Tencent Aims to Expand in U.S. -- WSJ

November 11 2019 - 2:02AM

Dow Jones News

Nintendo tie-up is key to an effort to make more console games

for Americans

By Takashi Mochizuki in Tokyo and Shan Li in Beijing

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 11, 2019).

China's Tencent Holdings Ltd., the world's largest videogame

company by revenue, is looking to make more console games for U.S.

consumers by leveraging its partnership with Japan's Nintendo Co.,

Tencent officials said.

Tencent, which dominates its home market with smartphone and

personal-computer games, has acquired stakes in prominent U.S. game

makers including Epic Games, creator of the hit "Fortnite," and

Activision Blizzard Inc., publisher of the shoot-'em-up game "Call

of Duty." But the Chinese company doesn't yet have a significant

direct presence in U.S. console games.

The U.S. videogame market is a prime target for growth,

especially because China has begun putting limits on games,

including a curfew for players under 18, blocking them from playing

late at night.

"What we want is to expand from China, and one target is console

game players in the U.S. and Europe," said a Tencent official, who

asked not to be identified. "We hope to create console games with

Nintendo characters, and learn the essence of making console games

from Nintendo engineers."

The Tencent-Nintendo partnership led Nintendo shares to rise 14%

when it was announced in April because investors thought it would

give Nintendo greater access to China's huge game-playing

population. Tencent said it would help Nintendo sell its Switch

consoles in China. Analysts say the partnership could also allow

Tencent to distribute smartphone games using Nintendo characters in

China.

The partnership is off to a slow start, though, because of

delays among regulators in China, who must clear both game consoles

and software.

Both companies are cautious about Nintendo business in China.

Tencent officials said they didn't believe the Switch would sell in

China as well as it has in the U.S. and Japan, because Chinese

customers are more accustomed to playing games on smartphones and

PCs.

As a part of its deal with Nintendo, Tencent promised the

Kyoto-based company it could sell at least a few million units of

the console in China throughout the machine's lifecycle, Tencent

officials said. That is a modest goal: The Switch sold more than a

million units in the U.S. during the July-September quarter

alone.

On the software side, analysts said Chinese smartphone users

might jump at the chance to play games with Nintendo characters

such as Mario the plumber, if Nintendo and Tencent can work out

terms for a distribution deal. Tencent officials, however, said

that wasn't their focus because Tencent already dominates the

Chinese market with its own games. "Nintendo games are not

constructed to make people pay a lot of money," another Tencent

official said.

Nintendo Chief Executive Shuntaro Furukawa has adopted the same

view as Tencent, telling analysts that they shouldn't expect a lot

from the Switch in China.

Nonetheless, Nintendo sees some potential to expand its

audience. Outside developers said they were asked by Nintendo to

make games for young women, such as romance games, a genre with

passionate fans including in China.

"Women are becoming a driving force behind the growth of the

gaming market," said Daniel Ahmad, an analyst at Niko Partners, an

Asia-focused games analytics company. "Chinese developers are not

only shifting to create games aimed at female players, they are

also tailoring existing games to better appeal to them."

Lisa Cosmas Hanson, managing partner at Niko Partners, said

while she didn't see console game development for the U.S. as a

priority for Tencent, she thought the move could give it an

observation post on the tastes of U.S. gamers.

"Tencent is skillfully pursuing silent global domination, via

expansion primarily in the form of major and minor investments in

[videogame] industry companies around the world without rebranding

them as Tencent," Ms. Hanson said.

For Tencent, the greater, though intangible, advantage of the

Nintendo tie-up may be the ability to learn from the Japanese

company, which has a knack for winning over U.S. game players.

Tencent tried the U.S. market two years ago with a smartphone game

called "Honor of Kings" that has drawn tens of millions of Chinese

players; rebranded "Arena of Valor" for Americans, it barely made a

dent.

Tencent officials say the learning will take time and that they

sometimes have trouble trying to decode messages from the Kyoto

company. Nintendo declined to comment.

Write to Takashi Mochizuki at takashi.mochizuki@wsj.com and Shan

Li at shan.li@wsj.com

(END) Dow Jones Newswires

November 11, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

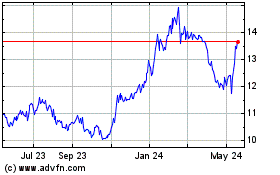

Nintendo (PK) (USOTC:NTDOY)

Historical Stock Chart

From Feb 2025 to Mar 2025

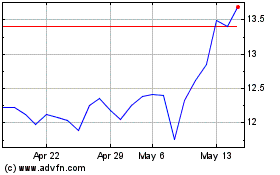

Nintendo (PK) (USOTC:NTDOY)

Historical Stock Chart

From Mar 2024 to Mar 2025