0001343465

false

FY

P2Y

P1Y

0001343465

2022-01-01

2022-12-31

0001343465

2022-06-30

0001343465

2023-04-17

0001343465

2022-12-31

0001343465

2021-12-31

0001343465

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001343465

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001343465

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001343465

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001343465

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001343465

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001343465

2021-01-01

2021-12-31

0001343465

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2020-12-31

0001343465

us-gaap:CommonStockMember

2020-12-31

0001343465

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001343465

us-gaap:RetainedEarningsMember

2020-12-31

0001343465

us-gaap:NoncontrollingInterestMember

2020-12-31

0001343465

2020-12-31

0001343465

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001343465

us-gaap:CommonStockMember

2021-12-31

0001343465

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001343465

us-gaap:RetainedEarningsMember

2021-12-31

0001343465

us-gaap:NoncontrollingInterestMember

2021-12-31

0001343465

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001343465

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001343465

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001343465

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001343465

us-gaap:NoncontrollingInterestMember

2021-01-01

2021-12-31

0001343465

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001343465

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001343465

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001343465

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001343465

us-gaap:NoncontrollingInterestMember

2022-01-01

2022-12-31

0001343465

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001343465

us-gaap:CommonStockMember

2022-12-31

0001343465

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001343465

us-gaap:RetainedEarningsMember

2022-12-31

0001343465

us-gaap:NoncontrollingInterestMember

2022-12-31

0001343465

SNPW:SunPacificPowerCorpMember

2022-01-01

2022-12-31

0001343465

srt:MaximumMember

2022-12-31

0001343465

us-gaap:VehiclesMember

2022-01-01

2022-12-31

0001343465

us-gaap:EquipmentMember

2022-01-01

2022-12-31

0001343465

SNPW:ForbearanceAgreementMember

2022-01-01

2022-12-31

0001343465

SNPW:OutdoorAdvertisingShelterRevenuesMember

2022-01-01

2022-12-31

0001343465

SNPW:OutdoorAdvertisingShelterRevenuesMember

2021-01-01

2021-12-31

0001343465

srt:ScenarioPreviouslyReportedMember

2021-12-31

0001343465

srt:RestatementAdjustmentMember

2021-12-31

0001343465

SNPW:PrivatePlacementMemorandumMember

2016-08-23

2016-08-24

0001343465

SNPW:PrivatePlacementMemorandumMember

2016-08-24

0001343465

2016-08-23

2016-08-24

0001343465

2016-08-24

0001343465

2018-08-31

0001343465

2018-08-01

2018-08-31

0001343465

SNPW:NicholasCampanellaMember

2015-10-22

2015-10-23

0001343465

SNPW:NicholasCampanellaMember

2015-10-23

0001343465

SNPW:NicholasCampanellaMember

2022-12-31

0001343465

SNPW:NicholasCampanellaMember

2021-12-31

0001343465

SNPW:NicholasCampanellaMember

2016-08-23

2016-08-24

0001343465

SNPW:NicholasCampanellaMember

2016-08-24

0001343465

SNPW:NicholasCampanellaMember

us-gaap:SeriesBPreferredStockMember

2016-08-23

2016-08-24

0001343465

SNPW:ContributionAgreementsMember

2018-06-01

2018-06-30

0001343465

SNPW:ContributionAgreementsMember

2018-06-30

0001343465

SNPW:LineofCreditAgreementMember

SNPW:NicholasCampanellaMember

2015-10-22

2015-10-23

0001343465

SNPW:LineofCreditAgreementMember

SNPW:NicholasCampanellaMember

2022-12-31

0001343465

SNPW:LineofCreditAgreementMember

SNPW:NicholasCampanellaMember

2021-12-31

0001343465

SNPW:PromissoryNoteMember

2019-06-21

0001343465

SNPW:PromissoryNoteMember

2019-07-07

2019-07-08

0001343465

SNPW:PromissoryNoteMember

2022-12-31

0001343465

SNPW:PromissoryNoteMember

2021-12-31

0001343465

SNPW:SeriesBConvertiblePreferredStockMember

2022-12-31

0001343465

SNPW:SeriesBConvertiblePreferredStockMember

2021-12-31

0001343465

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-12-31

0001343465

us-gaap:SeriesBPreferredStockMember

2017-10-02

2017-10-03

0001343465

us-gaap:SeriesCPreferredStockMember

SNPW:ReverseMergerMember

2022-01-01

2022-12-31

0001343465

us-gaap:SeriesCPreferredStockMember

2022-01-01

2022-12-31

0001343465

2020-01-01

2020-12-31

0001343465

SNPW:WarrantOneMember

2022-12-31

0001343465

SNPW:WarrantOneMember

2022-01-01

2022-12-31

0001343465

SNPW:WarrantTwoMember

2022-12-31

0001343465

SNPW:WarrantTwoMember

2022-01-01

2022-12-31

0001343465

SNPW:NicholasCampanellaMember

SNPW:EmploymentAgreementMember

2014-12-19

2014-12-20

0001343465

us-gaap:SeriesAPreferredStockMember

2017-10-01

2017-10-31

0001343465

srt:ChiefExecutiveOfficerMember

us-gaap:CommonStockMember

2017-10-01

2017-10-31

0001343465

srt:ChiefExecutiveOfficerMember

2017-10-31

0001343465

SNPW:NicholasCampanellaMember

SNPW:EmploymentAgreementMember

2022-12-31

0001343465

SNPW:NicholasCampanellaMember

SNPW:EmploymentAgreementMember

2021-12-31

0001343465

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNPW:CustomerOneMember

2022-01-01

2022-12-31

0001343465

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNPW:CustomerTwoMember

2022-01-01

2022-12-31

0001343465

us-gaap:SalesRevenueNetMember

SNPW:CustomerOneMember

2022-12-31

0001343465

us-gaap:SalesRevenueNetMember

SNPW:CustomerTwoMember

2022-12-31

0001343465

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNPW:CustomerOneMember

2021-01-01

2021-12-31

0001343465

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNPW:CustomerTwoMember

2021-01-01

2021-12-31

0001343465

us-gaap:SalesRevenueNetMember

SNPW:CustomerOneMember

2021-12-31

0001343465

us-gaap:SalesRevenueNetMember

SNPW:CustomerTwoMember

2021-12-31

0001343465

us-gaap:SubsequentEventMember

SNPW:CACRealtyLLCMember

2023-03-30

2023-04-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2022

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from to

Commission

file number 000-55785

Sun

Pacific Holding Corp

(Exact

name of registrant as specified in its charter)

| Nevada

|

|

90-1119774

|

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

345

Highway 9 South Suite 388

Manalapan

NJ 07726

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (732) 845-0906

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Exchange Act:

Common

Stock, $.0001 par value per share

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act ☐ Yes ☒ No

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

No

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). ☐ Yes ☒ No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non- accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer”, “accelerated filer”, “non-accelerated filer”,

“smaller reporting company” and “emerging growth” in Rule 12b-2 of the Exchange Act.

| Large

Accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☐ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s Knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒ Yes ☐ No

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As

of June 30, 2022, the last business day of the Registrant’s most recently completed fiscal year, the market value of our common

stock held by non-affiliates was $8,469,108, which is based on the closing price of such common equity, as of the last practical business

day of the registrant’s most recently completed fiscal year of $0.009.

