UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| ¨ | Preliminary Information Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14c-5(d)(2)) |

| x | Definitive Information Statement |

SMG INDUSTRIES INC.

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials |

| ¨ | Fee computed on table in exhibit required by Item 25(b) of

Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11 |

SMG Industries Inc.

20475 State Hwy 249, Suite 450

Houston, Texas 77070

NOTICE OF ACTIONS TAKEN BY WRITTEN

CONSENT OF STOCKHOLDERS

June 2, 2023

Dear Stockholders:

This Information Statement

is being furnished by the Board of Directors (the “Board”) of SMG Industries Inc., a Delaware corporation (“we,”

“us,” “our,” “SMG” or the “Company”), to holders of record of the Company’s common

stock, $0.001 par value (the “Common Stock”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of

1934, as amended (the “Exchange Act”) and pursuant to Section 228(a) of the Delaware General Corporation Law. The

purpose of this Information Statement is to inform those with voting rights to our Common Stock (the “Stockholders”) that,

on May 22, 2023, holders of at least a majority of the outstanding shares of Common Stock acted by written consent in lieu of a special

meeting of stockholders to: (i) approve an amendment to the Company’s Amended and Restated Certificate of Incorporation (the

“Certificate of Incorporation”) to increase our authorized shares of Common Stock from 250,000,000 shares to 500,000,000 shares;

(ii) approve an amendment to the Certificate of Incorporation to effect a reverse stock split of our issued and outstanding shares

of Common Stock at a ratio ranging between 1-for-5 and 1-for-50 (with our Board being authorized to determine the exact ratio); and (iii) approve

the Amended and Restated 2018 Stock Option Plan of the Company (the “Amended Option Plan”) to increase the number of shares

of Common Stock available for issuance under the 2018 Stock Option Plan, as amended (the “Option Plan”), from 4,000,000 shares

to 10,000,000 shares and to extend the Option Plan’s expiration date.

No action is required by you.

The accompanying Information Statement is furnished to inform our Stockholders of the actions described above before they take effect

in accordance with Rule 14c-2 promulgated under the Exchange Act. This Information Statement is first being mailed to you on or about

June 2, 2023. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

PLEASE

NOTE THAT A MAJORITY OF THE COMPANY’S OUTSTANDING SHARES OF COMMON STOCK HAVE BEEN VOTED TO: (I) APPROVE AN AMENDMENT TO THE

CERTIFICATE OF INCORPORATION TO INCREASE OUR AUTHORIZED SHARES OF COMMON STOCK FROM 250,000,000 SHARES TO 500,000,000 SHARES, (II) APPROVE

AN AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR ISSUED AND OUTSTANDING SHARES OF

COMMON STOCK AT A RATIO RANGING BETWEEN 1-FOR-5 AND 1-FOR-50 (WITH OUR BOARD BEING AUTHORIZED TO DETERMINE THE EXACT RATIO), AND (III) APPROVE

THE AMENDED OPTION PLAN TO INCREASE THE NUMBER OF SHARES OF COMMON STOCK AVAILABLE FOR ISSUANCE UNDER THE OPTION PLAN FROM 4,000,000 SHARES

TO 10,000,000 SHARES AND TO EXTEND THE OPTION PLAN’S EXPIRATION DATE.

| |

By Order of the Board of Directors |

| |

|

| |

/s/ Matthew Flemming |

| |

|

| |

Matthew Flemming |

| |

Chairman and CEO |

Houston, Texas

June 2, 2023

TABLE OF CONTENTS

SMG Industries Inc.

20475 State Hwy 249, Suite 450

Houston, Texas 77070

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

(THE “EXCHANGE ACT”), AND REGULATION

14C

PROMULGATED THEREUNDER

INTRODUCTORY STATEMENT

SMG Industries Inc. (“we,”

“us,” “our,” “SMG” or the “Company”) is a Delaware corporation with principal executive

offices located at 20475 State Hwy 249, Suite 450, Houston, Texas 77070. The telephone number is (713) 955-3497. On May 18,

2023, the Board of Directors (the “Board”), after careful consideration, unanimously deemed advisable and approved: (i) an

amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to

increase the authorized shares of the Company’s common stock, $0.001 par value (the “Common Stock”), from 250,000,000

shares to 500,000,000 shares (the “Authorized Share Amendment”); (ii) an amendment to the Certificate of Incorporation

to effect a reverse stock split of our issued and outstanding shares of Common Stock at a ratio ranging between 1-for-5 and 1-for-50 (with

our Board being authorized to determine the exact ratio) (the “Reverse Stock Split Amendment”); and (iii) the Amended

and Restated 2018 Stock Option Plan of the Company (the “Amended Option Plan”) to increase the number of shares of Common

Stock available for issuance under the 2018 Stock Option Plan, as amended (the “Option Plan”), from 4,000,000 shares to 10,000,000

shares and to extend the Option Plan’s expiration date.

This Information Statement

is being sent to holders of record of Common Stock as of May 25, 2023 (the “Record Date”) by the Board to notify them

about actions that the Company’s stockholders have taken by written consent in lieu of a special meeting of the stockholders to

approve the actions set forth herein. The written consent was delivered to the Company on May 22, 2023 in accordance with Section 228

of the Delaware General Corporation Law (the “DGCL”) and Article II, Section 7 of our Amended and Restated By-Laws

(the “By-Laws”).

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

NOT REQUESTED TO SEND US A PROXY.

Copies of this Information

Statement are expected to be mailed on or about June 2, 2023, to the holders of record on the Record Date of our outstanding Common

Stock. This Information Statement is being delivered only to inform you of the corporate actions described herein before they take effect

in accordance with Rule 14c-2 promulgated under the Exchange Act.

We have asked brokers and

other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of our Common Stock held of

record and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS

AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE

NOTE THAT A MAJORITY OF THE COMPANY’S OUTSTANDING SHARES OF COMMON STOCK HAVE BEEN VOTED TO: (I) APPROVE THE AUTHORIZED SHARE

AMENDMENT, (II) APPROVE THE REVERSE STOCK SPLIT AMENDMENT, AND (II) APPROVE THE AMENDED OPTION PLAN.

FORWARD-LOOKING STATEMENTS

In

this Information Statement, we may make certain forward-looking statements, including statements regarding our plans, strategies, objectives,

expectations, intentions and resources that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. The Securities and Exchange Commission (“SEC”) encourages companies

to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment

decisions. This Information Statement contains such “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995.

The

statements contained in this Information Statement that are not historical fact are forward-looking statements (as such term is defined

in the Private Securities Litigation Reform Act of 1995), within the meaning of Section 21E of the Exchange Act and Section 27A

of the Securities Act of 1933, as amended. Forward-looking statements may be identified by the use of forward-looking terminology such

as “should,” “could,” “may,” “will,” “expect,” “believe,” “estimate,”

“anticipate,” “intends,” “continue,” or similar terms or variations of those terms or the negative

of those terms. All forward-looking statements are management’s present expectations of

future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described

in the forward-looking statements. These statements appear in a number of places in this Information Statement and include

statements regarding the intent, belief or current expectations of SMG Industries Inc. Forward-looking statements are merely our

current predictions of future events. Investors are cautioned that any such forward-looking statements are inherently uncertain, are not

guaranties of future performance and involve risks and uncertainties. Actual results may differ materially from our predictions. There

are a number of factors that could negatively affect our business and the value of our securities, including, but not limited to, fluctuations

in the market price of our Common Stock; changes in our plans, strategies and intentions; changes in market valuations associated with

our cash flows and operating results; the impact of significant acquisitions, dispositions and other similar transactions; our ability

to attract and retain key employees; changes in financial estimates or recommendations by securities analysts; asset impairments; decreased

liquidity in the capital markets; and changes in interest rates. Such factors could materially affect our Company’s future operating

results and could cause actual events to differ materially from those described in forward-looking statements relating to our Company.

