TIDMCFYN

RNS Number : 6452T

Caffyns PLC

26 November 2021

HALF YEAR REPORT

for the six months ended 30 September 2021

Summary

6 months 6 months

to to

30 September 30 September

2021 2020

GBP'000 GBP'000

Revenue 110,785 85,352

Profit before tax 2,295 1,414

Underlying EBITDA (see note 1

below) 3,950 3,218

Underlying profit before tax (see

note 1 below) 2,396 1,534

Pence Pence

Underlying basic earnings per

share 73.0 55.9

Basic earnings per share 69.9 52.3

Interim dividend per ordinary 7.5 -

share

Financial and operational review

-- Underlying profit before tax of GBP2.40 million (2020: GBP1.53 million)

-- Profit before tax of GBP2.30 million (2020: GBP1.41 million)

-- Like-for-like revenue increase for the period of 29% (see note 2 below)

-- Underlying basic earnings per share up by 31% to 73.0 pence (2020: 55.9 pence)

-- Basic earnings per share up by 34% to 69.9 pence (2020: 52.3 pence)

-- Resumption of dividend payment reflecting first half performance

-- Net bank borrowings at 30 September 2021 of GBP8.7 million (2020: GBP12.2 million)

Simon Caffyn, Chief Executive, commented:

"Our results to September benefited from an unprecedented used

car performance. We have also implemented greater operational

efficiencies throughout the group and I am proud of the way our

operational and support teams have risen to the challenges to

deliver this strong performance'"

Enquiries:

Simon Caffyn, Chief

Caffyns plc Executive Tel: 01323 730201

Mike Warren, Finance

Director

Headland Chloe Francklin Tel: 020 3805 4855

Note 1: Underlying results exclude items that have non-trading

attributes due to their size, nature or incidence. Non-underlying

items for the period totalled GBP0.10 million (2020: GBP0.12

million) and are detailed in Note 4 to these condensed consolidated

financial statements. Underlying EBITDA of GBP3.95 million (2020:

GBP3.22 million) represents Operating profit before non-underlying

items of GBP2.97 million (2020: GBP2.23 million) and Depreciation

and amortisation of GBP0.98 million (2020: GBP0.99 million).

Note 2: Like-for-like comparisons exclude from the current year

the impact of the Lotus and MG businesses at Ashford, both of which

were opened during the period, as well as the LEVC business in

Eastbourne which opened during the prior year period. All other

businesses operated throughout both the current and prior six-month

periods.

INTERIM MANAGEMENT REPORT

Summary

The board is very pleased to report a strong underlying profit

before tax of GBP2.40 million for the half-year ended 30 September

2021 ("the period"). This is a considerable improvement on the

GBP1.53 million recorded for the comparative period in 2020.

Trading in the period, especially for used cars, has been robust

and actions implemented over the last year have strengthened the

resilience of the business, including against the adverse effects

of the covid-19 pandemic. During the period, the Company utilised

the support made available by Government from reductions in

business rates for retail premises and to a lesser extent from

Coronavirus Job Retention Scheme furlough grants, which assisted us

to maintain employment. New car availability for the important

September bi-annual registration plate change on 1 September was

constrained by the global shortage of semiconductors adversely

affecting car production levels and we expect this issue also to

affect the second half of the current financial year.

Revenue for the period increased by 30% to GBP110.8 million

(2020 GBP85.4 million). The increase resulted primarily from

business activity in the prior period being heavily restricted in

two of the six months due to covid-19, but partially offset by the

global shortage of semiconductors affecting the availability of new

cars in the period. Underlying basic earnings per share were 73.0

pence (2020: 55.9 pence).

The Company's defined-benefit pension scheme deficit, calculated

in accordance with the requirements of IAS 19 Pensions, showed an

encouraging reduction of GBP4.5 million from the last financial

year-end at 31 March 2021 to GBP4.9 million at 30 September 2021.

The Scheme's investments performed well, outpacing the increase in

the present value of the Scheme's pension liabilities, resulting in

a welcome narrowing of the deficit.

The Company continues to own all but two of the freeholds of the

properties from which it operates and this provides the dual

strengths of a strong asset base and minimal exposure to rent

reviews, which is reassuring in these uncertain times.

Profit before tax for the period was GBP2.30 million (2020:

GBP1.41 million) with basic earnings per share of 69.9 pence (2020:

52.3 pence).

The Board is aware of the importance of dividend payments to its

shareholders and is mindful that it has not paid a dividend for two

years due to the inherent uncertainty the covid-19 pandemic has

placed on the business. Having considered the interests of all

stakeholders and, i n light of the strong financial performance and

associated cash generation in the period and the longer-term

prospects for the business, the board has judged that it is

appropriate to re-start payment of dividends and has declared an

interim dividend of 7.5 pence per ordinary share (2020: Nil pence

per ordinary share).

Operating review

New and used cars

Our new car deliveries in the period rose by 12% from the

previous year on a like-for-like basis with our VAG-branded new car

deliveries performing strongly, ahead of the increase in the UK

market. Nationally, the SMMT reported a 19% increase in new car

registrations in the retail and small business market segment in

which we primarily operate. Used car sales volumes for the period

rose by 36% on a like-for-like basis. A number of improvements have

been made to our on-line presence and customer journeys over the

last year which have helped to make for a much more enjoyable

customer experience. Demand was further boosted by customers

switching into used car purchases due to the lack of availability

of new cars towards the end of the period.