The

number of shares of the Registrant’s common stock, $0.0001 par value per share, outstanding as of April 17, 2023 was 974,953,335.

TABLE

OF CONTENTS

GENERAL

INFORMATION

FORWARD-LOOKING

STATEMENTS

Certain

statements discussed in Item 1 (Business), Item 3 (Legal Proceedings), Item 7 (Management’s Discussion and Analysis of Financial

Condition and Results of Operations and elsewhere in this Annual Report on Form 10-K as well as in other materials and oral statements

that the Company releases from time to time to the public constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Such forward-looking statements concerning management’s expectations, strategic

objectives, business prospects, anticipated economic performance and financial condition and other similar matters involve significant

known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of

results to differ materially from any future results, performance or achievements discussed or implied by such forward-looking statements.

Such risks, uncertainties and other important factors are discussed and Item 7 Management’s Discussion and Analysis of Financial

Condition and Results of Operations. In addition, these statements constitute the Company’s cautionary statements under the Private

Securities Litigation Reform Act of 1995. It should be understood that it is not possible to predict or identify all such factors. Consequently,

the following should not be considered to be a complete discussion of all potential risks or uncertainties. The words “anticipate,”

“estimate,” “expect,” “project,” “intend,” “believe,” “plan,”

“target,” “forecast” and similar expressions are intended to identify forward-looking statements. Forward-looking

statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide

any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations or any change in

events, conditions or circumstances on which the forward-looking statement is based. It is advisable, however, to consult any further

disclosures the Company makes on related subjects in its Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the

Securities and Exchange Commission.

PART

I

Item

1. Business

Company

Overview

The

Company was incorporated under the laws of the State of New Jersey on July 28, 2009, as Sun Pacific Power Corporation and together with

its subsidiaries, are referred to as the “Company”. On August 24, 2017, the Company entered into an Acquisition Agreement

with EXOlifestyle, Inc. whereby the Company became a wholly owned subsidiary of EXOlifestyle, Inc. The acquisition was accounted for

as a reverse merger, resulting in the Company being considered the accounting acquirer. Accordingly, the accompanying consolidated financial

statements included the accounts of EXOlifestyle, Inc. since August 24, 2017.

Utilizing

management’s history in general contracting, coupled with our subject matter expertise and intellectual property (“IP”) knowledge

of solar panels and other leading-edge technologies, the Company is focused on building a “Next

Generation” green energy company. The Company offers competitively priced “Next Generation” solar panel and lighting

products by working closely with design, engineering, integration and installation firms in order to deliver turnkey solar and other

energy efficient solutions. We provide solar bus stops,

solar trashcans and “street kiosks” that utilize our unique advertising offerings that provide State and local municipalities

with costs efficient solutions.

Our

green energy solutions can be customized to meet most enterprise and/or government mandated regulations and advanced system requirements.

Our portfolio of products and services allow our clients to select a solution that enables them to establish a viable standard product

offering that focuses on the goals of the client’s entire organization.

Currently,

the Company has four (4) subsidiary holdings. Sun Pacific Power Corp., which was the initial company that specialized in solar &

other renewable energy projects., The Company also formed National Mechanical Group Corp, a New Jersey corporation focused on holding

the Company’s patents. The Company also formed Street Smart Outdoor Corp, a Wyoming corporation that acts as a holding company

for the Company’s state specific operations in unique advertising through solar bus stops, solar trashcans and “street kiosks.”

The Company also formed Elba Power Corp, an Alabama Corp for the development of a Solar Assembly company. Elba Power Corp has entered

into a property purchase contract for approximately $3 million, pending financing, and has obtained the approval for an inducement resolution

for $50 million dollars from the State of Alabama, along with a 100% tax abatement on sales and use tax in support of the development

of a solar assembly plant. Elba Power Corp is currently working with potential funders in support of the capitalization and development

of the project.

Sun

Pacific Power Corp. has entered into an agreement with FoxEss, a global leader in the development

of inverter and energy storage solutions as a wholesale distributer for North and South America and Australia. Sun Pacific Power Corp.

has also entered into an agreement with a South Asian solar manufacturer to act as an original equipment manufacturer (“OEM”)

for Sun Pacific Solar Panels and associated products. Sun Pacific Power Corp has also commenced in April 2023, a sales, marketing, and

affiliate program to market and install residential solar panels in various markets within the United States.

As

of today, our principal source of revenues is derived from Street Smart Outdoor Corp. operations in the outdoor advertising business

with contracts in place in New Jersey and Florida.

On

September 19, 2019, the United States Patent and Trademark Office published patent US 2019 288 139 A1 for the Frame-Less Encapsulated

Photo-Voltaic (PV) Solar Power Panel Supporting Solar Cell Modules Encapsulated Within Optically-Transparent Epoxy-Resin Material Coating

a Phenolic Resin Support Sheet issued to National Mechanical Group Corp. Originally designed for application in the solar bus shelters

operated by Street Smart Outdoor Corp, as a glassless solar panel, the Company has developed a patent protected product and process for

creating solar panels that can be integrated directly into the design of products as a molded, weather resistant plastic. The Company

began work developing a business plan for expanding on either manufacturing or licensing of the technology in 2020, with such work continuing

into 2023.

Strategic

Vision

Our

objective is to grow our business as a premier green energy-based provider of both product and services to the public and private sectors.

We are working to deploy our strategy in building upon our green energy expertise in conjunction with our intellectual property and subject

matter expertise that may allow us to grow a group of business lines in solar and other unique energy related areas.

Recent

advances in a multitude of different yet converging technologies have significantly improved the ability to integrate energy efficient

products and solutions into infrastructure related projects. These technological advances decrease the requirements needed to jointly

operate a multitude of differing assets, devices, and tools that create new ways to integrate evolving new technologies. This technological

change and convergence in energy efficient devices, integrated communications among devices, and societal needs to more effectively and

environmentally friendly we believe presents a significant opportunity for us in providing and supporting simple to complex integrated

solutions.