Although we have sought to identify the most significant risks to our business, we cannot predict whether, or to what extent, any of such

risks may be realized, nor is there any assurance that we have identified all possible issues that we might face.

In

light of these assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained in this

Information Statement might not occur. Stockholders are cautioned not to place undue reliance on the forward-looking statements, which

speak only as of the date of this Information Statement. We are not under any obligation, and we expressly disclaim any obligation, to

update or alter any forward-looking statements, whether as a result of new information, future events or otherwise except as may be required

by applicable law. All subsequent forward-looking statements attributable to the Company or to any person acting on our behalf are expressly

qualified in their entirety by the cautionary statements contained or referred to in this section. We urge readers to carefully review

and consider the various disclosures we make in this Information Statement and our reports filed with the SEC that attempt to advise interested

parties of the risks, uncertainties and other factors that may affect our business including the risk factors included in our Annual Report

on Form 10-K for the year ended December 31, 2022 under Part I, Item 1A. “Risk Factors.”

VOTES REQUIRED

Under Section 228 of

the DGCL and Article II, Section 7 of our By-Laws, stockholders may approve actions upon the written consent of the holders

of shares of Common Stock having at least the minimum number of votes required to authorize the action at a meeting at which all shares

entitled to vote were present and voted. As a result, stockholders holding at least a majority of the outstanding shares of Common Stock

are required to approve the Authorized Share Amendment, the Reverse Stock Split Amendment and the Amended Option Plan if such approval

is obtained via written consent. The holders of Common Stock are entitled to one vote for each share of Common Stock owned by them.

At the close of business

on May 22, 2023, there were 47,739,404 shares of Common Stock issued and outstanding, and certain stockholders who combined hold

approximately 57.8% of the Common Stock and are entitled to vote on the matters described herein (the “Consenting

Stockholders”) held 27,599,650 shares of Common Stock. On May 22, 2023, the Company received an executed written consent

from the Consenting Stockholders that approved the Authorized Share Amendment, the Reverse Stock Split Amendment and the Amended

Option Plan.

NOTICE

ITEM 1

AUTHORIZED SHARE AMENDMENT

The Board and the Consenting Stockholders have

approved the Authorized Share Amendment, attached hereto as Exhibit A, to increase our authorized shares of Common Stock from 250,000,000

shares to 500,000,000 shares.

As of May 22, 2023, 47,739,404

shares of our Common Stock were issued and outstanding. Accordingly, as of such date, a total of 202,260,596 shares of our Common Stock

were available for future issuance under the Certificate of Incorporation. After filing the Authorized Share Amendment with the Secretary

of State of the State of Delaware (the “Delaware SOS”), the number of shares of Common Stock available for future issuance

will increase to 452,260,596 shares. An additional 250,000,000 shares of Common Stock will be added to the existing class of Common Stock

and, if and when issued, will have the same rights and privileges as the shares of Common Stock presently issued and outstanding. The

additional shares may be used for various purposes which may not require further stockholder approval, including the conversion of outstanding

convertible promissory notes to common stock; the conversion of outstanding non-convertible indebtedness to common stock; raising capital;

providing equity incentives to employees, officers or directors; establishing strategic relationships with other companies; expanding

our business through the acquisition of other businesses or products; or other purposes.

The Authorized Share Amendment

will become effective upon its acceptance by the Delaware SOS. We may file the Authorized Share Amendment with the Delaware SOS beginning

20 calendar days after the mailing of this Information Statement.

NOTICE ITEM 2

REVERSE STOCK SPLIT AMENDMENT

The Board and the Consenting

Stockholders have approved the Reverse Stock Split Amendment, attached hereto as Exhibit B, to effect a reverse stock split of our

issued and outstanding shares of Common Stock at a ratio ranging between 1-for-5 and 1-for-50 (with our Board being authorized to determine

the exact ratio) (the “Reverse Stock Split”).

Effects of the Reverse Stock Split

Commencing 20 calendar days

after the mailing of this Information Statement, our Board will have the authority, in its sole discretion, without further action by

our stockholders, to effect the Reverse Stock Split at any time on or before June 30, 2024, effective at the date and time set forth

in the Reverse Stock Split Amendment that is filed with the Delaware SOS (the “Effective Time”). Even though the holders of

a majority of the outstanding shares of Common Stock have already approved the Reverse Stock Split, we reserve the right not to effect

the Reverse Stock Split of the Common Stock if our Board does not deem it to be in the best interests of the Company and our stockholders.

We believe that granting this discretion provides our Board with maximum flexibility to act in the best interests of the Company and our

stockholders. If the Reverse Stock Split Amendment has not been filed with the Delaware SOS on or before the June 30, 2024, the Board

will be deemed to have abandoned the Reverse Stock Split. Upon implementation of the Reverse Stock Split by the Board, between five (5) and

fifty (50) shares of outstanding Common Stock will be automatically converted into one (1) share of Common Stock.

Except for adjustments that

may result from the treatment of fractional shares, which will be rounded up to the nearest whole number, each stockholder will beneficially

hold the same percentage of our outstanding shares of Common Stock immediately following the Reverse Stock Split as such stockholder held

immediately prior to the Reverse Stock Split. In addition, proportionate adjustments will be made to the per-share exercise price and

the number of shares covered by outstanding options and warrants to buy Common Stock, so that the total price required to be paid to fully

exercise each option and warrant before and after the Reverse Stock Split will be approximately equal. Additionally, the conversion price

of convertible promissory notes and the number of shares of Common Stock available for issuance under the Amended Option Plan will be

proportionately adjusted to reflect the Reverse Stock Split ratio selected by the Board, such that fewer shares will be issuable upon

the conversion of convertible promissory notes and fewer shares will be subject to the Amended Option Plan.

The Board does not intend

as part of the Reverse Stock Split to reduce the amount of the Company’s authorized shares of Common Stock. As a result of the

increase in the number of authorized shares of Common Stock as described in Notice Item 1 above, upon the effectiveness of the Authorized

Share Amendment and the Reverse Stock Split Amendment, and based upon the number of shares of Common Stock outstanding as of May 22, 2023, we will have 500,000,000 authorized shares of Common Stock and 47,739,404 shares issued and outstanding, leaving 452,260,596 shares

available for issuance, not including shares reserved for issuance upon the exercise of warrants or options or the conversion of convertible

promissory notes. As a result of the increase in authorized shares of Common Stock, the number of unissued, available authorized shares

of Common Stock will increase, as reflected in the following table as if the Reverse Stock Split occurred on May 22, 2023:

| Ratio |

|

|

Authorized(1) |

|

|

Issued pre-Reverse

Stock Split(2) |

|

|

Issued post-Reverse

Stock Split(2)(3) |

|

|

Post-Reverse

Stock Split

Shares Available

for Issuance |

|

| |

1:5 |

|

|

|

500,000,000 |

|

|

|

47,739,404 |

|

|

|

9,547,881 |

|

|

|

490,452,119 |

|

| |

1:10 |

|

|

|

500,000,000 |

|

|

|

47,739,404 |

|

|

|

4,773,941 |

|

|

|

490,452,119 |

|

| |

1:20 |

|

|

|

500,000,000 |

|

|

|

47,739,404 |

|

|

|

2,386,971 |

|

|

|

497,613,029 |

|

| |

1:30 |

|

|

|

500,000,000 |

|

|

|

47,739,404 |

|

|

|

1,591,314 |

|

|

|

498,408,686 |

|

| |

1:40 |

|

|

|

500,000,000 |

|

|

|

47,739,404 |

|

|

|

1,193,486 |

|

|

|

498,806,514 |

|

| |

1:50 |

|

|

|

500,000,000 |

|

|

|

47,739,404 |

|

|

|

954,789 |

|

|

|

499,045,211 |

|

(1) Reflects

the actions taken in accordance with Notice Item 1, whereby the authorized shares of Common Stock shall be increased from 250,000,000

to 500,000,000.