Aftersales

Our aftersales revenues rose by 21% in the period on a

like-for-like basis, despite a slow start to the period in April

and May as that two-month period coincided with the 12-month

anniversary of the first covid-19 lockdown in 2020. The period also

faced the headwind of staff shortages from the "pingdemic" and from

social-distancing requirements adversely affecting productivity

levels. Throughout the period, we have continued to realise

improvements to our customer retention processes.

Operations

Given the headwinds to trading that the business has experienced

in the period from the background covid-19 pandemic and the growing

lack of availability of new cars, it was extremely pleasing that

all six of our established franchise businesses reported improved

profitability in comparison to the previous period. Our Audi and

Volkswagen businesses, in particular, performed very strongly. Our

Motorstore used car operation performed satisfactorily in the

period, particularly as the business was disrupted by building

improvement works at its base in Ashford.

During the period, we commenced representation with Lotus and

MG, opening in Ashford on 1 July 2021. Both businesses have

performed well, and we are encouraged by the starts that they have

made.

The Company benefited in the period from the Government's

business rates holiday for retail premises with savings of GBP0.5

million (2020: GBP0.6 million). Savings will continue until March

2022, albeit at a lower level. The Company also utilised the

Government's Coronavirus Job Retention Scheme, receiving GBP0.1

million in the period (2020: GBP1.7 million).

Property

Capital expenditure in the period was GBP1.2 million (2020:

GBP0.2 million). This included GBP0.7 million of assets in the

course of construction associated with an upgrade to our Volvo site

in Eastbourne, to allow for an expansion of the showroom facility

to better represent Volvo's extended model range. This upgrade will

be completed in the second half of the year.

We operate primarily from freehold sites and our property

portfolio provides additional stability to our business model.

Annually, we obtain an independent assessment of the values of our

freehold properties against their carrying value in our accounts

and had an unrecognised surplus to carrying value of GBP12.3

million at 31 March 2021, our last financial year-end. The board

does not consider there to have been any material movement in the

value of the Company's freehold properties since the year-end.

As part of the sale of the Land Rover business in April 2016,

our freehold premises in Lewes had been leased to a third-party but

that lease came to an end in early June 2021. The Board is

evaluating future opportunities for the site.

Pensions

The Company's defined-benefit pension scheme started the period

with a net deficit of GBP9.4 million. The board has little control

over the key assumptions in the valuation calculations as required

by accounting standards and the size and nature of the Scheme's

underlying assets and liabilities means that the deficit can be

subject to significant change. However, the board was pleased to

note a significant reduction in the assessed level of the deficit

at 30 September 2021, to GBP4.9 million. Net of deferred tax, the

net deficit was GBP4.0 million at 30 September 2021 (2020: GBP10.8

million) and GBP7.6 million at 31 March 2021. In the period, growth

in the value of the Scheme's gross assets was good, increasing in

value by GBP5.8 million, whilst the Scheme's liabilities increased

by just GBP1.3 million.

The pension cost under IAS 19 is recognised in the Condensed

Consolidated Statement of Financial Performance and continues to be

charged as a non-underlying cost, amounting to GBP101,000 in the

period (2020: GBP113,000).

As the Scheme is in deficit, the Company has in place a recovery

plan which has been agreed with the trustees, and which was last

updated in May 2021. During the period, the Company made cash

payments into the Scheme of GBP1.4 million, which included a

one-off payment of GBP1.0 million in June 2021. The recurring

element of these payments increase by a minimum of 2.25% per

annum.

Bank and other funding facilities

The Company has banking facilities with HSBC which comprise a

term loan, originally of GBP7.5 million, and a revolving-credit

facility of GBP7.5 million, both of which will become renewable in

March 2023. HSBC also provides an overdraft facility of GBP3.5

million, renewable annually. In addition, there is an overdraft

facility of GBP4.0 million provided by Volkswagen Bank, renewable

annually, together with a term loan, originally of GBP5.0 million,

which is repayable over the ten years to November 2023.

The Company has been cash generative during the period with

GBP2.7 million (2020: GBP4.4 million) generated from operating

activities, including a favorable working capital improvement of

GBP1.0 million (2020: GBP2.0 million).

Bank borrowings, net of cash balances, at 30 September 2021 were

GBP8.7 million (2020: GBP12.2 million), down from GBP10.3 million

at 31 March 2021. As a proportion of shareholders' funds, bank

borrowings, net of cash balances were 27% at 30 September 2021

(2020: 50%).

Taxation

The tax charge for the period has been based on an estimation of

the effective tax rate on profits for the full financial year of

20% (2020: 22%). The current year effective tax rate is marginally

higher than the standard rate of corporation tax in force for the

year of 19% due to the effect of items disallowable for tax

purposes.

Payments of corporation tax in the period, net of refunds, were

GBP0.3 million (2020: refund of GBP0.1 million).

The narrowing of the deficit of the Company's defined-benefit

pension scheme in the period contributed to the recognition of a

deferred tax liability on the Statement of Financial Position at 30

September 2021 of GBP0.4 million (2020: deferred tax asset of

GBP1.1 million).

People

The health and safety of our employees and customers during the

ongoing covid-19 pandemic has been our paramount concern with

policies implemented so that our showroom and workshop activities

continue to be undertaken in a responsible and socially distanced

way. The response from everyone in the Company to the pandemic

continues to be outstanding and the board would like to express its

gratitude to them for their hard work and professional application

. Our results to September benefited from an unprecedented used car

performance. We have also implemented greater operational

efficiencies throughout the group and our operational and support

teams have risen to the challenges to deliver this strong

performance .

