TIDMCLCO

RNS Number : 1324D

Cloudcoco Group PLC

17 February 2020

CloudCoCo Group plc

("CloudCoCo", the "Group" or the "Company")

Final results for the year ended 30 September 2019

CloudCoCo Group plc (AIM: CLCO.L), formerly Adept4 plc

("Adept4"), the AIM quoted provider of IT as a Service is pleased

to announce final results for the year ended 30 September 2019

("FY19"). These results reflect the performance of the legacy Adept

4 business only over what was a well-documented challenging

period.

FY19 Summary

-- Revenue in the year of GBP7.3 million (FY18: GBP10.2 million)

and gross profit GBP3.7 million (FY18: GBP5.7million), reflecting

the reduced emphasis on new business generation after the Board's

strategic review;

-- Trading overheads(2) fell by 23% to GBP4.0 million (FY18:

GBP5.1 million), due to reduced cost base required by as a result

of the Board's decision to focus on existing customer base;

-- Resultant Trading Group EBITDA(1) loss of GBP0.2 million (FY18: profit GBP0.6 million); and

-- Reported loss after tax of GBP5.2 million (FY18: GBP3.8

million), stated after a significant non-cash impairment charge of

GBP3.0m against goodwill and other intangible assets.

Post Year End

-- Completion of acquisition of CloudCoCo Limited on 21 October

2019, bringing a strong and experienced sales and business

development team to the Group;

-- The acquisition was satisfied by the issue of 218,160,568

ordinary shares of 1 pence each in the share capital of the

Company, representing a total value of GBP7.2 million on

completion;

-- Appointment of Andy Mills, former Chairman of CloudCoCo

Limited as Chief Executive Officer of the Company;

-- Refinancing of the Group's debt, reducing loan note debt from

GBP5.0 million to GBP3.5 million and extension of a new GBP0.5

million working capital facility;

-- Rebrand and change of the Company's name to CloudCoCo Group plc on 29 November 2019;

-- New business already being won and value of sales

opportunities growing evidencing strong sales pedigree of CloudCoCo

Limited team.

Si mon Duckworth, Chairman of CloudCoCo Group plc,

commented:

"The past couple of years have clearly been extremely

challenging for the business. However, with the acquisition of

CloudCoCo we believe we now have the right platform and the right

team to re-invigorate the business and return the Group to growth.

We are focused on four key objectives: increasing sales, reducing

customer churn, reducing costs and returning to a net cash

generation position. There are significant opportunities to improve

performance by increasing customer satisfaction through improved

customer service, combining CloudCoCo's proven and experienced

salesforce with our existing operations. This will enable more

sales to the existing customer base as well as driving new customer

sales, and this is already being evidenced by new business wins and

a growing sales pipeline. We can now look forward with renewed

confidence ."

For further information please contact:

CloudCoCo Group plc

Andy Mills, Chief Executive Officer 01925 398255

N+1 Singer (Nominated Adviser and Broker)

Peter Steel / Ben Farrow 0207 496 3000

MXC Capital Markets LLP

Charlotte Stranner 0207 965 8149

The information communicated in this announcement contains

inside information for the purposes of Article 7 of Regulation

596/2014.

(1) earnings before net finance costs, tax, depreciation,

amortisation, plc costs, separately identifiable items and

share-based payments.

(2) administrative expenses less plc costs.

Chairman's statement

The last few months have seen significant change for CloudCoCo

Group plc (formerly Adept4 plc) ("Adept4" or the "Company", and

together with its subsidiaries the "Group") as we begin our journey

of returning the Group to growth, profitability and delivering

improved shareholder value.

Following the acquisition of CloudCoCo Limited on 21 October

2019, the Company's name was changed to CloudCoCo Group plc

("CloudCoCo Group") on 29 November 2019. The results contained

within this report reflect trading for the year ended 30 September

2019 ("FY19") and as such relate to the period prior to the recent

changes within the business. The Company is therefore referred to

under its former name of Adept4 in the context of last year's

performance.

As the challenges of FY19 have been well-documented in previous

shareholder reports and detailed commentary is provided elsewhere,

I have instead focused on the steps taken by the Board to move the

Group forward in a positive way.

Overview and strategy

As previously reported, the Group has been challenged in the

recent past by the general level of economic uncertainty in the

market coupled with the investments made in a new sales team during

the previous financial years not delivering the results the Board

had expected. Continued delays in new sales in FY19 led to the

Group experiencing monthly Trading Group EBITDA(1) and cash losses.

As a result, and in order to protect the cash reserves of the Group

whilst the Board considered the strategic options available to the

Company, the decision was taken to focus on the Group's existing

customer base with less emphasis on new business acquisition.

Whilst this led to reduced revenue and gross profit, it requires a

significantly lower operating cost base and therefore a cost

reduction programme was implemented which completed in March

2019.

The performance of the Group was further affected by the loss,

in April 2019, of a customer contract which had generated GBP0.7

million of revenue in the year ended 30 September 2018. The

combined effect of these changes meant that during the year, the

Group returned to modest levels of monthly Trading Group EBITDA

profit generation and reduced levels of monthly net cash outflows

(after plc costs and debt service costs).

The Company explored several strategic options and the Board

concluded that the acquisition of CloudCoCo Limited ("CloudCoCo")

(the "Acquisition") represented the best opportunity to return to

growth and generate long-term value for all stakeholders.

CloudCoCo was established in September 2017 and started trading

in April 2018. It was formed by the former sales directors of

Redcentric plc (a UK managed service provider) and offers a variety

of cloud computing services, IT hardware, managed IT services,

voice and connectivity solutions via its partner ecosystem, aiming

to provide its customers with a simplified approach to IT services.

Though only recently established, CloudCoCo has a very strong and

experienced sales and business development team which had already

shown its ability to win new business using its agile sales

methodology.

The Acquisition completed on 21 October 2019 and was facilitated

by the issue of 218,160,568 ordinary shares of 1 penny each in the

share capital of the Company, representing a total value of GBP7.2

million on completion. At the same time Andy Mills, Chairman of

CloudCoCo, joined the board of Adept4 as Chief Executive

Officer.

We are pleased with the progress Andy and the senior management

teams of both businesses have made so far. Some details of the

progress to date are given below and we look forward to updating

the market further as the team continue to make progress.

Financing

In 2016, the Company issued unsecured loan notes with a value of

GBP5.0 million to BGF Investments L.P. ("BGF"). These loan notes

were repayable between 2021 and 2023 and carried a coupon of 8% per

annum, payable quarterly. In addition, BGF held 50 million options

in the Company at an exercise price of 6 pence per share.