(2) Does not

reflect shares issuable upon the exercise of warrants or options, the conversion of outstanding convertible promissory notes or the conversion

of any other outstanding debt to equity.

(3) For purposes

of this illustration, fractional shares are rounded up.

The increase in the number

of shares of Common Stock available for issuance and any subsequent issuance of such shares could have the effect of delaying or preventing

a change in control of the Company without further action by the stockholders. The Board is not aware of any attempt to take control of

the Company and has not presented this proposal with the intention that the Reverse Stock Split be used as a type of antitakeover device.

Any additional Common Stock, when issued, would have the same rights and preferences as the shares of Common Stock presently outstanding.

Pursuant to the Reverse Stock

Split, the par value of our Common Stock will remain $0.001 per share. As a result of the Reverse Stock Split, at the Effective Time,

the stated capital on our balance sheet attributable to our Common Stock will be reduced in proportion to the size of the Reverse Stock

Split, subject to a minor adjustment in respect of the treatment of fractional shares, and the additional paid-in capital account would

be credited with the amount by which the stated capital is reduced. Our stockholders’ equity, in the aggregate, would remain unchanged.

Reasons for the Reverse Stock Split

The Board believes the Reverse

Stock Split will be beneficial to the Company for the following reasons:

| · | The Board believes that the increased market price of the Common Stock expected as a result of implementing

the Reverse Stock Split will improve the marketability of the Common Stock and will encourage interest and trading in the Common Stock

by brokerage houses and institutions that are not currently able or willing to trade the Common Stock. Because of the trading volatility

often associated with low-priced stocks, many potential investors have internal policies and practices that either prohibit them from

investing in low-priced stocks or that tend to discourage individual brokers from recommending low-priced stocks to their customers. In

addition, low-priced stocks not listed on an exchange are subject to the additional broker-dealer disclosure requirements and restrictions

found in SEC Rule 15g-6. |

| · | In connection with any potential listing of the Company’s Common Stock on a national exchange, we

will likely be required to effect a reverse stock split of our shares of Common Stock to meet the initial listing requirements, and the

actions set forth herein will allow the Board to quickly and efficiently implement any such reverse stock split without delay at such

time. |

It should be noted that the

liquidity of the Common Stock may be adversely affected by the Reverse Stock Split given the reduced number of shares that would be outstanding

after the Reverse Stock Split. The Board anticipates, however, that the expected higher market price and a subsequent exchange listing,

if any, could mitigate, to some extent, the effects on the liquidity through the anticipated increase in marketability discussed above.

The Board understands that

there is a risk that the market price for the Common Stock may not react proportionally to the Reverse Stock Split. For example, if the

Company accomplishes a 1-for-20 Reverse Stock Split at a time when the market price is $0.20 per share, there can be no assurance that

the resulting market price will thereafter remain at or above $4.00 per share.

The Board confirms that the

contemplated reverse stock split is not and will not be the first step in a series of plans or proposals of a “going private transaction”

within the meaning of Rule 13e-3 of the Exchange Act.

Criteria the Board of Directors May Use

to Determine Whether to Implement the Reverse Stock Split

When determining whether to

implement the Reverse Stock Split, and which Reverse Stock Split ratio to implement, if any, the Board may consider various factors, including:

| · | the historical trading price and trading volume of our Common Stock; |

| · | the then-prevailing trading price and trading volume of our Common Stock and the expected impact of the

Reverse Stock Split on the trading market for our Common Stock in the short- and long-term; |

| · | the number of shares of our Common Stock outstanding; |

| · | the anticipated impact of a particular ratio on the Company’s ability to reduce administrative and

transactional costs; and |

| · | prevailing general market, legal and economic conditions. |

Shares Held in Book-Entry and Through a

Broker, Bank or Other Holder of Record

The combination of, and reduction

in, the number of our outstanding shares of Common Stock as a result of the Reverse Stock Split will occur automatically at the Effective

Time without any additional action on the part of our stockholders.

Upon the Reverse Stock Split,

we intend to treat stockholders holding shares of our Common Stock in “street name” (that is, through a broker, bank or other

holder of record) in the same manner as registered stockholders whose shares of our Common Stock are registered in their names. Brokers,

banks or other holders of record will be instructed to effect the Reverse Stock Split for their beneficial holders holding shares of our

Common Stock in “street name”; however, these brokers, banks or other holders of record may apply their own specific procedures

for processing the Reverse Stock Split. If you hold your shares of our Common Stock with a broker, bank or other holder of record, and

you have any questions in this regard, we encourage you to contact your holder of record.

If you hold registered shares

of our Common Stock in book-entry form, you do not need to take any action to receive your post-Reverse Stock Split shares of our Common

Stock in registered book-entry form. A transaction statement will automatically be sent to your address of record as soon as practicable

after the Effective Time indicating the number of shares of our Common Stock you hold.

If you hold any of your shares

of our Common Stock in certificate form, you will receive a transmittal letter from our transfer agent as soon as practicable after the

Effective Time. The transmittal letter will be accompanied by instructions specifying how you can exchange your certificate representing

the pre-Reverse Stock Split shares of our Common Stock for either: (1) a certificate representing the post-Reverse Stock Split shares

of our Common Stock or (2) post-Reverse Stock Split shares of our Common Stock in book-entry form, evidenced by a transaction statement

that will be sent to your address of record indicating the number of shares of our Common Stock you hold. Beginning at the Effective Time,

each certificate representing pre-Reverse Stock Split shares of our Common Stock will be deemed for all corporate purposes to evidence

ownership of post-Reverse Stock Split shares.

Stockholders should

not destroy any share certificate(s) and should not submit any share certificate(s) until requested to do so.

No Appraisal Rights

Under the DGCL, stockholders

are not entitled to appraisal rights with respect to the proposed Reverse Stock Split and Reverse Stock Split Amendment.

Material U.S. Federal Tax Consequences of the

Reverse Stock Split

The following discussion is

a summary of material U.S. federal income tax consequences of an implemented Reverse Stock Split to U.S. Holders (as defined below). This

summary is based upon the Internal Revenue Code of 1986, as amended (the “Code”), Treasury regulations promulgated thereunder,

published rulings and administrative pronouncements of the Internal Revenue Service (“IRS”), and judicial decisions in each

case in existence on the date hereof, all of which are subject to change. Any such change could apply retroactively and could adversely

affect the tax consequences described below. No assurance can be given that the IRS will agree with the consequences described in this

summary, or that a court will not sustain any challenge by the IRS in the event of litigation. No advance tax ruling has been or will

be sought or obtained from the IRS regarding the tax consequences of the transactions described herein.

For purposes of this summary,

a “U.S. Holder” is a beneficial owner of shares of our Common Stock that is (a) an individual who is a citizen of the

United States or who is resident in the United States for U.S. federal income tax purposes, (b) an entity that is classified for

U.S. federal income tax purposes as a corporation and that is organized under the laws of the United States, any state thereof, or the

District of Columbia, or is otherwise treated for U.S. federal income tax purposes as a domestic corporation, (c) an estate the income

of which is subject to U.S. federal income taxation regardless of its source, or (d) a trust (i) whose administration is subject

to the primary supervision of a court within the United States and all substantial decisions of which are subject to the control of one

or more United States persons as described in Section 7701(a)(30) of the Code (“United States persons”), or (ii) that

has a valid election in effect under applicable Treasury regulations to be treated as a United States person.

