false

2023

FY

0001190370

0001190370

2022-11-01

2023-10-31

0001190370

2023-04-30

0001190370

2024-02-13

0001190370

2023-10-31

0001190370

2022-10-31

0001190370

2021-11-01

2022-10-31

0001190370

us-gaap:CommonStockMember

2021-10-31

0001190370

ivdn:CommonStockToBeIssuedMember

2021-10-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2021-10-31

0001190370

us-gaap:RetainedEarningsMember

2021-10-31

0001190370

2021-10-31

0001190370

us-gaap:CommonStockMember

2022-10-31

0001190370

ivdn:CommonStockToBeIssuedMember

2022-10-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2022-10-31

0001190370

us-gaap:RetainedEarningsMember

2022-10-31

0001190370

us-gaap:CommonStockMember

2021-11-01

2022-10-31

0001190370

ivdn:CommonStockToBeIssuedMember

2021-11-01

2022-10-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2021-11-01

2022-10-31

0001190370

us-gaap:RetainedEarningsMember

2021-11-01

2022-10-31

0001190370

us-gaap:CommonStockMember

2022-11-01

2023-10-31

0001190370

ivdn:CommonStockToBeIssuedMember

2022-11-01

2023-10-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2022-11-01

2023-10-31

0001190370

us-gaap:RetainedEarningsMember

2022-11-01

2023-10-31

0001190370

us-gaap:CommonStockMember

2023-10-31

0001190370

ivdn:CommonStockToBeIssuedMember

2023-10-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2023-10-31

0001190370

us-gaap:RetainedEarningsMember

2023-10-31

0001190370

srt:MinimumMember

2023-10-31

0001190370

srt:MaximumMember

2023-10-31

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2015-07-11

2015-07-12

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2022-11-01

2023-10-31

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2017-11-01

2018-10-31

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2018-11-01

2019-10-31

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2023-02-01

2023-02-28

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2023-08-01

2023-08-31

0001190370

ivdn:SeparatePieceOfEquipmentsMember

2021-11-01

2022-10-31

0001190370

ivdn:SeparatePieceOfEquipmentsMember

2022-11-01

2023-10-31

0001190370

us-gaap:EquipmentMember

2023-10-31

0001190370

us-gaap:EquipmentMember

2022-10-31

0001190370

us-gaap:ContainersMember

2023-10-31

0001190370

us-gaap:ContainersMember

2022-10-31

0001190370

us-gaap:AutomobilesMember

2023-10-31

0001190370

us-gaap:AutomobilesMember

2022-10-31

0001190370

ivdn:USSmallBusinessAdministrationMember

ivdn:NotesPayableMember

2005-07-31

0001190370

ivdn:USSmallBusinessAdministrationMember

ivdn:NotesPayableMember

2006-01-31

0001190370

ivdn:USSmallBusinessAdministrationMember

ivdn:NotesPayableMember

2022-11-01

2023-10-31

0001190370

ivdn:RiccelliPropertiesMember

2017-10-31

0001190370

ivdn:USSmallBusinessAdministrationMember

2023-10-31

0001190370

ivdn:USSmallBusinessAdministrationMember

2022-10-31

0001190370

ivdn:RobertRiccelliMember

ivdn:LoanAgreementMember

2012-02-29

0001190370

ivdn:RobertRiccelliMember

ivdn:LoanAgreementMember

2012-02-01

2012-02-29

0001190370

ivdn:CorinthianDevelopmentMember

ivdn:LoanAgreementMember

2013-01-31

0001190370

ivdn:CorinthianDevelopmentMember

ivdn:LoanAgreementMember

2013-01-01

2013-01-31

0001190370

ivdn:RiccelliPropertiesMember

ivdn:LoanAgreementMember

2017-08-31

0001190370

ivdn:RiccelliPropertiesMember

ivdn:LoanAgreementMember

2017-08-01

2017-08-31

0001190370

ivdn:JosephRiccelliSrMember

ivdn:LoanAgreementMember

2019-12-31

0001190370

ivdn:JosephRiccelliSrMember

ivdn:LoanAgreementMember

2019-12-01

2019-12-31

0001190370

ivdn:LawrenceFraserMember

ivdn:LoanAgreementMember

2020-12-31

0001190370

ivdn:LawrenceFraserMember

ivdn:LoanAgreementMember

2020-12-02

2020-12-31

0001190370

ivdn:RobertRiccelliMember

2023-10-31

0001190370

ivdn:RobertRiccelliMember

2022-10-31

0001190370

ivdn:CorinthianDevelopmentMember

2023-10-31

0001190370

ivdn:CorinthianDevelopmentMember

2022-10-31

0001190370

ivdn:RiccelliPropertiesMember

2023-10-31

0001190370

ivdn:RiccelliPropertiesMember

2022-10-31

0001190370

ivdn:JosephRiccelliSrMember

2023-10-31

0001190370

ivdn:JosephRiccelliSrMember

2022-10-31

0001190370

ivdn:LawrenceFraserMember

2023-10-31

0001190370

ivdn:LawrenceFraserMember

2022-10-31

0001190370

ivdn:ExclusiveLicensingAndManufacturingAgreementMember

ivdn:KetutJayaMember

2022-11-01

2023-10-31

0001190370

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

ivdn:RevenueMember

2022-11-01

2023-10-31

0001190370

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

ivdn:RevenueMember

2021-11-01

2022-10-31

0001190370

ivdn:ImmediateFamilyMemberOfManagementOrPrincipalOwner1Member

2022-11-01

2023-10-31

0001190370

ivdn:ApparelMember

2022-11-01

2023-10-31

0001190370

ivdn:ApparelMember

2021-11-01

2022-10-31

0001190370

ivdn:HousewrapMember

2022-11-01

2023-10-31

0001190370

ivdn:HousewrapMember

2021-11-01

2022-10-31

0001190370

ivdn:SixteenInvestorsMember

2022-11-01

2023-10-31

0001190370

ivdn:OneInvestorsMember

2023-10-31

0001190370

ivdn:OneInvestorsMember

2022-11-01

2023-10-31

0001190370

ivdn:TwoInvestorsMember

2022-11-01

2023-10-31

0001190370

ivdn:TwoInvestorsMember

srt:MinimumMember

2023-10-31

0001190370

ivdn:TwoInvestorsMember

srt:MaximumMember

2023-10-31

0001190370

ivdn:SevenInvestorsMember

2021-11-01

2022-10-31

0001190370

ivdn:EightIndividualsMember

2021-11-01

2022-10-31

0001190370

ivdn:EightIndividualsMember

srt:MinimumMember

2022-10-31

0001190370

ivdn:EightIndividualsMember

srt:MaximumMember

2022-10-31

0001190370

2022-06-28

2022-06-29

0001190370

us-gaap:SubsequentEventMember

2023-12-31

0001190370

us-gaap:SubsequentEventMember

2023-12-01

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ |

Annual report under section 13 or 15(d) of the Securities Act of 1934.

