UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

[ X ] Quarterly Report pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

For the period ended August 31, 2010

[ ]Transition Report pursuant to 13 or 15(d) of the Securities Exchange Act

of 1934

For the transition period ____________ to __________________.

Commission File Number 333-134536

Regal Group, Inc.

(Exact name of Small Business Issuer as specified in its charter)

Nevada Pending

________________________________ ___________________________________

(State or other jurisdiction of (IRS Employer Identification No.)

incorporation or organization)

4/F, Building 1, Anle Industrial Park

Nantouguankou Road 2, Nanshan District

Shenzhen,China 518052

______________________________________ _____________________________

(Address of principal executive offices) (Postal or Zip Code)

|

Issuer's telephone number, including area code: 86-755-26470266

3723 E. Maffeo Road

Phoenix, Arizona, USA 85050

(Former name, former address and former fiscal year,

if changed since last report)

Indicate by check mark whether the registrant(1) has filed all reports required

by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 day.

[ X ] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer {square} Accelerated filer {square}

Non-accelerated filer {square} Smaller reporting company {checked-box}

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act).

Yes [ ] No [ x ]

Indicate the number of shares outstanding of each of the issuer's classes of

common stock, as of the latest practicable date: 58,816,665 shares of common

stock with par value of $0.001 per share outstanding as of October 15, 2010.

1

TABLE OF CONTENTS

Page

PART I - FINANCIAL INFORMATION 3

Item 1.Financial Statements. 4

Item 2.Management's Discussion And Analysis Of Financial Condition

And Results Of Operation 10

Item 3. Quantitative and Qualitative Disclosures About Market Risk 11

Item 4T.Controls And Procedures 12

PART II - OTHER INFORMATION 13

Item 1.Legal Proceedings 13

Item 2.Unregistered Sales Of Equity Securities And Use Of Proceeds 13

Item 3.Defaults Upon Senior Securities 13

Item 4.Submission Of Matters To A Vote Of Security Holders 13

Item 5.Other Information 13

Item 6.Exhibits 14

SIGNATURES 15

|

2

PART I - FINANCIAL INFORMATION

ITEM 1.FINANCIAL STATEMENTS

Index To Financial Statements

Consolidated Balance Sheets F-1

Consolidated Statements Of Operations F-2

Statements Of Cash Flows F-3

Notes To Consolidated Financial Statements F-4

|

3

REGAL GROUP, INC.

(FORMERLY REGAL LIFE CONCEPTS, INC.)

CONSOLIDATED FINANCIAL STATEMENTS

AUGUST 31, 2010

(UNAUDITED)

4

REGAL GROUP, INC.

(FORMERLY REGAL LIFE CONCEPTS, INC.)

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

August 31, February 29,

2010 2010

ASSETS

CURRENT

Cash $ 72,249 $ 191,699

Accounts receivable 30,853 -

Other receivables 4,863 -

107,965 191,699

EQUIPMENT, net 15,578 4,622

INTELLECTUAL PROPERTY RIGHTS, net (Note 2) 2,061,074 -

$ 2,184,617 $ 196,321

LIABILITIES AND STOCKHOLDERS' EQUITY

CURRENT

Accounts payable and accrued liabilities $ 156,163 $ 21,440

Due to related party 198 -

156,361 21,440

STOCKHOLDERS' EQUITY

Common stock (Note 3)

Authorized:

100,000,000 common shares, par value $0.001 per share

Issued and outstanding:

58,816,665 common shares (February 28, 2010 - 46,816,665) 58,816 46,816

Additional paid-in capital 6,261,967 891,117

Deficit accumulated during the development stage (4,292,527) (763,052)

2,028,256 174,881

$ 2,184,617 $ 196,321

|

The accompanying notes are an integral part of these financial statements.

F - 1

5

REGAL GROUP, INC.

(FORMERLY REGAL LIFE CONCEPTS, INC.)

