TIDMADME

RNS Number : 3147T

ADM Energy PLC

14 November 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

14 November 2023

ADM Energy PLC

("ADM" or the "Company")

Financing Update and Debt and Asset Restructuring

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC), a

natural-resources investing company, provides the following update

in respect of its financing, debt and asset restructuring exercise

("the Restructuring") that has been supported by its major

shareholders.

Highlights

-- OFX Holdings, LLC, ("OFXH") a substantial shareholder, has

supported the Company as it completes further agreements with trade

creditors, resulting in significantly reduced liabilities.

-- As a result of the transactions described herein, total debt

has been reduced by approximately GBP1.1 million in combination of

discounted debt settlements and equity transactions.

o Total reduction to original value of debt of GBP432,100

resulting in increase in net asset value for benefit of

shareholders.

o GBP204,918 in debt reduction related to amendments to Blade

Oil V, LLC transaction originally announced 25 May 2023.

o Remainder of debt settled as to GBP125,760 in cash and

GBP346,650 by issuance of 27,885,000 ordinary shares.

-- Further to the announcement of 25 May 2023 regarding

subscriptions for the Secured Convertible Loan Note ("SCLN") issued

by ADM Energy (USA), Inc. for US$900,000, US$425,000 has now been

received in cash with the balance of funds expected over next 90

days.

-- Terms of the SCLN have been amended (further details below)

to attract additional capital to advance the business development

objectives of the Company and to allow proceeds to be used in wider

applications.

-- OFXH, pursuant to its existing loan agreements, advanced an

additional net US$70,000 in cash to the Company in the second half

of 2024. In order to focus on the Altoona lease, part of the Blade

Oil V, LLC ("Blade V") investment announced on 25 May 2023, the

Company has returned the Texas and Kansas leases included in the

Blade V investment, resulting in a reduction of US$406,850 of total

maximum consideration associated with the transaction including

US$250,000 (circa GBP205,000) of the total debt reductions

announced in this RNS.

Debt Restructuring

The debt restructuring exercise carried out by the Company

comprises the following component parts:

i) Settlement of Certain Trade Creditors

The Company has entered into agreements to settle GBP709,280

original value of certain outstanding trade and other creditors for

GBP369,570 of which GBP101,170 has been paid in cash with

GBP147,750 remaining to be paid in installments over time and the

issuance of 12,065,000 ordinary shares (the "Settlement Shares")

resulting in a reduction of creditors of GBP339,710 or 48% of the

original value settled (the "Trade Creditor Settlement").

ii) Debt restructuring with OFX Holdings, LLC

Amendment to Blade Oil V, LLC Acquisition

Further to the announcement of the acquisition of Blade V on 25

May 2023, the Company has agreed with OFXH to amend the terms of

the transaction in order for it to focus on developing cash

generating assets as a priority. The amendments to the Blade V

transaction are as follows:

a) The Company will retain the interest in the Altoona lease;

b) The interest in the Texas and Kansas leases are reassigned to the Seller;

c) The following adjustments are made to the Total Maximum

Consideration (as defined in the RNS dated 25 May 2023):

1. The Seller (OFX Holdings, LLC) will cancel US$250,000.00 in

debt obligations owed to it by the Company;

2. The Seller will terminate US$150,000.00 of the Contingent Payment; and,

3. The Company and Seller have agreed to terminate 7 million 2-year, 2.5p warrants.

As a result of the changes to the Blade V investment, the total

maximum consideration associated with the transaction reduces from

US$1,614,000 to US$1,207,160. Further, given this reduction, the

Company is in discussions with OFXH regarding the possible

investment in a company operating in the oil and gas technology

sector which the Company considers has greater short term cash

generation prospects than the returned leases.

Further Debt Settlement of OFX Holdings, LLC Loans

Additionally, the Company and OFXH have agreed to discount and

restructure US$275,720 of loans due to OFXH (the "Debt Conversion

Settlement") as follows:

a) Issue 15,820,000 ordinary shares (the "Conversion Shares") at

a nominal value of 1p per share;

b) Issue 7,910,000 3-year, 1.5p warrants.

The Debt Conversion Settlement has been undertaken on the same

terms as other creditor settlements and, in the event of a change

to the terms of the settlement, all converting creditors will be

treated equally.