On completion of the Acquisition, GBP1.5 million of the loan

notes were waived and cancelled by BGF, reducing the Company's

liability to GBP3.5 million. MXC Guernsey Limited, a wholly owned

subsidiary of MXC Capital Limited ("MXC"), who currently hold 15.2%

of the shares in the Company, purchased the remaining GBP3.5

million loan notes from BGF and restructured their terms. The loan

notes now carry a coupon of 12% per annum which is rolled up,

compounded annually and payable only at the end of the term. The

term of the loan notes has been extended to October 2024 with no

repayment due until that date unless the Company chooses to repay

early. At the same time, MXC extended a GBP0.5 million, 2 year,

working capital facility to the Company with interest charged at a

rate of 12% per annum on amounts drawn down.

As part of the refinancing package, MXC also cancelled the

warrants it held over 5% of the then issued and to be issued share

capital of Adept4 and BGF's options were repriced to 0.35 pence.

BGF exercised all of its options in October 2019 (and sold the

resulting shares issued) and, as MXC no longer holds warrants in

the Company, the only obligations over the Company's shares are in

respect of outstanding staff share options. As part of the

Acquisition, the Board agreed to put in place a management

incentive scheme over an amount equal to up to 15% of the Company's

post-Acquisition share capital to motivate and retain certain key

staff. It is envisaged that this scheme will be implemented during

the current financial year.

People

Having the right management team in place is key to the success

of our business. The Acquisition brought a strong team which have

been able to complement and enhance our existing management team.

Andy Mills, former Chairman of CloudCoCo, has joined the Board of

Adept4 as Chief Executive Officer, focussing on driving the growth

of the enlarged Group. Mark Halpin (founder and former Chief

Executive Officer of CloudCoCo) is leading the Group's business

development activities.

The Company has recently announced a further key appointment,

with Mike Lacey taking on the role of full time Chief Financial

Officer ("CFO"), a role previously performed on an interim,

part-time basis by Jill Collighan, CFO of MXC. Jill will continue

on the Board as a non-executive director.

Chairman's statement (continued)

We previously announced Tom Black's intention to step down from

the Board as a non-executive director once a suitable replacement

has been found. The search for a replacement for Tom is well

underway and he will therefore stand down as a non-executive

director at this year's Annual General Meeting. I would like to

place on record my thanks to Tom for all of his work over the past

7 years and especially during the recent difficult times.

Given the enormous change which has taken place within Adept4 in

the past year, I would, once again, like to take this opportunity

to thank our dedicated staff. There have been many examples of our

people simply continuing to work very hard to produce great

outcomes for our customers despite the significant challenges we

have faced, and I would like to assure them of the Board's

appreciation.

FY19 results

As explained above, the challenges of the past few years have

been well-documented and significant change has already been

effected in the Company in the first few months of the current

financial year. The Acquisition was completed 3 weeks after the end

of FY19, with the new management team therefore only joining after

the year end. As stated above, these results therefore reflect the

performance of the legacy Adept4 business only and for that reason,

to avoid any confusion, the Company is referred to under its former

name of Adept4 in the context of last year.

As a result of the Board's decision to focus on existing

customers rather than the generation of new sales, together with

the loss of the customer announced in April 2019, revenue for FY19

decreased to GBP7.3 million (2018: GBP10.2 million) with gross

profits of GBP3.7 million (2018: GBP5.7 million).

Trading overheads fell by 23% to GBP4.0 million (2018: GBP5.1

million), reflecting the cost reduction programme undertaken during

the year. The resultant Trading Group EBITDA for the year was a

loss of GBP0.2 million (2018: profit of GBP0.6 million).

After all costs and income, including, inter alia, restructuring

costs and an impairment charge of GBP3.0 million (2018: GBP2.6

million) in respect of the Group's intangible assets in its legacy

businesses (see Note 8), the operating loss for the year was GBP5.0

million (2018: loss of GBP3.4 million) with a retained loss for the

year after tax of GBP5.2 million (2018: loss of GBP3.8

million).

Post-year end progress

Significant work has been undertaken since the completion of the

Acquisition. The rebrand of the Group to CloudCoCo and the change

of the Company's name to CloudCoCo Group plc were completed on 29

November 2019 at which point the Group's new website was launched.

The staff from both companies are integrating well, leading to a

more-settled team. Steady progress has been made with improving

customer service which in turn is leading to improved relationships

with customers and is opening up new opportunities within the

base.

The strong sales pedigree of the CloudCoCo team is already being

proven as the number, and value, of sales opportunities grow. The

team has already had success securing wins with six new customers,

including one of the UK's largest automotive dealers, competing

against large traditional IT services companies, leveraging our

security solutions and vendor partnerships.

The entire team is focussed on the four key objectives of the

business for the new financial year. These are:

1. Increasing sales;

2. Reducing customer churn;

3. Reducing costs whilst ensuring the business can deliver high levels of service; and

4. Returning to net cash generation.

Whilst seemingly simple objectives, it is important that the

business returns to basics to ensure the underpinning fundamentals

are right in order to drive improved performance. All staff are

focused on the delivery of these objectives and the benefits are

already being seen. Performance against these objectives will be

detailed in subsequent reports on a continuing basis. The Group has

achieved management's forecasts for the first quarter of the new

financial year and work continues to strengthen its propositions in

key growth areas of security and hybrid cloud computing.

Outlook

The past couple of years have clearly been extremely challenging

for the business. However, with the acquisition of CloudCoCo we

believe we now have the right platform and the right team to

re-invigorate the business. There are significant opportunities to

improve performance by increasing customer satisfaction through

improved customer service, which will enable more sales to the

existing customer base as well as driving new customer sales. In

addition, by harnessing CloudCoCo's proven and experienced

salesforce with our existing operations, we believe that there is a

clearly defined opportunity to return the Group to growth whilst

benefitting from the

headroom the refinancing has provided us. We look forward with renewed confidence.

Simon Duckworth

Non-Executive Chairman

14 February 2020

(1) earnings before net finance costs, tax, depreciation,

amortisation, plc costs, separately identifiable items and

share-based payments

Business overview

What we do

First and foremost, CloudCoCo Group is a people-led business.

With a skilled team of Microsoft, cloud, telephony, hardware, cyber

security, support and connectivity experts we unlock business

optimisation and transformation, team-working, cost savings,

streamlined workflows and innovative solutions to business problems

for clients of all sizes.

The Group's knowledge, gained through employees with multiple

years of industry experience, helps our customers create a

competitive edge, by providing IT solutions that underpin and

support our customers' business activities. We have a burning

passion to delight people with every aspect of our service and

provide the alternative to the archaic managed IT services models.

