TIDMACC

RNS Number : 7659Z

Access Intelligence PLC

16 January 2024

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

Access Intelligence plc

("Access Intelligence", the "Group" or the "Company")

Trading Update

Access Intelligence (AIM: ACC), the technology innovator

delivering Software-as-a-Service (SaaS) solutions for the global

marketing and communications industries, is pleased to announce an

update on trading for the year ended 30 November 2023.

Year to 30 November 2023

During 2023, Access Intelligence focussed its efforts in two key

areas: the continued advancement of its market leading products

including the release of the Group's next generation platform into

the APAC region; and further refinement of the Group's operating

model to improve EBITDA margins and free cash flow conversion.

The Group's Annual Recurring Revenue ("ARR") increased by

GBP2.7m(1) in the period, demonstrating clear progress in growth

momentum across the Group when compared to flat year on year ARR(1)

in 2022. This growth was underpinned by both improved renewal rates

and new business win performance year on year.

Each region within the Group contributed to the ARR growth

during the year, with a strong turnaround being delivered in APAC

where the first ARR growth has been delivered since the acquisition

of Isentia. The Group's audience intelligence proposition is

resonating well where the combination of global media monitoring

and world class social listening has secured major new wins. In

addition the Group has seen a number of very encouraging winbacks

from competitors in the period as customers that had left Isentia

prior to its acquisition by Access Intelligence have now returned

to benefit from the Group's market-leading technology and

services.

ARR FY21 FY22 FY22 FY23 FY23

Change Change

EMEA & North America GBP26.9m +GBP2.5m GBP29.4m +GBP1.1m GBP30.5m

(Constant Currency)

--------- --------- --------- --------- ---------

EMEA & North America GBP26.9m +GBP2.5m GBP29.4m +GBP1.1m GBP30.5m

(Reported)

--------- --------- --------- --------- ---------

APAC GBP31.7m -GBP2.5m GBP29.2m +1.6m GBP30.8m

(Constant Currency)

--------- --------- --------- --------- ---------

APAC GBP32.0m -GBP1.4m GBP30.6m +0.2m GBP30.8m

(Reported)

--------- --------- --------- --------- ---------

Group GBP58.6m +GBP0.0m GBP58.6m +GBP2.7m GBP61.3m

(Constant Currency)

--------- --------- --------- --------- ---------

Group GBP58.9m +GBP1.1m GBP60.0m +GBP1.3m GBP61.3m

(Reported)

--------- --------- --------- --------- ---------

The Board expects total revenue for the financial year to be

approximately GBP62.4m (2022: GBP65.7m reported, GBP 63.9 m(1) ). A

clear focus on optimisation of the Group's operating model during

the year has helped the Group to deliver year on year Adjusted

EBITDA growth of 204%, and improvement in Adjusted EBITDA margin

from 3%(1) in 2022 to 11% in 2023. It is expected that Adjusted

EBITDA will be approximately GBP7.0m (2022: GBP2.3m reported, GBP

2.2 m(1) ), slightly ahead of consensus expectations(2) .

Overall headcount (FTE) was reduced as the Group's AI led

technology platform has enabled automation of some previously

manual services, improving overall client experience through

enhanced accuracy and speed of delivery, whilst duplicate roles

have been removed across the Group as the business has become more

globally integrated.

Net cash at 30 November 2023 was approximately GBP2.2m,

reflecting the additional non-recurring restructuring costs

incurred during the second half as part of the Group's effort to

optimise its overall cost base leading into 2024. A new GBP3.0m

financing facility has been put in place by the Group to provide

additional working capital headroom during 2024 as management

continues to focus on improving margins and cash generation.

Accelerating ARR growth in APAC

A strong turnaround has been delivered in the APAC region during

the year with first period of ARR growth since the acquisition of

Isentia being delivered during the first half (GBP0.3m) and an

acceleration in ARR growth during the second half (GBP1.3m). The

overall ARR growth of GBP1.6m for the year represents a GBP4.1m(1)

improvement compared to the prior year where ARR in APAC declined

by GBP2.5m(1) . The combination of Isentia's established media

monitoring and insights services in the region alongside Access

Intelligence's audience intelligence offering has led to a notable

improvement in renewal rates alongside much stronger new business

performance and winbacks against the competition across various

sectors, including government, finance and retail.

A focus on profitable, long-term customer contracts alongside a

reduction in one-off campaign revenue has led to recurring revenue

increasing to over 93% for the year in the region compared to less

than 90% in 2022.