For the fiscal year ended October 31, 2023 |

| |

|

| ☐ |

Transition report under section 13 or 15(d) of the Securities Act of 1934.

For the Transition period from _______ to ________. |

Commission file number: 000-51791

Innovative Designs, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

03-0465528 |

| (State or other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification Number) |

| |

|

|

| 124 Cherry Street |

|

15223 |

Pittsburgh, Pennsylvania

(Address of Principal Executive Offices) |

|

(Zip Code) |

(412) 799-0350

(Registrant’s telephone number including area

code)

Securities to be registered pursuant to Section 12(b)

of the Exchange Act:

________________

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| |

|

|

|

|

| |

|

|

|

|

________________

Securities registered or to be registered pursuant

to Section 12(g) of the Exchange Act:

(Title of Class)

Common Stock, $.0001 par value per share

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes

☒ No

Indicate by check mark if the registrant is not required

to file reports pursuant to section 13 or Section 15 (d) of the Act.

☐ Yes

☒ No

Check whether the issuer (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the past 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x☐ No

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to

submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent

filers to Item 405 of Regulation S-K (sec. 229.405) is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ☐

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (Check One)

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☒ |

Emerging reporting Company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

No

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐

No ☒

The issuer’s revenues for its most recent fiscal

year were $ 347,763.

The aggregate market value of the voting and non-voting

stock held by non-affiliates of the registrant computed by reference to the price at which the common equity was sold, or the average

bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal

quarter was $ 6,706,230. This calculation does not reflect a determination that certain persons are affiliates of the registrant for any

other purposes.

The number of shares of the registrant’s common

stock outstanding on February 13, 2024, was 37,924,003.

Transitional Small Business Disclosure Format: Yes

☐ No ☒

| ITEM 1. |

DESCRIPTION OF BUSINESS. |

The Company was incorporated in the State of Delaware

on June 25, 2002. We operate in two separate business segments: a house wrap for the building construction industry and cold weather clothing.

Both of our segment lines use products made from Insultex, which is a low-density polyethylene semi-crystalline, closed cell foam in which

the cells are totally evacuated. with buoyancy, scent block, and thermal resistant properties. We have a license agreement directly with

the owner of the Insultex technology. In December 2015, we took delivery of equipment capable of producing Insultex. Given the time and

cost of bringing the equipment into production mode and our current financial condition until we are able to begin manufacturing Insultex,

we will continue to operate under the license agreement for the manufacture of Insultex used in our products.

Other companies are free to purchase Insultex from

us assuming that it is a company within the distribution jurisdiction that we have, which is worldwide with the exception of Korea and

Japan. Other than Korea and Japan, we are the sole worldwide supplier/distributor of the Insultex material.

We offer the following products containing Insultex:

| |

● |

House Wrap: Our house wrap product is designed for the home building construction industry. This product, made from Insultex provides barrier protection plus moisture vapor transmission and approximately R-3 and R-6 value insulation. We no longer manufacture the R-3 product line and are only selling it from our inventory. House Wrap is a multi-ply weatherization membrane that provides a protective layer under a building’s outer covering that resists water and air infiltration, preventing mold and mildew buildup that could cause structural rotting. What differentiates Insultex from its competition is the fact that it offers an R-Value, the term used to measure thermal resistance, and is most commonly used when referring to the insulating qualities of a building structure, thus increasing energy efficiency. We are currently working on developing a House Wrap product line for the commercial building construction industry. |

| |

|

|

| |

● |

In December 2016, we temporarily suspended any advertising of our House Wrap product line. We took this action as a result of a lawsuit brought by the Federal Trade Commission (‘FTC”). On September 24, 2020, a judgment was entered in favor of the Company against the FTC as to all claims by the FTC. The judgment was upheld on appeal by the FTC on July 22, 2021. In March of 2021, we resumed advertising for our House Wrap products. We also sell a tape that is designed to be used with the House Wrap. |

| |

|

|

| |

● |

Floating Swimwear: Product under our product name “Swimeez”. Our swimwear is designed to be a swim aid. The interior lining of our swimwear product is made from INSULTEX, which enhances floatability. This product was discontinued during 2010 and we are only selling from our existing inventory. |

| |

|

|

| |

● |

Hunting Apparel Line: Our hunting apparel provides almost total block from odors provided by the INSULTEX material. This product was discontinued during 2010 and we are only selling from our existing inventory. |

| |

|

|

| |

● |

Arctic Armor Line: The Arctic Armor line, introduced in April of 2006, consists of a jacket, bib and gloves. The suit contains 3 layers of INSULTEX for uncompromised warmth and provides the user with guaranteed buoyancy. The gloves contain a single layer of INSULTEX and are windproof, waterproof and good to sub-zero temperatures as are the jacket and bibs. We are currently only selling from our existing inventory. |

| |

|

|

| |

● |

Insultex Material: We sell Insultex material in bulk to non-competing customers. |

We also offer a product that helps restore the waterproof

character of the outer side of our Arctic Armor clothing. In addition, we offer cold weather headgear and base insulation clothing product.

We no longer manufacture our apparel products containing

Insultex. We only sell from our existing inventory. Our Inultex House Wrap product is manufactured in the United States through third-party

manufacturers.

For financial information regarding each segment,

please see Note 10 of the Notes to Financial Statements appearing elsewhere in this Report.

The Insultex License and Manufacturing Agreement

Under the terms of the agreement between us and the

Ketut Group, Ketut Group agrees to promptly deliver to Innovative Designs, Inc. within twenty-eight (28) days of receiving an order, all

Insultex ordered by us. Under the terms of the agreement, we are required to pay a fixed amount per meter of Insultex. This fixed amount

will not change under the agreement for a period of ten (10) years after the date of the agreement was signed, which was April 1, 2006.

The agreement provides that after the ten (10) year period, the price of the Insultex shall be adjusted for a subsequent ten (10) year

term, no more than twelve percent (12%) for the subsequent ten (10) year period. We order Insultex from time to time as needed and are

not required to purchase any minimum amount of Insultex during the term of the agreement, and we are not required to make any minimum

annual payment. However, should we place an order; any quantity ordered must be a minimum of 100,000 yards of Insultex. We are not required

to pay any part of any sublicense fee that we receive from third party sub-licensees, and we are not required to pay any fees to the Ketut

Group. This agreement will be in full legal force and effect for an initial term of ten (10) years from the date of its execution. We

have the option to renew this agreement for up to three (3) successive terms of ten (10) years each by giving notice of our intention

to so renew not less than ninety (90) days prior to the expiration of the then-current term. The Company has exercised the first ten-year

renewal option. We purchased the equipment capable of producing Insultex from the Ketut Group.