Our

challenges continue to be reaching critical mass in our solar shelter business, expanding into other green energy related projects, and

securing operational capital. While the Company has never been adequately funded from inception, the Company has attempted to use debt,

equity, and other opportunistic in-kind compensation to further the Company’s strategic vision.

Going

Concern

The

Company has an accumulated deficit of approximately $8.0 million and a working capital deficit of approximately $3.1 million as of December

31, 2022. The Company’s continuation as a going concern is dependent on its ability to generate sufficient cash flows from operations

to meet its obligations and/or obtain additional financing from its stockholders and/or other third parties.

In

order to further implement its business plan and satisfy its working capital requirements, the Company will need to raise additional

capital. There is no guarantee that the Company will be able to raise additional equity or debt financing at acceptable terms, if at

all.

There

is no assurance that the Company will ever be profitable. These consolidated financial statements do not include any adjustments to reflect

the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that

may result should the Company be unable to continue as a going concern.

Competition

Our

competitive market is made up of a variety of small to large company’s depending upon the area that we are competing within. In

the solar and advertising shelter marketplace it is made up of a smaller amount of direct competitors including JC Decaux, Lamar, Clear

Chanel, Signal Outdoor, and various others. We believe the Shelter marketplace and the new areas in other green energy marketplace may

be subject to more technological change. Given this we believe that the major competitive factors in our marketplace are distinctive

technical competencies, governmental certifications and approvals to operate within this space, successful past contract performance,

price of services, reputation for quality, and key management personnel with domain expertise.

Marketing

and Sales

We

currently engage in a limited amount of marketing activities related to request for proposals for projects related to government contracts

and or other contracting activities with commercial and private entities. We are developing a variety of new marketing activities designed

to broaden our market awareness of our products, services and solutions, that may include e-mail and direct mail campaigns, co-marketing

strategies designed to leverage developing strategic relationships, website marketing, topical webcasts, public relations campaigns,

speaking engagements and forums and industry analyst visibility initiatives. We plan to participate in and sponsor conferences that cater

to our target market and demonstrate and promote our products, services and solutions at trade shows targeted to green energy companies

and executives. We also plan to publish white papers relating to green energy projects and develop customer reference programs, such

as customer case studies, in an effort to promote better awareness of industry issues and demonstrate that our solutions can address

many of the benefits of our solutions.

Our

marketing strategy is to build our brand and increase market awareness of our products, services, and solutions in our target markets

and to generate qualified sales leads that will allow us to successfully build strong relationships with key decision makers. We plan

to use partnerships and other business arrangements to augment our marketing and sales reach in both our outdoor advertising, construction,

and waste to energy business.

Clients

Our

client base is presently made up predominately of U.S. based national advertisers. Historically, we have derived, and may continue to

derive in the future, a significant percentage of our total revenues from a relatively small number of contracts. Due to the nature of

our business and the relative size of certain contracts, which are entered into in the ordinary course of business, the loss of any single

significant customer would have a material adverse effect on our results of operations. In future periods, we will continue to focus

on diversifying our revenue by increasing the number of our customer contracts and seeking out partnerships that will allow us to increase

our customer reach.

Intellectual

Property

Our

intellectual property rights are important to our business. We believe we will come to rely on a combination of patent, copyright, trademark,

service mark, trade secret and other rights in the United States and other jurisdictions, as well as confidentiality procedures and contractual

provisions to protect our proprietary technology, processes and other intellectual property. We will protect our intellectual property

rights in a number of ways including entering into confidentiality and other written agreements with our employees, customers, consultants

and partners in an attempt to control access to and distribution of our documentation and other proprietary technology and other information.

Despite our efforts to protect our proprietary rights, third parties may, in an unauthorized manner, attempt to use, copy or otherwise

obtain and market or distribute our intellectual property rights or technology.

U.S.

patent filings are intended to provide the holder with a right to exclude others from making, using, selling or importing in the United

States the inventions covered by the claims of granted patents. Our patents, including our pending patents, if granted, may be contested,

circumvented or invalidated. Moreover, the rights that may be granted in those issued and pending patents may not provide us with proprietary

protection or competitive advantages, and we may not be able to prevent third parties from infringing those patents. Therefore, the exact

benefits of our issued patents and, if issued, our pending patents and the other steps that we have taken to protect our intellectual

property cannot be predicted with certainty.

On

September 19, 2019, the United States Patent and Trademark Office published patent US 2019 288 139 A1 for the Frame-Less Encapsulated

Photo-Voltaic (PV) Solar Power Panel Supporting Solar Cell Modules Encapsulated Within Optically-Transparent Epoxy-Resin Material Coating

a Phenolic Resin Support Sheet issued to National Mechanical Group Corp. Originally designed for application in the solar bus shelters

operated by Street Smart Outdoor Corp, as a glassless solar panel, the Company has developed a patent protected product and process for

creating solar panels that can be integrated directly into the design of products as a molded, weather resistant plastic. The Company

began work developing a business plan for expanding on either manufacturing or licensing of the technology in 2020, with such work continuing

into 2023.

Seasonality

Our

business is not seasonal. However, our revenues and operating results may vary significantly from quarter-to-quarter, due to revenues

earned on contracts, the commencement and completion of contracts during any particular quarter; as well as the schedule of government

agencies awarding contracts, the term of each contract that we have been awarded and general economic conditions. Because a portion of

our expenses, such as personnel and facilities costs, are fixed in the short term, successful contract performance and variation in the

volume of activity as well as in the number of contracts commenced or completed during any quarter may cause significant variations in

operating results from quarter to quarter.

Employees

As

of December 31, 2022, we had 2 full-time employees. We periodically engage additional consultants and employ temporary or full-time employees

as needed. Potential employees possessing the unique qualifications required are readily available for both part-time and full-time employment.

The primary method of soliciting personnel is through recruiting resources directly utilizing all known sources including electronic

databases, public forums, and personal networks of friends and former co-workers.

We

believe that our future success will depend in part on our continued ability to offer market competitive compensation packages to attract

and retain highly skilled, highly motivated and disciplined managerial, technical, sales and support personnel. We generally do not have

employment contracts with our employees, but we do selectively maintain employment agreements with key employees. In addition, confidentiality

and non-disclosure agreements are in place with many of our customer, employees and consultants and such agreements are included our

policies and procedures. None of our employees are subject to a collective bargaining agreement. We believe that our relations with our

employees are good.

Corporate

Information

The

Company was incorporated under the laws of the State of New Jersey on July 28, 2009, as Sun Pacific Power Corporation and together with

its subsidiaries, are referred to as the “Company”. On August 24, 2017, the Company entered into an Acquisition Agreement

with EXOlifestyle, Inc. whereby the Company became a wholly owned subsidiary of EXOlifestyle, Inc. The acquisition was accounted for

as a reverse merger, resulting in the Company being consider the accounting acquirer.