Dividend

The Company has not declared a dividend since the interim

dividend in late 2019. The Board is aware of the importance of

dividend payments to its shareholders, and for the need to resume

dividend payments once it is appropriate to do so. Despite the

uncertainty that remains over the covid-19 pandemic and the ongoing

supply chain issues the industry is facing, the judgement of the

board is that the first half performance and longer term prospects

mean that it is now appropriate to restart dividend payments.

Accordingly it has declared an interim dividend of 7.5 pence per

ordinary share (2020: Nil pence per ordinary share). This interim

dividend will be paid to shareholders on 10 January 2022 to those

shareholders on the register at close of business on 10 December

2021. The ordinary shares will be marked ex-dividend on 9 December

2021.

Strategy

Our continuing strategy is to focus on representing premium and

premium-volume franchises as well as maximising opportunities for

premium used cars, with an emphasis on delivering the highest

quality of customer experience. We recognise that we operate in a

rapidly changing environment and carefully monitor the

appropriateness of this strategy whilst also seeking new

opportunities to invest in the future growth of the business.

We concentrate on stronger markets so as to deliver higher

returns from fewer but bigger sites. We continue to seek to deliver

performance improvement, in particular in our used car and

aftersales operations.

Current trading and outlook

Customer demand for used cars remains strong, with few signs of

slowing. The Company's forward-order bank for new cars is at a

historically high level, which is especially encouraging for 2022

when it is hoped that new car availability will improve. However,

in the short-term new cars are expected to remain in short supply

and the high level of national covid-19 infections continues to be

a concern as winter approaches. Given these uncertainties, the

board remains cautious for the second half of the financial

year.

Our balance sheet is appropriately funded and our freehold

property portfolio is a source of substantial stability. We have

taken several actions over the last eighteen months that have

significantly enhanced our online presence, as well as improving

our productivity and increasing the resilience of the business. We

remain confident in the longer-term prospects for the Company and

are ready to explore future business opportunities as they

arise.

Simon G M Caffyn

Chief Executive

25 November 2021

Condensed Consolidated Statement of Financial Performance

for the half year ended 30 September 2021

Unaudited Unaudited Audited

Half year Half year Year ended

N o to to 31 March

t e 30 September 30 September 2021

2021 2020 Total

Total Total

GBP'000 GBP'000 GBP'000

Revenue 110,785 85,352 165,085

Cost of sales (95,058) (73,884) (142,304)

---------------------------------------- ------ -------------- -------------- ------------

Gross profit 15,727 11,468 22,781

Operating expenses (13,036) (9,618) (20,798)

---------------------------------------- ------ -------------- -------------- ------------

Operating profit before other income 2,691 1,850 1,983

Other income (net) 3 259 360 909

---------------------------------------- ------ -------------- -------------- ------------

Operating profit 2,950 2,210 2,892

---------------------------------------- ------ -------------- -------------- ------------

Operating profit before non-underlying

items 2,966 2,229 3,142

Non-underlying items within operating

profit 4 (16) (19) (250)

---------------------------------------- ------ -------------- -------------- ------------

Operating profit 2,950 2,210 2,892

Net finance expense 5 (570) (695) (1,266)

Non-underlying net finance expense

on pension scheme 4 (85) (101) (202)

---------------------------------------- ------ -------------- -------------- ------------

Net finance expense (655) (796) (1,468)

---------------------------------------- ------ -------------- -------------- ------------

Profit before taxation 2,295 1,414 1,424

---------------------------------------- ------ -------------- -------------- ------------

Profit before tax and non-underlying

items 2,396 1,534 1,876

Non-underlying items within operating

profit 4 (16) (19) (250)

Non-underlying net finance expense

on pension scheme 4 (85) (101) (202)

---------------------------------------- ------ -------------- -------------- ------------

Profit before taxation 2,295 1,414 1,424

Taxation 6 (410) (5) (14)

---------------------------------------- ------ -------------- -------------- ------------

Profit for the period 1,885 1,409 1,410

---------------------------------------- ------ -------------- -------------- ------------

Earnings per share

Basic 7 69.9p 52.3p 52.4p

Diluted 7 69.0p 52.3p 52.1p

Non-GAAP measure

Underlying basic earnings per share 7 73.0p 55.9p 66.0p

Underlying diluted earnings per

share 7 72.0p 55.9p 65.6p

Condensed Consolidated Statement of Comprehensive Expense

for the half year ended 30 September 2021

Note Unaudited Unaudited Audited

Half year Half year Year to

to to

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Profit for the period 1,885 1,409 1,410

--------------------------------------- ----- ------------- ------------- ---------

Items that will never be reclassified

to profit and loss:

Remeasurement of net pension

scheme obligation 12 3,224 (4,025) (301)

Deferred tax on remeasurement

of pension scheme obligation (612) 765 57

--------------------------------------- ----- ------------- ------------- ---------

Other comprehensive income/(expense),

net of tax 2,612 (3,260) (244)

--------------------------------------- ----- ------------- ------------- ---------

Total comprehensive income/(expense)

for the period 4,497 (1,851) 1,166

--------------------------------------- ----- ------------- ------------- ---------

