TIDMCGO

RNS Number : 8894Q

Contango Holdings PLC

24 February 2023

Contango Holdings Plc / Index: LSE / Epic: CGO / Sector: Natural Resources

24 February 2023

Contango Holdings Plc

('Contango' or the 'Company')

Unaudited Interim Results for the six months to 30 November 2022

Contango Holdings Plc, the London listed natural resource development company,

announces its results for the six-month period ended 30 November 2022.

Highlights

* GBP7.5 million raised ("Fundraise") in October 2022

at 6p to support the Lubu Coal Project ("Lubu") to

first coking coal production from Q1 2023.

* GBP1.0 million Convertible Loan converted at 6p on 5

July 2022 for 16,666,667 ordinary shares

* First offtake signed with AtoZ Investments (Pty) Ltd

to purchase 10,000 tonnes per month of washed coking

coal produced at Lubu.

* Coking coal and coke tests undertaken through

installed 1 tonne per hour test plant confirmed the

excellent quality of coal from Lubu further

strengthening Contango's position to complete

additional offtake agreements.

* Expansion of production strategy to include both

thermal coal and coke development scenarios to

provide additional near-term high value revenues

streams.

* Contango's operating subsidiary declared the winner

of the 2022 Excellence in Community, Empowerment &

Social Impact Award recognising its work at Lubu.

Post period

* MOU signed with a leading Multi-National Company for

collaboration across coking coal and manufacture of

coke at Lubu.

* Award of Environmental Impact Assessment certificate

for Lubu recognising the highest environmental

standards imposed by Contango at the mine.

* Delivery of the Lubu wash plant in early February and

assembly ahead of commissioning in March 2023 -

capacity to produce 20,000 tonnes per month.

* Delivery of surface miner (Wirtgen 2200SM) which has

a cutting width of 2200mm, ideal for selective mining,

and can mine up to 500 tonnes per hour of hard rock

and up to 1,000 tonnes per hour of coking coal.

* Laboratory delivered to site in February representing

the last of the significant capital items ahead of

first production and sales at the end of Q1 2023.

Carl Esprey, Chief Executive Officer of Contango Holdings, said:

"We expect Contango to transition into cash flow towards the end of the

current quarter with first sales of coking coal. Lubu's advancement over

recent months has been facilitated by the successful GBP7.5 million fundraising

during the period, which has enabled investment in building mining and processing

operations. These development initiatives are now reaching their conclusion,

with the wash plant now at site and being assembled ahead of commissioning.

Once calibrated and operating efficiently the wash plant is expected to

be able to produce 20,000 tonnes of washed coking coal per month which will

satisfy its first offtake partner, AtoZ Investments (Pty) Ltd, and also

provide sufficient supply to secure further offtakes for our coking coal.

"I would like to thank our long-standing shareholders for their support,

and welcome the new entrants to our register, as I reiterate my excitement

and enthusiasm for what is in store for Contango over the coming weeks and

months and we transition into a fully-fledged and cash generative production

company."

For further information, please visit www.contango-holdings-plc.co.uk or

contact:

Contango Holdings plc E: contango@stbridespartners.co.uk

Chief Executive Officer

Carl Esprey

Tavira Financial Limited T: +44 (0)20 7100 5100

Financial Adviser & Broker

Jonathan Evans

St Brides Partners Ltd T: +44 (0)20 7236 1177

Financial PR & Investor

Relations

Susie Geliher

Chairman's Statement

Activity at the Lubu Coal Mine in Zimbabwe ("Lubu") is intensifying as the

technical team and our various consultants direct the final elements of

our mining and processing operations to deliver first coking coal production

and sales by the end of the current quarter. Activity levels on site are

now significant marking the culmination of substantial operational, commercial,

and corporate undertakings orchestrated by the team over the past two and

half years since Contango acquired the project.