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

Cumulative

from

Three Three July 1, 2005

Months Months Six Months Six Months (Date of

Ended Ended Ended Ended Inception) to

August 31, August 31, August 31, August 31, August 31,

2010 2009 2010 2009 2010

SALES $ 5,510 $ - $ 5,510 $ - $ 5,510

COST OF SALE 2,807 - 2,807 - 2,807

2,703 - 2,703 - 2,703

EXPENSES

Amortization 40,486 42 40,529 85 42,308

Bank charges 53 96 183 229 1,508

Filing and transfer agent fees 140 150 140 650 34,714

Financing charge (Note 3) 789,850 - 789,850 - 789,850

Management fees 6,500 10,000 11,500 20,000 113,384

Office 11,801 1,198 26,793 8,561 58,862

Professional fees 36,133 26,240 105,809 19,851 326,244

Stock based compensation (Note 2) 2,523,000 - 2,523,000 - 2,523,000

Travel and promotion 11,382 19,161 34,374 32,682 205,360

Loss before Other Item (3,419,345) (56,887) (3,532,178) (82,058) (4,095,230)

OTHER ITEM

Impairment of loan receivable - - - - (200,000)

NET LOSS $(3,416,642) $(56,887) $(3,529,475) $(82,058) $(4,292,527)

NET LOSS PER SHARE - BASIC AND DILUTED $ (0.07) $ (0.00) $ (0.07) $ (0.00)

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING -

BASIC AND DILUTED

49,686,230 46,816,665 48,251,448 46,816,665

|

The accompanying notes are an integral part of these financial statements.

F - 2

6

REGAL GROUP INC.

(FORMERLY REGAL LIFE CONCEPTS, INC.)

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF CASH FLOWS

(UNAUDITED)

Cumulative from

July 1, 2005

Six Months Ended Six Months Ended (Date of Inception) to

August 31, 2010 August 31, 2009 August 31, 2010

CASH FLOWS FROM OPERATING ACTIVITIES:

Net loss $ (3,529,475) $ (82,058) $ (4,292,527)

Non-cash items:

Amortization 40,529 85 42,308

Donated capital - - 20,000

Impairment of loan receivable - - 200,000

Financing charge 789,850 - 789,850

Stock based compensation 2,523,000 - 2,523,000

Changes in non-cash operating

working capital items:

Accounts receivable (5,510) - (5,510)

Prepaid expenses - 3,910 -

Accounts payable and accrued liabilities 62,156 (5,768) 83,596

NET CASH USED IN OPERATING ACTIVITIES (119,450) (83,831) (639,283)

CASH FLOWS FROM INVESTING ACTIVITIES:

Acquisition of equipment - (2,712) (6,401)

Loan receivable - - (200,000)

NET CASH USED IN INVESTING ACTIVITIES - (2,712) (206,401)

CASH FLOWS FROM FINANCING ACTIVITIES:

Issuance of common shares - - 917,933

NET CASH PROVIDED BY FINANCING ACTIVITIES - - 917,933

INCREASE (DECREASE) IN CASH (119,450) (86,543) 72,249

CASH, BEGINNING 191,699 382,749 -

CASH, ENDING $ 72,249 $ 292,206 $ 72,249

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Cash paid for:

Interest $ - $ - $ -

Income taxes $ - $ - $ -

|

The accompanying notes are an integral part of these financial statements.

F - 3

7

REGAL GROUP, INC.

(FORMERLY REGAL LIFE CONCEPTS, INC.)

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AUGUST 31, 2010

(UNAUDITED)

1. BASIS OF PRESENTATION

The accompanying unaudited interim consolidated financial statements have been

prepared in accordance with United States generally accepted accounting

principles for interim financial information and with the rules and regulations

of the Securities and Exchange Commission ("SEC"). They do not include all

information and footnotes required by United States generally accepted

accounting principles for complete financial statements. However, except as

disclosed herein, there has been no material changes in the information

disclosed in the notes to the financial statements for the year ended February

28, 2010 included in the Company's Annual Report on Form 10-K filed with the

SEC. The unaudited interim financial statements should be read in conjunction

with those financial statements included in the Form 10-K. In the opinion of

Management, all adjustments considered necessary for a fair presentation,

consisting solely of normal recurring adjustments, have been made. Operating

results for the period ended August 31, 2010 are not necessarily indicative of

the results that may be expected for the year ending February 28, 2011.

2. SHARE EXCHANGE TRANSACTION

On August 10, 2010, The Company entered into a Share Exchange Agreement

("Agreement") to acquire 100% of the issued and outstanding shares of UHF

Logistics Limited ("UHF"), a private company incorporated in Hong Kong, and its

wholly owned subsidiary Shenzhen Rui Pu Da Electronics Technology Company Ltd.

("RPD"), a private company incorporated in the People's Republic of China, in

exchange for 12,000,000 shares of the common stock of the Company. The

Agreement also provided that certain shareholders of the Company agreed to sell

14,500,000 shares of the common stock of the Company at $0.01 per share to

the new senior management members who joined RPD as a consequence of the

acquisition. The difference between the fair value of the 14,500,000

shares and the amount paid of $2,523,000 was recorded as a compensation expense.