Condensed Consolidated Statement of Financial Position

at 30 September 2021

Unaudited Unaudited Audited

30 September 30 September 31 March

Note 2021 2020 2021

GBP'000 GBP'000 GBP'000

Non-current assets

Right-of-use assets 9 550 768 610

Property, plant and equipment 9 38,060 38,206 37,624

Investment properties 10 7,703 7,994 7,751

Interest in lease 473 643 557

Goodwill 286 286 286

Deferred tax asset - 1,080 412

--------------------------------------- ------- -------------- -------------- ----------

Total non-current assets 47,072 48,977 47,240

--------------------------------------- ------- -------------- -------------- ----------

Current assets

Inventories 27,703 31,309 36,562

Trade and other receivables 4,003 8,106 5,072

Interest in lease 171 175 173

Current tax recoverable - - 34

Cash and cash equivalents 4,958 5,273 5,735

--------------------------------------- ------- -------------- -------------- ----------

Total current assets 36,835 44,863 47,576

--------------------------------------- ------- -------------- -------------- ----------

Total assets 83,907 93,840 94,816

--------------------------------------- ------- -------------- -------------- ----------

Current liabilities

Interest-bearing overdrafts, loans

and borrowings 1,875 4,875 3,875

Trade and other payables 30,735 35,737 39,338

Lease liabilities 434 493 495

Current tax payable 165 320 306

--------------------------------------- ------- -------------- -------------- ----------

Total current liabilities 33,209 41,425 44,014

--------------------------------------- ------- -------------- -------------- ----------

Net current assets 3,626 3,438 3,562

Non-current liabilities

Interest-bearing loans and borrowings 11,750 12,625 12,187

Lease liabilities 695 1,115 783

Preference shares 812 812 812

Pension scheme obligation 12 4,920 13,310 9,434

Deferred tax liability 411 - -

--------------------------------------- ------- -------------- -------------- ----------

Total non-current liabilities 18,588 27,862 23,216

--------------------------------------- ------- -------------- -------------- ----------

Total liabilities 51,797 69,287 67,230

--------------------------------------- ------- -------------- -------------- ----------

Net assets 32,110 24,553 27,586

--------------------------------------- ------- -------------- -------------- ----------

Shareholders' equity

Ordinary share capital 1,439 1,439 1,439

Share premium 272 272 272

Capital redemption reserve 707 707 707

Non-distributable reserve 1,724 1,724 1,724

Retained earnings 27,968 20,411 23,444

--------------------------------------- ------- -------------- -------------- ----------

Total equity 32,110 24,553 27,586

--------------------------------------- ------- -------------- -------------- ----------

Condensed Consolidated Statement of Changes in Equity

for the half year ended 30 September 2021 (unaudited)

Capital

Share Share redemption Non-distributable Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2021

Total comprehensive income 1,439 272 707 1,724 23,444 27,586

Profit for the period - - - - 1,885 1,885

Other comprehensive income - - - - 2,612 2,612

----------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

Total comprehensive income

for the period - - - - 4,497 4,497

Transactions with owners:

Share-based payment - - - - 27 27

---------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

At 30 September 2021 (unaudited) 1,439 272 707 1,724 27,968 32,110

----------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

for the half year ended 30 September 2020 (unaudited)

Capital

Share Share redemption Non-distributable Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2020 1,439 272 707 1,724 22,238 26,380

Total comprehensive

income/(expense)

Profit for the period - - - - 1,409 1,409

Other comprehensive expense - - - - (3,260) (3,260)

----------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

Total comprehensive expense

for the period (1,851) (1,851)

Transactions with owners:

Share-based payment - - - - 24 24

---------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

At 30 September 2020 (unaudited) 1,439 272 707 1,724 20,411 24,553

----------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

for the year ended 31 March 2021 (audited)

Capital

Share Share redemption Non-distributable Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2020 1,439 272 707 1,724 22,238 26,380

Total comprehensive

income/(expense)

Profit for the year - - - - 1,410 1,410

Other comprehensive expense - - - - (244) (244)

--------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

Total comprehensive income

for the year 1,166 1,166

Transactions with owners:

Issue of shares - SAYE - - - - 3 3

Share-based payment - - - - 37 37

-------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

At 31 March 2021 (audited) 1,439 272 707 1,724 23,444 27,586

--------------------------------- ---------- ---------- ------------ ------------------ ----------- ----------

Condensed Consolidated Cash Flow Statement

for the half year ended 30 September 2021

Unaudited Unaudited Audited

Half year Half year Year to

to to 31 March

30 September 30 September 2021

2021 2020 GBP'000

GBP'000 GBP'000

Cash flows from operating activities

Profit before taxation 2,295 1,414 1,424

Adjustments for:

Net finance expense and pension scheme

service cost 655 796 1,468

Depreciation of property, plant and equipment,

investment properties and right-of-use

assets 984 989 1,982

Impairment against investment properties - - 184

Cash payments into the defined-benefit

pension scheme (1,391) (262) (526)

Loss on disposal of property, plant and

equipment - 1 3

Share-based payments 27 24 37

Decrease in inventories 8,859 1,221 3,484

Decrease/(increase) in receivables 1,069 (3,788) (754)

(Decrease)/increase in payables (8,881) 4,601 697

------------------------------------------------ --------------- --------------- -----------

Cash generated from operations 3,617 4,996 7,999

Net tax (paid)/recovered (307) 66 (31)

Interest paid (562) (683) (1,244)

------------------------------------------------ --------------- --------------- -----------

Net cash generated from operating activities 2,748 4,379 6,724

------------------------------------------------ --------------- --------------- -----------

Investing activities

Proceeds generated on disposal of property, - - -

plant and equipment

Purchases of property, plant and equipment (913) (198) (394)