We also champion putting the power back into the hands of

customers, offering easy-to-use self-service options and knowledge

and skills transfer.

At CloudCoCo Group we seek to be highly responsive and provide

customers with modern and innovative solutions to achieve their

objectives, achieved through collaborative partnerships with IT

solution and service providers, distributors and vendors. Our 24/7

UK response team, together with our strategic consulting and

professional services team, provides exactly what businesses need

from IT right now and into the future.

The revenue generated by CloudCoCo Group typically comes from

three core areas of our business: contracted recurring managed

services, professional services and the sale of associated hardware

and other products.

As many of the Enterprise-class technologies which underpin our

product suite can be provided "as a service", we provide our

clients with exactly what is required to support their needs in

accordance with business demands, billed on a monthly basis, based

on what is consumed.

Our market

The CloudCoCo Group customer base spans all aspects of the UK

market and the requirements for each can be quite different. We

typically see businesses more inclined to look for a single

organisation to provide as many services as possible across IT,

telephony and connectivity providing them with a "one stop shop"

approach. As we move towards the medium and large enterprise

clients, we typically see these look to a more specialist provider

for different aspects of the services they require. These customers

will generally start with a specific service from CloudCoCo Group

which addresses a particular business need and will then engage in

additional solution discussions once the initial service is being

successfully delivered. With the depth and breadth of our

technology offering, together with our specialist teams and our

flexible service options, we are ideally placed to grow our

existing enterprise accounts whilst continuing to service and

support our overall base.

In addition to its private sector customer base, the Group has a

number of public sector clients and we have experienced an increase

in requests to transact business through recognised government

procurement frameworks.

Our technology

As part of our drive to engage quickly and delight our

customers, we have continued the development of our technical

skills, accreditations, competencies and our engagement with key

vendor partners across our key strategic managed service

sectors.

We utilise industry leading technology products and services

from a number of vendor partners, including Microsoft, Mitel and

Fortinet in delivering our managed service offering.

This year we have been awarded the Microsoft "Gold Cloud

Platform" competency, which validates our continuously evolving

tech intensity in cloud technologies, identity management, systems

management, virtualisation, storage and networking. We have also

secured "Silver Data Platform" partner status which demonstrates

our competencies in collecting and managing diverse data types and

versatile database platforms. As a business we have also retained

two further Microsoft silver competencies in Application

Development and Cloud Solutions.

Telephony services continue to drive strong opportunities for

the Group, in both the traditional telecoms market - where we sell,

install and support systems from Mitel, a market leading voice

technology company - and in new technologies, such as integrated

solutions from Microsoft based on their Teams unified communication

and collaboration platform. We increasingly see customers looking

to introduce Microsoft Teams into their business as the basis for

modernised team working. We have added further functionality to our

offering, with the introduction of a contact centre product called

Anywhere365. This software application, which works directly with

Microsoft Teams, provides additional multichannel communication

functionality (telephone, text, e-mail, social media and web chat).

With the Group's capability across the telephony market, we are

ideally placed to continue to sell to and support clients requiring

traditional infrastructure and provide a migration strategy for

those that want to move to the new collaboration platforms.

CloudCoCo Group continues to see significant interest across its

security portfolio, including the innovative Paranoid EPR (Endpoint

Protection & Response) solution from US based company Nyotron.

This interest has led to introductions into large enterprise

organisations and businesses that are currently at varying stages

of the sales cycle. The Group continue to have exclusivity within

the UK for Paranoid, whilst also making sales in mainland Europe

over recent months. The Paranoid solution's approach to post

execution damage protection provides CloudCoCo Group with clear

differentiators and offers a unique selling point against

alternative solutions available.

Business overview (continued)

Additionally, in the cyber security market, we have built on our

strong relationship with Fortinet to sell security and threat

detection solutions. Given our post year sales success, we are due

to become a Fortinet Gold partner and have already executed on some

of our healthy growing pipeline in this area.

The need to interrogate data from multiple applications,

information stores and bring this all together to provide

analytical intelligence, collaboration and real-time reporting is

driving new conversations in our customer base, especially with the

ability to use tools such as PowerBI and PowerApps, and this is

expected to provide the Group with new revenue streams. We have a

team of in-house developers and, additionally, we have agreed a

partnership with a "nearshore" development provider to supplement

our own software development capabilities in a cost efficient and

scalable manner to allow us to maximise revenue opportunities.

Summary and outlook

As detailed above, we have made progress against our key

objectives during the year, but this was tempered by certain

challenges faced by the Group. Going forward, following the

acquisition of CloudCoCo Limited and our debt refinancing, we look

forward with renewed confidence. The priorities are to maintain our

strong relationships with existing customers, and to re-energise

new sales generation through a strengthened sales team.

Financial review

Revenue and gross margin

As detailed in the Chairman's statement, following the decision

to focus on existing customers rather than new sales generation,

Group revenue for the year to 30 September 2019 was below that

generated in the previous financial year, at GBP7.3 million (FY18:

GBP10.2 million). This produced a gross profit of GBP3.7 million

(FY18: GBP5.7 million) representing a gross margin of 51.4% (FY18:

56.0%). The reduction in margin predominantly relates to the

recurring services segment, as explained below.

The analysis of revenue and gross profit from each of our

operating segments of recurring services, product sales and

professional services is shown in Note 3 and is detailed below.

Recurring services

Revenues from recurring services were GBP5.2 million (FY18:

GBP7.1 million), generating a gross profit of GBP2.9 million (FY18:

GBP4.2 million) and a gross margin of 56% (FY18: 60%). We continue

to see a reduction in the gross profit from recurring services due

to the migration of certain services from our infrastructure to

that of a third party (such as Microsoft), in line with our

asset-light strategy. Whilst initially resulting in some margin

reduction, this strategy reduces risk and cost of ownership for us

and allows us to provide customers with best-of-breed solutions

with the ability to sell a wider range of services to the customer.

Our revenue in this sector was further affected by the cancellation

of a contract by a major customer who generated GBP0.7 million of

revenue in FY18, as announced on 8 April 2019. We continue to

dispute the validity of the cancellation of this contract and are

currently seeking legal redress.

The proportion of our total revenue derived from recurring

services continued to be high at 71% (FY18: 70%).

Product sales

Consistent with our strategy of focussing on sales with existing

customers, revenues from product sales were lower than those in

FY18 at GBP1.4 million (FY17: GBP2.0 million) generating a gross

profit of GBP0.3 million (FY18: GBP0.4 million) and gross margin of

20% (FY18: 22%).