As shareholders will be aware, we are now in our final phase of pre-production

at Lubu as we approach commissioning of the wash plant and we anticipate

first sales to our first offtake partner, AtoZ Investments (Pty) Ltd ("AtoZ"),

by the end of the current quarter. During this development phase, the Contango

team has also advanced other commercial negotiations and post period end,

Contango signed a Memorandum of Understanding with a l eading Multi-National

Company ("MNC"), which has the potential to support both a further expansion

of the Company's coking coal production capabilities and also its future

higher-margin coke production strategy. Final due diligence is underway,

and we will report on these findings in due course. Given the MOU's broader

focus than just coking coal offtake and subsequent potential to unlock significant

value, the Company has not elected to enter into any additional offtake

arrangements at this time, despite clear demand and interest from several

groups keen to acquire Lubu washed coking coal.

Alongside these technical and commercial deliverables, I was delighted to

learn that our vision for sustainable development was also recognised with

our operating company in Zimbabwe, Monaf Investments, being declared the

winner of the 2022 Excellence in Community, Empowerment & Social Impact

Award. Specifically, Monaf Investments was selected as the winner of this

prestigious award by Corporate Social Responsibility Network Zimbabwe (CSRNZ),

together with the Minister of Provincial Affairs and Devolution for Matabeleland

North Province, recognising our efforts in supporting issues of sustainability

in the Province of Matabeleland North, and developing and promoting the

Zimbabwean Government's Vision 2030 and Sustainable Development Goals. We

look forward to a long and harmonious partnership with the local communities

and authorities in Zimbabwe as we commit to upholding the sustainable and

responsible production philosophies that we have developed since commencing

work at Lubu.

Looking now to our Garalo-Ntiela Gold Project in Mali, our focus remains

on the strategic realisation of its full value. The team in Mali continue

to undertake low-cost exploration activities however the work to date has

pointed to the project's strong potential to host a resource of 1.8Moz-2Moz

gold, and the board has determined that comprehensive drill campaigns are

merited to fully delineate the wider resource potential of this asset. Our

primary focus is now on Lubu, particularly given the significant cashflows

expected from this asset in the near-term, and so discussions regarding

strategic investment to fund future exploration and development work at

Garalo-Ntiela is being prioritised. There remains healthy interest from

various parties and the Contango board are carefully considering numerous

opportunities to ensure the Company benefits appropriately from future development

upside.

Financial Review

In October 2022, the Company announced an oversubscribed placing of 125,000,000

new ordinary shares at 6 pence per share to raise gross proceeds of GBP7,500,000

from existing and new shareholders. The funds have, and will continue to

be, used to finalise mine development, complete the installation of the

wash plant, acquire further mining equipment, and expand operations at the

Lubu Project. The proceeds have also enabled the Company to finalise the

agreed relocation of additional households from the mine site, thereby providing

a larger footprint for the mine and operations to meet heightened demand.

As a pre-production Company, Contango did not generate revenue however was

able to source loans from supportive investors during the period to enable

the continued development of Lubu ahead of the Fundraise, which enabled

all Loans to be repaid. Additional one-off Administration costs and other

costs including commissions, professional fees and general transaction costs

relating to the publication of a prospectus in November 2022, as required

by the Prospectus Rules governed by the FCA, were also incurred.

The Company spent GBP2,090,604 on the exploration and fixed assets during

the period under review which relate to the development of the site and

operations at Lubu.

The Company is now fully funded to reach first cash flow from the sale of

coking coal from Lubu at the end of this quarter.

Revenue

The Company generated no revenue during the period under review but anticipates

making first coking coal sales by the end of Q1 2023.

Expenditure

The Company has applied its cash resources to the development of Lubu and

Garalo-Ntiela.

Liquidity, cash and cash equivalents

As of 30 November 2022, the Company held GBP3,314,359 (2021: GBP2,419,266).

The Company is fully funded to deliver first coking coal sales by the end

of Q1 2023.

Outlook

The coming weeks and months are clearly going to be a defining period for

Contango; one in which we establish ourselves as a production company and

begin to expand our horizons in order to fully realise the potential of

our +1 billion tonnes coal resource at Lubu. With the tailwinds of increasing

coal demand and prices supporting our various production strategies at Lubu,

I believe we are entering the coal market at an ideal time and will benefit

from the continuing demand and pricing dynamics many commentators are predicting.