This summary does not discuss

all U.S. federal income tax considerations that may be relevant to U.S. Holders in light of their particular circumstances or that may

be relevant to certain beneficial owners that may be subject to special treatment under U.S. federal income tax law (for example, tax-exempt

organizations, S corporations, partnership and other pass through entities (and investors therein), mutual funds, insurance companies,

banks and other financial institutions, dealers in securities, brokers or traders in securities, commodities or currencies, that elect

to use a mark-to-market method of accounting, real estate investment trusts, regulated investment companies, individual retirement accounts,

qualified pension plans, persons who hold shares of our Common Stock as part of a straddle, hedging, constructive sale, conversion, or

other integrated transaction, U.S. Holders that have a functional currency other than the U.S. dollar, and persons who acquired shares

of our Common Stock as a result of the exercise of employee stock options or otherwise as compensation or through a tax-qualified retirement

plan). Furthermore, this summary does not discuss any alternative minimum tax consequences or the Medicare contribution tax on net investment

income and does not address any aspects of U.S. state or local or non-U.S. taxation. This summary only applies to those beneficial owners

that hold shares of our Common Stock as “capital assets” within the meaning of Section 1221 of the Code (generally, property

held for investment).

If an entity classified for

U.S. federal income tax purposes as a partnership owns shares of our Common Stock, the tax treatment of a member of the entity will depend

on the status of the member and the activities of the entity and such member. The tax treatment of such an entity, and the tax treatment

of any member of such an entity, are not addressed in this summary. Any entity that is classified for U.S. federal income tax purposes

as a partnership and that owns shares of our Common Stock, and any members of such an entity, are encouraged to consult their tax advisors.

BENEFICIAL OWNERS OF SHARES

OF OUR COMMON STOCK ARE ENCOURAGED TO SEEK ADVICE FROM THEIR OWN TAX ADVISORS REGARDING THE INCOME TAX CONSEQUENCES OF THE REVERSE STOCK

SPLIT TAKING INTO ACCOUNT THEIR PARTICULAR SITUATIONS AS WELL AS ANY TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT ARISING UNDER THE U.S.

FEDERAL INCOME, ESTATE OR GIFT TAX LAWS OR UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR UNDER ANY APPLICABLE

INCOME TAX TREATY.

We intend to take the position

that the Reverse Stock Split constitutes a recapitalization for U.S. federal income tax purposes pursuant to Section 368(a)(1)(E) of

the Code. Assuming the Reverse Stock Split qualifies as a recapitalization:

| · | a U.S. Holder will not recognize gain or loss on the Reverse Stock Split; |

| · | the aggregate tax basis of the shares of our Common Stock received by a U.S. Holder in the Reverse Stock

Split will be equal to the aggregate tax basis of the shares exchanged therefor; and |

| · | the holding period of the shares of our Common Stock received by a U.S. Holder in the Reverse Stock Split

will include the holding period of the shares exchanged therefor. |

U.S. Treasury regulations

provide detailed rules for allocating the tax basis and holding period among shares of common stock which were acquired by a shareholder

on different dates and at different prices. U.S. Holders that acquired shares of our Common Stock on different dates or at different prices

should consult their tax advisors regarding the allocation of the tax basis and holding period among such shares.

NOTICE ITEM 3

AMENDED AND RESTATED 2018 STOCK OPTION PLAN

The Board and the Consenting

Stockholders have approved the Amended Option Plan, attached hereto as Exhibit C, to increase the number of shares of Common Stock

(“Shares”) available for issuance under the Option Plan from 4,000,000 shares to 10,000,000 shares, to extend the Option Plan’s

expiration date to May 18, 2033, and to update certain tax provisions.

The

Option Plan was effective as of January 24, 2018, and on January 31, 2018, the Company’s stockholders approved the Option

Plan, under which 2,000,000 shares of Common Stock were reserved for issuance. On February 19, 2020, the Board, subject to stockholder

approval, increased the number of Shares reserved for issuance to 4,000,000 shares, which was approved by the holders of a majority of

the outstanding Shares on August 14, 2020. As of May 22, 2023, the Company had 2,145,000 options issued and outstanding under

the Option Plan, and 1,855,000 Shares remained available for issuance. The Amended Option Plan will become effective 20 calendar

days after the mailing of this Information Statement.

The Board believes it is desirable

to increase the number of Shares authorized for issuance under the Option Plan to provide the Company with adequate flexibility to grant

stock options to incentivize, attract and compensate employees, consultants and directors of the Company and its parent and subsidiaries

(“affiliates”).

Summary of the Option Plan

The principal terms of the

Amended Option Plan are summarized below. This summary is not a complete description of the Amended Option Plan, and it is qualified in

its entirety by reference to the complete text of the Amended Option Plan document. The Amended Option Plan is attached as Exhibit C

to this Information Statement.

Shares

Available for Issuance. We initially reserved 2,000,000 Shares to be issued under the Option Plan (plus Shares related

to awards which are forfeited or expired). The Amended Plan reserves a total of 10,000,000 Shares.

Administration

of the Option Plan. The Amended Option Plan is administered by the Compensation Committee of the Board (the “Administrator”).

The Board shall appoint and remove members of the Compensation Committee in its discretion in accordance with applicable laws. The Administrator

may delegate non-discretionary administrative duties to such employees of the Company as it deems proper and the Board, in its absolute

discretion, may at any time and from time to time exercise any and all rights and duties of the Administrator under the Option Plan.

The

Administrator has the authority, in its discretion, to construe and interpret the Amended Option Plan, and to select participants, grant

options, modify or amend any option, and make all other determinations necessary or advisable for the administration of the Amended Option

Plan.

Eligibility.

The Amended Option Plan provides that employees, consultants, and non-employee directors of the Company or of any affiliate are eligible

to receive grants of stock options under the Amended Option Plan. Only employees are eligible to receive incentive stock options (“ISOs”)

under the Amended Option Plan. All eligible service providers may receive non-qualified stock options (“NQSOs”) under the

Amended Option Plan.

Awards.

The exercise price of each stock option must be at least equal to the fair market value of a Share on the date of grant; however,

the exercise price of ISOs granted to 10% stockholders must be at least equal to 110% of that value. The maximum term of options granted

under the Amended Option Plan is ten years or, in the case of an ISO granted to 10% stockholders, five years.

Dissolution,

Liquidation, Change in Capital Structure or Other Transaction. In the event of the proposed dissolution or liquidation of the

Company, the Administrator shall notify each optionee at least thirty days prior to such proposed action. All options will terminate

immediately prior to the consummation of such proposed action; however, the Administrator may permit exercise of any options prior to

their termination, even if such options were not otherwise exercisable. In the event of a merger or consolidation of the Company with

or into another corporation or entity in which the Company does not survive, or in the event of a sale of all or substantially all of

the assets of the Company in which the stockholders of the Company receive securities of the acquiring entity or an affiliate thereof,

all options shall be assumed or equivalent options shall be substituted. If options are not assumed or substituted, the Administrator

may permit the exercise of any of the options prior to consummation of such event, even if such options were not otherwise exercisable.

In the event there is a specified

type of change in our capital structure without our receipt of consideration, such as a stock split, appropriate adjustments will be made

to the number of Shares reserved under the Amended Option Plan and the number of Shares and exercise price of all outstanding option awards

under the Amended Option Plan, with fractional shares rounded down.

Termination

of Employment or Service. If for any reason other than death or permanent and total disability, an optionee ceases to

be employed by, or provide services as a consultant or director to, the Company or any of its affiliates, vested options held at the date

of termination may be exercised in whole or in part at any time within three months of the date of such termination, or such other

period of at least thirty days, as is specified in a stock option agreement (but in no event after the expiration date of the option).

