TIDMCLI

RNS Number : 8426M

CLS Holdings PLC

12 May 2015

Release date: 12 May 2015

Embargoed until: 07:00

CLS Holdings plc

("CLS", the "Company" or the "Group")

Trading Update for the period 1 January 2015 to 12 May 2015

The Group announces a Trading Update for the period 1 January

2015 to 12 May 2015.

HIGHLIGHTS

-- Acquisition of Tangentis, Betastrasse 5/9a, Munich for

EUR24.4m at a net initial yield of 7.9%

-- Occupational demand remains firm:

o Overall Group vacancy rate 4.8% (31 December 2014: 3.0%)

o 8,420 sqm vacated or expired, of which 4,966 sqm taken to

development stock

o 5,231 sqm of new leases, lease renewals and extensions

completed

o 4,421 sqm of former development stock added to available for

letting

-- Weighted average cost of debt remains low at 3.62% (31 December 2014: 3.64%)

o Spring Gardens, SE11 refinanced with GBP97 million 6 year loan

fixed at 2.8%

o Acquisition of Schellerdamm, Harburg financed by EUR24 million

7 year loan fixed at 1.9%

-- Spring Mews hotel opened end of January - averaging 80% occupancy within four months

-- 405 Kennington Road, SE11 - 1,380 sqm of offices under refurbishment, pre-let for 12 years

-- Continued progress on Vauxhall Square, London, SW8 (143,000

sqm scheme with full planning consent)

o Expect to satisfy all conditions in Q3 2015 for a long lease

to a student operator to build and manage 30 storey student

development

o Acquisition of 109 & 111 Wandsworth Road, SW8 adjoining

main site for GBP3.3 million

OVERVIEW - Since 1 January 2015, the Group has made good

progress in a number of areas: the completion of developments has

provided further space in central London available for letting;

core investment operations have delivered in line with, or above,

expectations; new bank financing has brought down still further our

financing costs; and the pipeline of potential investments has

continued to provide opportunities with a further acquisition in

Germany.

The occupational markets are firm: the Group's vacancy level has

risen to 4.8% (31 December 2014: 3.0%) by rental income following

the release of 4,421 sqm of new space from our development

portfolio. Demand from existing and potential occupiers is steady,

with good interest particularly in London. Since 1 January, 8,420

sqm of rented space has expired or become vacant, of which 4,966

sqm has been taken off the market and added to our development

stock, 3,851 sqm has been let or renewed, and a further 1,380 sqm,

which is under refurbishment, has already been pre-let. Of the

Group's income, 56.0% benefits from indexation and 67.5% is paid by

government occupiers (46.3% of the total) or major corporations

(21.2%).

The Greater London investment market, outside the West End and

City, remains competitive. We continue selectively to explore

investment opportunities within and around the M25, and in Germany

where financing conditions remain more attractive.

LONDON - London continues to benefit from its status as a global

safe haven, supported by an economy which remains stronger than

those of most of its European trading partners. Demand remains

solid from overseas investors searching for yield, with increasing

interest beyond the prime West End and City locations. Whilst the

UK's forecast GDP growth for 2015 of 2.6% is expected to ease

marginally to 2.4% in 2016, unemployment is expected to fall from

5.5% in 2015 to 5.2% in 2016, and CPI inflation is forecast to rise

from 0.4% in 2015 to 1.7% the following year.

With all of our asset management performed in-house, we continue

to be successful in leasing space. The vacancy rate has risen to

7.5% (31 December 2014: 3.3%) due mainly to 4,421 sqm of space

becoming available for the first time on completion of the

developments at 138 Fetter Lane and Spring Mews. Occupiers vacated

2,360 sqm, including 1,380 sqm at 405 Kennington Road, SE11, where

a new tenant signed for a 12 year term six months before the

completion of the building's refurbishment. New lettings, lease

renewals and extensions were completed on a further 1,807 sqm since

the beginning of the year, with Great West House, Brentford now

achieving record rents and having only one half of a floor vacant

in the 30 floor building.

Our 20,800 sqm Spring Mews development, comprising up-market

student accommodation, an extended-stay hotel and 1,133 sqm of

office space, completed on time last year. The student space is

fully let for 2014/15 and early bookings for 2015/16 are

progressing well. The adjoining 93 bedroom hotel under the

Staybridge Suites brand of InterContinental Hotels Group, and

operated by Cycas Hospitality on our behalf, opened for guests in

January and has already achieved an occupancy rate of 80%, at the

higher end of expectations. On TripAdvisor it is rated in the top

20 out of 1,063 hotels in London. We recently began marketing the

office space, which is included in our vacancy numbers for the

first time.

At 138 Fetter Lane, EC4 the refurbished 2,896 sqm of new Grade A

offices and eight newly developed residential apartments were

launched in January. Demand for the offices has been strong, and

half of the space is now under offer on ten-year leases.

The Vauxhall Nine Elms regeneration area, of which our 143,000

sqm mixed-use, residential-led Vauxhall Square scheme will be an

integral part, continues to progress. The new American and Dutch

embassies are well under construction, and many residential schemes

are now on site. Since January we have acquired two town houses

adjacent to the main site at 109 & 111 Wandsworth Road, SW8 for

GBP3.3 million. We are close to satisfying the conditionality of

the sale to a specialist student housing operator to build and

manage the 454 student room building adjacent to the main site. We

expect construction to start on this first phase of Vauxhall Square

in 2016. We continue to explore financing options for the main

scheme, on which we gain vacant possession in early 2017, and we

expect to be in a position to clarify our intentions towards the

site early in 2016.