I would like to take this opportunity to extend my thanks to our shareholders,

both new and old, and also my fellow board members and our operational team

for their tireless efforts to ensure our shared ambitions are realised.

Roy Pitchford

23 February 2023

CEO REPORT

Contango's primary objective during the period was to advance the Lubu Coal

Project in Zimbabwe through to commercial operations and sales, in tandem

with advancing strategic discussions to support the development of the Garalo-Ntiela

Project Area in Mali towards production.

Lubu Coal Project ('Lubu') - known as the Muchesu Coal Mine in Zimbabwe

Contango has a 70% interest in Lubu, with the remaining 30% held by local

partners.

Since acquisition in 2020, the Contango team have implemented a rapid development

plan with the objective of delivering first coking coal in as short a timeframe

as practicable.

The primary focus during the period under review was on the preparation

of the site for commercial mining and coking coal production, and also advancing

commercial discussions regarding coking coal offtake. Commercial discussions

were also undertaken regarding potential thermal coal and coke production,

and strategies for these additional products are now being advanced in tandem

with its coking coal activities.

Our focus now is on quickly getting to an initial production rate of 10,000

tonnes per month of washed coal, as covered by our existing offtake with

specialist coal trading company AtoZ Investments (Pty) Ltd ("AtoZ") out

of South Africa, whilst in tandem also identifying the optimal production

and processing route to maximise recoveries and minimise production costs.

The Company expects to then move to the headline production capacity of

the wash plant as either additional offtakes are signed or we successfully

conclude the existing MOU with a leading Multi-National Company. Given the

expected profitability of operations at Lubu, should demand for the Company's

suite of coal products continue as envisaged then the purchase of additional

wash plants and capital items to meet this demand are expected to be funded

via cashflow or non-equity finance. The coal mined to date has either been

washed using the installed 1 tonne per hour test plant located on site or

stockpiled in anticipation of the larger wash plant being commissioned by

the end of the current quarter.

Coal washed using the current test plant, which was supplied and supervised

by OneVision, the company that is currently installing the larger 100 tonne

per hour throughput wash plant, was used by Contango's technical team for

test work. This processing has confirmed that, after passing through the

wash plant, the coking coal product is of excellent quality and has been

an important mechanism in the Company's offtake discussions. An additional

test was undertaken on 15kg of washed coking coal from both the NUTTS and

PEAS sections. These were processed through a mini-coking test plant as

a first determinant of how the coking coal would react when processed into

coke. These coke results returned better than expected results and when

shared with potential coke offtake partners, we received very positive feedback

on this data and the characteristics of Lubu coking coal and coke products.

Post period end, in December, Contango signed a Memorandum of Understanding

with a leading Multi-National Company ("MNC"), which outlined a framework

for collaboration across not only coking coal, but also in the manufacture

of coke. The intention is to undertake a stage-gated due diligence exercise

which will look at all aspects that would underpin either a coking-coal

offtake agreement, or the possibility of establishing a coking plant adjacent

to the mine. The Company expects to be able to provide an update on these

negotiations in the coming weeks.

Garalo-Ntiela Project Area ('Garalo-Ntiela')

The Garalo-Ntiela Gold Project covers an area of 161.5km(2) in southern

Mali, and combines the Garalo Licence Area, acquired by Contango in October

2020, with the neighbouring Ntiela Licence Area, which was acquired in March

2021. Work programmes conducted by Contango on the Garalo-Ntiela Gold Project

have returned consistently positive results and the project area has demonstrated

its potential for a 1.8Moz-2Moz gold resource.

With this large potential resource now identified, and significant exploration

upside possible with further drilling, the board of Contango has determined

that the optimum route for development would be through a large processing

hub, capable of supporting multiple open pit operations.

In order to realise the full potential of this asset whilst also protecting

investors from the dilution at the PLC level, the board is advancing discussions

with a number of potential investors in relation to Garalo-Ntiela. The board

believes Garalo-Ntiela represents an exceptional asset with large scale

commercial value, and this remains at the forefront of all ongoing discussions.

The Company will provide further updates on these negotiations at the proper

time, as appropriate.