However, the exercise period may be extended in the event that an exercise would violate Section 16(b) of the Exchange Act.

If an optionee dies or becomes permanently and totally disabled while employed by the Company or an affiliate or within the period that

the option remains exercisable after a termination or service, options then held (if exercisable) may be exercised at any time within

twelve months after the death or twelve months after the permanent and total disability of the optionee or any longer period

specified in the option agreement.

Repricing,

Exchange and Buyout of Awards. Stock options granted under the Amended Option Plan may be repriced, stock options may be cashed

out, or new awards may be issued in exchange for the surrender and cancellation of any, or all, outstanding awards, without stockholder

approval.

Restrictions

on Transfer. No option granted under the Amended Option Plan shall be assignable or otherwise transferable by the optionee

except by will, by the laws of descent and distribution, or pursuant to a qualified domestic relations

order, except with approval of the Administrator, which may be granted for NQSOs only. During the life of the optionee, an option

shall be exercisable only by the optionee.

Amendment

and Termination. The Amended Option Plan will terminate on May 18, 2033 (ten years following the date the Board approved

the Amended Option Plan), unless it is terminated earlier by the Board. The Board may amend or terminate the Amended Option Plan at any

time, which may be without shareholder approval, except where needed to preserve ISO treatment or if the Board concludes that shareholder

approval is advisable.

Federal Income Tax Consequences

The following is a brief summary

of the federal income tax consequences applicable to awards granted under the Amended Option Plan based on federal income tax laws in

effect on the date of this Information Statement. This summary is not intended to be exhaustive and does not address all matters that

may be relevant to a particular participant. Because circumstances may vary, we advise all participants to consult their own tax advisors

under all circumstances.

Incentive

Stock Options (ISOs). An optionee generally realizes no taxable income upon the grant or exercise of an ISO. However, the exercise

of an ISO may result in an alternative minimum tax liability to the employee. With some exceptions, a disposition of shares purchased

under an ISO within two years from the date of grant or within one year after exercise produces ordinary income to the optionee equal

to the value of the shares at the time of exercise less the exercise price. The same amount is deductible by the Company as compensation,

provided that the Company reports the income to the optionee. Any additional gain recognized in the disposition is treated as a capital

gain for which the Company is not entitled to a deduction. However, if the optionee exercises an ISO and satisfies the holding period

requirements, the Company may not deduct any amount in connection with the ISO. If a sale or disposition of shares acquired with the ISO

occurs after the holding period, the employee will recognize long-term capital gain or loss at the time of sale equal to the difference

between proceeds realized and the exercise price paid. In general, an ISO that is exercised by the optionee more than three months after

termination of employment is treated as an NQSO. ISOs are also treated as NQSOs to the extent that they first become exercisable by an

individual in any calendar year for shares having a fair market value (determined as of the date of grant) in excess of $100,000.

Non-Qualified

Stock Options (NQSOs). An optionee generally has no taxable income at the time of grant of an NQSO but realizes income in connection

with exercise of the option in an amount equal to the excess (at the time of exercise) of the fair market value of shares acquired upon

exercise over the exercise price. The same amount is deductible by the Company as compensation, provided that, in the case of an employee

option, the Company reports the income to the employee. Upon a subsequent sale or exchange of the shares, any recognized gain or loss

after the date of exercise is treated as capital gain or loss for which the Company is not entitled to a deduction.

New Plan Benefits

The awards under the Amended Option Plan are within

the discretion of the Administrator. As a result, the benefits that will be awarded under the Amended Option Plan are not determinable

at this time.

Existing Plan Benefits

No grants of awards under the Option Plan have

been made to any employees, directors or consultants in the last three fiscal years.

Equity Compensation Plan Information

The following table provides

information with respect to our compensation plans under which equity compensation is authorized as of December 31, 2022.

| |

Number of | | |

| | |

Number of | |

| |

securities to | | |

| | |

securities | |

| |

be issued | | |

| | |

remaining | |

| |

upon | | |

| | |

available | |

| |

exercise of | | |

| | |

for | |

| |

outstanding | | |

| | |

future issuance | |

| |

options | | |

| | |

under equity | |

| |

and | | |

Weighted-average exercise | | |

compensation | |

| Plan Category | |

rights | | |

price of outstanding options | | |

plans | |

| Equity compensation plans not approved by stockholders | |

| — | | |

| — | | |

| — | |

| 2008 Long-Term Incentive Compensation Plan | |

| 590,000 | | |

$ | 0.47 | | |

| — | |

| 2018 Stock Option Plan* | |

| 50,000 | | |

| 0.79 | | |

| 2,475,000 | |

| Total | |

| 640,000 | | |

$ | 0.50 | | |

| 2,475,000 | |

| * |

In February 2020, the Company’s

board of directors adopted a board resolution increasing the number of shares available for issuance under the 2018 Stock Option Plan

from 2,000,000 to 4,000,000. |

EXECUTIVE AND DIRECTOR COMPENSATION

Summary Compensation Table

The following table shows

the total compensation earned during the fiscal years ended December 31, 2022 and 2021 to (1) our Chief Executive Officer,

and (2) our other named executive officers during the fiscal years ended December 31, 2022 and 2021 (collectively, the

“named executive officers”):

| |

| | |

| | |

| | |

| | |

| | |

Non-equity | | |

Non-qualified | | |

| | |

| |

| |

| | |

| | |

| | |

| | |

| | |

incentive | | |

deferred | | |

| | |

| |

| |

| | |

| | |

| | |

Stock | | |

Option | | |

plan | | |

compensation | | |

All other | | |

| |

| Name and principal | |

| | |

Salary | | |

Bonus | | |

awards | | |

awards | | |

compensation | | |

earnings | | |

compensation | | |

Total | |

| Position | |

Year | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | |

| Matthew Flemming | |

| 2022 | | |

| 180,000 | | |

| 65,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 245,000 | |

| Chief Business Development Officer, Interim Chief Executive Officer and Interim Chief Financial Officer | |

| 2021 | | |

| 146,401 | | |

| 5,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 151,401 | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Jeffrey Martini | |

| 2022 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Former Chief Executive Officer and Chief Financial

Officer through August 2021 | |

| 2021 | | |

| 215,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 215,000 | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allen Parrott | |

| 2022 | | |

| 52,788 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 52,788 | |

| Former Chief Financial Officer and Acting Chief Executive Officer

August 2021 through April 2022 | |

| 2021 | | |

| 83,788 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 83,788 | |

All compensation awarded to

directors and executive officers are deliberated among, and approved by, the Board.

Executive Compensation

On October 1, 2017, we

entered into an employment agreement with Mr. Flemming, formerly our Chief Executive Officer. Pursuant to the terms of the agreement,

Mr. Flemming is paid an annual salary of $180,000 and receives health care insurance and other customary benefits. The initial term

of the agreement is for a period of three years, with automatic three month extensions after the first term. In addition to Mr. Flemming’s

base salary, Mr. Flemming is entitled to bonuses at the discretion of the Compensation Committee of the Board. On February 27,

2020, the Board agreed to pay Mr. Flemming $5,000 per month in exchange for providing a personal guarantee in connection with the

Company notes, where payments shall be made until the termination of Mr. Flemming’s personal guarantees. Mr. Flemming

waived this guarantee fee through December 31, 2020. In December 2020, Mr. Flemming agreed to a voluntary temporary salary

reduction to an annual rate of $144,000 until June 2022, when it was restored to $180,000 per year.