REST OF UK - Of the 32 properties in the Rest of UK portfolio,

99% by rental value is let to central government departments, and

0.9% is vacant (31 December 2014: 0.9%). 687 sqm of space in

Brooklands Office Campus, Plymouth expired in March and an

agreement to lease has been entered into with a new tenant for a 15

year term.

FRANCE - With GDP growth expected to be 1.0% in 2015,

unemployment 10.4% and CPI inflation 0.2%, the French economy

remains challenged. However, our offices, particularly in Paris,

reflect a demand for less expensive, non-prime space.

In the overall market, lettings in the Paris region in the first

quarter of 2015 were 27% below the same period last year. Since the

beginning of January we have taken back 5,080 sqm of offices, of

which 3,698 sqm have been added to development stock and are no

longer immediately available for letting, and 1,105 sqm have been

let or renewed.

GERMANY - With GDP growth in 2015 forecast to be a modest 1.8%,

unemployment low at 6.4%, and CPI inflation only 0.4%, German

domestic demand should remain resilient. In 2015, the investment

market in Germany registered its second best first quarter since

2009, assisted by a competitive debt market.

In early May we exchanged unconditional contracts to acquire

Tangentis, Betastrasse 5/9a, Munich for EUR24.4 million at a net

initial yield of 7.9%. This office building, 8 kilometres

north-east of Munich, spans 14,630 sqm of lettable space and 252

parking spaces, and generates over EUR2.0 million of annual rent

from 11 media and technology tenants, including Sky Deutschland,

Kabel Deutschland, and the Bavarian Academy of Television.

Completion is expected to take place before the end of June.

Excluding the fully let Tangentis acquisition, our vacancy rate

in Germany remains very low at 2.5% (31 December 2014: 2.6%). Since

1 January we have taken back only 980 sqm of let space, and let or

renewed 939 sqm.

SWEDEN - Occupancy of the Group's only directly held property in

Sweden, Vänerparken, to the north of Gothenburg, has remained

unchanged with a vacancy of 0.8% by rental value. The Group's 13.5%

interest in Catena AB rose in the quarter by GBP7.0 million,

reflecting a 23% increase in its share price.

FINANCE -Rent collection rates have remained high, costs are in

line with budget, and the weighted average cost of debt has

continued to be one of the lowest in the property sector at 3.62%

(31 December 2014: 3.64%), being over 250 basis points below the

property portfolio's net initial yield.

Since the start of the year the Group has refinanced a GBP74.7

million loan on Spring Gardens, SE11 with a GBP97.0 million 6 year

loan at a fixed rate of 2.8%, and has financed the acquisition of

Schellerdamm, Harburg with a EUR24.0 million 7 year loan at a fixed

rate of 1.9%.

The Group has 60 loans from 23 lenders, two unsecured corporate

bonds, a secured note and a debenture. The Group currently has

liquid resources of over GBP225 million, comprising GBP54 million

of cash, GBP77 million of corporate bonds, and available undrawn

facilities in excess of GBP95 million.

In the latest tender offer, all of the shares available were

cancelled by the Company on 24 April resulting in a distribution of

GBP10.4 million to shareholders and leaving 42,402,323 shares in

circulation.

Executive Chairman of CLS, Sten Mortstedt, commented:

"The acquisition of the Tangentis building in Munich

demonstrates once again our ability to find opportunistic

investments at attractive yields and let to strong covenants.

Managing our properties in-house continues to pay dividends and I

am encouraged by our letting performance, particularly in France,

and by the interest shown in the recently-completed developments at

138 Fetter Lane and the hotel at Spring Mews.

"With a low cost of debt, high occupancy levels, and further

rental streams to come from our new developments, we look forward

with confidence to building on a strong start to the year."

-ends-

For further information, please contact:

CLS Holdings plc +44 (0)20 7582 7766

www.clsholdings.com

Sten Mortstedt, Executive Chairman

Henry Klotz, Executive Vice Chairman

Fredrik Widlund, Chief Executive Officer

John Whiteley, Chief Financial Officer

Liberum Capital Limited +44 (0)20 3100 2222

Tom Fyson

Charles Stanley Securities +44 (0)20 7149 6000

Mark Taylor

Hugh Rich

Kinmont Limited +44 (0)20 7087 9100

Jonathan Gray

Smithfield Consultants (Financial PR) +44 (0)20 7903 0669

Alex Simmons

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTABMRTMBJBBIA

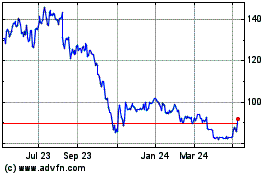

Cls (LSE:CLI)

Historical Stock Chart

From Jan 2025 to Feb 2025

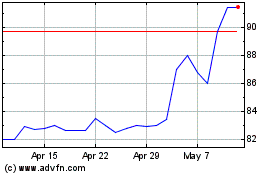

Cls (LSE:CLI)

Historical Stock Chart

From Feb 2024 to Feb 2025