Receipt from investment in lease 93 - 185

------------------------------------------------ --------------- --------------- -----------

Net cash used in investing activities (820) (198) (209)

------------------------------------------------ --------------- --------------- -----------

Financing activities

Bank revolving-credit facility repaid (2,000) (1,000) (2,000)

Revolving-credit facility utilised - - 1,000

Secured loans (repaid)/utilised (437) 781 (657)

Issue of shares - SAYE scheme - - 3

Repayment of lease liabilities (268) (167) (604)

------------------------------------------------ --------------- --------------- -----------

Net cash used in financing activities (2,705) (386) (2,258)

------------------------------------------------ --------------- --------------- -----------

Net (decrease)/increase in cash and cash

equivalents (777) 3,795 4,257

Cash and cash equivalents at beginning

of period 5,735 1,478 1,478

------------------------------------------------ --------------- --------------- -----------

Cash and cash equivalents at end of period 4,958 5,273 5,735

------------------------------------------------ --------------- --------------- -----------

Cash and cash equivalents 4,958 5,273 5,735

Bank revolving-credit facility (1,000) (4,000) (3,000)

------------------------------------------------ --------------- --------------- -----------

3,958 1,273 2,735

------------------------------------------------ --------------- --------------- -----------

Notes to the Condensed Consolidated Financial Statements

for the half year ended 30 September 2021

1. GENERAL INFORMATION

Caffyns plc is a company domiciled in the United Kingdom. The

address of the registered office is Meads Road, Eastbourne, East

Sussex, BN20 7DR.

These condensed consolidated financial statements for the half

year to 30 September 2021 and similarly for the half year to 30

September 2020 are unaudited. They do not include all the

information required for full annual financial statements and

should be read in conjunction with the financial statements of the

Company for the year ended 31 March 2021.

The comparative financial information for the year ended 31

March 2021 in these condensed consolidated financial statements

does not constitute statutory accounts for that year. The statutory

accounts for 31 March 2021 have been delivered to the Registrar of

Companies. The auditor's report on those accounts was unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006.

These condensed consolidated financial statements have been

reviewed by the Company's auditor and a copy of their review report

is set out at the end of these statements.

These consolidated interim financial statements were approved by

the directors on 25 November 2021.

2. ACCOUNTING POLICIES

The annual financial statements of Caffyns plc are prepared in

accordance with UK adopted International Accounting Standards . The

set of condensed consolidated financial statements included in this

half yearly financial report has been prepared in accordance with

UK adopted International Accounting Standard 34 'Interim Financial

Reporting'. As required by the disclosure guidance and transparency

rules of the Financial Conduct Authority, this set of condensed

consolidated financial statements has been prepared in accordance

with the accounting policies set out in the Annual Report for the

year ended 31 March 2021 .

Segmental reporting

Based upon the management information reported to the Group's

chief operating decision maker, the Chief Executive, in the opinion

of the directors, the Group only has one reportable segment. There

are no major customers amounting to 10% or more of the Group's

revenue. All revenue and non-current assets derive from, or are

based in, the United Kingdom.

Basis of preparation: Going concern

These condensed consolidated financial statements have been

prepared on a going concern basis which the directors consider

appropriate for the reasons set out below.

The directors have considered the going concern basis and have

undertaken a detailed review of trading and cash flow forecasts for

a period in excess of one year from the date of approval of this

Interim Report. This has focused primarily on the achievement of

the Company's banking covenants. These comprise two covenant tests,

the first of which requires the Company's underlying profit before

interest for the rolling twelve-month period to the testing date to

exceed 200% of interest paid in that period on bank borrowings. The

second covenant test requires that the Company's bank borrowings at

the testing date remain below 70% of the open-market value of its

freehold properties that have been charged as security. Both bank

covenant tests were passed for the period under review.

The Company has modelled the period to the end of 2022,

including the biannual registration plate change months of March

and September 2022, and has concluded that there is headroom that

would allow for a significant reduction in expected new and used

units over this period. External market commentary provided by the

Society of Motor Manufacturers and Traders ("SMMT") indicate that

new car registrations for the final quarter of the calendar year to

31 December 2021 are forecast to be 345,000, some 11% lower than

the same three-month period to December 2020, but thereafter with

an 18% increase in new car registrations being forecast for the

2022 calendar year. The Company's current new car forward-order

book for delivery in December and beyond is significantly ahead of

this time last year. T he used car market has remained stable over

the past four years, has been growing strongly in 2021 and is

expected to remain healthy in 2022 .

The directors have also considered the Company's working capital

requirements. The Company meets its day-to-day working capital

requirements through short-term stocking loans, bank overdrafts,

medium-term revolving credit facilities and term loans. At the

period end, the medium-term banking facilities included a term loan

with an outstanding balance of GBP6.4 million and a revolving

credit facility of GBP7.5 million from HSBC, its primary bankers,

with both facilities being renewable in March 2023. HSBC also make

available a short-term overdraft facility of GBP3.5 million, which

is due for its next annual renewal in August 2022. The Company also

has a ten-year term loan from VW Bank with a balance outstanding at

30 September 2021 of GBP1.3 million which is repayable to November

2023, and a short-term overdraft facility of GBP4.0 million, which

is renewable annually with the next scheduled renewal in August

2022. In the opinion of the directors, there is a reasonable

expectation that all facilities will be renewed at their scheduled

expiry dates. The failure of a covenant test would render these

facilities repayable on demand at the option of the lender.