COLD WEATHER CLOTHING PRODUCTS

Arctic Armor Line

Our Arctic Armor line products are intended for use

by the following consumer groups that are in the Company’s target market for these products: We are currently only selling these

products form our existing inventory.

| |

● |

Ice fisherman |

| |

|

|

| |

● |

Snowmobilers |

| |

|

|

| |

● |

Utility workers |

| |

|

|

| |

● |

Oil/gas pipeline workers |

| |

|

|

| |

● |

Railroad workers |

| |

|

|

| |

● |

Construction workers |

| |

|

|

| |

● |

Ski resort workers; and |

| |

|

|

| |

● |

Police and First Responders. |

Website and Retailers

We sell both wholesale and retail products on our

web site. Our web site, located at www.idigear.com, contains information on our products, technical information on Insultex insulation,

e-commerce capabilities with “shopping cart”, wholesaler information and order forms, company contact information, and links

to retailers that carry our products. We have obtained the services of BA Web Productions who assists us in designing and continually

developing our website. Our web site features a “wholesaler only” area, allowing our wholesalers access to information, ordering,

and reordering. Our products are offered and sold by retailers, distributors and through our web site in all states and Canada. Except

for products sold through our web site, others who purchase our products do so at wholesale prices which they plan to sell at their retail

prices or use within their industry.

Sales

We sell our products online, to distributors and through

independent sales agents and agencies. Once we have made contact with a potential sales agency or solo agent, we evaluate their existing

accounts, the capacity and potential for them to effectively push our products. We also look at their current product lines through the

sales channel. Our primary market area is the outdoor industry which includes all activity done in cold weather. These activities include

recreational such as hunting, ice fishing, snowmobiling, and industries such as oil and gas, utilities and construction. Once we agree

to bring on an independent sales agent or agency, we enter into a standard agreement.

A typical sales representative agreement will have

a term of one year with the right of either party to terminate upon thirty days written notice. We do not provide any free samples of

our products and all sales expenses are the sole obligation of the sales agent.

Certain retailers buy directly from us. We have no

verbal or written agreements with them. These retailers purchase our products strictly on a purchase order basis. During our last fiscal

year, we sold our products to such retailers as Canadian Tire Corporation Limited. Some of our distributors during the last fiscal year

were Pro Fishing Supplies and Fleece Corner. We distribute our products to the following:

Swimeez Products

We distribute our Swimeez products through our web

site.

Hunting Apparel Line

We distribute our hunting apparel through our web

site.

Arctic Armor Line

We distribute the Arctic Armor Line through our web

site, to retailers and to distributors across the United States and Canada. These products are also marketed to utility companies, oil/gas

pipeline workers, railroad workers, police and first responders, and to construction workers.

HOUSE WRAP

House Wrap

In early January 2008, we announced that we had completed

our research and development effort on a new use for Insultex as a house wrap for the home building construction industry. This house

wrap provides barrier protection plus moisture vapor transmission and the feature of approximately R-3 and R-6 value insulation. The Insultex

House Wrap was designed to specifically add enhanced insulating characteristics. In addition, the House Wrap is priced competitively with

existing house wraps that do not provide any insulation. The development efforts were conducted by our own personnel and an outside consultant.

In December 2016, we temporarily suspended any advertising for our House Wrap product line as we were in litigation with the Federal Trade

Commission (“FTC”). The litigation has concluded as to the matters set forth in the FTC complaint and in March 2021, we resumed

advertising for our House Wrap products.

Insultex House Wrap

During our last fiscal year, the following customers

each accounted for more than ten percent of our total sales of our House Wrap product, A-Team Building Supplies, LLC (30.9%), NorthStar

Systembuilt (19.1%) and Compound Construction (10.2%).

Competition

Many companies offer a type of house wrap, some with

insulating properties. These companies have large operations and are well financed. Some of the larger companies are DuPont, and Kimberly

Clark. The Company expects to face intense competition with others who have much greater resources in the building construction supply

industry.

Our marketing program consists of the following:

MARKETING COMPONENT

Website Development and Internet Marketing

We contract with marketing consultants to:

(a) increase visitation to our website.

(b) link with other established websites.

(c) issue press releases to on-line publications.

(d) conduct banner advertising.

(e) develop arrangements with online retailers

that purchase our products on a wholesale basis.

Sales Representatives

Our Vice President of sales and marketing works to:

(a) sell our merchandise to retail chain stores.

(b) initiate relationships with local and national recreational

organizations; and

(c) provide support to our distributor representatives

Contract with Manufacturer

We utilize the services of sales agencies to represent

our products in the United States and Canada.

Design and Develop

We presently use our own staff for services related

to literature, displays, develop brochures, point-of-sale displays, mailers, media materials, and literature and sales tools for our sales

representatives and manufacturer representatives. At such time as we have sufficient funding, we intend to contract out some of these

services. We no longer manufacture the R-3 House Wrap.

Establish Wholesale

We are and continue to develop relationships or distribution

relationships with retail points for our products to retail chain outlets and mass merchandisers to sell our products. We currently have

five domestic distributors and one international. Each distributor has a certain territory. Our domestic distributors collectively cover

the following jurisdictions: Texas, Oklahoma, Louisiana, North and South Dakota, Minnesota, Iowa, Michigan, Ohio, Pennsylvania, New York,

West Virginia, Maryland and Virginia. Our international distributor territory covers the UK, EU the Commonwealth countries except for

Canada and Africa.

We ship wholesale product orders by United Parcel

Service or trucking companies. Retail orders from our website are shipped United Parcel Ground Service or Federal Express overnight. The

costs of shipping our finished goods are paid by our customers. We have not instituted any formal arrangements or agreements with United

Parcel Service, Federal Express or trucking companies, and we do not intend to do so.

Insultex is used in all our Arctic Armor finished

goods, except for our headwear.

Any apparel inventory we maintain is stored at our

warehousing facility. Our warehouse facility has the capacity to hold 250,000 units of finished products in inventory. Our House Wrap

inventory is stored in our facility and in the facility that manufactures it.

In 2004, we were granted a trademark for our name

“idigear” with the United States Patent and Trademark Office.

In 2007, we were granted the mark “Insultex”

by the United States Patent and Trademark Office.

In 2011, we were granted a trademark for “Insultex

House Wrap” by the United States Patent and Trademark Office.

The Company has rights under a U.S Patent titled “Composite

Fabric Material and Apparel Made Therefrom” which issued April 30, 2013.

The Company has rights under a U.S. Paten titled “Composite

Materials” which issued February 21, 2017, published on September 5, 2013.

The Company caused to have filed a utility patent

application on December 18, 2009, titled “Composite House Wrap” which claimed priority to provisional patent application titled

“Composite House Wrap” on December 18, 2008. A patent application was published on June 24, 2010. Although no patent issued

from this original disclosure, this publication prevents third parties from patenting concepts obvious over these original teaching of

the Company.

The Company caused to have filed a utility patent

application on May 31, 2017, titled “Process for Forming Closed Cell Expanded Low density Polyethylene Foam and Products Formed

Thereby”, published January 24, 2018. The Company then caused to have filed a utility patent application on July 31, 2020, which

application was published February 11, 2021. In January 2023, the U.S Patent and Trademark Office issue a Notice of Allowance and a patent

shall issue in due course.

Additional patent application on other property concepts are also being

planned.