Professional services

Revenues from professional services were GBP0.7 million (FY18:

GBP1.1 million) generating a gross profit of GBP0.6 million (FY18:

GBP1.0 million) as permanent employee costs are included in

overheads. Following our cost reduction programme certain projects

are now outsourced using third party contractors resulting in a

fall in margin to 79% (FY18: 94%).

Operating performance, costs and EBITDA

Aside from revenue, gross profit and cash balances, one of our

main financial key performance indicators is our Trading Group

EBITDA - our operational trading performance before plc costs.

Excluding plc costs of GBP0.4 million (FY18: GBP0.5 million) and

following the successful implementation of our cost reduction

programme, our trading overheads during the year fell by 23% to

GBP4.0 million (FY18: GBP5.1 million), of which staff costs

comprised 84% (FY18: 88%). As a result of the cost reduction

programme, during the year the Group returned to modest levels of

monthly Trading Group EBITDA profit, however, the total Trading

Group EBITDA for the year was a loss of GBP0.2 million as a result

of an increase in certain provisions following a year-end review

(FY18: GBP0.6 million profit).

Separately identifiable items

During the year we incurred certain costs which were not

directly related to the generation of revenue and trading profits.

Given their size and nature, they have been classified as

separately identifiable items within the Consolidated Income

Statement. These items totalled GBP3.2 million of which GBP3.0

million relates to the impairment of goodwill and other intangible

assets on previous acquisitions and GBP0.2 million relates to

integration and reorganisation costs.

Net finance expenses

During the year the Group incurred net finance costs of GBP0.6

million (FY18: GBP0.6 million). GBP0.4 million of this was a cash

cost in relation to the interest on the BGF loan notes and GBP0.2

million related to the release to the income statement of the fair

value adjustments in respect of these loan notes.

Loss for the period

The Group incurred non-cash costs including total amortisation

and depreciation charges of GBP1.0 million (FY18: GBP1.0 million)

and a share-based payments charge of GBP0.1 million (2018: GBP0.1

million). After accounting for a deferred tax credit of GBP0.4

million (2018: GBP0.2 million) the reported loss for the year after

tax was GBP5.2 million (FY18: GBP3.8 million).

Statement of Financial Position and cash

Cash balances at 30 September 2019 were GBP0.3 million (FY18:

GBP1.4 million) whilst net debt was GBP4.0 million (FY18: GBP2.7

million). Net debt comprises cash balances of GBP0.3 million less

the fair value of the BGF loan notes of GBP4.3 million.

The main components of the Group's cash flows during the year

were as follows:

-- cash used in operating activities of GBP0.6 million (after

the payment of separately identifiable costs of GBP0.2 million and

plc costs of GBP0.4 million);

-- GBP0.1 million settlement of Chess dispute paid in October 2018; and

-- financing interest payments of GBP0.4 million.

At 30 September 2019, following the impairment charge in respect

of its intangible assets, the Group had negative net assets of

GBP1.1 million (FY18: net assets of GBP4.0 million).

Post-period end, in October 2019, significant refinancing took

place as part of the Acquisition. Further details are given in the

Chairman's statement and in Note 13. As a result of this

refinancing, together with the Acquisition, the Group has now

returned to a positive net asset position.

Consolidated income statement

for the year ended 30 September 2019

2019 2018

Note GBP'000 GBP'000

------------------------------------------------- ---- -------------- --------

Continuing operations

Revenue 3 7,257 10,185

Cost of sales (3,530) (4,480)

------------------------------------------------- ---- -------------- --------

Gross profit 3 3,727 5,705

------------------------------------------------- ---- -------------- --------

Administrative expenses (4,383) (5,598)

Amortisation of intangible assets 8 (907) (907)

Depreciation 9 (100) (136)

Separately identifiable costs 4 (3,255) (2,390)

Share-based payments (71) (48)

------------------------------------------------- ---- -------------- --------

Operating loss (4,989) (3,374)

------------------------------------------------- ---- -------------- --------

Interest receivable 5 3 7

Interest payable 5 (602) (609)

------------------------------------------------- ---- -------------- --------

Net finance expense (599) (602)

------------------------------------------------- ---- -------------- --------

Loss before taxation (5,588) (3,976)

------------------------------------------------- ---- -------------- --------

Taxation 438 169

------------------------------------------------- ---- -------------- --------

Loss and total comprehensive loss for the year

attributable to owners of the parent (5,150) (3,807)

------------------------------------------------- ---- -------------- --------

Loss per share

Basic and fully diluted 7 (2.27)p (1.68)p

------------------------------------------------- ---- -------------- --------

Non-statutory measure: Trading Group EBITDA(1)

Operating loss (4,989) (3,374)

Plc costs 421 482

Amortisation of intangible assets 8 907 907

Depreciation 9 100 136

Separately identifiable costs 4 3,255 2,390

Share-based payments 71 48

------------------------------------------------- ---- -------------- --------

Trading Group EBITDA(1) (235) 589

------------------------------------------------- ---- -------------- --------

(1) earnings before net finance costs, tax, depreciation,

amortisation, plc costs, separately identifiable items and

share-based payments

Consolidated statement of financial position

as at 30 September 2019

30 September 30 September

2019 2018

Note GBP'000 GBP'000

-------------------------------------- ---- ------------ ------------

Non-current assets

Intangible assets 8 4,394 8,282

Property, plant and equipment 9 62 146

-------------------------------------- ---- ------------ ------------

Total non-current assets 4,456 8,428

-------------------------------------- ---- ------------ ------------

Current assets

Inventories 32 26

Trade and other receivables 10 1,489 2,900

Cash and cash equivalents 311 1,427

-------------------------------------- ---- ------------ ------------

Total current assets 1,832 4,353

-------------------------------------- ---- ------------ ------------

Total assets 6,288 12,781

-------------------------------------- ---- ------------ ------------

Current liabilities

Short-term borrowings (32) (32)

Trade and other payables (876) (1,102)

Other taxes and social security costs (302) (377)

Accruals and deferred income (1,093) (1,937)

-------------------------------------- ---- ------------ ------------

Total current liabilities 11 (2,303) (3,448)

-------------------------------------- ---- ------------ ------------

Non-current liabilities

Long-term borrowings 11 (4,286) (4,117)

Deferred tax liability (810) (1,248)

-------------------------------------- ---- ------------ ------------

Total non-current liabilities (5,096) (5,365)

-------------------------------------- ---- ------------ ------------

Total liabilities (7,399) (8,813)

