Legend Oil and Gas Ltd. Closes the First of Its Canadian Property Sales

December 05 2013 - 8:00AM

Marketwired

Legend Oil and Gas Ltd. Closes the First of Its Canadian Property

Sales

SEATTLE, WA--(Marketwired - Dec 5, 2013) - Legend Oil and Gas

Ltd. (OTCQB: LOGL) ("Legend", the "Company") is pleased to announce

that the Company has closed the first in a number of asset sales

previously announced in its Canadian subsidiary, Legend Energy

Canada Ltd. The Wildmere Unit interest, producing

approximately 25 barrels of oil per day (BOPD), was sold at a price

of CAD$1,955,000 before adjustments, which translates to a price of

$78,200 per flowing barrel and over four times current cash

flow. This divestment follows the strategy employed by the

Company to sell assets at a higher price point than those it is

able to acquire. The previously announced McCune Kansas

acquisition was acquired at a value of approximately $50,000 per

flowing barrel.

The sale of Wildmere along with the sale of additional Canadian

assets, which will occur over the next several months, will reduce

Legend's gas weighted asset portfolio in Canada as well as its

associated bank debt. These divestments will allow for the

re-deployment of Legend's efforts and resources on its high return,

oil weighted production portfolio in the United States.

About Legend Oil and Gas Ltd.

Legend Oil and Gas Ltd. is a managed risk, oil and gas

exploration/exploitation, development and production company with

activities currently focused on leases in Canada, southeastern

Kansas and northern North Dakota.

Forward-looking Statements: This press release contains

forward-looking statements concerning future events and the

Company's growth and business strategy. Words such as "expects,"

"will," "intends," "plans," "believes," "anticipates," "hopes,"

"estimates," and variations on such words and similar expressions

are intended to identify forward-looking statements. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, no assurance can be

given that such expectations will prove to have been correct.

Forward looking statements in this press release include statements

about our drilling development program. These statements

involve known and unknown risks and are based upon a number of

assumptions and estimates that are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of the Company. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, the timing and results

of our 2013 drilling and development plan. Additional factors

include increased expenses or unanticipated difficulties in

drilling wells, actual production being less than our development

tests, changes in the Company's business; competitive factors in

the market(s) in which the Company operates; risks associated with

oil and gas operations in the United States; and other factors

listed from time to time in the Company's filings with the

Securities and Exchange Commission including the Company's Annual

Report on Form 10-K for the year ended December 31, 2012 and Form

10Q for the quarter ended June 30, 2013. The Company expressly

disclaims any obligations or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in the Company's expectations with

respect thereto or any change in events, conditions or

circumstances on which any statement is based.

Cautionary Note to U.S. Investors -- The United States

Securities and Exchange Commission permits oil and gas companies,

in their filings with the SEC, to disclose only proved reserves

that a company has demonstrated by actual production or conclusive

formation tests to be economically and legally producible under

existing economic and operating conditions. We use certain terms in

this press release, such as "probable," "possible," "recoverable"

or "potential" reserves among others, that the SEC's guidelines

strictly prohibit us from including in filings with the SEC.

Investors are urged to consider closely the disclosure in our

filings with the SEC.

Investor Contact Gross Capital, Inc. Barry Gross Investor

Relations legend@grosscapital.com 361-949-4999

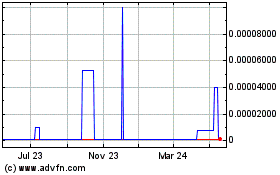

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Dec 2024 to Jan 2025

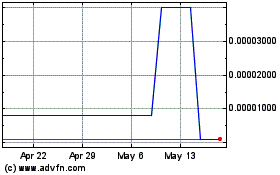

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Jan 2024 to Jan 2025