC said Tuesday that revenue for the first

quarter of fiscal 2023 fell due to inflationary pressures, among

other issues, as it reported a lower pretax profit for fiscal 2022

after booking higher costs.

---

Restaurant Group Buys Barburrito for GBP7 Mln

Restaurant Group PLC said Tuesday that it bought Mexican-style

restaurant chain Barburrito Group Ltd. for 7 million pounds ($8.3

million), and that it repaid a further GBP44 million of its term

loan in June.

---

Creightons Shares Fall on Lower FY 2022 Pretax Profit,

Revenue

Shares in Creightons PLC fell Tuesday after the company reported

a fall in pretax profit and revenue for fiscal 2022 owing to

inflationary and logistic challenges.

---

Sanderson Design Year-To-Date Performance in Line; Sees Meeting

FY Profit Expectations

Sanderson Design Group PLC said Tuesday that performance in the

year to date has been broadly in line with the prior year and that

profit remains on track to meet the board's full-year

expectations.

---

Knights Group Shares Rise as it Meets FY 2022 Guidance

Shares in Knights Group Holdings PLC rose Tuesday after the

company met its guidance for fiscal 2022 and said it has had a

strong start to the current financial year.

---

Pure Gold Completes Debt Refinancing

Pure Gold Mining Inc. said Tuesday that it has renegotiated debt

obligations with its lending partner, and has started to consider

selling the company or its gold mine in Ontario.

---

Softcat Appoints Graham Charlton as Next CEO

Softcat PLC said Tuesday that it has appointed Graham Charlton

as its next chief executive, effective Aug. 1, 2023.

---

TinyBuild Says 1H Performance Topped Views; Expects FY in Line

With Views

TinyBuild Inc. said Tuesday that performance for the first half

of 2022 was slightly above expectations, driven by strength in its

catalog titles and new game launches.

---

Sosandar 1Q Revenue Up; FY 2022 Pretax Loss Narrowed on Higher

Revenue

Sosandar PLC said Tuesday that revenue rose for the first

quarter of fiscal 2023 and it reported a narrowed pretax loss for

fiscal 2022 as revenue increased.

---

Synectics Swung to 1H Pretax Profit, Sees Further Growth for

2H

Synectics PLC said Tuesday that it swung to pretax profit in the

first half of fiscal 2022, and the progress seen in the period was

driven by its core systems division and strong gross margins.

---

Rambler Metals Says Ming Mine Achieved Record Production in

2Q

Rambler Metals & Mining PLC said Tuesday that its Ming mine

in Canada achieved record copper production in June and in the

second quarter.

---

Central Asia Metals Says It Is on Track to Meet 2022 Production

Guidance

Central Asia Metals PLC said Tuesday that it is on track to

achieve full-year production guidance, with copper output toward

the top end of the range.

---

Foresight Group to Buy Infrastructure Capital for Up to A$140

Mln

Foresight Group Holdings Ltd. said Tuesday that it has agreed to

acquire Infrastructure Capital Holdings Pty for up to 140 million

Australian dollars ($94.3 million).

---

AdEpt Technology FY 2022 Pretax Loss Widened, Resumes

Dividend

AdEpt Technology Group PLC said Tuesday that pretax loss for

fiscal 2022 widened on higher costs, and that it is reinstating its

dividend payout.

Market Talk:

Land Securities Makes Progress, But Slowdown Looms

0916 GMT - Land Securities has made good progress in starting to

implement its chief executive's new strategy, but faces hurdles

from a worsening economy, RBC Capital Markets says. "We expect a

weaker macro-economic environment to negatively affect Landsec,

given a relatively high level of variable rents in its

retail/leisure businesses and exposure to more economically

sensitive London office markets," RBC analyst Julian

Livingston-Booth says in a note. "We downgrade our rating for

Landsec's shares from outperform to sector-perform." RBC also cuts

its price target on the shares to 675 pence from 950p. The stock

drops 3.6% to 651p. (philip.waller@wsj.com)

British Land Faces a Tougher Economic Outlook

0858 GMT - British Land's outlook merits investor caution, RBC

Capital Markets says, downgrading the property firm to underperform

from sector-perform and its price target to 375 pence from 475p.

"Our more cautious view of London office and U.K. retail-property

markets negatively impacts our forecasts for British Land," RBC

analyst Julian Livingston-Booth says in a note. "Furthermore, we

believe a more negative macro scenario appears slightly at odds

with management's view of its markets, increasing the potential

negative impact to British Land's returns." Shares fall 4% to 444p.

(philip.waller@wsj.com)

Contact: London NewsPlus; paul.larkins@wsj.com

(END) Dow Jones Newswires

July 12, 2022 12:29 ET (16:29 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

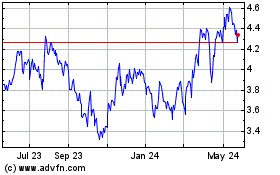

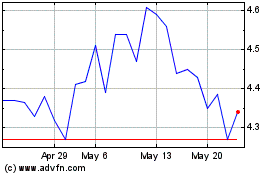

International Consolidat... (PK) (USOTC:ICAGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

International Consolidat... (PK) (USOTC:ICAGY)

Historical Stock Chart

From Dec 2023 to Dec 2024