Germany's Scout24 Plans IPO

September 07 2015 - 5:30AM

Dow Jones News

Deutsche Telekom AG and private-equity firms Hellman &

Friedman LLC and Blackstone Group plan to list Scout24 on the

Frankfurt stock exchange this year as the online-classifieds

company seeks to tap investors' appetite for German real estate to

fund further growth, according to a filing Monday.

The move comes as several large companies hope to list in

Frankfurt later this year, braving stock market volatility amid

worries over China and an expected rise in U.S. interest rates.

Aspirin-maker Bayer AG last week said it plans to list its plastics

unit Covestro on the stock market later this year in what could

become the largest German IPO in recent years with a valuation of

possibly more than 11 billion euros ($12.27 billion). Other

companies working on an IPO include shipping group Hapag-Lloyd AG,

Bombardier Inc's train unit and food delivery firm HelloFresh.

"The planned IPO is the logical next step in the company's

development path, and now is the right time to take it," said

Gregory Ellis, chief executive of Scout24.

The company that bundles leading digital marketplaces for cars

and real estate under one name said it would issue at least €200

million in new shares and place an unspecified number of existing

shares in a move that will bring its overall valuation above the €2

billion it received when Deutsche Telekom sold a 70% stake in

Scout24 to private-equity firm Hellman & Friedman in November

2013.

Deutsche Telekom is reshaping its business and has for several

years been looking to either sell its unit T-Mobile US Inc. or

merge it with another operator.

Scout24 also received interest from Axel Springer AG and

ProsiebenSat. 1 AG earlier this year, people familiar with the

matter said, but is pressing ahead with an IPO. With around 1,000

employees, Scout24 recorded earnings of €149 million before

interest, taxes, depreciation and amortization, or Ebitda, last

year on revenue of €342 million. It aims at strengthening its

dominant market position in Germany and other European countries to

continue its 12% annual revenue growth over the last couple of

years.

Its U.K. rivals Rightmove PLC and Auto Trader Group PLC are

valued at roughly 22 times their expected Ebitda in 2016.

Write to Eyk Henning at eyk.henning@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 07, 2015 06:15 ET (10:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

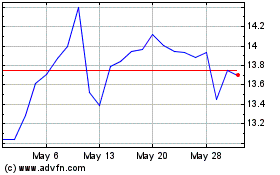

Rightmove (PK) (USOTC:RTMVY)

Historical Stock Chart

From Dec 2024 to Jan 2025

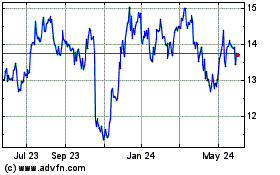

Rightmove (PK) (USOTC:RTMVY)

Historical Stock Chart

From Jan 2024 to Jan 2025