Our production costs are limited to the invoices we

receive for Insultex from Ketut Group and our House Wrap product from the manufacturer.

Although we are not aware of the need for any government

approval of our principal products, we may be subject to such approvals in the future.

United States and foreign regulations may subject

us to increased regulation costs, and possibly fines or restrictions on conducting our business. We are subject, directly or indirectly,

to governmental regulations pertaining to the following government agencies:

United States Customs Service

We are required to pay a 6.5% importation duty to

the United States Customs Service on all imported products. We import Insultex from Indonesia from the Ketut Group, in accordance with

our agreement with the Ketut Group.

United States Department of Labor’s Occupational

Safety and Health Administration

Because our sub-manufacturers manufacture our completed

products, we and our sub-manufacturers will be subject to the regulations of the United States Department of Labor’s Occupational

Safety and Health Administration.

We are not aware of any governmental regulations that

will affect the Internet aspects of our business. However, due to increasing usage of the Internet, a number of laws and regulations may

be adopted relating to the Internet covering user privacy, pricing, and characteristics and quality of products and services. Furthermore,

the growth and development of Internet commerce may prompt more stringent consumer protection laws imposing additional burdens on those

companies’ conducting business over the Internet. The adoption of any additional laws or regulations may decrease the growth of

the Internet, which, in turn, could decrease the demand for Internet services and increase the cost of doing business on the Internet.

These factors may have an adverse effect on our business, results of operations, and financial condition.

Moreover, the interpretation of sales tax, libel,

and personal privacy laws applied to Internet commerce is uncertain and unresolved. We may be required to qualify to do business as a

foreign corporation in each such state or foreign country. Our failure to qualify as a foreign corporation in a jurisdiction where we

are required to do so could subject us to taxes and penalties. Any such existing or new legislation or regulation, including state sales

tax, or the application of laws or regulations from jurisdictions whose laws do not currently apply to our business, could have a material

adverse effect on our business, results of operations and financial condition.

We currently have no costs associated with compliance

with environmental regulations. Because we do not manufacture our products, but rather they are manufactured by our sub-manufacturers,

we do not anticipate any costs associated with environmental compliance. Moreover, the delivery and distribution of our products will

not involve substantial discharge of environmental pollutants. However, there can be no assurance that we will not incur such costs in

the future.

We estimate that all of our revenues will be from

the sale of our products. We will sell our products at prices above our original cost to produce our products. We expect our product prices

to be lower than network marketing companies, but higher compared with retail establishments that directly manufacture their own products.

Products that are sold directly by our website will

be priced according to our Manufacturer Suggested Retail Prices. Our wholesale clients will purchase our products at our wholesale prices.

We recommend that our retailer clients sell our products at the Manufacturer Suggested Retail Prices that we provide to them which are

the same prices for products on our website; however, they are not required to do so and may price our products for retail sale at their

discretion. We have established M.A.P. (minimum advertised pricing) on our Arctic Armor™ suit in an attempt to allow all retailers

and distributors carrying the line to obtain reasonable gross margin dollars.

We currently have a total of two full time employees.

We hire part-time personnel as needed.

We have no collective bargaining or employment agreements.

Reports and Other Information to Shareholders

We are subject to the informational requirements of

the Securities Exchange Act of 1934. Accordingly, we file annual, quarterly and other reports and information with the Securities and

Exchange Commission. You may read and copy these reports and other information we file at the Securities and Exchange Commission’s

public reference rooms in Washington, D.C., New York, New York, and Chicago, Illinois. Our filings are also available to the public from

commercial document retrieval services and the Internet worldwide website maintained by the Securities and Exchange Commission at www.sec.gov.

Lack of Sufficient Operating Funds-Going Concern

Our independent registered public accounting firm

for the fiscal year ended October 31, 2023, has included an explanatory paragraph in their opinion that accompanies our audited financial

statements for the fiscal year ended October 31, 2023, indicating that as a result of the Company having had net losses and negative cash

flows and an accumulated deficit there is substantial doubt about the Company’s ability to continue as a going concern. Because

we are not able to generate sufficient funds from sales and because we are unable to access commercial sources of credit, we are consistently

underfunded. As a result, our growth is very limited, and we have difficulty in sustaining our current level of operations. We are not

able to initiate adequate marketing programs, hire additional staff, develop new products or have flexibility in ordering Insultex from

our manufacturer. Additionally, we must replace our quality control testing equipment for our House Wrap product line which we estimate

may cost $100,000. In the past, we have depended on borrowings from our CEO and other private parties, primarily stockholders in the private

sale of our common stock or debt. Should we not be able to continue to rely on these sources of funding and increase our revenue stream

to at least meet our current level of operations and to purchase new testing equipment the ability of the Company to continue as a going

concern will be adversely affected.

Competition

The markets served by the Company are highly competitive.

Competitive pricing pressure could result in loss of customers or decreased profit margins. Competition by product type includes the following:

The markets for our products are increasingly competitive.

Our competitors have substantially longer operating histories, greater brand name and company name recognition, larger customer bases

and greater financial, operating, and technical resources than us. Because we are financially and operationally smaller than our competitors,

we will encounter difficulties in capturing market share. Our competitors are able to conduct extensive marketing campaigns and create

more attractive pricing of their target markets than we are.

Some of our biggest competitors for our House Wrap

product line are;

| |

● |

Dupont |

| |

|

|

| |

● |

Kimberly Clark. |

Some of our biggest competitors in the Arctic Armor™

line are:

| |

● |

Ice Clam Corporation |

| |

|

|

| |

● |

Vexilar |

| |

|

|

| |

● |

Mustang Survival |

| |

|

|

| |

● |

Frabill |

| |

|

|

| |

● |

Stryker |

We compete in the following ways:

| A. |

Emphasize the Advantages of our Products. |

Arctic Armor Line

We emphasize the following characteristics and advantages

of our Arctic Armor line products:

| |

● |

light weight |

| |

|

|

| |

● |

waterproof |

| |

|

|

| |

● |

windproof |

| |

|

|

| |

● |

sub-zero protection |

| |

|

|

| |

● |

buoyancy |

Insultex provides a scent barrier which we had a permeation

test performed on at the Texas Research Institute Austin, Inc. The product was subjected to gas stimulant for an eight-hour period. The

product was tested for permeation of the gas every three minutes for the duration of the test with almost no detection of the gas throughout

the test. The testing was based upon accepted industry practices as well as the test method used.

HOUSE WRAP

Our House Wrap product

| |

● |

Utilize our web site to promote, market, and sell our products to consumers. |

| |

|

|

| |

● |

Utilize professional sales representatives, distributors and manufacturer representatives to sell our products to established retailers, contractors and end users. |

Our products have the following disadvantages in comparison

to the products of our competitors:

| |

● |

Lack of brand name recognition or recognition of the properties of Insultex and its advantages. We, as well as our products, have little brand name recognition compared to our competitors. And we may encounter difficulties in establishing product recognition. Also, although our products have insulation properties, the material “down” has a widespread and established reputation as being the superior insulation in the market, while the properties and advantages of Insultex has little public recognition. |

There can be no assurance that we will be able to

compete in the sale of our products, which could have a negative impact upon our business.