According to the Agreement, the Company agreed to use its commercially

reasonable efforts to raise up to US $1,000,000 of new capital, either through

the issuance of equity or debt or a combination ("Financing"). The newly issued

12,000,000 shares may be released to the shareholders of UHF upon the expiry

of the one year escrow, up to 5,800,000 shares may be subject to cancellation,

as follows:

A. If after 12 months from the conclusion of the Financing, the EBITDA of RPD

is less than $300,000, the shareholders of UHF shall retain ownership of

6,200,000 of 12,000,000 shares and the remaining 5,800,000 shares will be

subject to cancellation;

B. If after 12 months from the conclusion of the Financing, the EBITDA of RPD

is more than $300,000 but less than US $850,000, the shareholders of UHF

shall retain ownership of 9,000,000 of 12,000,000 shares and the remaining

3,000,000 shares will be subject to cancellation; and

C. If after 12 months from the conclusion of the Financing, the EBITDA of RPD

is more than $850,000, the shareholders of UHF shall retain ownership of

the 12,000,000 shares; and

D. Paragraphs A-C above notwithstanding, the escrowed shares shall only be

released to the shareholders of UHF if no claims are made against the

Company or any of its shareholders relating to the intellectual property

rights during the one year period immediately following the execution of

the Agreement.

F - 4

8

The allocation of the purchase price of UHF to the fair value of the assets and

liabilities acquired is as follows:

Purchase price

Fair value of shares issued $ 2,070,000

---------------------------------

Assets 42,351

Liabilities (73,725)

---------------------------------

Net liabilities acquired (31,374)

---------------------------------

Intellectual property rights $ 2,101,374

---------------------------------

|

Intellectual property rights have useful lives of three years and $40,300 has

been recorded in amortization expense for the period from August 10, 2010 to

August 31, 2010.

3. COMMON STOCK

During the six months ended August 31, 2010, the Company issued 12,000,000

shares to UHF to acquire all the issued and outstanding shares of UHF and its

wholly owned subsidiary RPD (Note 2).

During the six months ended August 31, 2010, the Company extended the life of

4,333,335 warrants for two years. The incremental fair value resulting from

this extension was $789,850 and was recorded in financing charge and additional

paid-in capital. The following assumptions were used for the Black-Scholes

valuation: dividend yield - 0; Expected stock price volatility - 163%; risk-free

interest rate - 0.76%; Expected life of warrants - 2 year. As at August 31,

2010, there were 4,333,335 warrants outstanding with an exercised price of $1

per share and an expiry date of May 28, 2012.

9

ITEM 2.MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATION

FORWARD-LOOKING STATEMENTS

This Form 10-Q includes "forward-looking statements" within the meaning of the

"safe-harbor" provisions of the Private Securities Litigation Reform Act of

1995. Such statements are based on management's current expectations and are

subject to a number of factors and uncertainties that could cause actual results

to differ materially from those described in the forward-looking statements.

All statements other than historical facts included in this Form, including

without limitation, statements under "Plan of Operation", regarding our

financial position, business strategy, and plans and objectives of management

for the future operations, are forward-looking statements.

Although we believe that the expectations reflected in such forward-looking

statements are reasonable, it can give no assurance that such expectations will

prove to have been correct. Important factors that could cause actual results

to differ materially from our expectations include, but are not limited to,

market conditions, competition and the ability to successfully complete

financing.

IN GENERAL

We were formed in the State of Nevada on July 1, 2005 as "Regal Rock, Inc". On

December 3, 2007, we changed our name to "Regal Life Concepts, Inc.," and on

March 31, 2010, we changed our name to "Regal Group Inc.". Until August 10,

2010, our Company's principal office was located in Phoenix, Arizona and we were

a public "shell" company in the exploration stage since formation and had not

realized any revenues from our initial planned operation of bamboo wood flooring

distribution. In light of the uncertainty as to whether our initial business

model was commercially and economically viable, we decided to review other

potential opportunities in the hospitality and health and wellness sectors,

including a 50-room spa resort located in Chiang Mai, Thailand, which project

is no longer under consideration given prior geopolitical uncertainty in

Thailand.

