Current Report Filing (8-k)

January 23 2023 - 4:25PM

Edgar (US Regulatory)

0001669400

false

0001669400

2023-01-23

2023-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 23, 2023

| Veritas Farms, Inc. |

| (Exact name of registrant as specified in charter) |

| Nevada |

|

333-210190 |

|

90-1254190 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 1815 Griffin Road, Suite 401, Dania Beach, FL |

|

33004 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (833) 691-4367

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act: None

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As used in this Current Report on Form 8-K, and

unless otherwise indicated, the terms “Company,” “Veritas Farms,” “we,” “us”

and “our” refer to Veritas Farms, Inc. and its subsidiary.

Our business strategy is to create long-term sustainable

growth, developing and selling our CBD products that address customer needs. We have embarked on a strategy to grow the Company by supplementing

our organic innovation efforts with key joint ventures, partnerships, and strategic alliances that are within or adjacent to our core

areas of focus to capitalize on current and next-generation market opportunities. We are looking to maximize shareholder value and improve

our financial position by looking at ‘business-2-business’ (B2B) and ‘business-2-consumer’ (B2C) companies to

explore synergies for potential strategic alternatives and or M&A activity within the health, wellness, and pet industries. Some examples

are CBD companies that sell direct to consumer, ancillary companies for the hemp/CBD industry, ancillary companies for the mushroom/nootropics

industry, mushroom/nootropic direct to consumer brands, natural supplement brands, and pet brands.

Additional risk factor disclosure

We may seek to

grow our business through key joint ventures, partnerships, and strategic alliances, including acquisitions of, or investments in, new

or complementary businesses, facilities, technologies, offerings, or products, and the failure to manage these strategic alliances, or

to integrate them with our existing business, could have a material adverse effect on us.

In the future we intend to consider opportunities

in key joint ventures, partnerships, and strategic alliances, and or acquire or make investments in new or complementary businesses, facilities,

technologies, offerings, or products, which may enhance our capabilities, complement our current products or expand the breadth of our

markets. Strategic alliances and or acquisitions involve numerous risks, including:

| · | we may find that the joint venture, partnership, and strategic alliance do not improve our financial and/or strategic position as

planned; |

| · | problems integrating the strategic business alliance and or acquired business, including issues maintaining uniform standards, procedures,

controls and policies; |

| · | unanticipated costs associated with strategic business alliances and or acquisitions; |

| · | diversion of management’s attention from our existing business; |

| · | risks associated with entering new markets in which we may have limited or no experience; |

| · | the risks associated with businesses we acquire, which may differ from or be more significant than the risks our other businesses

face; |

| · | potential unknown liabilities associated with a strategic business alliance and or business we acquire; and |

| · | increased legal and accounting costs. |

Our ability to successfully grow through

strategic transactions depends upon our ability to identify, negotiate, complete and integrate suitable target businesses, facilities,

technologies, products and services. These efforts could be expensive and time-consuming and may disrupt our ongoing business and prevent

management from focusing on our operations. As a result of future strategic transactions, we might need to issue additional equity securities,

spend our cash, or incur debt (which may only be available on unfavorable terms, if at all) or contingent liabilities, any of which could

reduce our profitability and harm our business. If we are unable to identify suitable strategic relationships, or if we are unable to

integrate any acquired businesses, facilities, technologies, offerings and products effectively, our business, financial condition, and

results of operations could be materially and adversely affected. Also, while we intend to employ several different methodologies to assess

potential business opportunities, the new business opportunities may not meet or exceed our expectations or desired objectives.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: January 23, 2023 |

VERITAS FARMS, INC. |

| |

|

|

| |

By: |

/s/ Ramon A. Pino |

| |

|

Ramon A. Pino,

Chief Financial Officer |

2

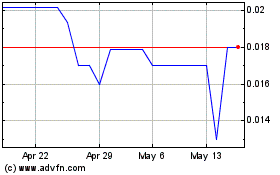

Veritas Farms (CE) (USOTC:VFRM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Veritas Farms (CE) (USOTC:VFRM)

Historical Stock Chart

From Feb 2024 to Feb 2025