On August 24, 2021, the

Board appointed Allen Parrott to serve as the Chief Financial Officer of the Company. Through December 31, 2021, Mr. Parrott’s

salary was $225,000 per annum and included customary company benefits. Commencing on January 1, 2022, Mr. Parrott’s compensation

was revised to $3,000 per week for his services. Mr. Parrott ceased employment as an officer of the Company in March 2022.

From December 2020 to

August 2021, Jeffrey Martini served as our Chief Executive Officer, however, we were not party to an employment agreement with Mr. Martini.

Instead, APEX Heritage Group, Inc. (“Apex”) contracted directly with Mr. Martini for such management services, and

is routinely compensated in turn via the provision of debt and/or equity instruments under the terms of an interim management services

agreement, among other arrangements. During 2020, Apex was reimbursed via convertible debt valued at $225,000, which was in part compensation

for such employment.

Pay Versus Performance Table

The following table sets forth

additional compensation information of our Chief Executive Officers and our other named executive officers (averaged) along with total

shareholder return, and net income (loss) performance results for our fiscal years ending in 2021 and 2022:

| | | |

Summary

Compensation

Table

Total for

CEO #1 (1) (2) ($) | | |

Compensation

Actually

Paid to

CEO #1(1) (2) ($) | | |

Summary

Compensation

Table

Total for

CEO #2(1) (2) ($) | | |

Compensation

Actually

Paid to

CEO #2(1) (2) ($) | | |

Summary

Compensation

Table

Total for

CEO #3(1) (2) ($) | | |

Compensation

Actually

Paid to

CEO #3(1) (2) ($) | | |

Average

Summary

Compensation

Table for

Other NEOs

(1) (2) ($) | | |

Average

Compensation

Actually Paid

to Other

NEOs (1) (2) ($) | | |

Value

of

Initial

Fixed

$100

Investment

Based

on: Total

Shareholder

Return (3) ($) | | |

Net

Income (Loss)

($ in

thousands) | |

| | 2022 | | |

| 245,000 | | |

| 211,462 | | |

| 52,788 | | |

| 52,788 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 104 | | |

| (11,610 | ) |

| | 2021 | | |

| — | | |

| — | | |

| 83,788 | | |

| 83,788 | | |

| 215,000 | | |

| 215,000 | | |

| 151,401 | | |

| 234,050 | | |

| 260 | | |

| (11,217 | ) |

(1)

| Year |

CEO#1 |

CEO#2 |

CEO

#3 |

Other

NEOs |

| 2022 |

Matthew Flemming |

Allen Parrott |

|

None |

| 2021 |

|

Allen Parrott |

Jeffrey Martini |

Matthew Flemming

Stephen Christian |

(a) From

December 18, 2020 to August 23, 2021, Jeffrey Martini (CEO #1) served as our Chief Executive Officer. Allen Parrott was our

Acting Chief Executive Officer (CEO #2) from August 24, 2021 to April 14, 2022. Our current Interim Chief Executive Officer

is Matthew Flemming (CEO #3).

(2) None

of our named executive officers participates in a pension plan; therefore, no adjustment from the Summary Compensation total related to

pension value was made. Mr. Flemming was the only named executive officer for 2021 or 2022 with an outstanding equity award. None

of the named executive officers received an equity award in 2021 or 2022. A reconciliation of Total Compensation from the Summary Compensation

Table to Compensation Actually Paid to Mr. Flemming is shown below:

| Adjustments | |

2022 ($) | | |

2021 ($) | |

| Total Compensation from SCT | |

| 245,000 | | |

| 151,401 | |

| (Subtraction): SCT amounts | |

| — | | |

| — | |

| Addition: Fair value at year-end of awards granted during the covered fiscal year that are outstanding and unvested at year-end | |

| — | | |

| — | |

| Addition (Subtraction): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at year end | |

| (9,396 | ) | |

| 59,708 | |

| Addition: Vesting date fair value of awards granted and vesting during such year | |

| — | | |

| — | |

| Addition (Subtraction): Change as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which vesting conditions were satisfied during such year | |

| (24,142 | ) | |

| 22,941 | |

| (Subtraction): Fair value at end of prior year of awards granted in any prior fiscal year that fail to meet the applicable vesting conditions during such year | |

| — | | |

| — | |

| Compensation Actually Paid (as calculated) | |

| 211,462 | | |

| 234,050 | |

(3) Total

shareholder return as calculated based on a fixed investment of one hundred dollars measured from the market close on December 31,

2020 (the last trading day of 2020) through and including the end of the fiscal year for each year reported in the table.

Relationship between Pay and Performance

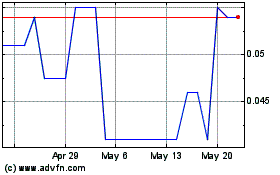

The charts shown below present

a graphical comparison of Compensation Actually Paid to our CEOs and the average Compensation Actually Paid to our Other NEOs set forth

in the Pay Versus Performance Table above, as compared against the following performance measures: our (1) total shareholder return

(TSR) and (2) net income (loss).

Compensation Actually Paid

versus TSR

| (1) | Total shareholder return in the above chart reflects the cumulative return of $100 as if invested on December 31,

2020, including reinvestment of any dividends. |

Compensation Actually Paid

versus Net Income (Loss)

Director Compensation

Director Compensation Table

During the year ended

December 31, 2022, none of our non-executive independent directors received compensation for their Board service.

Cash Compensation of Directors

Members of our Board do not

currently receive cash compensation for their services, however, the Board may in the future determine to compensate its members through

the payment of cash compensation. We reimburse our non-employee directors for out-of-pocket expenses for attending such meeting.

Equity Compensation of Directors

Our independent directors

are eligible to participate in our Option Plan. During 2022, no members of our Board received any cash or equity consideration for their

services.

Outstanding Equity Awards at 2022 Year End

Other than 1,000,000 options

to purchase shares of our common stock held by Mr. Flemming at an exercise price of $0.30 per share, of which 944,444 were exercisable

as of December 31, 2022, there are no outstanding unexercised options, unvested stock and equity incentive plan awards held by any

of our executive officers as of December 31, 2022. The Company granted such options to Mr. Flemming on February 28, 2020,

and 1/36 of the options vest monthly thereafter.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth,

as of May 8, 2023, information regarding the beneficial ownership of our Common Stock based upon the most recent information available

to us for: (i) each person known by us to own beneficially five percent (5%) or more of our outstanding Common Stock, (ii) each

of our named executive officers and directors, and (iii) all of our current executive officers and directors as a group. Unless otherwise

indicated, each of the persons listed below has sole voting and investment power with respect to the shares beneficially owned by them.

As of May 8, 2023, there were 47,739,284 shares of our Common Stock issued and outstanding. Except as otherwise listed below, the

address of each person is 20475 State Hwy 249, Suite 450, Houston Texas 77070.

| | |

Amount of Beneficial | | |

| |

| | |

Ownership of Common | | |

Percent of Common | |

| Name | |

Stock (1) | | |

Stock | |

| George Gilman (7) | |

| 3,457,630 | | |

| 7.1 | % |

| Dane Stewart (8) | |

| 4,025,000 | | |

| 8.3 | % |

| Richard Fallin (9) | |

| 11,500,000 | | |

| 23.7 | % |

| | |

| | | |

| | |

| Directors and Named Executive Officers: | |

| | | |

| | |

| Matthew Flemming (2) | |

| 1,600,000 | | |

| 3.3 | % |

| Steven Madden (3) | |

| 63,040,480 | | |

| 66.5 | % |

| Newton Dorsett (4) | |

| 3,376,840 | | |

| 6.9 | % |

| Joseph Page | |

| — | | |

| — | |

| Allen Parrott | |

| — | | |

| — | |

| Brady Crosswell (5) | |

| 6,900,000 | | |

| 14.2 | % |

| Todd Riedel | |

| — | | |

| — | |

| James E. Frye (6) | |

| 10,890,434 | | |

| 22.5 | % |

| All Directors and Executive Officers as a group (7 persons) (1)-(6) | |

| 85,807,754 | | |

| 78.5 | % |

*less than one percent

| (1) | Pursuant to the rules and regulations of the Securities and Exchange Commission, shares of Common