-------------------------------------- ---- ------------ ------------

Net (liabilities) / assets (1,111) 3,968

-------------------------------------- ---- ------------ ------------

Equity

Share capital 2,271 2,271

Share premium account 11,337 11,337

Capital redemption reserve 6,489 6,489

Merger reserve 1,997 1,997

Other reserve 1,720 1,649

Retained earnings (24,925) (19,775)

-------------------------------------- ---- ------------ ------------

Total equity (1,111) 3,968

-------------------------------------- ---- ------------ ------------

Consolidated statement of changes in equity

for the year ended 30 September 2019

Capital

Share Share redemption Merger Other Retained

capital premium reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- -------- -------- ----------- -------- -------- --------- --------

At 1 October 2017 2,271 11,337 6,489 1,997 1,601 (15,968) 7,727

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Loss and total comprehensive

loss for the period - - - - - (3,807) (3,807)

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Transactions with owners

Share-based payments - - - - 48 - 48

Total transactions with owners - - - - 48 - 48

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Total movements - - - - 48 (3,807) (3,759)

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Equity at 30 September 2018 2,271 11,337 6,489 1,997 1,649 (19,775) 3,968

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Capital

Share Share redemption Merger Other Retained

capital premium reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- -------- -------- ----------- -------- -------- --------- --------

At 1 October 2018 2,271 11,337 6,489 1,997 1,649 (19,775) 3,968

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Loss and total comprehensive

loss for the period - - - - - (5,150) (5,150)

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Transactions with owners

Share-based payments - - - - 71 - 71

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Total transactions with owners - - - - 71 - 71

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Total movements - - - - 71 (5,150) (5,079)

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Equity at 30 September 2019 2,271 11,337 6,489 1,997 1,720 (24,925) (1,111)

------------------------------- -------- -------- ----------- -------- -------- --------- --------

Consolidated statement of cash flows

for the year ended 30 September 2019

2019 2018

GBP'000 GBP'000

---------------------------------------------------- -------- --------

Cash flows from operating activities

Loss before taxation (5,588) (3,976)

Adjustments for:

Depreciation 100 136

Amortisation 907 907

Share-based payments 71 48

Net finance expense 599 602

Settlement of warranty claim 600 (1,578)

Impairment of goodwill 3,021 2,644

Decrease in trade and other receivables 811 73

(Increase)/decrease in inventories (6) 40

(Decrease)/increase in trade payables, accruals and

deferred income (1,045) 195

---------------------------------------------------- -------- --------

Net cash used in operating activities (530) (909)

---------------------------------------------------- -------- --------

Cash flows from taxation - -

---------------------------------------------------- -------- --------

Cash flows from investing activities

Purchase of property, plant and equipment (16) (70)

Purchase of intangible assets (40) -

Payment of deferred consideration - (8)

Interest received 3 7

---------------------------------------------------- -------- --------

Net cash used in investing activities (53) (71)

---------------------------------------------------- -------- --------

Cash flows from financing activities

Finance lease income received - 56

Payment of finance lease liabilities (30) (44)

Interest paid (403) (410)

Net cash used in financing activities (433) (398)

---------------------------------------------------- -------- --------

Cash flows from discontinued operations

Settlement of dispute with Chess ICT Limited (100) (100)

---------------------------------------------------- -------- --------

Net cash used in discontinued operations (100) (100)

---------------------------------------------------- -------- --------

Net decrease in cash (1,116) (1,478)

Cash at bank and in hand at beginning of period 1,427 2,905

---------------------------------------------------- -------- --------

Cash at bank and in hand at end of period 311 1,427

---------------------------------------------------- -------- --------

Comprising:

Cash at bank and in hand 311 1,427

---------------------------------------------------- -------- --------

Notes to the consolidated financial statements

1. General information

CloudCoCo Group plc (formerly Adept4 plc) is a public limited

company incorporated in England and Wales under the Companies Act

2006. The Board of Directors approved this preliminary announcement

on 14 February 2019. Whilst the financial information included in

the preliminary announcement has been prepared in accordance with

the recognition and measurement criteria of International Financial

Reporting Standards ("IFRS") as endorsed by the European Union,

this announcement does not itself contain sufficient information to

comply with all the disclosure requirements of IFRS and does not

constitute statutory accounts of the Company for the years ended 30

September 2019 and 2018.

The financial information for the period ended 30 September 2018

is derived from the statutory accounts for that year which have

been delivered to the Registrar of Companies. The statutory

accounts for the year ended 30 September 2019 will be delivered to

the Registrar of Companies following the Company's annual general

meeting. The auditors have reported on those accounts; their

reports were unqualified and did not contain a statement under

s498(2) or s498(3) of the Companies Act 2006.

2. Basis of preparation

The consolidated financial statements have been prepared in

accordance with applicable International Financial Reporting

Standards (IFRSs) as adopted by the EU and in accordance with the

Companies Act 2006.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It also

requires management to exercise its judgement in the process of

applying the Group's accounting policies.

The financial statements have been prepared on a going concern

basis. Taking into account post balance sheet financial

restructuring and after reviewing the forecast sales growth,

budgets and cash projections, including sensitivity analysis on the

key assumptions, for the next twelve months and beyond, the

Directors have reasonable expectations that the Group and the

Company have adequate resources to continue operations for the

foreseeable future. Furthermore, taking into account the assurance

of ongoing support from a significant shareholder, which the

Directors reasonably believe has sufficient resources to provide

such support, the Directors continue to adopt the going concern

basis in preparing these financial statements.

The same accounting policies and methods of computation are

followed as in the latest published audited financial statements

for the year ended 30 September 2018, which are available on the

Group's website, except as described below:

New standards and interpretations of existing standards that

have been adopted by the Group for the first time

During the year ended 30 September 2019, the Group adopted the

following new financial reporting standards for the first time:

-- IFRS 15 Revenue from Contracts with Customers (for accounting

periods commencing on/after 1 January 2018); and

-- IFRS 9 Financial Instruments (for accounting periods commencing on/after 1 January 2018).

The key areas of difference between the IFRS 15 policies and

those used in prior financial years are as follows:

Previously, we did not capitalise the cost of obtaining a

contract unless it involved significant set-up costs. Under IFRS 15

there is a broader definition of what can be capitalised as cost to

obtain a contract. Where these costs have been identified, we have

matched the amortisation of capitalised costs to obtain a contract

to the revenue recognised in the period but have used the practical

expedient of lFRS 15 not to capitalise costs that relate to revenue

that will be recognised within twelve months.