Carl Esprey

23 February 2023

Condensed Consolidated Statements of Comprehensive Income

For the six months ended 30 November 2022

Audited

Unaudited Unaudited Year to

Six Months Six Months 31 May

ended ended 2022

30 November 30 November

2022 2021

Notes GBP GBP GBP

Administrative fees and

other expenses 3 (1,786,947) (636,398) (2,944,656)

-------------- -------------- ------------

Operating loss (1,786,947) (636,398) (2,944,656)

Finance revenue - - -

Finance expense - - -

-------------- -------------- ------------

Loss before tax (1,786,947) (636,398) (2,944,656)

Income tax - - -

Loss for the period (1,786,947) (636,398) (2,944,656)

-------------- -------------- ------------

Loss attributable to owners

of the parent company (1,632,379) (591,350) (2,805,563)

Loss attributable to non-controlling

interests (154,568) (45,048) (139,093)

-------------- -------------- ------------

(1,786,947) (636,398) (2,944,656)

-------------- -------------- ------------

Basic and diluted loss

per Ordinary Share 4 (0.55) (0.27) (1.00)

Other comprehensive income 319,624 (40,735) 127,977

-------------- -------------- ------------

Total comprehensive loss

for the period (1,467,323) (677,133) (2,816,679)

-------------- -------------- ------------

Total comprehensive loss

attributable to owners

of Contango Holdings PLC (1,403,389) (618,569) (2,700,477)

Total comprehensive loss

attributable to non-controlling

interests (63,934) (58,564) (116,202)

-------------- -------------- ------------

Total comprehensive loss

for the period (1,467,323) (677,133) (2,816,679)

-------------- -------------- ------------

Condensed Consolidated Statements of Financial Position

For the six months ended 30 November 2022

Unaudited Unaudited Audited

as at as at as at

30 November 30 November 31 May

Notes 2022 2021 2022

GBP GBP GBP

Non-current assets

Intangible assets 5 13,416,214 10,515,941 11,936,206

Investments 46,474 62,260 46,474

Property, plant and

equipment 1,095,911 256,641 737,727

------------- ------------- ------------

Total non-current

assets 14,558,599 10,834,842 12,720,407

Current assets

Other receivables 6 576,713 587,348 52,211

Cash and cash equivalents 3,314,359 2,419,266 610,546

Total current assets 3,891,072 3,006,614 662,757

Total assets 18,449,671 13,841,456 13,383,164

------------- ------------- ------------

Current liabilities

Trade and other payables 7 (310,148) (1,155,632) (503,732)

Convertible debt and

Investor loans (1,331,750)

------------- ------------- ------------

Total current liabilities (310,148) (1,155,632) (1,835,482)

Net assets/(liabilities) 18,139,523 12,685,824 11,547,682

------------- ------------- ------------

Equity

Share capital 8 4,580,246 2,687,760 2,949,679

Share premium 8 18,130,551 11,176,636 11,047,218

Shares to be issued 400,000 400,000 400,000

Warrant reserve 2,059,584 90,474 1,013,815

Option reserve - 1,700,505 1,700,505

Foreign exchange reserve 300,683 (6,174) 71,693

Retained earnings (8,590,889) (4,744,297) (6,958,510)

------------- ------------- ------------

Total equity attributable

to owners of owners

owners of Contango

Holdings owners of

Contango Holdings owners

of the parent company 16,880,175 11,304,904 10,224,400

Non-controlling interests 1,259,348 1,380,920 1,323,282

------------- ------------- ------------

Total equity 18,139,523 12,685,824 11,547,682

------------- ------------- ------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 November 2022

Shares Total

Share Share to be Warrant Option Translation Retained Equity Non-controlling

capital premium issued reserve reserve reserve earnings of Owners interests Total

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance

at 31 May

2021 2,279,338 8,294,643 400,000 160,074 1,700,505 (33,393) (4,152,947) 8,648,220 1,439,484 10,087,704

----------- ---------------- ----------- ---------- ---------------- ------------ ---------------- ----------------- ---------------- -----------------

