Amended Current Report Filing (8-k/a)

October 12 2021 - 6:52AM

Edgar (US Regulatory)

0001094084

false

0001094084

2021-08-06

2021-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

August

6, 2021

(Date of earliest event reported)

TELKONET,

INC.

(Exact Name of Registrant as Specified in Its Charter)

Utah

(State or Other Jurisdiction of Incorporation)

|

000-31972

|

87-0627421

|

|

(Commission File No.)

|

(I.R.S. Employer Identification No.)

|

20800 Swenson Drive, Suite 175, Waukesha, WI

53186

(Address of Principal Executive Offices)

414.302.2299

(Registrant's Telephone Number)

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

None

|

None

|

Securities registered pursuant to Section 12(g) of the Act: Common

Stock, $0.001 par value

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Explanatory Note

This Amendment No. 1 (the “Amendment”)

to the Registrant’s Current Report on Form 8-K filed on August 10, 2021 (the “Original Report”) is being filed solely

to add Item 3.02, which incorporates by reference the disclosure provided under Item 1.01 in the Original Report. Except as described

above, this Amendment does not amend, update or change any other disclosures in the Original Report. In addition, the information contained

in this Amendment does not reflect events occurring after the filing of the Original Report and does not modify or update the disclosures

therein, except as specifically identified above.

Item 1.01. Entry into a Material Definitive Agreement.

Stock Purchase Agreement

On August 6, 2021, Telkonet, Inc. (the “Company”)

entered into a stock purchase agreement (the “Purchase Agreement”) with VDA Group S.p.A., an Italian joint stock company

(“VDA”), pursuant to which VDA will, at the closing, contribute $5 million to Telkonet

(the “Financing”) and, in exchange, Telkonet will issue to VDA (the “Issuance”): (i) 162,900,947 shares of common

stock of Telkonet, par value $0.001 per share (the “Common Stock”); and (ii)

a warrant to purchase 105,380,666 additional shares of Common Stock (the “Warrant”)

(the Financing and the Issuance referred to herein collectively as the “Transaction”). Under the terms of the Warrant, VDA

is entitled to purchase the additional shares of Common Stock at any time beginning on the date the Company achieves a volume

weighted average price of the aggregate outstanding Common Stock of at least $17,000,000, measured for a period of time consisting of

sixty (60) consecutive trading days and ending five years after the date of issuance of the Warrant.

Also

in connection with the Transaction, the majority of the existing members of Telkonet’s board of directors (the “Board”)

will resign and the vacancies resulting from those resignations will be filled by individuals designated by VDA and appointed by the

remaining Board members, resulting in a change of control of the Board. In addition, certain stockholders of the Company have entered

into Voting Agreements with VDA pursuant to which such stockholders have agreed to commit their shares of Telkonet stock to vote in favor

of the amendment to the Articles of Incorporation and the approval of the Issuance, if a vote, consent or other approval with respect

to such matters is sought, and to vote against (i) any Acquisition Proposal (as defined in the Purchase Agreement) other than the Purchase

Agreement and (ii) any amendment to the Company’s Organizational Documents (as defined in the Purchase Agreement) other than the

Amendment.

Following

the issuance of 162,900,947 shares of Common Stock to VDA upon the closing of the Transaction, VDA will own 53% of the issued and outstanding

Common Stock on a fully diluted as exercised/converted basis and could eventually own as much as 65% of the issued and outstanding Common

Stock on a fully diluted as exercised/converted basis if it fully exercises the Warrant. As a result, our current stockholders would own

between 35% and 47% of the Common Stock and Common Stock equivalents (i.e., warrants, options and other convertible securities

issued and outstanding at closing) following the Transaction. Accordingly, the Transaction will result in a change of control of the Company.

The

Transaction is subject to customary closing conditions, including, without limitation: (i) approval by the stockholders of Telkonet and

the filing of an amendment to Telkonet’s Amended and Restated Articles of Incorporation (the “Amendment”); (ii) the

approval by the stockholders of Telkonet of the Issuance to effectuate the Transaction; (iii) the absence of a material adverse effect

on the Company; and (iv) certain Company cash flow requirements.

The Purchase

Agreement also contains customary representations and warranties of each of the parties.