We do not expect our business to be dependent on one

or a few customers or retailers; however, there is no assurance that we will not become so dependent.

Cyclicality

The Company’s Arctic Armor apparel sales fluctuate

based on temperature and weather conditions. Our products are suitable primarily for cold weather conditions. This will have a cyclical

effect on sales. It also makes our revenues totally dependent on cold weather for this product line. For the fiscal year ended October

31, 2023, our cold weather products accounted for approximately 10% of our total revenue.

Material Acquisition

The Company has only one supplier of Insultex, the

special material which is manufactured within the apparel of our cold weather products and our House Wrap product. Additionally, we have

one manufacturer that produces the apparel on behalf of the Company, located in Indonesia. Currently, we are only selling apparel from

our inventory. Any delays in getting Insultex will adversely affect our revenue stream. Once we have our own equipment operating, we will

be able to produce Insultex. We intend to use such Insultex for our House Wrap product.at the present time.

Geographic Concentration

Most of the Company’s sales for its cold weather

clothing products to retailers are concentrated in colder climates of the United States and Canada.

Management

The Company is dependent on the management of Joseph

Riccelli, our Chief Executive Officer. The loss of Mr. Riccelli’s services could have a negative effect on the performance and growth

of the Company for some period of time.

Penny Stock Considerations

Our shares are “penny stocks” as that

term is generally defined in the Securities Exchange Act of 1934 as equity securities with a price of less than $5.00. Our shares may

be subject to rules that impose sales practice and disclosure requirements on broker-dealers who engage in certain transactions involving

a penny stock.

Under the penny stock regulations, a broker-dealer

selling a penny stock to anyone other than an established customer or “accredited investor” must make a special suitability

determination regarding the purchaser and must receive the purchaser’s written consent to the transaction prior to the sale, unless

the broker-dealer is otherwise exempt. Generally, an individual with a net worth, exclusive of one’s residence, in excess of $1,000,000

or annual income exceeding $200,000 individually or $300,000 together with his or her spouse is considered an accredited investor. In

addition, under the penny stock regulations the broker-dealer is required to:

| |

● |

Deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt; |

| |

|

|

| |

● |

Disclose commissions payable to the broker-dealer and its registered representatives and current bid and offer quotations for the securities; |

| |

|

|

| |

● |

Send monthly statements disclosing recent price information pertaining to the penny stock held in a customer’s account, the account’s value and information regarding the limited market in penny stocks; and |

| |

|

|

| |

● |

Make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction, prior to conducting any penny stock transaction in the customer’s account. |

Because of these regulations, broker-dealers may encounter

difficulties in their attempt to sell shares of our stock, which may affect the ability of shareholders or other holders to sell their

shares in the secondary market and have the effect of reducing the level of trading activity in the secondary market. These additional

sales practice and disclosure requirements could impede the sale of our securities if our securities become publicly traded. In addition,

the liquidity of our securities may be adversely affected, with a corresponding decrease in the price of our securities.

| ITEM 1B |

Unresolved Staff Comments. |

None.

We do not maintain any information systems that would be subject to a cybersecurity

threat. Our credit card processing is outsourced to a third party that uses a double authentication protocol.

We lease warehouse space for our inventory and raw

materials at 124 Cherry Street, Etna, Pennsylvania. We also use this space as our principal executive offices. This facility encompasses

13,000 square feet of storage space on the first floor and 2,000 square feet for our sales department offices located on the second floor.

We have entered into a verbal agreement with the owner of the building, and we pay $3,500 per month for the space. This facility is composed

of: (a) warehouse and storage areas including four (4) shipping bays and a distribution area consisting of square footage to store upward

of 250,000 finished goods products; and (b) four (4) offices, one (1) conference room, with presentation area and sample display and (2)

bathrooms totaling approximately 2,000 square feet located on the second floor. Mr. Frank Riccelli is the brother to our Chief Executive

Officer and the owner of the property. The condition of our leased property is good and suitable for our needs.

| ITEM 3. |

LEGAL PROCEEDINGS.

See Note 15 of the Notes to Financial Statement appearing

elsewhere in this Report. |

PART II

| ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY; RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

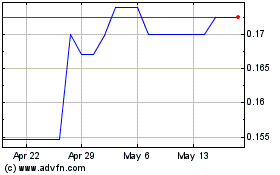

Our Common Stock is traded on the OTCQB tier under

the symbol IVDN. As of February 12, 2024, we had 249 holders of record of our common stock (not including beneficial holders of stock

held in street names).

We have one class of stock outstanding. We have no

shares of our preferred stock outstanding.

Dividends

We have not declared any cash dividends on our stock

since our inception and do not anticipate paying such dividends in the foreseeable future. We plan to retain any future earnings for use

in our business. Any decisions as to future payment of dividends will depend on our earnings and financial position and such other factors

as the Board of Directors deems relevant.

| ITEM 6. |

SELECTED FINANCIAL DATA. |

As a smaller reporting company, under SEC regulations,

we are not required to furnish selected financial data.

| ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

General

The following information should be read in conjunction

with the financial statements and the notes thereto appearing elsewhere in this report.

Disclosure Regarding Forward-Looking Statements

Certain statements made in this report, and other

written or oral statements made by or on behalf of the Company, may constitute “forward-looking statements” within the meaning

of the federal securities laws. When used in this report, the words “believes,” “expects,” “estimates,”

“intends,” and similar expressions are intended to identify forward-looking statements. Statements regarding future events

and developments and our future performance, as well as our expectations, beliefs, plans, intentions, estimates, or projections relating

to the future, are forward-looking statements within the meaning of these laws. Examples of such statements in this report include descriptions

of our plans and strategies with respect to developing certain market opportunities, and our overall business plan. All forward-looking

statements are subject to certain risks and uncertainties that could cause actual events to differ materially from those projected we

believe that these forward-looking statements are reasonable; however, you should not place undue reliance on such statements. These statements

are based on current expectations and speak only as of the date of such statements. We undertake no obligations to publicly update or

revise any forward-looking statement, whether as a result of future events, new information or otherwise.

Background

Innovative Designs, Inc. (hereafter referred to as

the “Company”, “we” or “our”) produces and sells a house wrap product using Insultex a material with

thermal resistance and buoyancy properties. We also offer a cold weather product line called “Artic Armor” which also uses

Insultex. We no longer produce any Artic Armor products. We are only selling from our existing inventory. We obtain Insultex through a

license agreement with the owner and manufacturer of the material. In December 2015, we took delivery of equipment capable of producing

our own Insultex. At such time as we have sufficient funding, we intend to put the equipment into production and use the Insultex from

this equipment in the production of our House Wrap product and for the sale of Insultex to others.

Results of Operations

Comparison of the fiscal year ended October 31, 2022,

with the fiscal year ended October 31, 2021.