Loss for

the year - - - - - - (2,805,563) (2,805,563) (139,093) (2,944,656)

Other

comprehensive

income

Translation

differences - - - - - 105,086 - 105,086 22,891 127,977

----------- ---------------- ----------- ---------- ---------------- ------------ ---------------- ----------------- ---------------- -----------------

Total

comprehensive

income for

the year - - - - - 105,086 (2,805,563) (2,700,477) (116,202) (2,816,679)

Transactions

with owners

Share issues

- cash

received

net 419,091 2,100,909 - - - - - 2,520,000 - 2,520,000

Share issues

- warrants

exercised 251,250 651,666 - (69,599) - - - 833,317 - 833,317

Warrants

issued - - - 923,340 - - - 923,340 - 923,340

Total

transactions

with owners 670,341 2,752,575 - 853,741 - - - 4,276,657 - 4,276,657

----------- ---------------- ----------- ---------- ---------------- ------------ ---------------- ----------------- ---------------- -----------------

Balance

at 31 May

2022 2,949,679 11,047,218 400,000 1,013,815 1,700,505 71,693 (6,958,510) 10,224,400 1,323,282 11,547,682

----------- ---------------- ----------- ---------- ---------------- ------------ ---------------- ----------------- ---------------- -----------------

Loss for

the period - - - - - - (1,632,379) (1,632,379) (154,568) (1,786,947)

Other

comprehensive

income

Translation

differences - - - - - 228,990 - 228,990 90,634 319,624

----------- ---------------- ----------- ---------- ---------------- ------------ ---------------- ----------------- ---------------- -----------------

Total

comprehensive

income for

the period - - - - - 228,990 (1,632,379) (1,403,389) (63,934) (1,467,323)

Transactions

with owners

Share issues

- cash

received

net 1,630,567 7,083,333 - - - - - 8,713,900 - 8,713,900

Share issues

- warrants

exercised - - - - - - - - - -

Shares to

be issued - - - - - - - - - -

Warrants

issued - - - 1,045,769 - - - 1,045,769 - 1,045,769

Options

exercised - - - - (1,700,505) - - (1,700,505) - (1,700,505)

Minority

interest

share of

intangible

asset

acquisitions - - - - - - - - - -

----------- ---------------- ----------- ---------- ---------------- ------------ ---------------- ----------------- ---------------- -----------------

Total

transactions

with owners 1,630,567 7,083,333 - 1,045,769 (1,700,505) - - 8,059,164 - 8,059,164

----------- ---------------- ----------- ---------- ---------------- ------------ ---------------- ----------------- ---------------- -----------------

Balance

at 30 Nov

2022 4,580,246 18,130,551 400,000 2,059,584 - 300,683 (8,590,889) 16,880,175 1,259,348 18,139,523

----------- ---------------- ----------- ---------- ---------------- ------------ ---------------- ----------------- ---------------- -----------------

Condensed Consolidated Statements of Cash Flows

For the six months ended 30 November 2022

Unaudited Unaudited Audited

Six Months Six Months Year

ended ended ended

30 November 30 November 31 May

Notes 2022 2021 2022

GBP GBP GBP

Operating activities

Loss after tax (1,786,947) (636,398) (2,944,656)

Adjustment for:

Depreciation 104,825 11,200 77,922

Share based transactions (108,480) (69,600) 853,741

Revaluation of intangible - -

asset -

Impairment of listed investment 15,786

Changes in working capital

(Increase)/decrease in trade

and other receivables (524,503) (451,650) 83,488

Increase in trade and other

payables (193,584) 873,968 222,068

------------- ------------- ------------

(Decrease) in Net cash from

operating activities (2,508,689) (272,480) (1,691,651)

------------- ------------- ------------

Investing activities

Purchase of exploration licences - - -

Spending on exploration licences (1,551,836) (372,143) (1,775,809)

Purchase of fixed assets (538,768) (221,846) (786,995)

Purchase of investment - - -

------------- ------------- ------------

(Decrease) in Net cash from

investing activities (2,090,604) (593,989) (2,562,804)