We are now engaged in the business of acquiring private companies based and

operating in China and providing these companies with support, including

administrative, legal, accounting and marketing assistance. We also plan to

provide these companies with an infusion of capital to further their business

plan. We believe that equity investments in China present one of the most

attractive global investment opportunities available in the coming four to seven

years. The local Chinese equity markets are highly concentrated, serving only

a small fraction of the local corporate market. This fact, taken together with

current international economic uncertainty, presents a unique opportunity to

acquire small, growing and profitable Chinese companies at historically

realistic valuations.

We previously entered into a Capital Increase and Equity Investment Agreement

with Guangzhou AWA Wine Co., Ltd. and we applied for, but to date have not yet

received the necessary government approvals for the establishment of the joint

venture under the Chinese rules and regulations. To ensure proper allocation of

limited financial resources to our projects and given our subsequent closing on

the acquisition of a technology company in China, we are no longer focused on

the wine sector in China.

Pursuant to a Share Exchange Agreement dated July 15, 2010 and the transactions

contemplated thereby, the Company acquired UHF Logistics Limited, a Hong Kong

corporation ("UHF") from UHF shareholders and as a result, acquired UHF's

controlled subsidiary, Shenzhen Rui Pu Da Electronic Technology Company Ltd

("RPD"), a Chinese limited liability company engaged in the development of RFID

(Radio Frequency Identification) solutions in the People's Republic of China

("China" or the "PRC"). The closing of the Share Exchange took place on August

10, 2010.

Since August 10, 2010, through RPD, our Chinese operating subsidiary, we have

commenced the business of developing proprietary and integrating off-the-shelf

RFID solutions to service contracts acquired by RPD and its related company,

Shenzhen DDCT Communication Technology Co ("DDCT"), for clients requiring

solutions for supply chain management, parkade management, cigarette industry

logistics, the pig breeding industry, and anti-theft and secured access

applications in China. We are based in the city of Shenzhen, Guangdong

Province, China.

10

.

RPD specializes in the development, production, and sales of RFID UHF (ultrahigh

frequency) hardware, including UHF readers, antenna and tags. The company owns

intellectual property rights to its next generation RFID technology platform and

its RFID products are designed for a broad range of applications that span

personal and property safety and security management, e-ticketing management,

tracking in animal breeding, pharmaceutical product fraud prevention, and

warehouse/inventory control.

We intend to retain one full-time project coordinator in the next six months to

handle all business matters and communication with our subsidiary companies

respecting business development, marketing and promotion aspects of UHF and

related Chinese projects.. We also intend to provide working capital funding to

our operating subsidiaries in China to increase marketing efforts in China as

well as provide them with a stronger registered capital base in order to

directly tender for larger government contracts as well as fund initial

inventory requirements for contracts awarded. Other than as disclosed herein, we

have no plans to significantly change our number of employees for the next 12

months.

We therefore expect to incur the following costs in the next 12 months in

connection with our business operations:

Marketing costs: $ 75,000

General administrative costs: $100,000

Working Capital $500,000

Total: $675,000

|

In addition, we anticipate spending an additional $40,000 on professional fees.

Total expenditures over the next 12 months are therefore expected to be

$715,000.

We do not have sufficient funds on hand to undertake intended business

operations to meet our obligations for the next twelve-month period. As a

result, we will need to seek additional funding in the near future.

If we are unable to raise the required financing, we will be delayed in

conducting our business plan.

RESULTS OF OPERATIONS FOR THE THREE MONTH PERIOD ENDING AUGUST 31, 2010

We earned $5,510 in revenues for the three months ended August 31 2010 as

opposed to $0 revenues for the comparative period due to the formal closing of

our acquisition of UHF on August 10 2010, thus resulting in the recognition of

revenues from UHF and its Chinese operating subsidiary for the period August 10

until August 31 2010. During the same period, we incurred operating expenses of

$3,419,345 consisting of professional fees of $36,133, travel and promotional

expenses of $11,382, management fees of $6,500, office charges of $11,801, bank

charges of $53, filing and transfer agent fees of $140, amortization charges of

$40,486 and financing charge of $789,850 due to the extension of common shares

warrant and stock based compensation expense of $2,523,000 due to the sale of

14,500,000 shares by the company's existing shareholders to the new management

of RPD.