As a practical expedient and as allowed under the standard we

have applied the five-step approach under IFRS 15 to portfolios of

contracts which have similar characteristics and where we expect

that the financial statements would not reasonably differ

materially had the standard been applied to the individual

contracts within the portfolio.

IFRS 15 has not had a material impact on the timing and amount

of revenue and costs being recognised in the current or previous

financial year and there was no impact on cash flows with cash

collections remaining in line with contractual terms.

IFRS 9 has not had a material impact on the results of the

Group.

Following the adoption of these new accounting standards, the

Group's revenue recognition and financial assets accounting

policies have been revised as follows:

Revenue and revenue recognition

Revenue arises from the sale of goods and the rendering of

services. It is measured by reference to the fair value of

consideration received or receivable, excluding valued added tax,

rebates, trade discounts and other sales-related taxes.

The Group enters into sales transactions involving a range of

the Group's products and services; for example, for the delivery of

hardware, software, support services, managed services and

professional services. At the inception of each contract the Group

assesses the goods or services that have been promised to the

customer. Goods or services can be classified as either i) distinct

or ii) substantially the same, having the same pattern of transfer

to the customer as part of a series. Using this analysis, the

Company identifies the separately identifiable performance

obligations over the term of the contract.

Goods and services are classified as distinct if the customer

can benefit from the good or services on their own or in

conjunction with other readily available resources. A series of

goods or services, such as Recurring Services, would be an example

of a performance obligation,that is transferred to the customer

consecutively over time. The Group applies the revenue recognition

criteria set out below to each separately identifiable performance

obligation of the sale transaction. The consideration received from

multiple-component transactions is allocated to each separately

identifiable performance obligation in proportion to its relative

fair value.

Sale of goods (hardware and software)

Sale of goods is recognised when the Group has transferred the

significant risks and rewards of ownership to the buyer, generally

when the customer has taken undisputed delivery of the goods.

Revenue from the sale of software with no significant service

obligation is recognised on delivery.

Rendering of services

The Group generates revenues from managed services, support

services, maintenance, resale of telecommunications ("Recurring

Services") and professional services. Consideration received for

these services is initially deferred (when invoiced in advance),

included in accruals and deferred income and recognised as revenue

in the period when the service is performed.

In recognising Recurring Services revenues, the Group recognises

revenue equally over the duration of the contractual term.

Third-party costs (where relevant) relating to these services are,

likewise, spread equally over the duration of the contractual

term.

Financial assets

Financial assets are divided into categories as appropriate.

These are the first full year results which are presented by the

Group following the adoption of IFRS 9 and 15. The adoption of both

IFRS 15 and IFRS 9 has not resulted in restatements but has

resulted in additional disclosure.

The Group implemented IFRS 9 Financial Instruments, as of 1

October 2018 and also considered the impact on the comparative

results. IFRS 9 introduces principle-based requirements for the

classification of financial assets, using the following measurement

categories: (i) Amortised cost; (ii) Fair value through Other

Comprehensive Income with cumulative gains and losses reclassified

to profit or loss upon derecognition; and (iii) Fair value through

profit or loss. IFRS 9 also introduces a new impairment model, the

expected credit loss model.

The Group undertook an assessment of how the adoption of IFRS 9

would impact the Group's financial instruments. The key area that

was identified across the business was the bad debt provisioning

because of the implementation of the expected credit loss model and

it was concluded that no restatement was required.

The Group now reviews the amount of credit loss associated with

its trade receivables based on forward looking estimates, taking

into account current and forecast credit conditions as opposed to

relying on past historical default rates. In adopting IFRS 9 the

Group has applied the Simplified Approach, applying a provision

matrix based on number of days past due to measure lifetime

expected credit losses and after taking into account customers with

different credit risk profiles and current and forecast trading

conditions. Having assessed the requirements according to the new

standard, the Group has concluded that no significant additional

impairment to the carrying values of the assets was required at 1

October 2017, at 30 September 2018 or at 30 September 2019.

Trade receivables are held in order to collect the contractual

cash flows and are initially measured at the transaction price as

defined in IFRS 15, as the contracts of the Group do not contain

significant financing components. Impairment losses are recognised

based on lifetime expected credit losses in profit or loss.

Other receivables are held in order to collect the contractual

cash flows and accordingly are measured at initial recognition at

fair value, which ordinarily equates to cost and are subsequently

measured at cost less impairment due to their short-term nature. A

provision for impairment is established based on 12-month expected

credit losses unless there has been a significant increase in

credit risk when lifetime expected credit losses are recognised.

The amount of any provision is recognised in profit or loss.

All financial assets are recognised when the Group becomes a

party to the contractual provisions of the instrument. All

financial assets are initially recognised at fair value, plus

transaction costs. Derecognition of financial assets occurs when

the rights to receive cash flows from the instruments expire or are

transferred and substantially all of the risks and rewards of

ownership have been transferred. An assessment for impairment is

undertaken, at least, at each reporting date.

Interest and other cash flows resulting from holding financial

assets are recognised in the Consolidated Income Statement when

receivable.

3. Segment reporting

The Chief Operating Decision Maker ("CODM") has been identified

as the directors of the Company and its subsidiaries, who review

the Group's internal reporting in order to assess performance and

to allocate resources.

The CODM assess profit performance principally through adjusted

profit measures consistent with those disclosed in the Annual

Report and Accounts. The Board believes that the Group comprises a

single reporting segment, being the provision of IT managed

services to customers. Whilst the CODM reviews the revenue streams

and related gross profits of three categories separately (Recurring

Services, Product and Professional Services), the operating costs

and operating asset base used to derive these revenue streams are

the same for all three categories and are presented as such in the

Group's internal reporting. Accordingly, the segmental analysis

below is therefore shown at a revenue and gross profit level in

line with the CODM's internal assessment based on the following

reportable operating segments:

Recurring Services

* This segment comprises the provision of continuing IT

services which have an ongoing billing and support

element.

Product

* This segment comprises the resale of solutions

(hardware and software) from leading technology

vendors.

Professional Services

* This segment comprises the provision of highly

skilled resource to consult, design, install,

configure and integrate IT technologies.

--------------------- -----------------------------------------------------------------

All revenues are derived from customers within the UK and no

customer accounts for more than 10% of external revenues.

Inter-segment transactions are accounted for using an arm's length

commercial basis.

3.1 Analysis of continuing results

All revenues from continuing operations are derived from

customers within the UK. This analysis is consistent with that used

internally by the CODM and, in the opinion of the Board, reflects

the nature of the revenue.