The directors have a reasonable expectation that the Company has

adequate resources and headroom against the covenant test to be

able to continue in operational existence for the foreseeable

future and for at least twelve months from the date of approval of

this Interim Report. For those reasons, they continue to adopt the

going concern basis in preparing these condensed consolidated

financial statements .

Non-underlying items

Non-underlying items are those items that are unusual because of

their size, nature or incidence. Management considers that these

items should be disclosed separately to enable a full understanding

of the operating results. Profits and losses on disposal of

property, plant and equipment and property impairment charges are

disclosed as non-underlying, as are certain redundancy costs and

costs attributable to vacant properties held pending their

disposal.

The net financing return and service cost on pension obligations

in respect of the defined benefit pension scheme is presented as a

non-underlying item due to the inability of management to influence

the underlying assumptions from which the charge is derived. The

defined benefit pension scheme is closed to future accrual.

All other activities are treated as underlying.

3. OTHER INCOME (NET)

Unaudited Unaudited Audited

half year half year year to

to to 31 March

30 September 30 September 2021

2021 2020 GBP'000

GBP'000 GBP'000

Rent receivable 205 361 710

Local Government covid-19 support

grants 54 - 202

Loss on disposal of tangible fixed

assets - (1) (3)

------------------------------------ -------------- -------------- ----------

Total other income 259 360 909

------------------------------------ -------------- -------------- ----------

4. NON-UNDERLYING ITEMS

Unaudited Unaudited Audited

half year half year year to

to to 31 March

30 September 30 September 2021

2021 2020

GBP'000 GBP'000 GBP'000

Other income:

Net loss on disposal of property,

plant and equipment - 1 3

---------------------------------------- -------------- -------------- ----------

Within operating expenses:

Service cost on pension scheme 16 12 23

Redundancy and restructuring costs - 6 40

Property impairments - - 184

--------------------------------------- -------------- -------------- ----------

16 18 247

---------------------------------------- -------------- -------------- ----------

Total non-underlying items within

operating profit 16 19 250

---------------------------------------- -------------- -------------- ----------

Net finance expense on pension scheme 85 101 202

---------------------------------------- -------------- -------------- ----------

Total non-underlying items within

profit before taxation 101 120 452

---------------------------------------- -------------- -------------- ----------

5. NET FINANCE EXPENSE

Unaudited Unaudited Audited

half year half year year to

to to 31 March

30 September 30 September 2021

2021 2020 GBP'000

GBP'000 GBP'000

Interest in lease interest receivable (5) - -

Interest payable on bank borrowings 156 227 367

Interest payable on inventory stocking

loans 306 367 681

Interest on lease liabilities 14 12 21

Financing costs amortised 63 53 125

Preference dividends 36 36 72

---------------------------------------- -------------- -------------- ----------

Finance expense 570 695 1,266

---------------------------------------- -------------- -------------- ----------

6. TAXATION

Unaudited Unaudited Audited

half year half year year to

to to 31 March

30 September 30 September 2021

2021 2020 GBP'000

GBP'000 GBP'000

Current UK corporation tax

Charge for the period 239 320 401

Reversal of impairment of Advanced - (302) -

Corporation Tax asset

Adjustments recognised in the period

for current tax of prior periods (40) - (33)

-------------------------------------- -------------- -------------- ----------

Total current tax charge 199 18 368

-------------------------------------- -------------- -------------- ----------

Deferred tax

Origination and reversal of timing

differences 211 (12) (381)

Adjustments recognised in the period

for deferred tax

of prior periods - (1) 27

-------------------------------------- -------------- -------------- ----------

Total deferred tax charge/(credit) 211 (13) (354)

-------------------------------------- -------------- -------------- ----------

Total tax charged in the Income

Statement 410 5 14

-------------------------------------- -------------- -------------- ----------

The tax charge arises as follows:

Unaudited Unaudited Audited

half year half year year to

to to 31 March

30 September 30 September 2021

2021 2020 GBP'000

GBP'000 GBP'000

On normal trading 429 27 100

Non-underlying items (19) (22) (86)

-------------------------------------- -------------- -------------- ----------

Total tax charge 410 5 14

-------------------------------------- -------------- -------------- ----------

Taxation of trading items for the half year has been provided at

the current rate of taxation of 20% (2020: 22%) expected to apply

to the full year. This effective rate is marginally higher than the

standard rate of corporation tax in force of 19% due to the effect

of items disallowable for tax purposes.

7. EARNINGS PER SHARE

The calculation of basic earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the period.

Treasury shares are treated as cancelled for the purposes of this

calculation.

The calculation of diluted earnings per share is based on the

basic earnings per share, adjusted to allow for the issue of shares

and the post-tax effect of dividends and/or interest, on the

assumed conversion of all dilutive options and other dilutive

potential ordinary shares .

Reconciliations of the earnings and the weighted average number

of shares used in the calculations are set out below.