Other Disclosures Related to OFX Holdings, LLC

-- In the second half of 2023, under the terms of its existing

loan agreements, OFXH advanced a net US$70,000 in cash to the

Company, and forgave US$60,000 in short-term loans, to partially

fund the creditor settlements described above and for general

working capital purposes.

-- OFXH has funded US$125,000 toward its US$250,000 commitment

to the Secured Convertible Loan Note announced 25 May 2023 and has

reaffirmed its commitment to fund the remaining US$125,000 within

90 days.

-- As part of these negotiations and in light of funding for the

Company coming from OFXH, OFXH has settled approximately GBP102,000

in creditors on behalf of the Company via the assignment of

20,400,000 shares held by OFXH to the creditor on behalf of the

Company.

-- As consideration for monies advanced by OFXH to help the

Company fund the Trade Creditor Settlement, the Company and OFXH

agreed to a US$35,000 Creditor Restructuring Fee to be capitalised

and added to the amount due and the award to OFXH of 26.5 million

3-year, 1.5p warrants.

-- The Company and OFXH are working on additional transactions

related to settlement of debt owed to OFXH, the assets in which the

Company and OFXH share ownership and other assets and business

interests owned by OFXH.

Consolidation of OFXH Loans

Following the reorganisation noted above, the Company has

remaining outstanding loan advances due to OFXH of US$337,500 (the

"OFXH Loans"). The Company and OFX have agreed that the OFXH Loans

will be consolidated into a new loan facility (the "Consolidated

Loan") to replace all previous loan facilities with OFXH. The key

terms of the new loan facility are:

Borrower: ADM Energy (USA), Inc.

Maturity: 31 December 2025

Interest Rate: 15.0% per annum

Payments: Monthly amortisation, in arrears starting February

2024.

The other terms of the Consolidated Loan remain in line with the

OFXH Loans as previously announced.

iii) Amendments to the Secured Convertible Loan Note

On 25 May 2023, the Company announced that it had received

subscriptions for the SCLN totalling US$900,000 which would be

settled in due course. Of the total amount subscribed for, the

Company has received a total of US$425,000 in gross proceeds to

date and expects to receive the balance subscribed for within

ninety days. Only the SCLNs that have been paid for have been

issued.

The terms of the SCLN, which have previously been announced,

have been amended by mutual agreement between the Company and

holders of the SCLN pursuant to the original terms of the SCLN, as

follows:

a) The requirement to use 100.0% of the proceeds to fund

development of the Altoona lease has been replaced with the

following:

a. The Company must use a minimum of 50.0% of the gross proceeds

from the SCLN to fund development of projects held by or

investments in the business interests of ADM Energy (USA), Inc.

b. The Company may use up to 30.0% of the gross proceeds from

the SCLN to fund general working capital requirements of the

Company.

c. The Company may use up to 20.0% of the gross proceeds from

the SCLN for debt repurchased at, at least, a 50% discount.

b) The Interest rate has been increased from 8.0% to 15.0% per

annum to align it with the Consolidated Loan.

c) The equity conversion price has been lowered from 1.2p per share to 1.0p per share.

d) The 1.25% over-ride royalty interest to be granted in the

Altoona lease has been replaced by a 10.0% net profits interest in

the pre-tax profits of ADM Energy (USA), Inc.

The restructuring of the SCLN has occurred as a result of the

Company's focus on debt reorganisation and short term cash and

value generation, which includes the change in the Blade V assets

and potential further investment. The Board of Directors of the

Company believe that the amended terms of the SCLN will enable the

Company to attract additional capital to further the projects and

investment objectives of the Company while providing flexibility to

the Company in managing its working capital and other

obligations.

Restructuring Fee

Ventura Energy Advisors, LLC, ("VEA") a related party of OFX

Holdings, LLC, is to be paid a US$50,000.00 restructuring fee

("Restructuring Fee") in conjunction with its services related to

the creditor restructuring transactions described above. The

Restructuring Fee will be paid by issuance to VEA of US$50,000 in

Secured Convertible Loan Notes.