On

October 3, 2017, pursuant to the written consent of the majority of the shareholders in lieu of a meeting, Sun Pacific Holding Corp.,

f/k/a EXOlifestyle, Inc. (the “Company”) filed a Certificate of Amendment with the state of Nevada to change the name of

the Company from EXOlifestyle, Inc. to Sun Pacific Holding Corp.

Our

principal executive offices are located at 345 Highway 9 South Suite 388 Manalapan NJ 07726. Our internet address www.sunpacificholding.com

. Information on our website is not incorporated into this Form 10-K. We make available free of charge through our website our Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file

such material with, or furnish it to, the United States Securities and Exchange Commission (the “SEC”). The SEC maintains

an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically

with the SEC at http://www.sec.gov.

Item

2. Properties

Currently,

we operate in a virtual setting and have no direct costs related to office space. We believe we will obtain additional facilities required

to accommodate projected needs without difficulty and at commercially reasonable prices.

Item

3. Legal Proceedings

From

time to time the Company is a party to various legal or administrative proceedings arising in the ordinary course of our business. While

any litigation contains an element of uncertainty, we have no reason to believe that the outcome of such proceedings will have a material

adverse effect on the financial condition or results of operations of the Company.

There

is no material bankruptcy, receivership, or similar proceeding with respect to the Company or any of its significant subsidiaries.

There

are no administrative or judicial proceedings arising from any federal, state, or local provisions that have been enacted or adopted

regulating the discharge of materials into the environment or primary for the purpose of protecting the environment.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market

Information

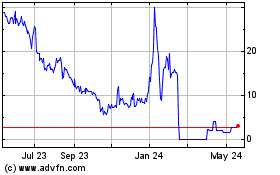

The

high and low per share closing sales prices of the Company’s stock on the OTC Markets (ticker symbol: SNPW) for each quarter for

the years ended December 31, 2022 and 2021 were as follows:

| Quarter Ended | |

High | | |

Low | |

| | |

| | |

| |

| March 31, 2021 | |

| 0.210 | | |

| 0.002 | |

| June 30, 2021 | |

| 0.062 | | |

| 0.025 | |

| September 31, 2021 | |

| 0.041 | | |

| 0.015 | |

| December 31, 2021 | |

| 0.027 | | |

| 0.012 | |

| March 31, 2022 | |

| 0.014 | | |

| 0.014 | |

| June 30, 2022 | |

| 0.014 | | |

| 0.006 | |

| September 31, 2022 | |

| 0.021 | | |

| 0.009 | |

| December 31, 2022 | |

| 0.014 | | |

| 0.006 | |

Holders

of our Common Stock

As

of April 15, 2023, there were approximately 581 stockholders of record of our common stock. This number does not include shares held

by brokerage clearing houses, depositories or others in unregistered form. The stock transfer agent for our securities is VStock Transfer.

Dividend

Policy

We

have never paid dividends on our Common Stock and intend to continue this policy for the foreseeable future. We plan to retain earnings

for use in growing our business base. Any future determination to pay dividends will be at the discretion of our Board of Directors and

will be dependent on our results of operations, financial condition, contractual and legal restrictions and any other factors deemed

by the management and the Board to be a priority requirement of the business.

Our

Series C Preferred Stockholders were to be paid an annual dividend in the amount of $0.125 per year, for a total of $0.25, over an eighteen

(18) month term, from the date of issuance (the “Commencement Date. Dividend payments shall be payable as follows: (i) dividend

in the amount of $0.0625 per share of Series C Preferred Stock at the end of each of the third quarter and fourth quarter of the first

twelve (12) months of the twenty-four (24) month period after the Commencement Date; and (ii) dividend in the amount of $0.03125 per

share of Series C Preferred Stock at the end of each of the four quarters of the second twelve ( 12) months of the twenty-four (24) month

period after the Commencement Date. The source of payment of the dividends will be derived from up to thirty-five percent (35%) of net

revenues (“Net Revenues”) from the Street Furniture Division of the Corporation following the seventh (7th) month after the

Commencement Date. To the extent the amount derived from the Net Revenues of the Street Furniture Division is insufficient to pay dividends

of Series C Preferred Stock, if a sufficient amount is available, the next quarterly payment date the funds will first pay dividends

of Series C Preferred Stock past due. As of today’s date, no dividend payments have been made. 275,000 shares of Series C Preferred

Stock were originally issued as Series B Preferred Stock of Sun Pacific Holding Corp. and all dividend payments have ceased, leaving

only accrued payments due.

Securities

Authorized for Issuance Under Equity Compensation Plans

The

Company has not adopted an equity compensation plan.

Unregistered

Sales of Equity Securities

On

or about January 29, 2021 we issued 50,000 shares of common stock to one entity pursuant to a subscription agreement for $0.20 per share.

On

or about February 8, 2021 we issued 250,000 shares of common stock to one entity pursuant to a subscription agreement for $0.10 per share.

On

or about March 11, 2021, we issued 300,000 shares of common stock to one entity pursuant to a cashless exercise of a warrant, with an

exercise price of $0.031 per share of common stock.

On

or about March 11, 2021, we issued 7,626,978 shares of common stock to one entity pursuant to a conversion of a convertible note, with

an conversion price of $0.02035 per share of common stock.

All

the offers and sales of securities listed above were made to accredited investors. The issuance of the above securities is exempt from

the registration requirements under Rule 4(2) of the Securities Act of 1933, as amended, and/or Rule 506 as promulgated under Regulation

D.

Repurchases

of Equity Securities

We

repurchased no shares of our Common Stock during the years ended December 31, 2022 and 2021.

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The

discussion and analysis of our financial condition and results of operations are based on our consolidated financial statements, which we have prepared

in accordance with accounting principles generally accepted in the United States of America. This discussion should be read in conjunction

with the other sections of this Form 10-K, including “Risk Factors,” and the Financial Statements. The various sections of

this discussion contain a number of forward-looking statements, all of which are based on our current expectations and could be affected

by the uncertainties and risk factors described throughout this Annual Report on Form 10-K. See “Forward-Looking Statements.”

Our actual results may differ materially. The preparation of these consolidated financial statements requires us to make estimates and assumptions

that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the

financial statements, as well as the reported revenues and expenses during the reporting periods. On an ongoing basis, we evaluate estimates

and judgments, including those described in greater detail below. We base our estimates on historical experience and on various other

factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying

value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under

different assumptions or conditions.

As

used in this “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” except where the

context otherwise requires, the term “we,” “us,” “our,” or “the Company,” refers to the

business of Sun Power Holdings Corp.