The following table shows a comparison of the results

of operations between the fiscal years ended October 31, 2023, and October 31, 2022:

| | |

Fiscal Year | |

| |

Fiscal Year | |

| |

| |

|

| | |

Ended | |

| |

Ended | |

| |

| |

|

| | |

October 31, | |

% of | |

October 31, | |

% of | |

Increase | |

% |

| | |

2023 | |

Sales | |

2022 | |

Sales | |

(Decrease) | |

Change |

| | |

| |

| |

| |

| |

| |

|

| REVENUE | |

$ | 347,763 | | |

| 100.00 | % | |

$ | 258,734 | | |

| 100.00 | % | |

$ | 89,029 | | |

| 25.6 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 167,788 | | |

| 48.2 | % | |

| 146,912 | | |

| 56.8 | % | |

| (20,876 | ) | |

| 12.4 | % |

| Selling, general and administrative expenses | |

| 464,065 | | |

| 133.47 | % | |

| 666,239 | | |

| 257.5 | % | |

| (202,174 | ) | |

| (43.6 | )% |

| Total operating expenses | |

| 631,853 | | |

| 55 | % | |

| 813,151 | | |

| 225 | % | |

| 276,792 | | |

| 54 | % |

| Loss from operations | |

| (284,090 | ) | |

| (81.7 | )% | |

| (554,417 | ) | |

| 214.3 | % | |

| (270,327 | ) | |

| (95.2 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME/(EXPENSE) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| — | | |

| | | |

$ | 371,000 | | |

| 100.0 | % | |

| (371,000 | ) | |

| 100 | % |

| Interest expense | |

| (24,807 | ) | |

| (7.1 | )% | |

| (42,072 | ) | |

| 16.3 | % | |

| (66,879 | ) | |

| (269.6 | )% |

| Gain (Loss) on sale of property and equipment | |

| 7,519 | | |

| | | |

| | ) | |

| | | |

| | ) | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (301,378 | ) | |

| (86.7 | )% | |

$ | (225,489 | ) | |

| (87.2 | )% | |

$ | (75,889 | ) | |

| 25.2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding - undiluted | |

| 35,487,572 | | |

| | | |

| 34,650,560 | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss per common share - undiluted | |

$ | (0.01 | ) | |

| | | |

$ | (0.01 | ) | |

| | | |

| | | |

| | |

Results of Operations

Revenues for the fiscal year ended October 31, 2023,

were $ 347,763 compared to revenues of $258,734 for the comparable period ending October 31, 2022. House Wrap product revenue totaled

$312,983 for the period compared to $193,302 for fiscal year ended October 31, 2022. All of the remaining revenues were derived from our

Arctic Armor and related product lines which totaled $34,780 for the period compared to revenues of $65.432 for the fiscal year ended

October 31, 2022. Revenues are net of returns and discounts. We continue to work on rebuilding our House Wrap product line brand after

doing no advertising during the time of the FTC litigation, November 2016 to July 2021, and the effect of the litigation on our House

Wrap products acceptance, and the use of Insultex in other applications in the marketplace.

However, until we are able to have Insultex ICC-ES

certified we do not believe we will be able to significantly increase our revenue from our House Wrap product.

Selling, general and administrative expenses decreased

from $666,339 in fiscal year 2022, to $464,065 in the fiscal year ending October 31, 2023. This decrease reflects, in part, a decrease

in stock-based compensation of $200,000, professional fees decreased by $,9,000, payroll decreased by $18,000 and office supplies decreased

by $8,000. Some of the increases were travel expenses increased by $17,000, shipping costs increased by $8,000, product testing increased

by $8,000 and sales commission increased by $5,000.

Our cost of sales increased from $146,912 as of October 31, 2022, to $16,00

as of October 31, 2023, as a result of more sales.

Liquidity and Capital Resources

During the fiscal year ended October 31, 2023, we

funded our operations from revenues and the private sales of our common stock and the exercise of certain common stock purchase warrants.

We received a total of $355,000 from the sale of stock and warrant exercise. During the period we repaid advances from stockholders totaling

$107,630. Subsequent to the period, we receive proceeds totaling $ 218,831 from the sale of our common stock. We will continue to fund

our operations from revenues, private borrowings and the sale of our common stock until we are able to produce sales sufficient to cover

our cost structure or to secure commercial lending arrangements.

On July 12, 2015, the Company reached an agreement

with Ketut Jaya to purchase machinery and equipment utilized to produce the INSULTEX material. The purchase price is $700,000 and to be

made in four installments. The first installment of $300,000 is to be made at the execution of the agreement. The second installment of

$200,000 is to be made when the machinery and equipment is ready to be shipped to the United States. The third installment of $100,000

is to be made once the machinery and equipment is producing INSULTEX, and the fourth and final installment of $100,000 is to be made after

the first commercial production run of INSULTEX is completed. As of October 31, 2016, the Company has made payments of $600,000. In addition

to the final payments, the Company will have to have the equipment and machines installed and ensure that the machine can be operated

in compliance with environmental regulations. The Company has not made an estimate of the costs required for bringing the machine into

compliance, but it is considered to be substantial. Given the expected time and cost of bringing the equipment into production mode and

our current financial condition we are unable to estimate when we will be able to do so.

We also must purchase new quality control testing

equipment for use in testing Insultex. The testing equipment is finished, and we are in discussions with the vendor regarding certain

charges. Once we take delivery of the equipment it will have to go through a certification process. Once the testing equipment is certified,

we intend to begin the process of having Insultex certified by ICC Evaluation Services, LLC (“ICC-ES”). ICC-ES certifies,

among other items, building materials and products of which our House Wrap falls under. The reason we need to have ICC-ES certification

is that we believe in order to get large orders for House Wrap ICC-ES certification will be required. The other component part of the

House Wrap produced by a third party is ICC-Es certified. Getting ICC-ES certification is costly and time consuming.

During the period we paid ${Amount} on our loans.

Subsequent to the period we paid an additional $[Amount} on the loans.

Short Term: We funded our operations with revenues

from sales, private sales of our common stock and from a legal settlement. We could not access commercial lines of credit during our last

fiscal year.

The Company intends to repay these debt obligations

with funds it generates from revenues, from the possible sale of its securities, either debt or equity, from advances from our stockholders

or others. Because we cannot currently access commercial lending facilities, should we not be able to continue to obtain funding from

these sources should our revenues decrease, our operations would be severely affected as we would not be able to fund our purchase orders

to our suppliers for finished goods. The Company continues to pay its creditors when payments are due.

Long Term: The Company will continue to fund operations

from revenues, borrowings and the possible sale of its securities. Should we not be able to continue to rely on these sources our operations

would be severely affected as we would not be able to fund our purchase orders to our suppliers for finished goods.

| ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK. |

As a smaller reporting company under SEC Regulation,

we are not required to provide this information.

| ITEM 8. |

FINANCIAL STATEMENTS. |

INNOVATIVE

DESIGNS, INC.