------------- ------------- ------------

Financing activities

Ordinary Shares issued (net

of issue costs) 5 4,717,196 3,290,415 3,422,916

Proceeds from convertible

debt - - 831,750

Conversion of convertible 1,331,750 -

debt -

Proceeds from investor loans 1,349,493 - 500,000

------------- ------------- ------------

Net cash flows from financing

activities 7,398,439 3,290,415 4,754,666

------------- ------------- ------------

Increase/(decrease) in cash

and short-term deposits 2,799,146 1,134,983 500,211

Cash and short-term deposits as

at the start of period 610,546 22,143 22,143

Effect of foreign exchange

changes (95,333) (26,823) 88,192

------------- ------------- ------------

Cash at the end of the period 3,314,359 2,419,266 610,546

------------- ------------- ------------

Notes to the Condensed Consolidated Financial Statements

For the six months ended 30 November 2022

1 General information

The Company was incorporated in England under the Laws of

England and Wales with registered number 10186111 on 18 May 2016.

All of the Company's Ordinary Shares were admitted to the London

Stock Exchange's Main Market and commenced trading on 1 November

2017. The company was re-registered as a public company under

Companies Act 2006 on 1 June 2017, by the name Contango Holdings

plc.

The Company is listed on the Standard Market of London Stock

Exchange plc.

The unaudited interim consolidated financial statements for the

six months ended 30 November 2022 were approved for issue by the

board on 23 February 2023.

The figures for the six months ended 30 November 2022 and 30

November 2021 are unaudited and do not constitute full accounts.

The comparative figures for the period ended 31 May 2022 are

extracts from the annual report and do not constitute statutory

accounts.

2 Basis of Preparation and Risk Factors

The Company Financial Information has been prepared in

accordance with and comply with IFRS as adopted by the European

Union, International Financial Reporting Interpretations Committee

interpretations and the Companies Act 2006. The financial

statements have been prepared under the historical cost convention

as modified for financial assets carried at fair value.

The financial information of the company is presented in British

Pound Sterling ("GBP").

The accounting policies and methods of calculation adopted are

consistent with those of the financial statements for the year

ended 31 May 2022.

The business and operations of the Company are subject to a

number of risk factors which may be sub-divided into the following

categories:

Exploration and development risks, including but not limited

to:

o Mineral exploration is speculative and uncertain

o Verification of historical washability analysis

o Independent verification of internal resource estimation at

Garalo-Ntiela

o Mining is inherently dangerous and subject to conditions or

events beyond the Company's control, which could have a material

adverse effect on the Company's business

o The volume and quality of coal recovered may not conform to

current expectations

o The extend and grade of gold mineralisation at Garalo-Ntiela

may not conform to current expectations

-- Permitting and title risks, including but not limited to:

o Licence and permits

o The Company will be subject to a variety of risks associated

with current and any potential future joint ventures, which could

result in a material adverse effect on its future growth, results

of operations and financial position

-- Political risks, including but not limited to:

o Political stability

o Enforcement of foreign judgements

o Potential legal proceedings or disputes may have a material

adverse effect on the Company's financial performance, cash flow

and results of operations

-- Financial risks, including but not limited to:

o Foreign exchange effects

o Valuation of intangible assets

o The Company may not be able to obtain additional external

financing on commercially acceptable terms, or at all, to fund the

development of its projects

o The Company will be subject to taxation in several different

jurisdictions, and adverse changes to the taxation laws of such

jurisdictions could have a material adverse effect on its

profitability

o The Company's insurance may not cover all potential losses,

liabilities and damage related to its business and certain risks

are uninsured and uninsurable

-- Commodity prices, including but not limited to:

o The price of coal may affect the economic viability of

ultimate production at Lubu

o The revenues and financial performance are dependent on the

price of coal

o The price of gold may affect the economic viability of

ultimate production at Garalo-Ntiela

-- Operational risks, including but not limited to:

o Availability of local facilities

o Adverse seasonal weather

o The Company's operational performance will depend on key

management and qualified operating personnel which the Company may

not be able to attract and retain in the future

o The Company's directors may have interests that conflict with

its interests

o Risk relating to Controlling Shareholders

The Company's comments and mitigating actions against the above

risk categories are as follows:

Exploration and development risks

There can be no assurance that the Company's development

activities will be successful however significant exploratory work

has been conducted to date at Lubu and Garalo-Ntiela which supports

the Board's confidence that a profitable mining operation can be

developed.