Organizational

Overview

Utilizing

managements history in general contracting, coupled with our subject matter expertise and intellectual property (“IP”) knowledge

of solar panels and other leading-edge technologies, Sun Pacific Holding (“the Company”) is focused on building a “Next

Generation” green energy company. The Company offers competitively priced “Next Generation” solar panel and lighting

products by working closely with design, engineering, integration and installation firms in order to deliver turnkey solar and other

energy efficient solutions. We provide solar bus stops, solar trashcans and “street kiosks” that utilize our unique advertising

offerings that provide State and local municipalities with costs efficient solutions.

Our

green energy solutions can be customized to meet most enterprise and/or government mandated regulations and advanced system requirements.

Our portfolio of products and services allow our clients to select a solution that enables them to establish a viable standard product

offering that focuses on the goals of the client’s entire organization.

Currently,

the Company has four (4) subsidiary holdings. Sun Pacific Power Corp., which was the initial company that specialized in solar &

other renewable energy projects., The Company also formed National Mechanical Group Corp, a New Jersey corporation focused on holding

the Company’s patents. The Company also formed Street Smart Outdoor Corp, a Wyoming corporation that acts as a holding company

for the Company’s state specific operations in unique advertising through solar bus stops, solar trashcans and “street kiosks.”

The Company also formed Elba Power Corp, an Alabama Corp for the development of a Solar Assembly company. Elba Power Corp has entered

into a property purchase contract for approximately $3 million, pending financing, and has obtained the approval for an inducement resolution

for $50 million dollars from the State of Alabama, along with a 100% tax abatement on sales and use tax in support of the development

of a solar assembly plant. Elba Power Corp is currently working with potential funders in support of the capitalization and development

of the project.

Sun

Pacific Power Corp. has entered into an agreement with FoxEss, a global leader in the development

of inverter and energy storage solutions as a wholesale distributer for North and South America and Australia. Sun Pacific Power Corp.

has also entered into an agreement with a South Asian solar manufacturer to act as an original equipment manufacturer (“OEM”)

for Sun Pacific Solar Panels and associated products. Sun Pacific Power Corp has also commenced in April 2023, a sales, marketing, and

affiliate program to market and install residential solar panels in various markets within the United States.

As

of today, our principal source of revenues is derived from Street Smart Outdoor Corp. operations in the outdoor advertising business

with contracts in place in New Jersey and Florida.

Strategic

Vision

Our

objective is to grow our business as a premier green energy-based provider of both product and services to the public and private sectors.

We are working to deploy our strategy in building upon our green energy expertise in conjunction with our intellectual property and subject

matter expertise that may allow us to grow a group of business lines in solar and other unique energy related areas.

Recent

advances in a multitude of different yet converging technologies have significantly improved the ability to integrate energy efficient

products and solutions into infrastructure related projects. These technological advances decrease the requirements needed to jointly

operate a multitude of differing assets, devices, and tools that create new ways to integrate evolving new technologies. This technological

change and convergence in energy efficient devices, integrated communications among devices, and societal needs to more effectively and

environmentally friendly we believe presents a significant opportunity for us in providing and supporting simple to complex integrated

solutions.

Our

challenges continue to be reaching critical mass in our solar shelter business, expanding into other green energy related projects, and

securing operational capital. While the Company has never been adequately funded from inception, the Company has attempted to use debt,

equity, and other opportunistic in-kind compensation to further the Company’s strategic vision.

Going

Concern

The

Company has an accumulated deficit of approximately $8.0 million and a working capital deficit of approximately $3.1 million as of December

31, 2022. The Company’s continuation as a going concern is dependent on its ability to generate sufficient cash flows from operations

to meet its obligations and/or obtain additional financing from its stockholders and/or other third parties.

In

order to further implement its business plan and satisfy its working capital requirements, the Company will need to raise additional

capital. There is no guarantee that the Company will be able to raise additional equity or debt financing at acceptable terms, if at

all.

There

is no assurance that the Company will ever be profitable. These consolidated financial statements do not include any adjustments to reflect

the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that

may result should the Company be unable to continue as a going concern.

Critical

Accounting Policies and Estimates

Our

significant accounting policies are more fully described in the notes to our consolidated financial statements. Those material accounting

estimates that we believe are the most critical to an investor’s understanding of our financial results and condition are discussed

immediately below and are particularly important to the portrayal of our financial position and results of operations and require the

application of significant judgment by our management to determine the appropriate assumptions to be used in the determination of certain

estimates.

Use

of estimates in the preparation of consolidated financial statements

Preparation

of consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make

estimates and assumptions that affect reported amounts in the consolidated financial statements and accompanying notes. Actual results could differ

from those estimates. Significant estimates include the allowance for doubtful accounts and impairment assessments related to long-lived

assets.

Consolidation

The

consolidated financial statements include the accounts of the Company and its wholly owned, and less-than-wholly owned subsidiaries of

which the Company holds a controlling interest. All significant intercompany balances and transactions have been eliminated. Amounts

attributable to minority interests in the Company’s less-than-wholly owned subsidiary are presented as non-controlling interest

on the accompanying consolidated balance sheets and statements of operations.

Cash

and cash equivalents

For

purposes of the consolidated statements of cash flows, cash and cash equivalents includes demand deposits and short-term liquid investments with original

maturities of three months or less when purchased. The Federal Deposit Insurance Corporation (“FDIC”) provided insurance coverage of up

to $250,000, per depositor, per institution. At December 31, 2022 and 2021, none of the Company’s cash balances were in excess

of federally insured limits. Any and all withdrawals are strictly controlled by the lending institution and use of proceeds must be approved

prior to release of funds.

Accounts

Receivable

In

the normal course of business, we decide to extend credit to certain customers without requiring collateral or other security interests.

Management reviews its accounts receivable at each reporting period to provide for an allowance against accounts receivable for an amount

that could become uncollectible. This review process may involve the identification of payment problems with specific customers. Periodically

we estimate this allowance based on the aging of the accounts receivable, historical collection experience, and other relevant factors,

such as changes in the economy and the imposition of regulatory requirements that can have an impact on the industry. These factors continuously

change and can have an impact on collections and our estimation process. The Company determined that an allowance for doubtful accounts was not necessary as of December 31, 2022 and 2021.

Leases

In

February 2016, the FASB issued ASU No. 2016-02 (Topic 842). Topic 842 amends several aspects of lease accounting, including requiring

lessees to recognize leases with a term greater than one year as a right-of-use asset and corresponding liability, measured at the present

value of the lease payments. In July 2018, the FASB issued supplemental adoption guidance and clarification to Topic 842 within ASU 2018-10

Codification Improvements to Topic 842, Leases and ASU 2018-11 Leases (Topic 842): Targeted Improvements. The new

guidance aims to increase transparency and comparability among organizations by requiring lessees to recognize lease assets and lease

liabilities on the balance sheet and requiring disclosure of key information about leasing arrangements. A modified retrospective application

is required with an option to not restate comparative periods in the period of adoption.

