Lingo Media Reports 2013 Fourth Quarter and Year End Results

April 30 2014 - 12:25PM

Marketwired

Lingo Media Reports 2013 Fourth Quarter and Year End Results

TORONTO, ONTARIO--(Marketwired - Apr 30, 2014) - Lingo Media

Corporation (TSX-VENTURE:LM)(OTCBB:LMDCF) ("Lingo Media" or the

"Company"), an ESL industry acquisition company that is

'Changing the way the world learns English', announces its

financial results for the fourth quarter and year ended December

31, 2013. All figures are reported in Canadian Dollars, and are in

accordance with International Financial Reporting Standards unless

otherwise noted.

Operational

Highlights

- Print-Based English Language Learning:

- secured approval for balance of product revisions for PEP

Primary English levels 7 and 8 of eight level program from

China's State Ministry of Education

- secured approval for balance of product revisions for

Starting Line levels 9 thru 12 of twelve level program

from China's State Ministry of Education

- negotiated seven year renewals of co-publishing agreements for

both recently approved PEP Primary English and

Starting Line programs with People's Education Press and

Peoples Education Electronic & Audiovisual Press, China's State

Ministry of Education's publishing arm

- Online English Language Learning:

- completed the final stages of redesign of the product user

interface, learning management system and the multi-browser

delivery system for desktops and tablets for ELL Technologies'

suite of products including - Scholar, Business,

Master, Kids, and Placement Test

- continued to advance the re-development of Speak2Me with

Advancina LLC, our strategic partner, to enhance and update

Speak2Me.cn's product offering

Corporate

Highlights

- negotiated a one year extension to the term of the $880,000

loan outstanding for a further one year term to September 8,

2015

Financial Highlights

for the Fourth Quarter Ended December 31, 2013

|

Fourth Quarter Ended December 31 |

2013 |

2012 |

|

Revenue |

$ |

1,024,555 |

$ |

891,747 |

|

Operating expenses |

|

163,374 |

|

561,944 |

|

Amortization, share-based payments, and depreciation |

|

125,826 |

|

146,344 |

|

Finance charges, taxes, foreign exchange |

|

114,686 |

|

66,902 |

|

Total expenses |

|

403,886 |

|

775,190 |

|

Net profit |

|

620,669 |

|

116,557 |

|

Total Comprehensive Income |

$ |

558,765 |

$ |

38,611 |

- Revenue for the fourth quarter ended December 31, 2013 totalled

$1,024,555 compared to $891,747 for the same period in 2012.

- Operating expenses for the quarter ended December 31, 2013

totalled $163,374 as compared to $561,944 in 2012.

- Net profit for the quarter was $620,669 as compared to $116,557

for the same period in 2012.

- Total comprehensive income for the fourth quarter was $558,765

or $0.028 earnings per share based on 21.2 million shares compared

to a total comprehensive income of $38,611 or $0.002 earnings per

share based on 20.9 million shares for the same period in

2012.

Financial Highlights for the Year Ended December 31, 2013

|

Year Ended December 31 |

2013 |

|

2012 |

|

|

Revenue |

$ |

2,008,066 |

|

$ |

2,016,261 |

|

|

Operating expenses |

|

1,136,786 |

|

|

2,394,292 |

|

|

Amortization, share-based payments, and depreciation |

|

500,599 |

|

|

618,785 |

|

|

Finance charges, taxes, foreign exchange |

|

347,738 |

|

|

365,710 |

|

|

Total expenses |

|

1,985,123 |

|

|

3,378,787 |

|

|

Net profit (loss) |

|

22,943 |

|

|

(1,362,526 |

) |

|

Total Comprehensive Loss |

$ |

(56,311 |

) |

$ |

(1,364,737 |

) |

- Revenue for the year ended December 31, 2013 totalled $2.00

million, as compared to $2.02 million in 2012.

- Operating expenses for the year ended December 31, 2013

totalled $1.14 million compared to $2.39 million in 2012.

- Profit from operations for the year ended December 31, 2013 was

$370,681 as compared to a loss from operations of $(996,816) in

2012.

- Net profit for the year ended December 31, 2013 was $22,943 as

compared to a net loss of $(1,362,526) for 2012. This improvement

in profitability is primarily attributed to a reduction in selling,

general and administrative expenses of $1.17 million.

- Total comprehensive loss for 2013 was $(56,331) or $0.00 loss

per share based on 21.2 million shares compared to a total

comprehensive loss of $(1.36 million) or $0.07 loss per share based

on 20.9 million shares as at December 31, 2012.

The audited financial statements for the year ended December

31, 2013 and Management Discussion & Analysis are available

at www.sedar.com.

About Lingo Media

(TSX-VENTURE:LM)(OTCBB:LMDCF)

Lingo Media

Corporation (www.lingomedia.com) is an ESL industry acquisition

company that is 'Changing the way the world learns

English', focused on English language learning ("ELL") on an

international scale through its four distinct business units: ELL

Technologies; Parlo; Speak2Me; and Lingo Learning. ELL Technologies

is a globally-established ELL multi-media and online training

company (www.elltechnologies.com). Parlo is a fee-based online ELL

training and assessment service. Speak2Me is a free-to-consumer

advertising-based online ELL service in China. Lingo Learning is a

print-based publisher of ELL programs in China. Lingo Media has

formed successful relationships with key government and industry

organizations, establishing a strong presence in China's education

market of more than 300 million students. The Company continues to

expand its ELL offerings and is extending its reach globally.

Portions of this press release may include "forward-looking

statements" within the meaning of securities laws.

Forward-looking statements contained in this press release are

made pursuant to the safe harbour provisions of the Private

Securities Litigation Reform Act of 1995. These statements are

based on management's current expectations and involve certain

risks and uncertainties. Actual results may vary materially from

management's expectations and projections and thus readers should

not place undue reliance on forward-looking statements. Certain

factors that can affect the Company's ability to achieve projected

results are described in the Company's filings with the Canadian

and United States securities regulators available on www.sedar.com

or www.sec.gov/edgar.shtml.

NEITHER THE TSX-VENTURE EXCHANGE NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX-VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

Lingo MediaMichael KraftPresident & CEO(416) 927-7000 Ext.

23 or Toll Free: (866) 927-7011(416)

927-1222mkraft@lingomedia.comwww.lingomedia.com

Everybody Loves Languages (PK) (USOTC:LMDCF)

Historical Stock Chart

From Jan 2025 to Feb 2025

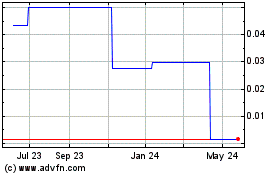

Everybody Loves Languages (PK) (USOTC:LMDCF)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Everybody Loves Languages Corporation (PK) (OTCMarkets): 0 recent articles

More Lingo Media Corp. (QB) News Articles