RESULTS OF OPERATIONS FOR THE SIX MONTH PERIOD ENDING AUGUST 31, 2010

We earned $5,510 in revenues for the six months ended August 31 2010 as opposed

to $0 revenues for the comparative period due to the formal closing of our

acquisition of UHF on August 10 2010, thus resulting in the recognition of

revenues from UHF and its Chinese operating subsidiary for the period August 10

until August 31 2010. During the same period, we incurred operating expenses of

$3,532,178 consisting of professional fees of $105,809, travel and promotional

expenses of $34,374, management fees of $11,500, office charges of $26,793, bank

charges of $183, filing and transfer agent fees of $140, amortization charges of

$40,529 and financing charge of $789,850 due to the extension of common shares

warrant and stock based compensation expense of $2,523,000 due to the sale of

14,500,000 shares by the company's existing shareholders to the new management

of RPD.

At August 31, 2010, we had assets of $2,362,917, consisting of $72,249 in cash,

accounts receivable of $30,853, other receivables of $4,863 and equipment

recorded at $15,578 and intellectual property of $2,061,074. We have accrued

liabilities of $156,163 as of August 31, 2010.

11

We have not to date attained profitable operations and are dependent upon

obtaining financing to pursue our intended operating activities and expand the

operations scope for our acquired operations in the RFID sector. For these

reasons our auditors believe that there is substantial doubt that we will be

able to continue as a going concern.

ITEM 3.QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4T. CONTROLS AND PROCEDURES.

EVALUATION AND DISCLOSURE CONTROLS AND PROCEDURES

The Company, under the supervision and with the participation of the Company's

management, including the Company's Chief Executive Officer and Principal

Accounting Officer, has evaluated the effectiveness of the design and operation

of the Company's "disclosure controls and procedures," as such term is defined

in Rules 13a-15e promulgated under the Exchange Act. Based upon that evaluation,

the Chief Executive Officer and Principal Accounting Officer have concluded that

the disclosure controls and procedures were not effective as of the end of the

period covered by this report due to a material weakness identified by

management relating to the (1) lack of a functioning audit committee and lack of

a majority of outside directors on the Company's board of directors, resulting

in ineffective oversight in the establishment and monitoring of required

internal controls and procedures; (2) inadequate segregation of duties

consistent with control objectives; (3) insufficient written policies and

procedures for accounting and financial reporting with respect to the

requirements and application of US GAAP and SEC disclosure requirements; and (4)

ineffective controls over period end financial disclosure and reporting

processes.

Based upon its evaluation, our management, with the participation of our Chief

Executive Officer and Principal Accounting Officer, has concluded there is a

material weakness with respect to its internal control over financial reporting

as defined in Rule 13a-15(e).

We are committed to improving our financial organization. As part of this

commitment, we will create a position to segregate duties consistent with

control objectives and will increase our personnel resources and technical

accounting expertise within the accounting function when funds are available to

the Company: i) Appointing one or more outside directors to our board of

directors who shall be appointed to the audit committee of the Company resulting

in a fully functioning audit committee who will undertake the oversight in the

establishment and monitoring of required internal controls and procedures such

as reviewing and approving estimates and assumptions made by management; and

ii) Preparing and implementing sufficient written policies and checklists which

will set forth procedures for accounting and financial reporting with respect to

the requirements and application of US GAAP and SEC disclosure requirements.

Management believes that the appointment of one or more outside directors, who

shall be appointed to a fully functioning audit committee, will remedy the lack

of a functioning audit committee and a lack of a majority of outside directors

on the Company's Board. In addition, management believes that preparing and

implementing sufficient written policies and checklists will remedy the

following material weaknesses (i) insufficient written policies and procedures

for accounting and financial reporting with respect to the requirements and

application of US GAAP and SEC disclosure requirements; and (ii) ineffective

controls over period end financial close and reporting processes. Further,

management believes that the hiring of additional personnel who have the

technical expertise and knowledge will result in proper segregation of duties

and provide more checks and balances within the financial reporting department.

Additional personnel will also provide the cross training needed to support the

Company if personnel turn over issues within the financial reporting department

occur. This coupled with the appointment of additional outside directors will

greatly decrease any control and procedure issues the Company may encounter in

the future.

12

A control system, no matter how well conceived and operated, can provide only

reasonable, not absolute, assurance that the objectives of the control system

are met. Because of the inherent limitations in all control systems, our

evaluation of controls can only provide reasonable assurance that all control

issues, if any, within a company have been detected. Such limitations include

the fact that human judgment in decision-making can be faulty and that

breakdowns in internal control can occur because of human failures, such as

simple errors or mistakes or intentional circumvention of the established

process. The company thus hereby conclude that the Company's disclosure

controls and procedures were ineffective at a reasonably assurance level.