3.1.1 Revenue

2019 2018

GBP'000 GBP'000

---------------------- --------- ---------

Recurring Services 5,153 7,100

Product 1,405 1,987

Professional Services 699 1,098

Total Revenue 7,257 10,185

---------------------- --------- ---------

3.1.2 Gross Profit

2019 2018

GBP'000 GBP'000

---------------------- --------- ---------

Recurring Services 2,896 4,231

Product 278 439

Professional Services 553 1,035

Total Gross Profit 3,727 5,705

---------------------- --------- ---------

4. Separately identifiable costs

Items which are material and non-routine in nature are presented

as separately identifiable items in the Consolidated Income

Statement.

2019 2018

GBP'000 GBP'000

------------------------------------------------------ -------- --------

Income from settlement of warranty claim - 1,578

Costs in relation to the warranty claim and other M&A

activities - (481)

Settlement of historic Microsoft licence review - (376)

Impairment of goodwill and intangible assets (Note 8) (3,021) (2,644)

Integration and restructure costs (226) (271)

Foreign exchange rate variances (8) -

Costs in relation to disposal of Pinnacle CDT Limited - (196)

Separately identifiable costs (3,255) (2,390)

------------------------------------------------------ -------- --------

The Board has assessed the carrying value of the Group's

goodwill and following an assessment of current budgets and

forecasts for the Group, an impairment charge of GBP3.0m (FY18:

GBP2.6m) has been made.

5. Finance income and finance costs

Finance cost includes all interest-related income and expenses.

The following amounts have been included in the Consolidated Income

Statement line for the reporting periods presented:

2019 2018

GBP'000 GBP'000

-------------------------------------------------------- -------- --------

Interest income resulting from short-term bank deposits 3 7

-------------------------------------------------------- -------- --------

Finance income 3 7

-------------------------------------------------------- -------- --------

Interest expense resulting from:

Finance leases 3 10

BGF loan notes 400 400

Effective interest on liability element of the BGF loan

notes 199 199

Finance costs 602 609

-------------------------------------------------------- -------- --------

6. Operating loss

2019 2018

GBP'000 GBP'000

----------------------------------------- -------- --------

Operating loss is stated after charging:

Depreciation of owned assets 100 136

Amortisation of intangibles 907 907

Operating lease rentals:

- Buildings 106 105

Auditor's remuneration:

- Audit of parent company 22 20

- Audit of subsidiary companies 42 37

- Audit costs relating to prior year 20 28

- Audit-related assurance services 7 6

- Corporation tax services 10 16

----------------------------------------- -------- --------

7. Loss per share

2019 2018

GBP'000 GBP'000

----------------------------------------------------- ----------- -----------

Loss attributable to ordinary shareholders (5,150) (3,807)

----------------------------------------------------- ----------- -----------

Number Number

----------------------------------------------------- ----------- -----------

Weighted average number of Ordinary Shares in issue,

basic and diluted 227,065,100 227,065,100

Basic and diluted loss per share (2.27)p (1.68)p

----------------------------------------------------- ----------- -----------

8. Intangible assets

IT, billing

and

website Customer

Goodwill systems Brand lists Total

Intangible assets GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- -------- ----------- -------- -------- --------

Cost

At 1 October 2017 4,447 113 1,157 7,580 13,297

Adjustments to provisional

fair values - 29 - - 29

---------------------------- -------- ----------- -------- -------- --------

At 1 October 2018 4,447 142 1,157 7,580 13,326

Additions - 40 - - 40

---------------------------- -------- ----------- -------- -------- --------

At 30 September 2019 4,447 182 1,157 7,580 13,366

---------------------------- -------- ----------- -------- -------- --------

Accumulated amortisation

At 1 October 2017 - (7) (150) (1,136) (1,293)

Charge for the year -(20) (115) (772) (907)

-------------------------- ---- ----- ------- -------

At 1 October 2018 -(27) (265) (1,908) (2,200)

Charge for the year -(20) (115) (772) (907)

-------------------------- ---- ----- ------- -------

At 30 September 2019 -(47) (380) (2,680) (3,107)

-------------------------- ---- ----- ------- -------

Impairment

At 1 October 2017 (200) - - - (200)

Charge in the year (2,644) - - - (2,644)

---------------------- ------- ----- ------- -------

At 1 October 2018 (2,844) - - - (2,844)

Charge in the year (1,603) -(225) (1,193) (3,021)

---------------------- ------- ----- ------- -------

At 30 September 2019 (4,447) -(225) (1,193) (5,865)

---------------------- ------- ----- ------- -------

Carrying amount

At 30 September 2019 - 135 552 3,707 4,394

-------------------------------- ----- --------- --------- --------- ---------

At 30 September 2018 1,603 115 892 5,672 8,282

-------------------------------- ----- --------- --------- --------- ---------

Average remaining amortisation 1.8 years 4.8 years 4.8 years 4.8 years

period

-------------------------------- ----- --------- --------- --------- ---------

In determining whether intangible assets including goodwill were

impaired, the directors estimated the discounted future cash flows

associated with the intangible assets over a ten-year period, using

a discount rate equivalent to the WACC. The directors also

considered the impact of the customer notice of termination

received and the reduction in Trading EBITDA(1) during the year as

indicators that the intangible assets were impaired. The goodwill

and other intangibles were impaired by GBP3.0m during the year.

9. Property, plant and equipment

Fixtures,

fittings

and

leasehold

IT equipment improvements Total

GBP'000 GBP'000 GBP'000

--------------------- ------------ ------------- --------

Cost of assets

At 1 October 2017 302 148 450

Additions 70 - 70

Disposals (16) - (16)

--------------------- ------------ ------------- --------

At 30 September 2018 356 148 504

Additions 23 - 23

Disposals (125) (54) (179)

--------------------- ------------ ------------- --------

At 30 September 2019 254 94 348

--------------------- ------------ ------------- --------

Depreciation

At 30 September 2017 152 70 222

Charge for the year 79 57 136

--------------------- ----- ---- -----

At 30 September 2018 231 127 358

Charge for the year 80 20 100

Disposals (118) (54) (172)

At 30 September 2019 193 93 286

--------------------- ----- ---- -----

Net book value

At 30 September 2019 61 1 62

--------------------- ----- ---- -----

At 30 September 2018 125 21 146

--------------------- ----- ---- -----

10. Trade and other receivables

2019 2018

GBP'000 GBP'000

------------------------------- -------- --------

Trade receivables 951 1,343

Warranty settlement - 600

Other Debtors 3 36

Prepayments and accrued income 535 921

------------------------------- -------- --------

Trade and other receivables 1,489 2,900

------------------------------- -------- --------

11. Trade and other payables

11.1 Current

2019 2018

GBP'000 GBP'000

----------------------------------------------- -------- --------

Trade payables 876 1,102

Accruals and deferred income 1,093 1,937

Finance leasing liability - short-term element 32 32

Other taxes and social security costs 302 377

Total current liabilities 2,303 3,448

----------------------------------------------- -------- --------

11.2 Non-current

2019 2018

GBP'000 GBP'000

------------------------------------------------------ -------- --------

BGF loan notes repayable to the BGF between three and

seven years 5,000 5,000

Less fair value adjustment relating to the BGF loan

notes (730) (929)