Unaudited Unaudited Audited

half year half year year to

to to

30 September 30 September 31 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Basic

Profit after tax for the period 1,885 1,409 1,410

---------------------------------- ------------- ------------- ---------

Basic earnings per share 69.9p 52.3p 52.4p

---------------------------------- ------------- ------------- ---------

Diluted earnings per share 69.0p 52.3p 52.1p

---------------------------------- ------------- ------------- ---------

Underlying

Profit before tax 2,295 1,414 1,424

Adjustment: Non-underlying items

(note 4) 101 120 452

---------------------------------- ------------- ------------- ---------

Underlying profit for the period 2,396 1,534 1,876

Taxation on normal trading (note

6) (429) (27) (100)

---------------------------------- ------------- ------------- ---------

Underlying earnings 1,967 1,507 1,776

---------------------------------- ------------- ------------- ---------

Underlying basic earnings per

share 73.0p 55.9p 66.0p

---------------------------------- ------------- ------------- ---------

Underlying diluted earnings per

share 72.0p 55.9p 65.6p

---------------------------------- ------------- ------------- ---------

The number of fully paid ordinary shares in issue at the period

end was 2,879,298 (2020: 2,879,298). Excluding the shares held for

treasury, the weighted average shares in issue for the purposes of

the earnings per share calculation were 2,695,376 (2020:

2,694,790).

The shares granted under the Company's current SAYE scheme for

the period, and for the year ended 31 March 2021, are dilutive. The

weighted average number of shares in issue for the purposes of the

diluted earnings per share calculation were 2,733,587 (2020:

2,694,790). The shares granted under the Company's previous SAYE

scheme, in place for the comparative period, have not been treated

as dilutive as the market price of the Company's ordinary shares at

30 September 2020 of GBP2.70 was less than the option price of

GBP3.99.

The Directors consider that underlying earnings per share

figures provide a better measure of comparative performance.

8. DIVIDS

Ordinary shares of 50p each

An interim dividend of 7.5 pence per ordinary share has been

declared and will be paid to shareholders on 10 January 2022 to

those shareholders on the register at the close of business on 10

December 2021. The ordinary shares will be marked ex-dividend on 9

December 2021 . No interim dividend was declared in respect of the

half-year ended 30 September 2020 and no final dividend was

declared in respect of the year ended 31 March 2021.

Preference shares

Preference dividends were paid in October 2021. The next

preference dividends are payable in April 2022. The cost of the

preference dividends has been included within finance costs.

9. PROPERTY, PLANT AND EQUIPMENT AND RIGHT-OF-USE ASSETS

The following is a reconciliation of changes in the balances of

Property, plant and equipment and Right-of-use assets.

Property, plant and equipment:

Unaudited

half year

to

30 September

2021

GBP'000

Property, plant and equipment at

1 April 2021 37,624

Less: Depreciation charges (772)

Less: Net book value of disposals -

Add: Purchases 545

Add: Assets in the course of construction 663

--------------------------------------------- ---------------

Property plant and equipment at

30 September 2021 38,060

--------------------------------------------- ---------------

At 30 September 2021, assets in the course of construction

amounting to GBP295,000 had been invoiced but not settled.

Right-of-use assets:

Unaudited

half year

to

30 September

2021

GBP'000

Right-of-use assets at 1 April 2021 610

Less: Amortisation of right-of-use

assets (164)

Add: Purchases 104

--------------------------------------- ---------------

Right-of-use assets at 30 September

2021 550

--------------------------------------- ---------------

10. INVESTMENT PROPERTIES

The following is a reconciliation of changes in the balances of

Investment Properties.

Investment properties:

Unaudited

half year

to

30 September

2021

GBP'000

Investment properties at 1 April

2021 7,751

Less: Depreciation charges (48)

------------------------------------ ---------------

Property plant and equipment at

30 September 2021 7,703

------------------------------------ ---------------

11. LOANS AND BORROWINGS

Liabilities

Revolving arising Bank

Bank credit Lease Preference from and cash Net

loans facilities liabilities shares financing balances debt

GBP'000 GBP'000 GBP'000 GBP'000 activities GBP'000 GBP'000

GBP'000

At 1 April 2021

(audited) 8,062 8,000 1,278 812 18,152 (5,735) 12,417

Cash movement (437) (2,000) (268) - (2,705) 777 (1,928)

Other movements - - 119 - 119 - 119

---------------------- ---------- ------------- ------------- ------------- ------------ ----------- ----------

At 30 September

2021 7,625 6,000 1,129 812 15,566 (4,958) 10,608

(unaudited)

---------------------- ---------- ------------- ------------- ------------- ------------ ----------- ----------

Current

liabilities/(assets) 875 1,000 434 - 2,309 (4,958) (2,649)

Non-current

liabilities 6,750 5,000 695 812 13,257 - 13,257

---------------------- ---------- ------------- ------------- ------------- ------------ ----------- ----------

At 30 September

2021 7,625 6,000 1,129 812 15,566 (4,958) 10,608

---------------------- ---------- ------------- ------------- ------------- ------------ ----------- ----------

12. PENSIONS

The pension scheme deficit reflects a defined benefit obligation

that has been updated to reflect its valuation as at 30 September

2021. This has been calculated by a qualified actuary using a

consistent valuation method to that which was adopted in the

audited financial statements for the year ended 31 March 2021 and

in the period to 30 September 2020, and which complies with the

accounting requirements of IAS 19 Pensions (revised).

The net liability for defined benefit obligations has decreased

from GBP9,434,000 at 31 March 2021 to GBP4,920,000 at 30 September

2021. The reduction of GBP4,514,000 comprises the net charge to the

Condensed Consolidated Statement of Financial Performance of

GBP101,000, a net remeasurement surplus credited to the Condensed

Consolidated Statement of Comprehensive Income of GBP3,224,000 and

contributions of GBP1,391,000.