Stock that an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants or the conversion

of convertible promissory notes are deemed to be outstanding for the purposes of computing the percentage ownership of such individual

or group, but are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person shown in the

table. |

| (2) | Flemming Family Trust, an irrevocable trust, is the owner of 600,000 of the shares. Rolf O. Flemming,

father to Matthew Flemming, is the grantor of the trust and Matthew Flemming is the trustee. Certain of his immediate relatives are the

beneficiaries. Includes 1,000,000 shares of Common Stock issuable upon the exercise of options held by Mr. Flemming. |

| (3) | Includes: (i) 43,144,390 shares of Common Stock issuable upon the conversion of convertible promissory

notes held by Mr. Madden, (ii) 1,848,000 shares of Common Stock and 3,660,000 shares of Common Stock issuable upon the conversion

of a convertible promissory note held by Apex Heritage Investments, LLC, over which Mr. Madden has sole voting and investment control,

and (iii) 375,000 shares held by Madden Heritage Foundation, over which Mr. Madden has sole voting and investment control. The

business address of Steven H. Madden is 9821 Katy Freeway #880, Houston, Texas 77024. |

| (4) | Includes 775,920 shares of Common Stock issuable upon the conversion of convertible promissory notes held

by Mr. Dorsett. The address for Mr. Dorsett is 220 Travis Street, 5th Floor, Shreveport, LA 71101. |

| (5) | Includes: (i) 2,525,000 shares of Common Stock and 4,000,000 shares of Common Stock issuable upon

the conversion of convertible promissory notes held by Grey Fox Investments LLC, of which Mr. Crosswell is the sole member and manager

and over which he has sole voting and investment control, and (ii) 375,000 shares of Common Stock held by Grey Fox Secured Funding

LP, over which Mr. Crosswell has sole voting and investment control. The business address of Grey Fox Investments LLC is 902 Wild

Valley Road, Houston, Texas 77057. |

| (6) | Includes 8,707,090 shares of Common Stock issuable upon the conversion of convertible promissory notes

held by Mr. Frye. |

| (7) | Includes: (i) 650,015 shares of Common Stock held by Aeneas, LC, of which Mr. Gilman is the

manager and over which he has sole voting and investment control, (ii) 812,164 shares of Common Stock held by The Mary Payne Family

Trust, of which Mr. Gilman is the Trustee and over which he has sole voting and investment control, (iii) 140,000 shares of

Common Stock issuable upon the conversion of a convertible note held by the Mary Payne Trust, (iv) 195,000 shares of Common Stock

issuable upon the exercise of warrants held by The Mary Payne Trust, and (v) 803,334 shares of Common Stock issuable upon the exercise

of warrants held by Mr. Gilman. |

| (8) | Includes: (i) 300,000 shares of Common Stock and 2,000,000 shares of Common Stock issuable upon the

conversion of a convertible promissory note held by Stewart Investment Partners Ltd. of which Mr. Stewart is the managing partner

and over which he has sole voting and investment control, and (ii) 225,000 shares of Common Stock and 1,500,000 shares of Common

Stock issuable upon the conversion of a convertible promissory note held by Whitewing Investment Partners I, Ltd., of which Mr. Stewart

is the managing partner and over which he has sole voting and investment control. The business address for Mr. Stewart is 7500 San

Felipe, Suite 1060, Houston, Texas 77063. |

| (9) | Includes 10,000,000 shares of Common Stock issuable upon the conversion of convertible promissory notes

held by Mr. Fallin. The address for Mr. Fallin is 9545 Katy Freeway, Houston, Texas 77024. |

Interest

of Certain Persons in or Opposition to Matters to be Acted Upon

No officer, director or director

nominee of the Company has any substantial interest in the matters acted upon, other than his role as an officer, director or stockholder

of the Company. No director of the Company informed the Company that such director opposed any of the actions as set forth in this Information

Statement.

DELIVERY

OF DOCUMENTS TO SECURITY

HOLDERS SHARING AN ADDRESS

Only one copy of this Information

Statement is being delivered to multiple stockholders sharing an address, unless the Company has received contrary instructions from one

or more of the stockholders. The Company will deliver promptly, upon written or oral request, a separate copy of this Information Statement

to a stockholder at a shared address to which a single copy of this document was delivered. A stockholder may mail a written request to

SMG Industries Inc., Attention: Secretary, 20475 State Hwy 249, Suite 450, Houston Texas 77070, or call (713) 955-3497, to request:

| ● | a separate copy of this Information Statement; |

| ● | a separate copy of Information Statements in the future; or |

| ● | delivery of a single copy of Information Statements, if such stockholder is receiving multiple copies of those documents. |

ADDITIONAL INFORMATION

The Company is subject to the informational requirements

of the Exchange Act and in accordance therewith files reports, proxy statements and other information, including annual and quarterly

reports on Form 10-K and 10-Q and current reports on Form 8-K, with the SEC. The SEC maintains a website on the Internet (http://www.sec.gov)

that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC,

including the Company.

The entire cost of furnishing this Information

Statement will be borne by the Company. The Company will request brokerage houses, nominees, custodians, fiduciaries and other like parties

to forward this Information Statement to the beneficial owners of the Common Stock held of record by them and will reimburse such persons

for their reasonable charges and expenses in connection therewith. The close of business on May 25, 2023 is the Record Date for the

determination of stockholders who are entitled to receive this Information Statement.

You are being provided with this Information Statement

pursuant to Section 14(c) of the Exchange Act and Regulation 14C and Schedule 14C thereunder, and, in accordance therewith,

none of the actions described above will become effective until at least 20 calendar days after the mailing of this Information Statement.

This Information Statement is expected to be mailed

on or about June 2, 2023 to all stockholders of record at the close of business on the Record Date.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Matthew C. Flemming |

| |

Matthew C. Flemming, Chairman and CEO |

Exhibit A

PROPOSED AMENDMENT

TO THE

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

SMG INDUSTRIES INC.

INCREASE IN AUTHORIZED

SHARES OF COMMON STOCK

The amendment would provide

that Article Fourth of the Amended and Restated Certificate of Incorporation be amended to read in its entirety as follows:

“FOURTH:

The total number of shares of all classes of capital stock which the Corporation shall have the authority to issue is 501,000,000 shares,

consisting of 500,000,000 shares of Common Stock with a par value of $.001 per share (the “Common Stock”) and 1,000,000 shares

of Preferred Stock with a par value of $.001 per share (the “Preferred Stock”).

A description

of the respective classes of stock and a statement of the designations, preferences, voting powers (or no voting powers), relative, participating,

optional or other special rights and privileges and the qualifications, limitations and restrictions of the Preferred Stock and Common

Stock are as follows:

The Preferred

Stock may be issued in one or more series at such time or times and for such consideration or considerations as the Corporation’s

Board of Directors may determine. Each series of Preferred Stock shall be so designated as to distinguish the shares thereof

from the shares of all other series and classes. Except as otherwise provided in this Certificate of Incorporation, different

series of Preferred Stock shall not be construed to constitute different classes of shares for the purpose of voting by classes.