Related Party Transactions

As part of the Restructuring, various agreements with OFXH noted

above have been entered into or amended including, inter alia, the

amendment to the Blade V investment, the Debt Conversion

Settlement, settlement of creditors on the Company's behalf, the

Restructuring Fee, Creditor Restructuring Fee, the Consolidated

Loan and the issue of warrants constitute related party

transactions for the purposes of AIM Rule 13. The Company's

Directors consider, having consulted with the Company's nominated

adviser, Cairn Financial Advisers LLP, that the terms of the

transactions are fair and reasonable insofar as the Company's

shareholders are concerned.

The SCLN has been subscribed to by OFXH and Hessia Group Limited

(both substantial shareholders) and Oliver Andrews and Stefan

Olivier (a former and current director respectively) and,

accordingly the amendment the SCLN constitutes a related party

transaction for the purposes of AIM Rule 13. The Company's

Directors consider, having consulted with the Company's nominated

adviser, Cairn Financial Advisers LLP, that the terms of the

transaction are fair and reasonable insofar as the Company's

shareholders are concerned.

Admission to AIM and Total Voting Rights

Application has been made for the Settlement Shares, Conversion

Shares and Award Shares, which total 27,885,000 new ordinary shares

and which will rank pari passu with the Company's existing ordinary

shares, to be admitted to trading on AIM ("Admission"). It is

expected that Admission of the New Ordinary Shares will become

effective and that dealings will commence at 08.00 am on or around

17 November 2023.

Following Admission, the Company's enlarged issued share capital

("Enlarged Issued Share Capital") will comprise 397,673,614

ordinary shares of GBP0.01 each with voting rights in the Company.

This figure may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in the

interest in, the share capital of the Company under the FCA's

Disclosure and Transparency Rules.

Following issuance of the Conversion Shares, OFX will hold

34,551,334 ordinary shares of ADM Energy plc representing 8.7% of

the Enlarged Issued Share Capital of the Company on Admission.

Stefan Olivier, CEO of ADM Energy, commented , "The transactions

announced today are significant for the Company and its

shareholders as they result in over GBP1 million of debt reduction

and a direct increase in net asset value for benefit of

shareholders. The support demonstrated by our large shareholders,

Hessia Group Limited and OFXH, in terms of additional funding and

settlement of debt has been and remains a significant source of

strength and stability for ADM. ADM will enter 2024 in a much

stronger position than it did in 2023 to advance the business

interests of the Company."

Enquiries:

ADM Energy plc +44 20 7459 4718

Stefan Olivier, CEO

www.admenergyplc.com

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Hybridan LLP +44 20 3764 2341

(Broker)

Claire Louise Noyce

ODDO BHF Corporates & Markets AG +49 69 920540

(Designated Sponsor)

Michael B. Thiriot

Gracechurch Group +44 20 4582 3500

(Financial PR)

Harry Chathli, Alexis Gore, Henry Gamble

About ADM Energy PLC

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC) is a natural

resources investing company with an existing asset base in Nigeria

and the United States. ADM Energy holds a 9.2% profit interest in

the oil producing Aje Field, part of OML 113, which covers an area

of 835km(2) offshore Nigeria. Aje has multiple oil, gas, and gas

condensate reservoirs in the Turonian, Cenomanian and Albian

sandstones with five wells drilled to date. ADM also has interest

in an oil and gas lease in the U.S. state of California.

ADM Energy is committed to maximizing long-term value from its

existing asset base in Nigeria while targeting other investment

opportunities in the oil and gas sector with attractive risk reward

profiles such as proven nature of reserves, level of historic

investment, established infrastructure and route to early cash

flow.

About OFX Holdings, LLC

Formerly, Tennessee Black Gold LLC, OFX Holdings is a private

U.S. investment company led by Claudio Coltellini, an Italian

national who for the last 15 years has invested in U.S. oil and gas

and leads four private companies with assets in the states of

Texas, Louisiana, Kansas and California.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFESSLEDSEEF

(END) Dow Jones Newswires

November 14, 2023 02:00 ET (07:00 GMT)

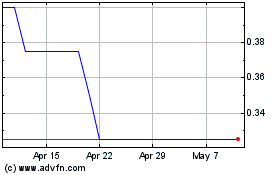

Adm Energy (LSE:ADME)

Historical Stock Chart

From Dec 2024 to Jan 2025

Adm Energy (LSE:ADME)

Historical Stock Chart

From Jan 2024 to Jan 2025