Asset values increased significantly in the period, by

GBP5,763,000, despite divestments to pay pension transfers and

benefits in the period of GBP1,981,000. Despite these transfers and

pensions that were paid in the period, pension liabilities also

increased by GBP1,249,000, as a result of an increase in the CPI

inflation assumption rate from 2.75% at 31 March 2021 to 3.00% at

30 September 2021. The discount rate applied to discount the

scheme's liabilities to their net present value remained unchanged

at 30 September 2021, at 1.95%.

13. RISKS AND UNCERTAINTIES

There are a number of potential risks and uncertainties which

could have a material impact on the Group's performance over the

remaining six months of the financial year and could cause actual

results to differ materially from expected and historical results.

The Board believes these risks and uncertainties to be consistent

with those disclosed in our latest Annual Report, including the

ongoing covid-19 pandemic and general economic factors, their

impact on the Group's defined benefit pension scheme, liquidity and

financing, the Group's dependency on its manufacturers and their

stability, used car prices and regulatory compliance.

14. CAPITAL COMMITMENTS

At 30 September 2021, the Company had capital commitments of

GBP0.9 million (2020: GBPNil) relating to the redevelopment of one

dealership's premises.

15. CONTINGENT LIABILITIES

Since 2015, the Company has been named as co-defendant in a

number of legal actions that have been initiated against certain of

the vehicle manufacturers which it represents. These actions

contend that customers have been unfairly treated as a result of

their vehicles having been fitted with software which is suggested

by the claimant law firms to have operated such that when the

vehicles were experiencing test conditions, the emission levels of

nitrogen oxides ("NOx") were affected. The vehicles remain safe and

roadworthy.

These claims on behalf of multiple claimants, arising out of or

in relation to their purchase or acquisition on finance of a

vehicle affected by the NOx issue, have been brought against a

number of Jaguar Land Rover, Vauxhall, Volkswagen and Audi group

entities and dealers, including the Company. The Company has been

named as a defendant on a number of claim forms alleging fraudulent

misrepresentation, breach of contract, breach of statutory duty,

breach of the Consumer Credit Act 1974 and a breach of the Consumer

Protection from Unfair Trading Regulations 2008, although not all

of these causes of action are being brought against the Company

specifically.

In all cases brought to date, the relevant vehicle manufacturers

listed above have agreed to indemnify the Company for the

reasonable legal costs of defending the litigation and any damages

and adverse legal costs that Caffyns may be liable to pay to the

claimants as a result of these legal actions. The possibility,

therefore, of an economic cost to the Company resulting from the

defence of these legal actions is remote.

At present, no timetable can be determined for the resolution of

these cases and the relevant issues of liability, loss and

causation have not yet been decided. It is therefore too early to

assess reliably the merit of any claim and so we cannot confirm

that any future outflow of resources is probable.

Accordingly, no provision for liability has been made in these

condensed consolidated financial statements.

16. RESPONSIBILTY STATEMENT

We confirm that to the best of our knowledge:

a) these condensed consolidated financial statements have been

prepared in accordance with IAS 34 'Interim Financial

Reporting';

b) these condensed consolidated financial statements include a

fair review of the information required by DTR 4.2.7R of the

disclosure guidance and transparency rules (indication of important

events during the first six months and their impact on the set of

financial statements; and a description of the principal risks and

uncertainties for the remaining six months of the year); and

c) the Half Year Report includes a fair review of the

information required by DTR 4.2.8R of the disclosure and guidance

transparency rules (disclosure of related parties' transactions and

changes therein).

By order of the Board

S G M Caffyn

Chief Executive

M Warren

Finance Director

25 November 2021

INDEPENT REVIEW REPORT

to Caffyns plc

Introduction

We have been engaged by the Company to review the condensed

consolidated set of financial statements in the half year report

for the six months ended 30 September 2021 which comprises the

Condensed Consolidated Statement of Financial Performance, the

Condensed Consolidated Statement of Comprehensive Expense, the

Condensed Consolidated Statement of Financial Position, the

Condensed Consolidated Statement of Consolidated Changes in Equity,

the Condensed Consolidated Cash Flow Statement and the notes to the

set of financial information.

We have read the other information contained in the half year

report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed consolidated set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of and

has been approved by the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

As disclosed in note 2, the annual financial statements of the

group will be prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this interim financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting".

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed consolidated set of financial statements in the half

year report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed consolidated set of

financial statements in the half-yearly report for the six months

ended 30 September 2021 is not prepared, in all material respects,

in accordance with UK adopted International Accounting Standard 34

and the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting its responsibilities in

respect of half-yearly financial reporting in accordance with the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. No person is

entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose

of our terms of engagement or has been expressly authorised to do

so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

BDO LLP

Chartered Accountants

Southampton

25 November 2021

BDO LLP is a limited liability partnership registered in England

and Wales

(with registered number OC305127).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZMZMKKLGMZM

(END) Dow Jones Newswires

November 26, 2021 02:00 ET (07:00 GMT)

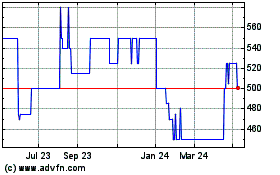

Caffyns (LSE:CFYN)

Historical Stock Chart

From Feb 2025 to Mar 2025

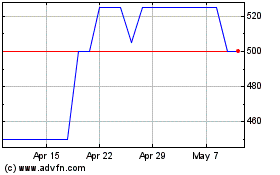

Caffyns (LSE:CFYN)

Historical Stock Chart

From Mar 2024 to Mar 2025