The Board of

Directors is expressly authorized to provide for the issuance of all or any shares of the Preferred Stock in one or more series, each

with such designations, preferences, voting powers (or no voting powers), relative, participating, optional or other special rights and

privileges and such qualifications, limitations or restrictions thereof as shall be stated in the resolution or resolutions adopted by

the Board of Directors to create such series, and a certificate of said resolution or resolutions shall be filed in accordance with the

General Corporation Law of the State of Delaware. The authority of the Board of Directors with respect to each such series

shall include, without limitation of the foregoing, the right to provide that the shares of each such series may: (i) have such distinctive

designation and consist of such number of shares; (ii) be subject to redemption at such time or times and at such price or prices;

(iii) be entitled to the benefit of a retirement or sinking fund for the redemption of such series on such terms and in such amounts;

(iv) be entitled to receive dividends (which may be cumulative or non-cumulative) at such rates, on such conditions, and at such

times, and payable in preference to, or in such relation to, the dividends payable on any other class or classes or any other series of

stock; (v) be entitled to such rights upon the voluntary or involuntary liquidation, dissolution or winding up of the affairs, or

upon any distribution of the assets of the Corporation in preference to, or in such relation to, any other class or classes or any other

series of stock; (vi) be convertible into, or exchangeable for, shares of any other class or classes or any other series of stock

at such price or prices or at such rates of exchange and with such adjustments, if any; (vii) be entitled to the benefit of such

conditions, limitations or restrictions, if any, on the creation of indebtedness, the issuance of additional shares of such series or

shares of any other series of Preferred Stock, the amendment of this Certification of Incorporation or the Corporation’s By-Laws,

the payment of dividends or the making of other distributions on, or the purchase, redemption or other acquisition by the Corporation

of, any other class or classes or series of stock, or any other corporate action; or (viii) be entitled to such other preferences,

powers, qualifications, rights and privileges, all as the Board of Directors may deem advisable and as are not inconsistent with law and

the provisions of this Certificate of Incorporation.

1. Relative

Rights of Preferred Stock and Common Stock. All preferences, voting powers, relative, participating, optional or other

special rights and privileges, and qualifications, limitations, or restrictions of the Common Stock are expressly made subject and subordinate

to those that may be fixed with respect to any shares of the Preferred Stock.

2. Voting

Rights. Except as otherwise required by law or this Certificate of Incorporation, each holder of Common Stock shall have

one vote in respect of each share of stock held by him of record on the books of the Corporation for the election of directors and on

all matters submitted to a vote of stockholders of the Corporation.

3. Dividends. Subject

to the preferential rights of the Preferred Stock, if any, the holders of shares of Common Stock shall be entitled to receive, when and

if declared by the Board of Directors, out of the assets of the Corporation which are by law available therefor, dividends payable either

in cash, in property or in shares of capital stock.

4. Dissolution,

Liquidation or Winding Up. In the event of any dissolution, liquidation or winding up of the affairs of the Corporation,

after distribution in full of the preferential amounts, if any, to be distributed to the holders of shares of the Preferred Stock, holders

of Common Stock shall be entitled, unless otherwise provided by law or this Certificate of Incorporation, to receive all of the remaining

assets of the Corporation of whatever kind available for distribution to stockholders ratably in proportion to the number of shares of

Common Stock held by them respectively.”

Exhibit B

PROPOSED AMENDMENT

TO THE

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

SMG INDUSTRIES INC.

REVERSE STOCK SPLIT

The amendment would add

a new Subsection 5 to Section B of Article Fourth of the Amended and Restated Certificate of Incorporation as follows:

5. “Upon

the filing and effectiveness (the “Reverse Stock Split Effective Time”) pursuant to the GCL of the State of Delaware of the

Certificate of Amendment to these Articles of Incorporation of the Corporation, each [number between and including 5 and

50] shares of Common Stock issued and outstanding immediately prior to the Reverse Stock

Split Effective Time shall, automatically and without any further action on the part of the Corporation or any of the respective holders

thereof, be reclassified, combined and converted into one (1) fully paid and nonassessable share of Common Stock (the “Reverse

Stock Split”), subject to the treatment of fractional share interests as described below. The reclassification of the Common Stock

will be deemed to occur at the Reverse Stock Split Effective Time. From and after the Reverse Stock Split Effective Time, certificates

representing Common Stock prior to such reclassification shall represent the number of shares of Common Stock into which such Common Stock

prior to such reclassification shall have been reclassified pursuant to the Certificate of Amendment. No fractional shares shall be issued

in connection with the Reverse Stock Split and, in lieu thereof, the number of shares to be received by a stockholder shall be rounded

up to the nearest whole number of shares in the event that such stockholder would otherwise be entitled to receive a fractional share

upon the Reverse Stock Split.”

Exhibit C

AMENDED

AND RESTATED

2018 STOCK OPTION

PLAN

OF

SMG

INDIUM RESOURCES LTDINDUSTRIES INC.

The

purposes of the Amended and Restated 2018 Stock Option Plan (the “Plan”) of

SMG Indium Resources, LtdIndustries Inc., a Delaware

corporation (the “Company”), are to:

(a) Encourage

selected employees, directors and consultants to improve operations and increase profits of the Company;

(b) Encourage

selected employees, directors and consultants to accept or continue employment or association with the Company or its Affiliates; and

(c) Increase

the interest of selected employees, directors and consultants in the Company's welfare through participation in the growth in value of

the common stock of the Company (the “Shares”).

Options

granted under this Plan (“Options”) may be “incentive stock options” (“ISOs”) intended to satisfy

the requirements of Section 422 of the Internal Revenue Code of 1986, as amended, and the regulations thereunder (the “Code”),

or “non-qualified stock options” (“NQSOs”).

Every

person who at the date of grant of an Option is an employee of the Company or of any Affiliate (as defined below) of the Company is eligible

to receive NQSOs or ISOs under this Plan. Every person who at the date of grant is a consultant to, or non-employee director

of, the Company or any Affiliate (as defined below) of the Company is eligible to receive NQSOs under this Plan. The term “Affiliate”

as used in the Plan means a parent or subsidiary corporation as defined in the applicable provisions (currently Sections 424(e) and

(f), respectively) of the Code. The term “employee” (within the meaning of Section 3401(c) of the Code)

includes an officer or director who is an employee of the Company. The term “consultant” includes persons employed

by, or otherwise affiliated with, a consultant.

| 3. |

STOCK SUBJECT TO THIS PLAN; MAXIMUM NUMBER OF GRANTS |

Subject

to the provisions of Section 6.1.1 of the Plan, the total number of Shares which may be issued under Options granted pursuant to

this Plan shall not exceed twoten million

(2,000,00010,000,000) Shares. The Shares covered

by the portion of any grant under the Plan which expires unexercised shall become available again for grants under the Plan.

(a) The

Plan shall be administered by either the Board of Directors of the Company (the “Board”) or by a committee (the “Committee”)

to which administration of the Plan, or of part of the Plan, may be delegated by the Board (in either case, the “Administrator”). The

Board shall appoint and remove members of such Committee, if any, in its discretion in accordance with applicable laws. If necessary in

order to comply with Rule 16b-3 under the Securities Exchange Act and

Section 162(m) of the Codeof 1934, as amended (the “Exchange Act”),

the Committee shall, in the Board's discretion, be comprised solely of “non-employee directors” within the meaning of said

Rule 16b-3 and “outside directors” within the meaning of Section 162(m) of

the Code. The foregoing notwithstanding, the Administrator may delegate nondiscretionary administrative duties to such

employees of the Company as it deems proper and the Board, in its absolute discretion, may at any time and from time to time exercise

any and all rights and duties of the Administrator under the Plan.

(b) Subject

to the other provisions of this Plan, the Administrator shall have the authority, in its discretion: (i) to grant Options; (ii) to

determine the fFair mMarket

vValue of the Shares subject to Options; (iii) to