The foregoing descriptions of the Purchase Agreement

and the Warrant do not purport to be complete and are qualified in their entirety by reference to the full text of the Purchase Agreement

and the Warrant, copies of which are attached to this Form 8-K as Exhibit 10.1 and Exhibit 10.2, respectively, and are incorporated herein

by reference

Registration

Rights Agreement

Also on August 6, 2021, in connection with the

Transaction, the Company entered into a Registration Rights Agreement by and between the Company and VDA (the “Registration Rights

Agreement”). Under the Registration Rights Agreement, VDA has the right (i) at any time following

(a) the filing of the Company’s 2021 Form 10-K with the SEC (on or about March 31, 2022) and (b) one year from the closing of the

Transaction to require the Company to use its reasonable best efforts to effect up to a total of two registrations under the Securities

Act of 1933, as amended (the “Securities Act”), of the shares of Common Stock issued to VDA upon the closing of the Transaction

or issuable to VDA from the exercise of the Warrant at any time when the Company is not eligible to file registration statements with

the SEC on Form S-3 and (ii) to effect an unlimited number of such registrations at any time when the Company is eligible to file registration

statements with the SEC on Form S-3. In addition, if the Company proposes to register any of its Common Stock under the Securities Act

for public sale, except in specified circumstances, it will be required to give VDA the right to include any or all of its shares of Common

Stock in the registration. The registration rights are subject to customary notice requirements, timing restrictions and volume limitations

that may be imposed by the underwriters of an offering.

The foregoing description of the Registration

Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Registration Rights

Agreement, a copy of which is attached to this Form 8-K as Exhibit 10.3 and incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

The information disclosed

under Item 1.01 of this Current Report is incorporated herein by reference.

The shares of Common

Stock that may be issued under the Purchase Agreement and the Warrant are being offered and sold in a transaction exempt from registration

under the Securities Act, in reliance on Section 4(a)(2) of the Securities Act.

Item 7.01. Regulation FD Disclosures.

On August 9, 2021, the Company issued a press

release announcing the Transaction. A copy of the press release is furnished as Exhibit 99.1 of this report.

The information under Item 7.01 and in Exhibit

99.1 of this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for the purpose of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section.

The information under Item 7.01 and in Exhibit 99.1 of this Current Report on Form 8-K shall not be incorporated by reference into any

filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

Description

|

|

10.1*

|

Stock

Purchase Agreement, dated August 6, 2021, between Telkonet, Inc. and VDA Group S.p.A.

|

|

10.2*

|

Common

Stock Purchase Warrant

|

|

10.3*

|

Registration

Rights Agreement, dated August 6, 2021, between Telkonet, Inc. and VDA Group S.p.A.

|

|

99.1*

|

Press

Release, dated August 9, 2021

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

____________

* Previously filed

Forward Looking Statements

This Form 8-K contains forward-looking statements,

which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking

statements generally can be identified by use of statements that include, but are not limited to, phrases such as “anticipate,”

“believe,” “expect,” “future,” “intend,” “plan,” and similar expressions

to identify forward-looking statements. Forward-looking statements include, without limitation, the ability of the Company to retain

and hire key personnel and maintain relationships with its customers, suppliers, partners, and others with whom it does business, or

on its operating results and business generally, the Company’s ability to increase income streams, to grow revenue and earnings,

the contemplated forgiveness of the Loan, the uncertainty in the financial markets in the wake of the COVID-19 pandemic and the effect

of the COVID-19 pandemic on the Company's business and operating results. These statements are only predictions and are subject to

certain risks, uncertainties, and assumptions, which include, but are not limited to, those identified and described in the Company’s

public filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. The Company does not undertake any obligation to update any forward-looking statements as a result

of new information, future developments, or otherwise, except as expressly required by law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: October 12, 2021

|

TELKONET, INC.

|

|

|

|

|

|

|

|

|

By: /s/ Jason L. Tienor

|

|

|

Jason L. Tienor

Chief Executive Officer

|

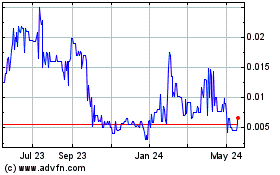

Telkonet (PK) (USOTC:TKOI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Telkonet (PK) (USOTC:TKOI)

Historical Stock Chart

From Feb 2024 to Feb 2025