Offer Update

November 14 2005 - 1:30AM

UK Regulatory

RNS Number:0584U

Compagnie de Saint-Gobain

14 November 2005

Not for release, publication or distribution, in whole or in part, in, into or

from Australia, Canada or Japan

14 November 2005

Compagnie de Saint-Gobain

Cash Offer for BPB plc

Extension of the Offer and Level of Acceptances

1. Extension of the Offer

The Offeror announces that the Offer is being extended and will remain open for

acceptance until 1:00 p.m. (London time) on 2 December 2005.

2. Level of acceptances and ownership

As at 1:00 p.m. (London time) on 13 November 2005, being the third closing date,

valid acceptances of the Offer had been received in respect of 3,599,286 BPB

Shares, representing approximately 0.71 per cent. of the issued BPB Shares (1).

Enquiries

Saint-Gobain (for analysts and investors)

Florence Triou-Teixeira, Head of IR Tel: +33 1 47 62 45 19

Alexandre Etuy, Deputy Head of IR Tel: +33 1 47 62 37 15

BNP Paribas (joint financial adviser to Saint-Gobain)

Thierry Dormeuil Tel: +33 1 42 98 12 34

Oliver Ellingham Tel: +44 20 7595 2000

UBS Investment Bank (joint financial adviser and broker to Saint-Gobain)

Charles-Henri Le Bret Tel: +33 1 48 88 30 30

Liam Beere Tel: +44 20 7567 8000

Brunswick (PR adviser to Saint-Gobain)

John Sunnucks Tel: +44 20 7404 5959

Sophie Fitton Tel: +44 20 7404 5959

Notes

(1) As disclosed in the Offer Document, prior to the commencement of the Offer

Period, BNP Paribas and its affiliates, who are acting in concert with the

Offeror, held (through BNP Paribas Arbitrage SNC) a long position of 8,000,000

BPB Shares, representing 1.59% per cent. of the issued BPB Shares, as a hedge in

relation to an open interest in an equity swap that consists of a basket of

shares which includes 8,000,000 BPB Shares. As the equity swap matured on 5

September 2005 and its hedge was unwound, the 8,000,000 BPB Shares were sold and

BNP Paribas Arbitrage SNC no longer hold the long position.

Copies of the Offer Document and the Form of Acceptance are available for

collection (during normal business hours) from Capita Registrars at PO Box 166,

The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TH.

Further information on Saint-Gobain is available on Saint-Gobain's website

www.saint-gobain.com

Terms used in this announcement shall have the meaning given to them in the

Offer Document.

The Offer in the United States is made solely by the Offeror and neither BNP

Paribas, UBS nor any of their respective affiliates is making the Offer into the

United States.

The Saint-Gobain Directors and the Offeror Directors accept responsibility for

the information contained in this announcement. To the best of the knowledge and

belief of the Saint-Gobain Directors and the Offeror Directors (who have taken

all reasonable care to ensure that such is the case), the information contained

in this announcement for which they are responsible is in accordance with the

facts and does not omit anything likely to affect the import of such

information.

BNP Paribas and UBS are acting exclusively for Saint-Gobain and the Offeror in

connection with the Offer and no one else, and will not be responsible to anyone

other than Saint-Gobain and the Offeror for providing the protections afforded

to respective clients of BNP Paribas and UBS nor for providing advice in

relation to the Offer or any other matter referred to herein.

This announcement does not constitute an offer to sell or an invitation to

purchase any securities or the solicitation of an offer to buy any securities.

This information is provided by RNS

The company news service from the London Stock Exchange

END

OUPUSUARVVRAARA

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Oct 2024 to Nov 2024

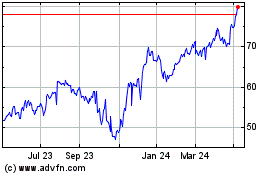

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Nov 2023 to Nov 2024