Additionally, the phased development route which will be

employed at Lubu seeks to mitigate risks along the development life

cycle of the project.

Permitting and title risks

The Company complies with existing laws and regulations and

ensures that regulatory reporting and compliance in respect of each

permit is achieved. Applications for the award of a permit may be

unsuccessful. Applications for the renewal or extension of any

permit may not result in the renewal or extension taking effect

prior to the expiry of the previous permit. There can be no

assurance as to the nature of the terms of any award, renewal or

extension of any permit.

The Company regularly monitors the good standing of its

permits.

Political risks

The Company maintains an active focus on all regulatory

developments applicable to the Company, in particular in relation

to the local mining codes.

In recent years the political and security situations in

Zimbabwe and Mali have been particularly volatile.

Financial risks

The board regularly reviews expenditures on projects. This

includes updating working capital models, reviewing actual costs

against budgeted costs, and assessing potential impacts on future

funding requirements and performance targets.

Commodity prices

As projects move towards commercial mining the Company will

increasingly review changes in commodity prices so as to ensure

projects remain both technically and economically viable.

Operational risks

Continual and careful planning, both long-term and short-term,

at all stages of activity is vital so as to ensure that work

programmes and costings remain both realistic and achievable.

COVID-19 outbreak

In addition to the foregoing comments and mitigating actions

against the above risk categories the Company has implemented

various protocols in relation to the current COVID-19 outbreak.

Contango places the health and safety of its employees and

contractors as its highest priority. Accordingly, a business

continuity programme has been put in place to protect employees

whilst ensuring the safe operation of the Company.

Having spoken with, amongst others, local government, staff and

contractors, strict protocols have been implemented to reduce the

risk of transmission of COVID-19 at all the Company's

operations.

The situation in respect of COVID-19 is an evolving one and the

Board will continue to review its potential impact on its staff and

the business.

3 Loss before taxation

Loss before income tax

is stated Unaudited Unaudited

after charging: Six Months Six Months

Ended 30 Ended 30 Audited Year

November November Ended 31

2022 2021 May 2022

GBP GBP GBP

Directors' remuneration 43,500 50,400 95,900

Ongoing listing costs 117,585 151,177 302,419

Finance costs 513,000 -

Share-based finance costs 457,356 - 160,000

Salaries 421,697 217,184 536,842

Consultancy fees 500 - 182,829

Legal and accountancy

fees 33,775 4,869 19,317

Travel 301,549 174,673 364,444

Office costs 147,620 66,742 170,817

Share performance options (1,486,605) - -

Net warrant issue costs 1,045,769 (69,600) 853,741

Impairment of listed investment - - 15,786

Depreciation 104,825 11,200 77,922

Other 86,376 29,753 -

Group audit fee

- -

Fee payable to the Company's

auditor in respect of

all other non-audit services - - 35,000

Fees paid to auditors - - -

for non-audit work services

4 Loss per Ordinary Share

The calculation of the basic and diluted loss per Ordinary Share

is based on the following data:

Unaudited Unaudited Audited

Six Months Six Months Year

to to to

30 November 30 November 31 May

2022 2021 2022

GBP GBP GBP

Earnings

Loss from continuing operations

for the period attributable

to the equity holders of the

Company (1,632,379) (591,350) (2,805,563)

Number of Ordinary Shares

Weighted average number of

Ordinary Shares for the purpose

of basic and diluted earnings

per Ordinary Share (number) 296,565,032 222,711,321 280,455,370

------------- ------------- ------------

Basic and diluted loss per

Ordinary Share (pence) (0.55) (0.27) (1.00)

------------- ------------- ------------

There are no potentially dilutive Ordinary Shares in issue.