The

Company, effective January 1, 2019 has adopted the provisions of the new standard. The Company has operating leases for warehouses and

offices. Management evaluates each lease independently to determine the purpose, necessity to its future operations in addition to other

appropriate facts and circumstances.

We

adopted Topic 842 using a modified retrospective approach for all existing leases at January 1, 2019. The adoption of Topic 842 impacted

our balance sheet by the recognition of the operating lease right-of-use assets and the liability for operating leases. Accordingly,

upon adoption, leases that were classified as operating leases under the previous guidance were classified as operating leases under

Topic 842. The lease liability is based on the present value of the remaining lease payments, discounted using a market based incremental

borrowing rate as the effective date of January 1, 2019 using current estimates as to lease term including estimated renewals for each

operating lease. As of January 1, 2019, the Company recorded an adjustment of approximately $1,339,000 to operating lease right-of-use

assets (“ROU”) and the related lease liability (Note 7).

Contingencies

Certain

conditions may exist as of the date financial statements are issued, which may result in a loss, but which will only be resolved when

one or more future events occur or do not occur. We assess such contingent liabilities, and such assessment inherently involves an exercise

of judgment. In assessing loss contingencies related to pending legal proceedings that are pending against us or unasserted claims that

may result in such proceedings, we evaluate the perceived merits of any legal proceedings or unasserted claims as well as the perceived

merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates that it is probable

that a liability has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in

our consolidated financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is

reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of

the range of possible loss if determinable would be disclosed.

Fair

value of financial instruments

The

carrying amounts of the Company’s accounts receivable, accounts payable, accrued expenses, and accrued expenses due to related parties approximate fair

value due to their short-term nature. The Company’s long-term debt approximates fair value given the instruments bear market rates of interest.

Property

and equipment

Property

and equipment are stated at cost. Additions and improvements that significantly add to the productive capacity or extend the life of

an asset are capitalized. Maintenance and repairs are expensed as incurred. Depreciation is computed using the straight-line method over

three to five years for vehicles and five to ten years for equipment. Leasehold improvements are amortized over the lesser of the estimated

remaining useful life of the asset or the remaining lease term.

Impairment

of long-lived assets

The

Company periodically reviews for the impairment of long-lived assets whenever events or changes in circumstances indicate that the carrying

amount of an asset may not be realizable. An impairment loss would be recognized when estimated future cash flows expected to result

from the use of the asset and its eventual disposition is less than its carrying amount. At December 31, 2022 and 2021, the Company has

not identified any such impairment losses.

Income

taxes

Under

ASC Topic 740, Income Taxes, the Company is required to account for its income taxes through the establishment of a deferred tax

asset or liability for the recognition of future deductible or taxable amounts and operating loss and tax credit carry forwards. Deferred

tax expense or benefit is recognized as a result of timing differences between the recognition of assets and liabilities for book and

tax purposes during the year.

Deferred

tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. Deferred tax assets are recognized for deductible temporary differences and operating

losses, and tax credit carry forwards. A valuation allowance is established to reduce that deferred tax asset if it is “more likely

than not” that the related tax benefits will not be realized.

Revenue

Recognition

The

Company recognizes revenue when or as it satisfies a performance obligation by transferring a promised good or service to a customer

in accordance with Topic 606. Revenue from the sale of advertising space on displays from the Company’s Outdoor Advertising Shelter

Revenues is generally recognized ratably over the term of the contract as the advertisement is displayed.

The

Company recognizes revenue in amounts that reflect the consideration it expects to receive in exchange for transferring goods or services

to customers, excluding sales taxes and other similar taxes collected on behalf of governmental authorities (the “transaction price”).

When this consideration includes a variable amount, the Company estimates the amount of consideration it expects to receive and only

recognizes revenue to the extent that it is probable it will not be reversed in a future reporting period. Because the transfer of promised

goods and services to the customer is generally within a year of scheduled payment from the customer, the Company is not typically required

to consider the effects of the time value of money when determining the transaction price. Advertising revenue is reported net of agency

commissions.

In

order to appropriately identify the unit of accounting for revenue recognition, the Company determines which promised goods and services

in a contract with a customer are distinct and are therefore separate performance obligations. If a promised good or service does not

meet the criteria to be considered distinct, it is combined with other promised goods or services until a distinct bundle of goods or

services exists.

For

revenue arrangements that contain multiple distinct goods or services, the Company allocates the transaction price to these performance

obligations in proportion to their relative standalone selling prices. The Company has concluded that the contractual prices for the

promised goods and services in its standard contracts generally approximate management’s best estimate of standalone selling price

as the rates reflect various factors such as the size and characteristics of the target audience, market location and size, and recent

market selling prices. However, where the Company provides customers with free or discounted services as part of contract negotiations,

management uses judgment to determine how much of the transaction price to allocate to these performance obligations.

The

Company receives payments from customers based on billing schedules that are established in its contracts, and deferred revenue is recorded

when payment is received from a customer before the Company has satisfied the performance obligation or a non-cancelable contract has

been billed in advance in accordance with the Company’s normal billing terms.

All of the Company’s revenue for the years ended December 31, 2022 and 2021, is recognized based on

the Company’s satisfaction of distinct performance obligations identified in each agreement, generally at a point in time as

defined by Topic 606, as amended.

In

May 2014, the FASB issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts

with Customers. This standard replaced most existing revenue recognition guidance and is codified in FASB ASC Topic 606. Effective

January 1, 2018, the Company adopted ASU No. 2014-09 using the modified retrospective method. Under the new guidance, the Company recognizes

revenue from contracts based on the Company’s satisfaction of distinct performance obligations identified in each agreement. The

adoption of the guidance under ASU No. 2014-09 did not result in a material impact on the Company’s consolidated revenues, results

of operations, or financial position. As part of the implementation of ASC 606 the Company must present disaggregation of revenues from

contracts with customers into categories that depict how the nature, timing, and uncertainty of revenue and cash flows are affected by

economic factors. Quantitative disclosures on the disaggregation of revenue are as follows:

| | |

2022 | | |

2021 | |

| Outdoor Advertising Shelter Revenues | |

$ | 265,573 | | |

$ | 377,593 | |

Earnings

Per Share

Under

ASC 260, Earnings Per Share (“EPS”), the Company provides for the calculation of basic and diluted earnings per share.

