TIDMADME

RNS Number : 2825V

ADM Energy PLC

01 December 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

1 December 2023

ADM Energy PLC

("ADM" or the "Company")

Internal Review of Aje Field Interest

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC), a

natural-resources investing company, announces that the Board of

Directors have completed an internal review of existing

investments, financial resources and future investment

opportunities available to the Company. The key takeaways of this

review include:

-- The Board has concluded that opportunities available to it in

energy technology, such as the OFX Technologies, LLC investment

announced 29 November 2023, present a compelling path to growth in

per share value and cash flow for the Company.

-- As a result, the Board has resolved to consider alternatives

for monetising its 12.3% cost share and 9.2% profit share interest

in the Aje Field, OML-113 offshore Lagos, Nigeria.

-- Alternatives to be considered by the Company for Aje include

its sale, a joint-venture, farming-out or other such

transactions.

-- Among other alternatives to be considered, Energy Equity

Resources (Nigeria), Ltd. ("EER"), a 16.8% cost share and 12.6%

profit share partner in the Aje consortium, will work with the

Company on potential alternatives involving third party financing

to meet the requirements of both EER and the Company related to the

Aje.

-- The Board has resolved to hire a third-party adviser to

manage the process of identifying and executing a potential

transaction related to its interest in OML-113 and to discuss with

its auditors any implications in respect of the classification of

the Aje asset.

OML-113 Description and Recent Developments

The Company holds a 12.3% cost share and 9.2% profit share

interest in OML-113 covering an area of 835km(2) offshore Nigeria,

which includes the Aje Field. Aje, which has produced more than 5

million barrels of oil to date, is rich in gas and condensate

reserves with multiple oil, gas, and gas condensate reservoirs in

the Turonian, Cenomanian and Albian sandstones with five wells

drilled to date. Based on ADM's 2019 Competent Persons Report, Aje

represents 8.9 million barrels of oil equivalent resources with a

mid-case PV-10% of US$25.9 million to ADM's interest based on a

US$70 oil price scenario.

The decision by the Board to consider alternatives for

monetising the Company's interest in Aje follows the acquisition by

PetroNor E&P ASA ("PetroNor") of an additional 32.1% cost

sharing and 24.1% profit share interest in OML-113 announced 3

October 2023. Under PetroNor's leadership, the Company and its

consortium partners have been in dialog regarding plans to proceed

to a final investment decision regarding the further development of

Aje in 2024.

Additionally, the consortium has commenced reprocessing of 3-D

seismic covering the Aje Field and a significant portion of the OML

113 license area offshore Nigeria. The reprocessing is near

completion and fully reprocessed 3-D seismic is expected to be

available for interpretation in early 2024.

The Board view these positive developments with respect to

commercialising Aje as presenting a favourable time to initiate the

process of partnering, financing or monetising its interest through

sale of the asset with the objective of maximising value and

freeing up capital to deploy into other projects in keeping with

the focus of the Company on opportunities in energy related

technologies.

Stefan Olivier, CEO of ADM Energy plc, said: "The investment in

Efficient Oilfield Solutions, LLC announced 29 November 2023 is a

pivotal strategic development representing a new focus for the

Company away from capital intensive, long lead-time projects toward

compelling opportunities with a clear path to cash flow in high

growth energy technology and energy transition related

opportunities."

"With recent interest by the German government in working with

Nigeria to realise the potential of its massive natural gas

reserves, Aje represents a de-risked asset that we believe will be

attractive to a variety of strategic and financial investors. Along

with the entire Board of ADM, I am committed to realising the

potential of the Aje Field and the entire license area for ADM and

its shareholders while re-deploying capital into the attractive

energy technology opportunities available to the Company."

Enquiries:

ADM Energy plc +44 7595 779520

Stefan Olivier, Chief Executive Officer

www.admenergyplc.com

Cairn Financial Advisers LLP +44 20 7213 0880

(Nominated Adviser)

Jo Turner, James Caithie

Hybridan LLP +44 20 3764 2341

(Broker)

Claire Louise Noyce

ODDO BHF Corporates & Markets AG +49 69 920540

(Designated Sponsor)

Michael B. Thiriot

Gracechurch Group +44 20 4582 3500

(Financial PR)

Harry Chathli, Alexis Gore, Henry Gamble

About ADM Energy PLC

ADM Energy PLC (AIM: ADME; BER and FSE: P4JC) is a natural

resources investing company focused on building a portfolio of

investments in line with growth in energy technology and the energy

transition. ADM Energy holds a 9.2% profit interest in the Aje

Field, part of OML 113, which covers an area of 835km(2) offshore

Nigeria. Aje has multiple oil, gas, and gas condensate reservoirs

in the Turonian, Cenomanian and Albian sandstones with five wells

drilled to date.

Forward Looking Statements

Certain statements in this announcement are, or may be deemed to

be, forward looking statements. Forward looking statements are

identified by their use of terms and phrases such as "believe",

"could", "should", "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements reflect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCURVNROUUAOAA

(END) Dow Jones Newswires

December 01, 2023 02:00 ET (07:00 GMT)

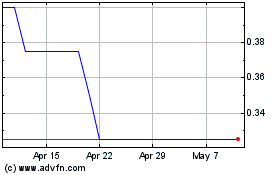

Adm Energy (LSE:ADME)

Historical Stock Chart

From Dec 2024 to Jan 2025

Adm Energy (LSE:ADME)

Historical Stock Chart

From Jan 2024 to Jan 2025