Current Report Filing (8-k)

April 21 2021 - 4:02PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 21, 2021 (April 16, 2021)

MJ

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55900

|

|

20-8235905

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

7320

S. Rainbow Blvd., Suite 102-210, Las Vegas, NV 89139

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code:

(702)

879-4440

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.001 par value per share

|

|

MJNE

|

|

OTC

Markets “PINK”

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Forward-looking

Statements

This

Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Such forward-looking statements can generally be identified by our use of forward-looking

terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,”

“believe,” “continue,” or other similar words. Readers of this report should be aware that there are various

factors that could cause actual results to differ materially from any forward-looking statements made in this report. Factors that could

cause or contribute to such differences include, but are not limited to, changes in general economic, regulatory and business conditions

in Colorado, and or changes in U.S. Federal law. Accordingly, readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this report.

Item

8.01. OTHER EVENTS.

On

March 19, 2021, a Complaint was filed against the Company, Jim Mueller, John Mueller, MachNV, LLC, Acres Cultivation, Paris Balaouras,

Dimitri Deslis, ATG Holdings, LLC and Curaleaf, Inc. (collectively, the “Defendants”) by DGMD Real Estate Investments, LLC,

ARMPRO, LLC, Zhang Springs LV, LLC, Prodigy Holdings, LLC and Green Organics, LLC (collectively, the “Plaintiffs”) in the

District Court of Clark County, Nevada.

In the Complaint, the Plaintiffs allege

that the Defendants: (i) intended to fraudulently obtain money from the Plaintiffs in order to put that money towards the Acres

dispensary and to make Acres look more appealing to potential buyers as well as pay off Defendants’ agents, and (ii) the

Defendants acted together in order to find investors to invest money into the Acres and MJ Holdings “Investment Schemes”,

and (iii) the Defendants intended to fraudulently obtain Plaintiffs’ money for the purpose of harming the Plaintiffs to

benefit the Defendants, and (iv) the Defendants committed unlawful fraudulent misrepresentation in the furtherance of the agreement

to defraud the Plaintiffs. The Plaintiffs allege that damages are in excess of $15,000.

As

the complaint pleads only the statutory minimum of damages, the Company is unable to estimate the potential exposure, if any,

resulting from this matter but believes it is without merit as to liability and otherwise deminimis as to damages. Thus, the Company

does not expect this matter to have a material effect on the Company’s consolidated financial position or its results of operations.

The Company will vigorously defend itself against this action and has filed an

appropriate and timely answer to the Complaint including a lengthy and comprehensive series of affirmative defenses and liability

and damage avoidances.

Item

9.01. FINANCIAL STATEMENTS AND EXHIBITS.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

MJ

HOLDINGS, INC.

|

|

|

|

|

Date:

April 21, 2021

|

By:

|

/s/

Roger Bloss

|

|

|

|

Roger

Bloss

|

|

|

|

Interim

Chief Executive Officer

|

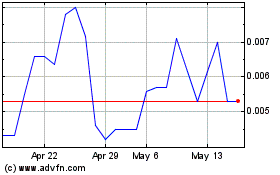

MJ (CE) (USOTC:MJNE)

Historical Stock Chart

From Feb 2025 to Mar 2025

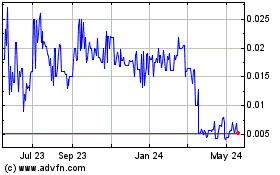

MJ (CE) (USOTC:MJNE)

Historical Stock Chart

From Mar 2024 to Mar 2025