Fair value of BGF loan notes 4,270 4,071

Finance leasing liability - long-term element 16 46

Total non-current liabilities 4,286 4,117

------------------------------------------------------ -------- --------

12. Financial instrument

On 26 May 2016, the Company issued GBP5m unsecured loan notes

("Loan Notes") to the BGF with a seven-year term (although

redemption is permissible from the third anniversary) with

repayment between the fifth and seventh anniversaries in equal

semi-annual repayments that carry interest at 8% per annum

("Coupon"). Assuming that the Loan Notes were held for seven years

and not redeemed early, the maximum credit exposure at 30 September

2019, including interest, is GBP6.0m (2018: GBP6.4m), of which

GBP1.0m (2018: GBP1.4m) relates to interest. As previously

described, the Company also agreed to grant the BGF an option to

subscribe for 50,000,000 Ordinary Shares of 1p at a subscription

price of 6p any time before 26 May 2031. As the Loan Notes are

unsecured, no collateral was offered to the BGF as security. The

Loan Notes are not exposed to market interest rate increases over

the term.

In accordance with IAS 32, the Loan Notes and share warrant

elements were linked and treated as a single financial instrument

and shown at fair value.

The fair value of the share options at 26 May 2016 (date of

grant) has been calculated using the Black Scholes pricing model

incorporating the following key assumptions:

-- share price volatility of 40%;

-- spot price of 6p per share;

-- risk-free rate of 0.9%; and

-- option period, aligned with the maximum amount of time the loan can remain outstanding.

Based on the assumptions above, the Black Scholes pricing model

provided a fair value for the share option of 2.89p per share,

which implied a total fair value for the share option of GBP1.4m.

Based on the expected Coupon payments and repayment profile under

the loan notes, this implies an effective borrowing rate of 15%.

This resulted in a fair value of the loan amount at 26 May 2016 of

GBP3.6m. The difference between the Coupon rate and the effective

interest charge at 15% is charged through the Consolidated Income

Statement over the life of the loan notes and increases the

outstanding loan note balance over time to match actual Coupon and

capital cash repayments relating to the Loan Notes.

Loan Carrying 8%

Note value interest

balance Loan Notes payable

GBP'000 GBP'000 GBP'000

---------------------------------------------------- -------- ----------- ---------

Cash received from the BGF on 26 May 2016 for Loan

Notes at 8% per annum interest 5,000 - -

---------------------------------------------------- -------- ----------- ---------

At 30 September 2018 5,000 4,071 -

Interest on Loan Notes at 8% per annum for the year

to 30 September 2019 - - 400

Notional interest on liability element of the BGF

Loan Notes to 30 September 2019 - 199 -

---------------------------------------------------- -------- ----------- ---------

At 30 September 2019 5,000 4,270 400

---------------------------------------------------- -------- ----------- ---------

On 21 October 2019, the Group reached a settlement with BGF in

relation to the GBP5m unsecured loan notes, further details are

contained in note 13.

13. Post-balance sheet events

On 21 October 2019, the Group acquired the entire share capital

of CloudCoCo Limited ("CloudCoCo"). CloudCoCo is a cloud, IT

hardware, and IT services company that commenced trading in 2018

and has seen impressive growth in that short period. The

consideration for the acquisition was satisfied through the issue

of 218,160,586 ordinary shares in the Company which represents

approximately 49.0% of the enlarged share capital. The shares were

issued at the mid-market closing price of 3.3 pence, representing a

total value of GBP7.2 million on completion.

Whilst it is too early to accurately assess the fair value of

the assets and liabilities acquired prior to the production of this

report, on 21 October 2019, CloudCoCo had cash balances of

GBP157,000 and had signed a number of recurring customer contracts

generating unaudited revenue of over GBP1m per annum. CloudCoCo has

a very strong and experienced sales and business development team

which had already shown its ability to win new business using its

agile sales methodology. On 21 October 2019, following the

acquisition, Andy Mills, former Chairman of CloudCoCo, joined the

Board as Chief Executive Officer, focussing on driving the growth

of the enlarged Group. Mark Halpin (founder and former Chief

Executive Officer of CloudCoCo) is leading the Group's business

development activities.

On completion of the acquisition, GBP1.5 million of the loan

notes were waived and cancelled by BGF, reducing the Company's

liability to GBP3.5 million. MXC Guernsey Limited, a wholly owned

subsidiary of MXC Capital Limited ("MXC"), who now hold 15.2% of

the shares in the Company, purchased the remaining GBP3.5 million

loan notes from BGF and restructured their terms. The loan notes

now carry a coupon of 12% compound per annum, rolled up and payable

only at the end of the term. The term of the loan notes has been

extended to October 2024 with no repayment due until that date

unless the Company chooses to repay early. At the same time, MXC

extended a GBP0.5 million, 2 year, working capital facility to the

Company with interest charged at a rate of 12% per annum on amounts

drawn down.

As part of the refinancing package, MXC also cancelled the

warrants it held over 5% of the issued and future share capital of

Adept4 and BGF's options were repriced to 0.35 pence. BGF exercised

all of its options in October 2019 and, as MXC no longer holds

warrants in the Company, the only obligations over the Company's

shares are in respect of outstanding staff share options.

On 29 November 2019, the Company's name was changed to CloudCoCo

Group plc.

The website address, at which information required pursuant to

AIM Rule 26 is available, was changed with effect from 2 December

2019, to www.cloudcoco.co.uk.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR KKABQKBKDPBD

(END) Dow Jones Newswires

February 17, 2020 02:00 ET (07:00 GMT)

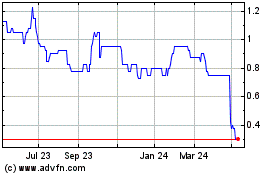

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Dec 2024 to Jan 2025

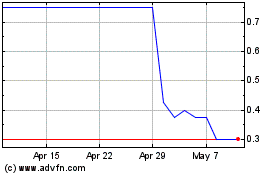

Cloudcoco (LSE:CLCO)

Historical Stock Chart

From Jan 2024 to Jan 2025