5. Intangible Asset

Unaudited Unaudited Audited As

As at As at at

30 November 30 November 31 May

2022 2021 2022

GBP GBP GBP

At start of period 11,936,206 10,118,098 10,118,098

Additions - during

year 1,392,836 397,843 1,775,809

Foreign exchange movements 87,172 - 42,299

Amortisation - - -

-------------- -------------- ------------

Total 13,416,214 10,515,941 11,936,206

-------------- -------------- ------------

Mining rights Zimbabwe 11,314,113 8,495,807 9,849,069

Mining rights Mali

(Garalo) 1,272,650 1,273,617 1,260,686

Mining rights Mali

(Ntiela) 829,451 746,517 826,451

13,416,214 10,515,941 11,936,206

-------------- -------------- ------------

The intangible asset represents the mining rights and technical

information acquired when the Group acquired its 70% shareholding

in Monaf Investments (Pty) Ltd on 18 June 2020; its 75% share in

the Garalo gold licence in Mali bought for $1 million on 22 October

2020; and its 100% share in the Ntiela gold licence (adjacent to

Garalo) in Mali. The Ntiela licence was acquired for approximately

GBP750,000 - being EUR400,000 (GBP346,517) in cash and 4,000,000

ordinary shares at GBP0.10 to be issued during 2023.

The Ntiela gold licence is still under the name of Samagold

Resources SARL (a subsidiary of the vendor - African Mineral

Exploration Resources Mali SARL) whilst the formal transfer is

processed by the Mali Ministry of Mining. The cash element paid

(GBP346,517) together with the GBP400,000 of shares to be issued

are currently held on the parent company balance sheet until the

transfer is completed.

6. Other receivables

Unaudited Unaudited Audited As

As at As at at

30 November 30 November 31 May

2022 2021 2022

GBP GBP GBP

Prepayments 17,970 16,332 17,895

Other debtors 558,743 571,016 34,316

576,713 587,348 52,211

-------------- -------------- ------------

7. Trade and other payables

Unaudited Unaudited Audited As

As at As at at

30 November 30 November 31 May

2022 2021 2022

GBP GBP GBP

Trade payables 245,481 221,919 175,316

Accruals and other

payables 64,667 101,963 328,416

Convertible debt - 831,750 831,750

Investor loans - - 500,000

310,148 1,155,632 1,835,482

-------------- -------------- ------------------

The convertible loan note was announced on 3(rd) June 2021

and had a fixed conversion price of 6 pence per share, with

a mandatory conversion to take place on 4 January 2022.

Due to a lack of headroom to issue new shares in January

all note holders unanimously agreed to extend the life of

the instruments by a further six months with no additional

charges or penalties. The instruments were duly converted

and the new shares admitted for trading on 12 July 2022.

The term of the attaching one warrant for every two ordinary

shares, with an exercise price of 8p, remained unchanged.

8 Share capital

Number of

Ordinary Shares

issued and Total Share

fully paid Share Capital Share Premium Capital

GBP GBP GBP

----------------- -------------- -------------- ------------

As at 01 June 2022 309,667,356 2,949,679 11,047,218 13,996,897

----------------- -------------- -------------- ------------

Loan conversion 16,666,667 166,667 833,333 1,000,000

Placement November

2022 125,000,000 1,250,000 6,250,000 7,500,000

Performance shares 21,390,000 213,900 - 213,900

As at 30 November

2022 472,724,023 4,580,246 18,130,551 22,710,797

----------------- -------------- -------------- ------------

The Ordinary Shares issued by the Parent Company have par value

of 1p each and each Ordinary Share carries one vote on a poll vote.

The Authorised share capital of the Parent Company is GBP5,000,000

ordinary shares at GBP0.01 per share resulting in 500,000,000

ordinary shares.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FZGZZFFNGFZM

(END) Dow Jones Newswires

February 24, 2023 02:00 ET (07:00 GMT)

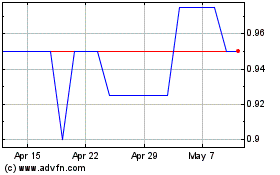

Contango (LSE:CGO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Contango (LSE:CGO)

Historical Stock Chart

From Jan 2024 to Jan 2025