FINANCIAL

STATEMENTS

FOR THE FISCAL YEARS ENDED

OCTOBER

31, 2023 AND 2022

TABLE OF CONTENTS

Report of Independent Registered Public Accounting

Firm

To the Shareholders and the

Board of Directors of

Innovative Designs, Inc.

Opinion on the Financial Statements

We have audited the accompanying balance sheets of

Innovative Designs, Inc. (the Company) as of October 31, 2023 and 2022, the related statements of operations, changes in stockholders’

equity and cash flows, for each of the years in the two year period ended October 31, 2023, and the related notes (collectively, the financial

statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company

as October 31, 2023 and 2022, and the results of its operations and its cash flows for each of the years in the two-year period ended

October 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Substantial Doubt About the Company’s Ability

to Continue as a Going Concern

The accompanying financial statements have been prepared

assuming that that Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company had net losses

and negative cash flows from operations for the years ended October 31, 2023 and 2022 and an accumulated deficit at October 31, 2023 and

2022. These factors raise substantial doubt about the Company’s ability to continue as a going concern for one year from the issuance

date of these financial statements. Management’s plans are described in Note 2. Our procedures included an evaluation of management’s

plans to continue as a going concern and a conclusion as to whether management’s plans appear reasonable and achievable. The financial

statements do not include adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility

of the Company’s management. Our responsibility is to express an opinion on the Company’s

financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board

(United States) (PCAOB) and are required to be independent with respect to the Company in accordance with U.S. federal securities laws

and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards

of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements

are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform,

an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal

control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal

control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess

the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond

to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating

the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are

matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the

audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially

challenging, subjective or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the

financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions

on the critical audit matters or on the accounts or disclosures to which they relate.

Revenue Recognition

Critical Audit Matter Description

The Company’s recognition of revenue involves

the evaluation against five criteria described by generally accepted accounting principles. With regards to the Company’s transaction

classes the primary criteria is the satisfaction of their performance obligations.

How the Critical Audit Matter Was Addressed in the Audit

Our procedures related to the Company meeting their performance obligations

included evaluation of initial sale transaction documentation, shipping records, and invoices.

Substantial Doubt About the Company’s Ability to Continue

as a Going Concern

Critical Audit Matter Description

Due to the financial position and results of cumulative

losses the Company evaluates it ability to continue as a going concern and has a plan in place to be able to conclude that it will be

able to continue as a going concern for one year from the issuance date of the financial statements.

How the Critical Audit Matter Was Addressed in the Audit

Our procedures included an evaluation of management’s plans to continue

as a going concern and a conclusion as to whether management’s plans appear reasonable and achievable.

RW Group, LLC

We have served as the Company’s auditor since 2021.

Kennett Square, PA

February 22, 2024

5020

INNOVATIVE

DESIGNS, INC.

BALANCE

SHEETS

OCTOBER 31, 2023 AND OCTOBER 31, 2022

| | |

| | | |

| | |

| | |

2023 | |

2022 |

| | |

| |

|

| ASSETS |

| | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash | |

$ | 238,677 | | |

| 263,293 | |

| Accounts receivable, net | |

| 31,050 | | |

| 11,203 | |

| Inventory, net | |

| 549,277 | | |

| 494,580 | |

| | |

| | | |

| | |

| Total current assets | |

| 819,004 | | |

| 769,076 | |

| | |

| | | |

| | |

| PROPERTY AND EQUIPMENT, net | |

| 23,479 | | |

| 5,960 | |

| | |

| | | |

| | |

| OTHER ASSETS: | |

| | | |

| | |

| Inventory on consignment | |

| — | | |

| 1,625 | |

| Deposits on inventory | |

| — | | |

| 80,000 | |

| Advance to employees | |

| 8,200 | | |

| 13,200 | |

| Deposits on equipment | |

| 652,944 | | |

| 607,370 | |

| | |

| | | |

| | |

| Total other assets | |

| 661,144 | | |

| 702,195 | |

| | |

| | | |

| | |

| TOTAL | |

$ | 1,503,627 | | |

$ | 1,477,231 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable | |

$ | 216,626 | | |

$ | 162,063 | |

| Current portion of note payable | |

| 20,397 | | |

| 20,128 | |

| Accrued interest on stockholder loans | |

| 42,873 | | |

| 46,345 | |

| Current portion of stockholder loans | |

| 70,668 | | |

| 110,631 | |

| Accrued expenses | |

| — | | |

| 3,778 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 350,564 | | |

| 342,945 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Long-term portion of note payable | |

| 44,429 | | |

| 64,547 | |

| Long-term portion of stockholder loans | |

| — | | |

| 66,667 | |

| | |

| | | |

| | |

| Total long-term liabilities | |

| 44,429 | | |

| 131,214 | |

| | |

| | | |

| | |

| STOCKHOLDERS' EQUITY: | |

| | | |

| | |

| Preferred stock, $0.0001 par value, 25,000,000 shares authorized | |

| — | | |

| — | |

| Common stock, $0.0001 par value, 100,800,000 shares authorized, and 36,532,560 and 34,650,560 issued and outstanding | |

| 3,656 | | |

| 3,467 | |

| Additional paid-in capital | |

| 11,741,935 | | |

| 11,335,184 | |

| Accumulated deficit | |

| (10,636,957 | ) | |

| (10,335,579 | ) |

| | |

| | | |

| | |

| Total stockholders' equity | |

| 1,108,634 | | |

| 1,003,072 | |

| | |

| | | |

| | |

| TOTAL | |

$ | 1,503,627 | | |

$ | 1,477,231 | |

The accompanying notes are an integral part of these financial statements.

INNOVATIVE DESIGNS, INC.

STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED OCTOBER 31, 2023 AND 2022

| | |

| | | |

| | |

| | |

2023 | |

2022 |

| | |

| |

|

| REVENUES, net | |

$ | 347,763 | | |

$ | 258,734 | |

| | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | |

| Cost of sales | |

| 167,788 | | |

| 146,912 | |

| Selling, general and administrative expenses | |

| 464,065 | | |

| 666,239 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 631,853 | | |

| 813,151 | |

| | |

| | | |

| | |

| Income (loss) from operations | |

| (284,090 | ) | |

| (554,417 | ) |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSE): | |

| | | |

| | |

| Miscellaneous income (expense) | |

| — | | |

| 371,000 | |

| Gain (loss) on sale of property and equipment | |

| 7,519 | | |

| — | |

| Interest expense | |

| (24,807 | ) | |

| (42,072 | ) |

| | |

| | | |

| | |

| Total other income (expense) | |

| (17,288 | ) | |

| 328,928 | |

| | |

| | | |

| | |

| Net income (loss) | |

$ | (301,378 | ) | |

$ | (225,489 | ) |

| | |

| | | |

| | |

| PER SHARE INFORMATION - UNDILUTED: | |

| | | |

| | |

| Net income (loss) per common share | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding | |

| 35,487,572 | | |

| 34,650,560 | |

| | |

| | | |

| | |

| PER SHARE INFORMATION - DILUTED: | |

| | | |

| | |

| Net income (loss) per common share | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding | |

| 36,529,252 | | |

| 35,330,560 | |

The accompanying notes are an integral part of these financial statements.

