Current Report Filing (8-k)

October 07 2021 - 3:37PM

Edgar (US Regulatory)

0001456857

false

0001456857

2021-10-07

2021-10-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 7, 2021 (August 26, 2021)

MJ

Holdings, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55900

|

|

20-8235905

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

2580

S. Sorrel St., Las Vegas, NV 89146

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code:

(702)

879-4440

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.001 par value per share

|

|

MJNE

|

|

OTCQB

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Forward-looking

Statements

This

Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Such forward-looking statements can generally be identified by our use of forward-looking

terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,”

“believe,” “continue,” or other similar words. Readers of this report should be aware that there are various

factors that could cause actual results to differ materially from any forward-looking statements made in this report. Factors that could

cause or contribute to such differences include, but are not limited to, changes in general economic, regulatory and business conditions

in Nevada, and or changes in U.S. Federal law. Accordingly, readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this report.

Item

8.01. OTHER EVENTS

As

previously reported by MJ Holdings, Inc. (the “Company”) in its Current Report on Form 8-K filed with the Securities and

Exchange Commission (the “SEC”) on August 2, 2021, the Company’s wholly owned subsidiary, Red Earth, LLC (the “Subsidiary”),

entered into a Stipulation and Order for Settlement of Disciplinary Action (the “Stipulation Order”) with the Nevada Cannabis

Compliance Board (“CCB”).

As

per the terms of the Stipulation Order, the Subsidiary paid a civil penalty in the amount of $10,000 on July 29, 2021. On August 26,

2021, the Company and the Company’s Chief Cultivation Officer and previous owner of the Subsidiary, Paris Balaouras, entered into

a Termination Agreement. Under the terms of the Termination Agreement, the Purchase Agreement (the “Purchase Agreement”),

dated December 15, 2017, entered into between the Company and the Subsidiary was terminated as of the date of the Termination Agreement

resulting in the return of ownership of the Subsidiary to Mr. Balaouras. Neither party shall have any further obligation to one

another pursuant to the terms of the Purchase Agreement.

On

September 2, 2021, the Company received approval of the Termination Agreement from the CCB.

The

foregoing provides only a brief description of the material terms of the Termination Agreement, does not purport to be a complete description

of the rights and obligations of the parties thereunder, and such description is qualified in its entirety by reference to the full text

of the Termination Agreement filed as an exhibit to this Current Report on Form 8-K and is incorporated herein by reference.

Item

9.01. FINANCIAL STATEMENTS AND EXHIBITS.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

MJ

HOLDINGS, INC.

|

|

|

|

|

Date:

October 7, 2021

|

By:

|

/s/

Roger Bloss

|

|

|

|

Roger

Bloss

|

|

|

|

Interim

Chief Executive Officer

|

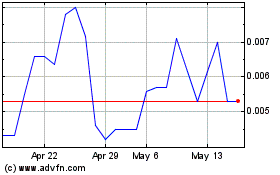

MJ (CE) (USOTC:MJNE)

Historical Stock Chart

From Feb 2025 to Mar 2025

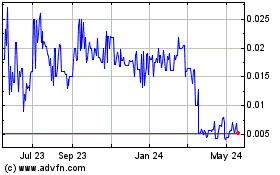

MJ (CE) (USOTC:MJNE)

Historical Stock Chart

From Mar 2024 to Mar 2025