CHANGES IN INTERNAL CONTROLS OVER FINANCIAL REPORTING

There were no changes to the internal controls during the quarter ended August

31, 2010 that have materially affected or that are reasonably likely to

materially affect the internal controls over financial reporting.

PART II- OTHER INFORMATION

ITEM 1.LEGAL PROCEEDINGS

The Company is not a party to any pending legal proceeding. Management is not

aware of any threatened litigation, claims or assessments.

ITEM 2.UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

In connection with the closing of the Exchange Agreement on August 10, 2010, the

Company issued an aggregate of 12,000,000 Newly Issued Regal Shares to the

Selling Shareholders in exchange for UHF Shares.

The exchange of the UHF Shares for the Newly Issued Regal Shares qualifies as an

exemption from registration pursuant to Rule 903 of Regulation S promulgated

under the Securities Act of 1933. We believe that this exemption from

registration was available because each shareholder represented to us in a duly

signed Certificate of Non-US Shareholder, among other things, that he, she or it

was a non-U.S. person as defined in Regulation S, was not acquiring the shares

for the account or benefit of, directly or indirectly, any U.S. person, had the

intention to acquire the securities for investment purposes only and not with a

view to or for sales in connection with any distribution thereof, and that such

shareholder was sophisticated and was able to bear the risk of loss of the

entire investment. Further, we did not otherwise engage in distribution of

these shares in the U.S.

ITEM 3.DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4.SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None

ITEM 5. OTHER INFORMATION

None.

13

ITEM 6.EXHIBITS AND REPORT ON FORM 8-K

Exhibits

31.1 Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to

Section 302 of the Sarbanes-Oxley Act of 2002

31.2 Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

32.1 Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

32.2 Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

Report on Form 8-K

(i)On July 15, 2010, Regal finalized a Share Exchange Agreement with UHF

Logistics Limited ("UHF"), a Hong Kong-incorporated company whose

operating subsidiaries are developers of RFID (Radio Frequency

Identification) solutions in China. Under the terms of the Share

Exchange Agreement, Regal will issue and certain of its shareholders

will sell an aggregate of 26,500,000 shares of its common stock, or

approximately 45% of the equity of the Company, on a post-transaction

basis, to certain shareholders and senior management of UHF or its

operating subsidiaries in exchange for 100% of the common stock of UHF.

The effectiveness of the Share Exchange Agreement was subject to the

fulfillment of customary closing conditions, including the receipt of

the necessary regulatory approvals, receipt by the Company of legal

opinions from Chinese counsel opining on the legality of the proposed

transaction, as well as receipt by the Company of audited financial

statements of UHF and its operating subsidiary, prepared in accordance

with GAAP and audited by an independent auditor registered with the

Public Company Accounting Oversight Board in the United States.

(ii) On August 10, 2010 (the "Closing Date"), Regal (the "Company"),

certain shareholders of the Company (the "Regal Shareholders"), UHF

Logistics Limited, a Hong Kong corporation ("UHF"), certain

shareholders of UHF (the "Selling Shareholders") and certain members of

senior management (the "Purchasing Shareholders") of Shenzhen Rui Pu Da

Electronic Technology Company, Ltd., a China limited liability company

("Shenzhen RPD") and a subsidiary of UHF, closed on a Share Exchange

Agreement (the "Exchange Agreement"), pursuant to which the Company

acquired all of the issued and outstanding shares of UHF ("UHF Shares")

from the Selling Shareholders in exchange for 12,000,000 shares of the

Company's common stock, par value $0.001 (the "Newly Issued Regal

Shares"). In addition, the Exchange Agreement provided that the Regal

Shareholders shall sell an aggregate of 14,500,000 shares of the

Company's common stock, par value $0.001 (the "Regal Issued Shares")

to the Purchasing Shareholders, for a purchase price of US$145,000.

14

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused

this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

October 15, 2010

Regal Group, Inc.

/s/ Parrish Medley

------------------------------

Parrish Medley, President, CEO & Director

|

15

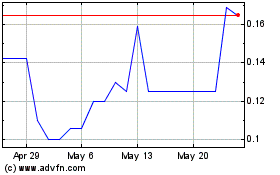

UHF Logistics (PK) (USOTC:RGLG)

Historical Stock Chart

From Feb 2025 to Mar 2025

UHF Logistics (PK) (USOTC:RGLG)

Historical Stock Chart

From Mar 2024 to Mar 2025