INNOVATIVE DESIGNS, INC.

STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED OCTOBER 31, 2023 AND 2022

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Common Stock | |

Common Stock To Be | |

Additional Paid-In | |

Accumulated | |

|

| | |

Shares | |

Amount | |

Issued | |

Capital | |

Deficit | |

Total |

| | |

| |

| |

| |

| |

| |

|

| Balance at October 31, 2021 | |

| 33,315,560 | | |

$ | 3,333 | | |

$ | — | | |

$ | 11,039,118 | | |

$ | (10,110,090 | ) | |

$ | 932,361 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of stock | |

| 460,000 | | |

| 46 | | |

| — | | |

| 86,154 | | |

| — | | |

| 86,200 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exercise of warrants | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for services | |

| 875,000 | | |

| 88 | | |

| — | | |

| 209,912 | | |

| — | | |

| 210,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| — | | |

| (225,489 | ) | |

| (225,489 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at October 31, 2022 | |

| 34,650,560 | | |

| 3,467 | | |

| — | | |

| 11,335,184 | | |

| (10,335,579 | ) | |

| 1,003,072 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of stock | |

| 1,635,000 | | |

| 164 | | |

| — | | |

| 354,836 | | |

| — | | |

| 355,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exercise of warrants | |

| 40,000 | | |

| 4 | | |

| — | | |

| 9,996 | | |

| — | | |

| 10,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for services | |

| 207,000 | | |

| 21 | | |

| — | | |

| 41,919 | | |

| — | | |

| 41,940 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| — | | |

| (301,378 | ) | |

| (301,378 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at October 31, 2023 | |

| 36,532,560 | | |

| 3,656 | | |

| — | | |

| 11,741,935 | | |

| (10,636,957 | ) | |

| 1,108,634 | |

The accompanying notes are an integral part of these financial statements.

INNOVATIVE

DESIGNS, INC.

CONDENSED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED OCTOBER 31, 2023 AND 2022

| | |

| | | |

| | |

| | |

2023 | |

2022 |

| | |

| |

|

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net income (loss) | |

$ | (301,378 | ) | |

$ | (225,489 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Write off of accounts payable | |

| — | | |

| (111,000 | ) |

| Common stock issued for services | |

| 41,940 | | |

| 210,000 | |

| Depreciation | |

| 3,074 | | |

| 1,490 | |

| Amortization of right of use asset | |

| — | | |

| 40,962 | |

| Gain on sale of asset | |

| (7,519 | ) | |

| — | |

| (Increase) decrease from changes in: | |

| | | |

| | |

| Accounts receivable | |

| (19,847 | ) | |

| (10,002 | ) |

| Inventory | |

| (53,072 | ) | |

| 48,008 | |

| Deposits on inventory | |

| 80,000 | | |

| (80,000 | ) |

| Increase (decrease) from changes in: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

| 50,785 | | |

| 23,137 | |

| Accrued interest expense | |

| (3,472 | ) | |

| 3,209 | |

| | |

| | | |

| | |

| Net cash provided by (used in) operating activities | |

| (209,489 | ) | |

| (99,685 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of equipment | |

| (20,593 | ) | |

| — | |

| Deposits on equipment | |

| (45,574 | ) | |

| (7,370 | ) |

| Proceeds from sale of equipment | |

| 7,519 | | |

| — | |

| Advances to employees | |

| 5,000 | | |

| (5,000 | ) |

| | |

| | | |

| | |

| Net cash provided by (used in) investing activities | |

| (53,648 | ) | |

| (12,370 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Proceeds from sale of stock | |

| 355,000 | | |

| 86,200 | |

| Proceeds received from the exercise of warrants | |

| 10,000 | | |

| — | |

| Payments on stockholder loans | |

| (106,630 | ) | |

| (144,666 | ) |

| Payments on lease liability | |

| — | | |

| (40,962 | ) |

| Proceeds on notes payable | |

| — | | |

| 1,818 | |

| Payments on notes payable | |

| (19,849 | ) | |

| (7,493 | ) |

| | |

| | | |

| | |

| Net cash provided by (used in) financing activities | |

| 238,521 | | |

| (105,103 | ) |

| | |

| | | |

| | |

| NET INCREASE (DECREASE) IN CASH | |

| (24,616 | ) | |

| (217,158 | ) |

| | |

| | | |

| | |

| CASH, BEGINNING OF YEAR | |

| 263,293 | | |

| 480,451 | |

| | |

| | | |

| | |

| CASH, END OF YEAR | |

$ | 238,677 | | |

$ | 263,293 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |

| | | |

| | |

| | |

| | | |

| | |

| Cash paid for interest | |

$ | 28,279 | | |

$ | 38,863 | |

| | |

| | | |

| | |

| Non-cash financing activities - common stock issued for services | |

$ | 41,940 | | |

$ | 210,000 | |

The accompanying notes are an integral part of these financial statements.

INNOVATIVE

DESIGNS, INC.

NOTES

TO FINANCIAL STATEMENTS

| 1. | NATURE OF OPERATIONS

AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES NATURE OF OPERATIONS |

Innovative

Designs, Inc. (the “Company”), which was incorporated in the State of Delaware on June 25, 2002, markets cold weather

recreational and industrial clothing products, as well as house wrap, which are made from INSULTEX, a low density foamed polyethylene,

a material with buoyancy, scent block, and thermal resistant properties. The Company’s clothing and house wrap is offered

and sold by retailers, distributors, and companies throughout the United States and Canada.

The

Company operates two reportable segments: apparel and house wrap. The apparel segment offers a wide variety of extreme cold weather

apparel and related items. The house wrap segment offers the INSULTEX house wrap which has an R-value of 3 and an R-value of 6,

as well as the Company’s seam tape.

BASIS

OF ACCOUNTING

The

financial statements of the Company have been prepared on the accrual basis of accounting and, accordingly, report all significant

receivables, payables, and other liabilities as prescribed by accounting principles generally accepted in the United States of

America (“U.S. GAAP”).

FISCAL

YEAR END

The

Company’s fiscal year ends on October 31st. The fiscal years ended October 31, 2023 and 2022 are referred to

as 2023 and 2022, respectively, throughout the Company’s financial statements.

USE

OF ESTIMATES

The

preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ from those estimates.

CASH

AND CASH EQUIVALENTS

The

Company defines cash and cash equivalents as those highly liquid investments purchased with a maturity of three months or less.

INNOVATIVE

DESIGNS, INC.

NOTES

TO FINANCIAL STATEMENTS

REVENUE

RECOGNITION

Revenues

are measured based on the amount of consideration specified in a contract with a customer. The Company recognizes revenue when

and as performance obligations (i.e., obligations to transfer goods and/or services) are satisfied, which generally occurs with

the transfer of control of the goods or services to the customer.

To