New client wins and client winbacks in the APAC region during

the second half include: Bulgari, Chubb, Hyundai, Independent

Parliamentary Expenses Authority, Mazda, National University of

Singapore, New South Wales Government, Office of the Chief

Minister, Paramount (Channel 10), Queensland Rail, Services

Australia, Western Power, and University of Auckland.

Continued growth in EMEA & North America

Performance in Europe continues to remain on track with ARR and

margin both increasing year on year. The previously reported

slowdown in decision making at the Enterprise level in North

America has continued albeit a healthy pipeline of opportunities

continues to be developed in this market and a number of leading

global agencies including Havas and McCann have adopted our

combined audience intelligence proposition during the year. Overall

ARR growth in the EMEA & NA region for the year was

GBP1.1m.

New client wins in the EMEA & NA region during the second

half include: Brooklyn Museum, CBRE, Colt Technology, Driver and

Vehicle Standards Agency, Essar Group, Financial Conduct Authority,

GB Railfreight, Guardian Life, Kraft Heinz, Marie Curie, National

Grid, Natural History Museum, Phoenix Group, Royal College Of

Surgeons, Save The Children, Tesco, and UK Infrastructure Bank.

Overall ARR for the year across all regions increased by

GBP2.7m(1) (2022: GBP0.0m(1) ), resulting in a total ARR at 30

November 2023 of GBP61.3m (2022: GBP58.6m(1) ).

Outlook

In 2024 management will continue to focus on enhancing product

functionality for customers, building on the Group's market leading

audience intelligence proposition and driving further acceleration

in ARR growth across both the APAC and EMEA & North America

regions.

The introduction of the Group's next generation product into the

APAC market during 2023 has already created significant upsell and

cross-sell opportunities. This is expected to gain momentum in 2024

as additional features become available for customers.

In Europe, the Company also expects to see an increase in ARR

growth compared to 2023 whilst in North America, the Group's

streamlined team will continue to concentrate on a select number of

high value, high margin deals through developing enterprise

corporate accounts to improve long term ARR.

Enhancing operational efficiency to improve margins has been a

significant priority in 2023 and will continue to be a core focus

throughout 2024. As the Group continues to integrate global systems

more effectively, additional opportunities to realise margin

improvement and free cash flow generation are expected. The focus

on ensuring that the business operates from a lean cost base should

support further margin enhancement and positive cash flow during

2024 and beyond.

Christopher Satterthwaite, Non-Executive Chairman of the

Company, said:

"Access Intelligence's integrated audience intelligence

proposition is pioneering an innovative approach to marketing and

communications and has been adopted by leading global agencies who

forge strategies for the world's largest brands and

organisations.

In 2023, a notable acceleration in ARR growth and improved

Adjusted EBITDA margins has been delivered despite the challenges

posed by a difficult macro-economic environment. The turnaround in

the APAC region has been particularly remarkable, as the Group's

market leading products and services have been well-received by

existing, former and new customers. This growth in ARR in the year

provides confidence of revenue growth(1) being delivered during

2024.

The Board is pleased with the progress made during 2023 to

deliver profitable, global ARR growth and

remains confident about the opportunity for the Group to deliver

improved margins and free cash flow generation in 2024 and

beyond."

1 On a constant currency basis.

2 The Board understands that consensus expectations for the

Company's Adjusted EBITDA for 2023 is GBP6.7m.

For further information:

Access Intelligence plc 020 3426 4024

Joanna Arnold (CEO) / Mark Fautley (CFO)

Cavendish Capital Markets Limited (Nominated Adviser and

Broker)

020 7220 0500

Corporate Finance:

Marc Milmo / Fergus Sullivan

Corporate Broking:

Sunila de Silva

The Group's Nominated Adviser and Broker, finnCap Ltd, has now

changed its name to Cavendish Capital Markets Limited following

completion of its own corporate merger.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSFDESIELSEEF

(END) Dow Jones Newswires

January 16, 2024 02:00 ET (07:00 GMT)

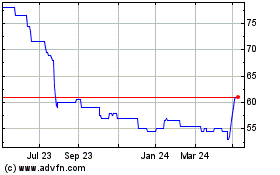

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Jan 2025 to Feb 2025

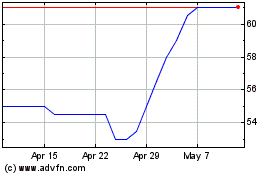

Access Intelligence (LSE:ACC)

Historical Stock Chart

From Feb 2024 to Feb 2025