Basic EPS includes no dilution and is computed by dividing income or loss available to common shareholders by the weighted average number

of common shares outstanding for the period. Diluted EPS reflects the potential dilution of securities that could share in the earnings

or losses of the entity. For the year ended December 31, 2022, basic and diluted loss per share are the same as the calculation of diluted

per share amounts would result in an anti-dilutive calculation. The following summarizes the calculation of diluted income per share

for the year ended December 31, 2021:

| | |

Net Income | | |

Weighted Average Shares Outstanding | |

| Basic | |

$ | 2,968,950 | | |

| 974,192,392 | |

| Convertible Debt | |

| 41,814 | | |

| 142,645,305 | |

| Diluted | |

$ | 3,010,764 | | |

| 1,116,837,697 | |

| Diluted Net Income Per Share | |

$ | 0.00 | | |

| | |

Results

of Operations for the Year Ended December 31, 2022 as Compared to the Year Ended December 31, 2021

Revenues

During

the year ended December 31, 2022, revenues decreased $112,020, from $377,593 for the year ended December 31, 2021 to $265,573 in 2022,

as a result of more advertising revenues and less general contracting services as the Company migrates away from general contracting

services and towards the development of Green Energy Projects including the sale of Solar powered shelters and other energy related projects

that derive income from advertising sources. The Company has entered into revenue sharing agreements with the City of Tallahassee and

the State of New Jersey, along with others. Depending upon the timing of installation and advertising revenue generated per shelter and

or other advertising-based product, the Company’s Revenue may increase materially from this green energy offering.

Cost

of Revenues

During

the year ended December 31, 2022, cost of revenues decreased by $10,401, from $27,044 for the year ended December 31, 2021 to $16,643

in 2022, as a result of less general contracting services revenues. Costs of revenues may shift dramatically depending upon how the Company’s

comparative revenue profile of the products and services shift in the future.

Operating

Expenses

During

the year ended December 31, 2022, operating expenses increased by $95,248, from $441,311 for the year ended December 31, 2021 to $536,559

in need to disclose the reason for the increase - professional fees increased $33,083 and general and administrative increased $63,284.

Other

Income (Expenses)

During

the year ended December 31, 2022, other income (expenses) decreased by $42,865 from total other expense of $33,846 for the year ended

December 31, 2021 to $9,019 total other income for the year ended December 31, 2022.

Net

Loss from Continuing Operations

As

a result of the above, the Company incurred Net (Loss) Income from Continuing Operations of $(278,610) and $696,113 for the years ended December

31, 2022 and 2021, respectively.

Liquidity

and Capital Resources

Net

Working Capital

We

have, since inception, financed operations and capital expenditures through the sale of stock and convertible notes and debt. Our immediate

sources of liquidity include cash and cash equivalents, accounts receivable, and unbilled receivables.

At

December 31, 2022, we had a net working capital deficit of approximately $3,120,589 compared to $2,883,433 at December 31, 2021.

We

intend to seek additional financing for our working capital, in the form of equity or debt, to provide us with the necessary capital

to accomplish our plan of operation. There can be no assurance that we will be successful in our efforts to raise additional capital.

During

the years ended December 31, 2022 and 2021, we received $0 and $35,905, respectively, from the Payroll Protection Program.

Generally,

the Company has insufficient capital to maintain operations. Cashflows from operations of the Company and all its subsidiary holdings

will not sustain the Company’s operations, let alone its filing requirements, unless there is substantial influx of cash flow through

either debt and/or equity financing.

Cash

Flows from Operating Activities

Cash

provided by operating activities provides an indication of our ability to generate sufficient cash flow from our recurring business activities.

Fixed costs such as labor, direct materials, and office rent represent a significant portion of the Company’s continuing operating

costs.

For

the year ended December 31, 2022, net cash used in operations was $17,925 driven primarily by net loss offset by decreases in accounts

receivable and increases in accrued compensation to officers.

For

the year ended December 31, 2021, net cash used in operations was approximately $522,748 driven primarily by current year operating loss,

and $272,304 of cash deconsolidated.

Cash

Flows from Investing Activities

For

the year ended December 31, 2022, cash provided by investing activities was approximately $96,000, from the sale of property.

There

were no investing activities for the year ended December 31, 2021.

Cash

Flows from Financing Activities

Cash

provided by financing activities provides an indication of our debt financing and proceeds from capital raise transactions.

There

were no financing activities for the year ended December 31, 2022.

For

the year ended December 31, 2021, cash provided by financing activities was approximately $535,905, from the issuance of convertible

debt of $500,000 and $35,905 of proceeds from the payroll protection program.

In

the short term, we must raise additional capital through debt or equity financing to support our business operations and grow our business.

Over the long term, we must successfully execute our growth plans to increase profitable revenue and income streams to generate positive

cash flows to sustain adequate liquidity without impairing growth initiatives or requiring the infusion of additional funds from external

sources to meet minimum operating requirements. We may need to raise additional capital to fund our operations and there can be no assurance

that additional capital will be available on acceptable terms or at all.

Off-Balance

Sheet Arrangements

We

have no off-balance sheet financing arrangements.

Contractual

Obligations

Not

required of smaller reporting companies.

Item

8. Financial Statements and Supplementary Data

Our

consolidated financial statements and notes thereto and the report of our independent registered public accounting firm, are set forth

on pages F-1 through F-15 of this report.

Item

9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item

9A. Controls and Procedures

As

of the end of the period covered by this Annual Report, our Chief Executive Officer and Chief Financial Officer performed an evaluation

of the effectiveness of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act. Based

on the evaluation and the identification of the material weaknesses in internal control over financial reporting described below, our

Chief Executive Officer and Chief Financial Officer concluded that, as of December 31, 2022, the Company’s disclosure controls

and procedures were not effective.

Evaluation

of Disclosure Controls and Procedures

The

Company’s management is responsible for establishing and maintaining adequate disclosure controls and procedures for the Company.

3As of the end of the period covered by this Annual Report, our Chief Executive Officer and Chief Financial Officer performed an evaluation

of the effectiveness of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act. Based

on the evaluation and the identification of the material weaknesses in internal control over financial reporting described below, our

Chief Executive Officer and Chief Financial Officer concluded that, as of December 31, 2022, the Company’s disclosure controls

and procedures were not effective.

Management’s

Report on Internal Control over Financial Reporting

Pursuant

to Rule 13a-15(c) under the Securities Exchange Act of 1934, as amended (“Exchange Act”), the Company carried out an evaluation,

with the participation of the Company’s management, including the Company’s Chief Executive Officer and Chief Financial Officer

of the effectiveness of the Company’s internal control over financial reporting as of the end of the period covered by this report

, using the criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations

of the Treadway Commission. The term “internal control over financial reporting”, as defined under Rule 13a-15(f) under the

Exchange Act, means a process designed by, or under the supervision of, the issuer’s principal executive officer and principal

financial officers, or persons performing similar functions, and effected by issuer’s board of directors, management and other

personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements

for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that: (1)

pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the

assets of the issuer; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial

statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the issuer are being made

only in accordance with authorizations of management and directors of the issuer; and (3) provide reasonable assurance regarding prevention

or timely detection of unauthorized acquisition, use or disposition of the issuer’s assets that could have a material effect on

the financial statements. Based upon the evaluation of the internal control over financial reporting at the end of the period covered

by this report, the Company’s Chief Executive Officer and Chief Financial Officer concluded that the Company’s internal control

over financial reporting were not effective as a result of continuing weaknesses principally due to the following:

| |

-

|

The

Company has not established adequate financial reporting monitoring activities to mitigate the risk of management override, specifically

because there are few employees and only one officers with management functions and therefore there is lack of segregation of duties.

|

| |

|

|

| |

-

|

An

outside consultant assists in the preparation of the annual and quarterly financial statements and partners with the Company to ensure

compliance with US GAAP and SEC disclosure requirements. |

| |

|

|

| |

-

|

Outside

counsel assists the Company in the external attorneys to review and editing of the annual and quarterly filings and to ensure compliance

with SEC disclosure requirements. |

At

such time as the Company raises additional working capital it plans to add staff, initiate training, add additional subject matter expertise

in its finance area so that it may improve it processes, policies, procedures, and documentation of its internal control processes.

Changes

in Internal Control over Financial Reporting

There

have been no changes in our internal control over financial reporting that occurred during our last fiscal quarter that have materially

affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Item

9B. Other Information

None.

PART

III

Item

10. Directors, Executive Officers, and Corporate Governance;

The

current Directors and Officers of the Company are as follows:

| Executive

|

|

Age

|

|

Position

|

| Nicholas

Campanella |

|

58

|

|

Chairman

of the Board, Chief Executive Officer and Director |

| Vincent

Randazzo |

|

61 |

|

Director

|

Nicholas

Campanella, Director, CEO, and President is the founder of Sun Pacific Power Corp. and has been its President and a director

since its inception in 2009. Mr. Campanella has been a serial entrepreneur. He has managed, owned, and led a number of companies in the

development, contracting, insurance and manufacturing industries. From 1996 until 2015 he was the President of CGA Associates, an insurance

brokerage company. From 2005 until 2009 he was the President of Northwoods Manufacturing and from 2004 to the present he is the President

of Triplet Square, a real estate development company. Prior to 2004 he held positions of Vice President and Account Executive in the

insurance industry. He has also served in many roles in community service including as an environmental commissioner and as the chairman

of the economic development committee, along with serving as the Grand Knight for the Knights of Columbus. Mr. Campanella attended New

York Institute of Technology in 1984, where he majored in Business Management.

Vincent

Randazzo, Director was appointed to the Board of Directors of Sun Pacific Holding Corp. because of his management experience

with manufacturing operations and financial reporting. Mr. Randazzo received his Bachelor of Science in Business Administration from

Saint Francis College. Mr. Randazzo started his career as an accounting clerk for Agip, USA. Thereafter, he quickly became a Manager

of General Accounting for Time Warner Corporation rising to Plant Manager within 10 years with the company. In 1998, Mr. Randazzo joined

I.L Walker, Inc., a folding carton manufacturing operation, as Vice President/General Manager. I.L. Walker, Inc. at the time had annual

sales of $23,000,000. Mr. Randazzo was responsible for 155 employees, initiated new manufacturing and quality standards. Based on his

experience with I.L. Walker, Inc., in 2001, Mr. Randazzo started his own firm, Zapp Packaging, Inc. driving sales from $1,500,000 the

first year of operations to $15,000,000 in 2005 when he sold the company. In 2006, Mr. Randazzo joined MyPrint a division of e-Tools

Corporation as V.P. of Operations until he was appointed C.E.O. in 2007. Mr. Randazzo’s experience brings

expertise in building and growing businesses.

Committees

As

of the date of this Annual Report, the Company’s board of directors does not have any committees.

The

Board of Directors does not currently have a formal nominating committee as we are deemed a “controlled company” in that

our CEO and Chairman, Nicholas Campanella holds greater than 50% voting control. As such, nominations of additional board members or

nominees for shareholder election are set forth by Mr. Campanella. Mr. Campanella will consider shareholder nomination. However, there

are currently no formal standards for accepting or rejecting such nominations.

The

Board of Directors does not currently have a formal auditing committee nor a member of the board that is a “audit committee financial

expert” as defined by Item 507(d)(5).

Family

Relationships

Nicholas

Campanella and Vincent Randazzo are brothers in law. There are no other family relationships among the directors and executive officers

of the Company. There is no arrangement or understanding between or among the directors or executive officers of the Company to which

a director or executive officer of the Company was or is to be selected as a director.

Involvement

in Certain Legal Proceedings

To

our knowledge, during the last ten years, none of our directors and executive officers has:

| |

●

|

Had

a bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at

the time of the bankruptcy or within two years prior to that time. |

| |

●

|

Been

convicted in a criminal proceeding or been subject to a pending criminal proceeding, excluding traffic violations and other minor

offenses. |

| |

●

|

Been

subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction,

permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities

or banking activities. |

| |

●

|

Been

found by a court of competent jurisdiction (in a civil action), the SEC, or the Commodities Futures Trading Commission to have violated

a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated. |

| |

●

|

Been

the subject to, or a party to, any sanction or order, not subsequently reverse, suspended or vacated, of any self-regulatory organization,

any registered entity, or any equivalent exchange, association, entity or organization that has disciplinary authority over its members

or persons associated with a member. |

Code

of Ethics

We

do not currently have a code of ethic that applies to any member of the Board of Directors or our executive officers.

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers and persons who own more than

10% of the issued and outstanding shares of our common stock to file reports of initial ownership of common stock and other equity securities

and subsequent changes in that ownership with the SEC. Officers, directors and greater than ten percent stockholders are required by

SEC regulation to furnish us with copies of all Section 16(a) forms they file. To our knowledge, based solely on a review of the copies

of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December

31, 2021 all Section 16(a) filing requirements applicable to our officers, directors and greater than 10% beneficial owners were complied

with.

Item

11. Executive Compensation

| Name and Principal Position | |

Year Ended | |

Salary | | |

Bonus | | |

Stock Awards | | |

Option Awards | | |

Non-Equity Incentive Plan Compensation Earnings | | |

Non- Qualified Deferred Compensation Earnings | | |

All Other Compensation(1) | | |